Introduction

The fourth quarter was painful for Intel Corporation (NASDAQ:INTC) as the total revenue declined by 20% for the entire year and plummeted by 32% to $14 billion, which was at the low end of the projected range, while earnings and cash flow were both drastically down at the same time.

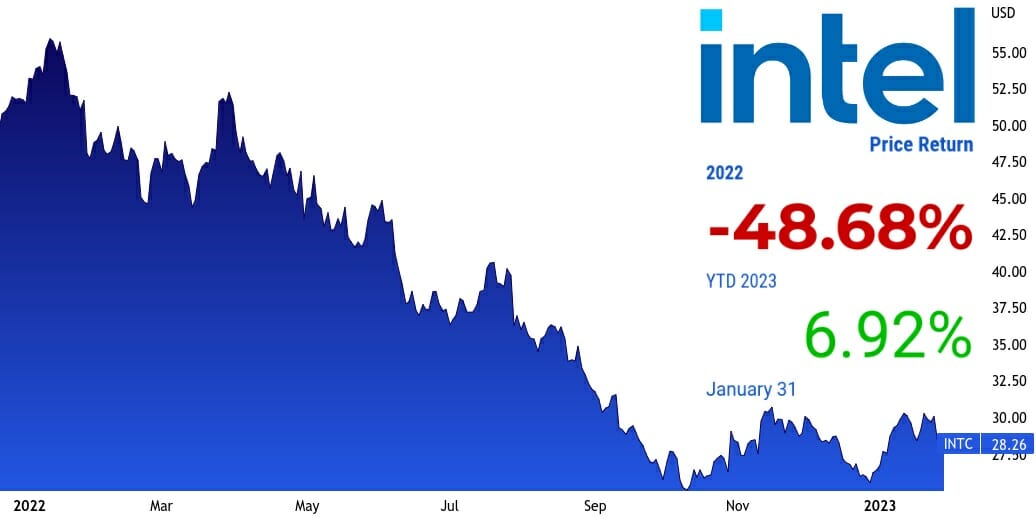

The company’s stock price has suffered due to these shocking financial figures, reflecting the poor sentiment in the market for the stock. From its peak at the beginning of last year, the stock has lost approximately 50% of its worth, and INTC might have found a bottom at around $25.

Q4 2022 hedge fund letters, conferences and more

The stock plunge has created an attractive entry point for long-term investors who believe that Pat Gelsinger can turn around the firm delivering on his promises and the 'IDM 2.0' Strategy for Manufacturing. Although income-focused investors may find its dividend yield of 5% tempting, the company's dividend payment might jeopardize if market conditions deteriorate.

However, Intel is a cyclical firm, and the worst might be over as we approach the second half of the year and the end of the semiconductor downturn.

Sapphire Rapids Mark A Turning Point

Intel launched its Sapphire Rapids server CPUs after multiple delays over a year. The processors can't surpass Advanced Micro Devices’s (NASDAQ:AMD) processors on performance, but in specific workloads (AI, security, storage, analytics, networking, and high-performance computing), the built-in accelerators can provide an edge to Intel. Over the next two years, Intel is aiming for two new product lines under Sapphire Rapids.

The house of Sapphire Rapids comprises 52 CPUs based on an extensive range of cores and features. Sapphire Rapids were introduced alongside Ponte Vecchio (new data center GPUs), and are attached with extensive customer and partner adoption.

The launch delays provide a massive advantage to rival AMD, which can introduce its considerably more powerful Genoa server processors to the market earlier than Intel. With its substantial core density (96-core), the Genoa family provides peak performance capabilities. As AMD's server processors are based on a 5nm fabrication process, Intel can't compete on performance gains.

Intel's strategic decision to integrate special-purpose accelerators can help its new chips stand up against AMD's advantages. Sapphire Rapids' delayed launch has adversely impacted Intel's competitive position.

Intel still controls nearly 70% of the server market, and the delays in the launch of the Sapphire Rapids (scalable processors) and Ponte Vecchio (data center GPU) had significant reverberation across the supply chain. (Sapphire Rapids delays)

Undoubtedly Intel is lagging behind AMD, and the MI300 announcement vanished the immediate effect of the launch of Intel's Data Center GPU Max Series. Sapphire Rapids and Ponte Vecchio have missed numerous delivery schedules that caused server vendors to hold their platforms' significant upgrades.

Meteor Lake Remains On Track for 2023

The development of Intel's next-generation processors is on track as per the previously released roadmaps. Meteor Lake processors are scheduled to hit the market in 2023's second half, followed by the production of the Lunar Lake family in 2024. For Intel, Meteor Lake is a critical technological milestone. It is Intel's first client CPU based on a disaggregated multi-tile structure applying 7nm process technology.

