Hidden Value Stocks issue for the fourth quarter ended December 31, 2022, featuring an update from Rowan Street Capital, pitching their thesis on Meta Platforms Inc (NASDAQ:META).

Rowan Street’s Thesis On Meta

In the September 2019 issue of Hidden Value Stocks, Rowan Street Capital pitched Box Inc (NYSE:BOX) and Under Armour Inc (NYSE:UA).

Rowan’s Box Inc pitch proved to be incredibly well-timed. The company reported a surge in business during the global pandemic, and the stock took off. Over the past three years, shares in the cloud storage provider have returned 22.4% per annum.

Q3 2022 hedge fund letters, conferences and more

The fund has now directed its attention to Facebook's parent company Meta. It believes the market's view of the company's spending and growth plans is far too short-term focused, and it's failing to consider the group's long-term potential and the skill of CEO Mark Zuckerberg.

Here's the condensed version of Rowan's recently published thesis:

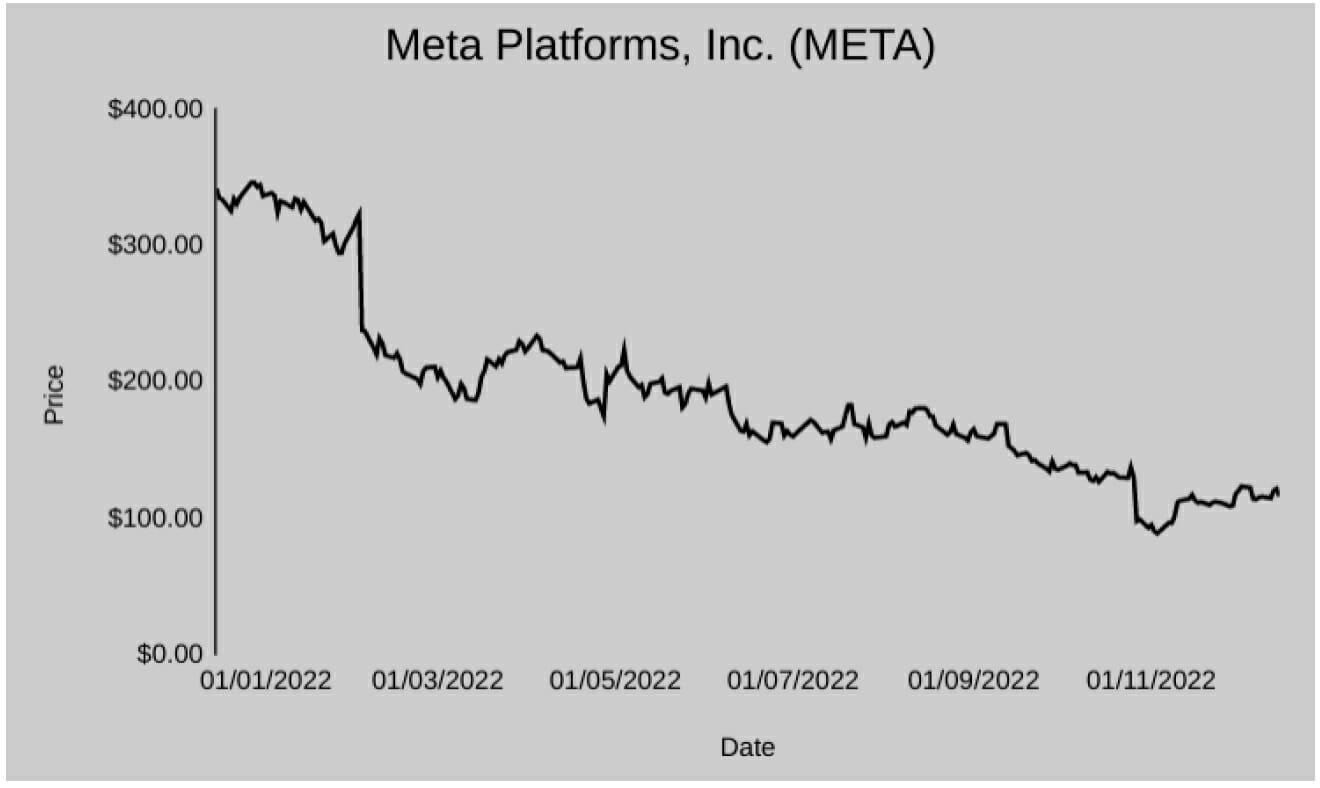

"Most investors don’t care about the next 10 years, they cannot see past the next 6-12 months, at best. They are quick to judge and critique over short-term results, especially when stock is dropping at such a rapid pace.

They take what they can see and measure, which is the latest quarterly results and project them into the future, often ignoring many intangible variables that could be a major value driver for the company over a longer investment horizon.

As a CEO of Facebook, Mark Zuckerberg oversaw a staggering growth in revenues from $3.7 billion in 2011 to $118 billion in 2021 (that's a compound annual growth rate of 41%). Earnings per share (EPS) have also grown 41% per annum from $0.43 to $13.77 over the same time period.

Free cash flow per share has increased 42% per annum from $0.40 to $13.68. Gross margins for this business have been 80%+ since 2014 and operating margins have been 40%+ since 2014. How many companies in the world do you know that can put up these kinda numbers? You can count them on one hand…

Wall Street's Focus On The Flattening Of Near-Term Revenues

In our opinion, all Wall Street is currently focused on is the flattening of near-term revenues due to economic impact on digital downturn and a dramatic increase in expenses from $71 billion in 2021 to an estimated ~$99 billion in 2023, which will cause a drop in operating profits from $46.8 billion in 2021 to our estimate of $28 billion in 2023 (please note that even then, their operating margins are still expected to be above 20%).

Combine that with a dramatic increase in capital expenditures from $18.6 billion in 2021 to estimated $36.5 billion in 2023 and we have the herd selling and asking questions later.

The losses for Reality Labs in the past 12 months have been substantial amounting to $12.7 billion. However, when we compare it against the very profitable core business (Family of Apps) and its operating profits of $48 billion, which by the way enjoyed operating margins north of 40% before they fell to 34% in the recent quarter, it could be argued that these investments are sustainable and Zuck is not betting the house as the media loves to portray.

We do agree that current investments are staggering and have a very uncertain future payoff profile, which makes the investment community uneasy. At the same time, we truly believe that the company should be making these important investments, which is the future of communication. We stand by the “man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly.

Meta is estimated to make close to $120 billion in revenues this year. Gross profits are still around 80%. The core Family of Apps business generated $48 billion in operating profits over the past 12 months, and the entire market cap is currently $240 billion (5x core operating profits). Free cash flow over the past 12 months netted at $26 billion, even after the heavy capital expenditures we described above.

Since 2017, Meta had invested $210 billion into R&D and Capex — close to the current market cap (please refer to the chart above). In 2022 alone, they are investing $65 billion into R&D and Capex (in comparison, Apple is doing about half of that).

Is Zuck just burning through piles of cash? Given his incredible track record, his unique ability to see where the world and technology is headed over the next 10-15 years and to execute against his vision, we would not bet against him."