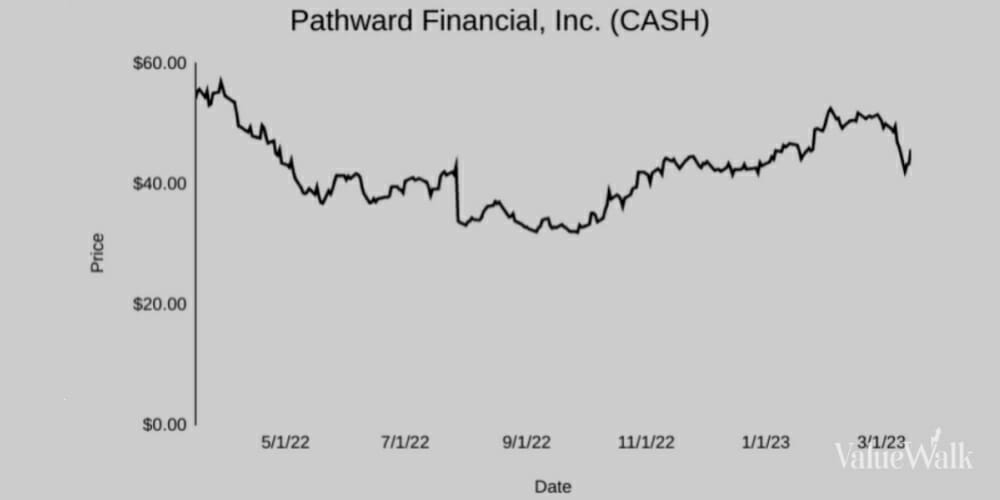

Hidden Value Stocks issue for the first quarter ended March 31, 2023, featuring an update from Alta Fox Opportunities Fund, pitching their thesis on Pathward Financial Inc (NASDAQ:CASH).

Connor Haley manages the Alta Fox Opportunities Fund, which focuses on finding undervalued small-cap equities.

While the fund struggled last year, reporting a net return of -19.5%, since its inception in April 2018, Alta Fox has returned 318% net, outpacing the S&P 500 (58%) and Russell 2000 (22.5%).

Q1 2023 hedge fund letters, conferences and more

Alta Fox's New Top Holding - Pathward Financial

In Haley's latest letter to investors, he highlighted a new top holding for the fund, Pathward Financial:

"Pathward is a small cap bank based in Sioux Falls, South Dakota. Like all banks, it takes customer deposits and then invests those deposits into higher yielding assets like loans & securities."

"For most banks, the rising interest rate environment means that the asset side (loans and securities) of their balance sheets are generally seeing higher yields as capital is redeployed. However, increases in asset yields are eventually offset by increasing deposit costs as customers shop around for better interest rates on their deposits."

"This is where Pathward is unique. Pathward has a competitively advantaged low-cost source of deposits: funds held for prepaid & reloadable gift/debit cards. The bank not only acts as the custodian of funds but serves as the marketing compliance organization for the card issuer. For its services, the bank tends to earn the majority of interest revenue from its deposit-funded assets as well as a share of interchange on card transactions."

"The barriers to entry that create Pathward's moat are twofold: regulatory and reputational. The Durbin amendment, passed in 2010, limited the amount banks with greater than $10B in assets can allow their card issuing customers to charge on debit interchange transactions.

This effectively prevents larger banks from competing in this market. At the same time, there are significant regulatory costs and expertise required to service customers in this industry. As a result, smaller banks are competitively disadvantaged from an experience and scale perspective.

"Furthermore, having a partnership with Pathward is viewed as "best-in-class." Pathward and The Bancorp (TBBK) pioneered the industry two decades ago and as a result have cultivated the industry perception that the risk of regulatory scrutiny is far lower with their partnership when compared to services offered by competing banks.

In addition to lowering the cost of customer acquisition, this also results in meaningful pricing power for Pathward."

"In summary, for most banks without sustainable competitive advantages, the benefits of higher asset yields will be mostly offset by a rising cost of deposits. However, given Pathward's competitive advantage in a low-cost deposit source, Pathward's asset base will continue to reprice at higher yields while its sticky deposit base should see relatively flat costs as interest rates stabilize."