Meteor Lake also signifies Intel's first node to implement extreme ultraviolet lithography in the fabrication process. Meteor Lake can deliver higher transistor performance per watt with competitive core density.

Currently, the existing Intel 7 includes Alder Lake and Raptor Lake, based on 10nm enhanced SuperFin and in high-volume production. Comparatively, Meteor Lake’s fabrication is based on Intel 4 (7nm), which is expected to deliver 20% higher performance per watt than Intel 7.

PC TAM & Platform Roadmap Update

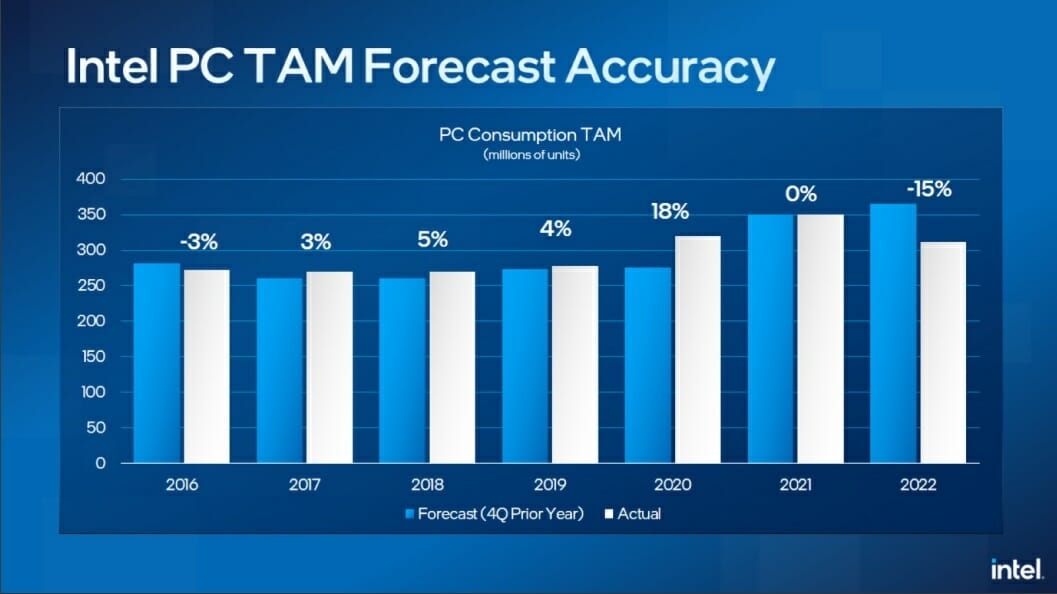

Intel's recent PC TAM and Roadmap events ignited major accuracy issues related to market intelligence and forecasting. Intel's TAM forecasting could be more accurate than its peers, especially AMD, and 2022 represents Intel's hyper-aggressive estimates.

Most of the semiconductor industry was forecasted at minus ~10% for the year, nearly 300 million units, but Intel's forecasts signaled 350 million units. Based on the estimates, Intel filled the channels instead of controlling the supply due to the prevalence of slow demand. Now the supply channels are occupied with massive PC inventory, surpassing the smartphone oversupply (as a percentage of the market size).

Intel projected a long-term PC TAM of nearly 300 million units annually. It is not viable considering the extending PC life cycles due to the slower release of new computer applications relative to the smartphone application market. Most PC users utilize basic office applications and web browsers only. Intel is concentrating on a PC replacement cycle of 6.5 years, but multi-core laptops with over 8 GB of RAM and an SSD have a much longer useful life.

Executing Well On Client CPU Roadmaps

Intel Foundry Services confirmed its progress to execute five nodes in four years on the processor development and fabrication front to attain and sustain process leadership. Execution milestones during 2022 include launching Sapphire Rapids scalable processors, Sapphire Rapids HBM, and Data Center GPU Max Series Ponte Vecchio. In addition, Intel announced the world's fastest processors, the Core i9-13900KS1 and i9-13980HX2.

Moreover, Intel shipped its Data Center GPU Flex Series to its customers and partners globally to deploy large-scale cloud gaming and media delivery. As of 2022, the Intel 7 process at high-volume manufacturing with the Intel 4 process is in a manufacturing-ready state. The Intel 3 process will be production-ready in the second half of 2023. Intel 4 and Intel 3 have become the first nodes fabricated through extreme ultraviolet lithography.

Angstrom Era nodes 20A and 18A are under development to become production-ready in the first and second halves of 2024, respectively. Meteor Lake, based on the Intel 4 process, is the first consumer processor based on a multi-chip module design, integrating different tiles (CPU, GPU, SoC (system-on-a-chip), and I/O) through Foveros 3D technology.

The successor processors, "Emerald Rapids," are developed in Intel labs, with production-ready states scheduled for 2023's second half and Granite Rapids in 2024. Sierra Forest, the first all-efficiency core design-based processor, is labeled for the 2024 launch.

Emerald Rapids processors are expected to hit the 64-cores and surpass Sapphire Rapids’ IPC and clock speeds. Granite Rapids processors are expected to have 128 cores fabricated on the Intel 3 process, and the cores are expected to build upon the Redwood+ microarchitecture. (Intel DCAI)

Massive CapEx Spending Despite Pullback

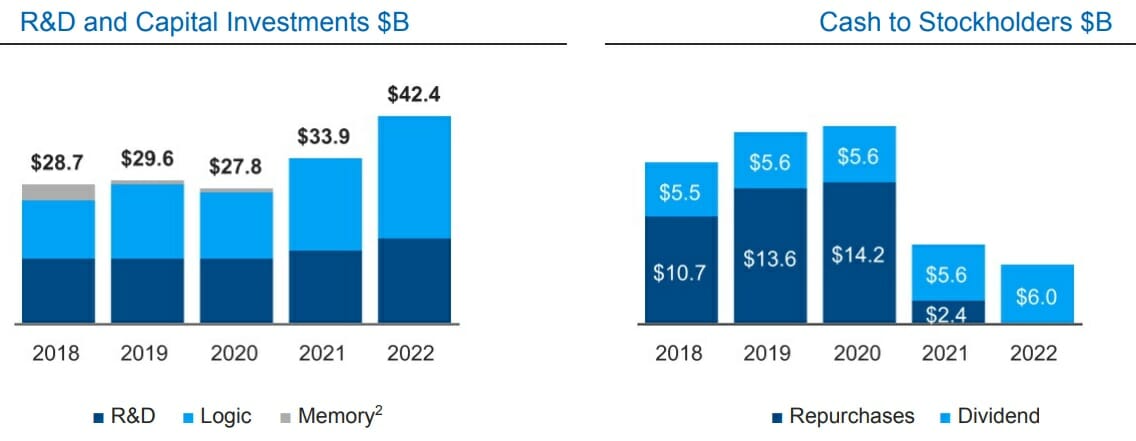

During 2022, Intel prepared the business for a potential recession, considering adverse macroeconomic conditions, especially continued COVID-related impacts on the supply chain. During the tightening, capital expenditures were forecast to be reduced by $4 billion, and reached $24.8 billion in 2022.

As per Intel's annual filing for 2022, commitments for CapEx were at $31.0 billion as of December 31, 2022, which represents an increase of $4 billion year-over-year from $27.0 billion, the similar period last year. A majority of CapEx commitments will be due within the next 12 months, with $22.7 billion commitments related to 2023 and $8.3 billion for the long term.

Intel expects a constant enhancement in CapEx over historical levels in the long term that is required to execute its goal of delivering five nodes in four years. In the short term, Intel’s planned capital investments will continue to pressure its free cash flow considerably.

Intel has invested massively in R&D and Logic to edge out competitors, with those two areas reaching $42.4 billion in investments in 2022, a significant increase from 2021 ($33.9 billion).

Buybacks Fall, Yet Returns Are Still Large

Intel’s ongoing authorization for stock repurchases, as of December 31, 2022, is authorized to repurchase stocks up to $110.0 billion, out of which $7.2 billion remains available. During 2022, no buybacks were executed, even when stock prices were at historical lows. Intel’s investment in its IDM 2.0 strategy, capacity expansions, and process technology

Roadmap shifted its allocation priorities more heavily towards business operations optimization and away from stock buybacks. As a result, Intel’s stance is not justifying any enhancement in long-term stockholder value through stock buybacks.

Good Financial Shape Despite The Headwinds

During the fourth quarter, Intel generated an operating cash flow of $7.7 billion. That was sufficient to pay its $4.6 billion in net capital expenses, allowing the company to generate an adjusted free cash flow of $3.1 billion. As a result, Intel had more than enough cash to pay its $1.5 billion dividend throughout the period.

Last year, Intel paid $6 billion due to the payout, which increased its cash outflow, leading to a loss of around $1 billion in total cash and short-term assets and an increase of $4 billion in overall debt. In contrast to its $42 billion in debt, Intel still has approximately $28 billion in cash, cash equivalents, and short-term investments.

Conclusion

Intel's dividend future is uncertain, and the recent CFO's remarks about the dividend's future appeared ambiguous. The conglomerate is spending a lot of money this year to support its IDM 2.0 plan. However, the changing market conditions and falling demand will affect Intel's capital allocation plan in the short-term.

Nevertheless, the company does have a solid, cash-rich balance sheet, which will support dividend payments despite this active investment phase. Therefore, with a P/E ratio at nearly 15x, INTC appears undervalued, and the long-term prospects of the firm remain favorable.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives.