Hidden Value Stocks issue for the fourth quarter ended December 31, 2020, featuring interviews an update from Fred Liu and Hayden Capital on their investment in Afterpay and interviews with Shreekkanth “Shree” Viswanathan, CFA, CPA, the President and Portfolio Manager of SVN Capital, LLC, and Eric Schleien, the founder of Granite State Capital Management, Wyoming Warehousing & Safe Deposit Co, Transformational Leadership Associates, and ProxyActivism.com.

Welcome to the December 2020 (Q4) issue of Hidden Value Stocks.

In this issue, we have our usual two interviews and an update from Fred Liu and Hayden Capital.

The first interview is with Shreekkanth “Shree” Viswanathan, CFA, CPA, the President and Portfolio Manager of SVN Capital, LLC.

SVN Capital manages a concentrated value portfolio of equities with the goal of doubling investor capital over a business cycle. Shree believes that owning just ten to fifteen businesses, adequately analyzed, will provide enough diversification. In our interview, Shree

presented the two global value ideas that he’s most excited about right now.

Our second interview is with Eric Schleien. Eric is the founder of Granite State Capital Management, Wyoming Warehousing & Safe Deposit Co, Transformational Leadership Associates, and ProxyActivism.com. He also is the host of The Intelligent Investing Podcast.

Granite State Capital Management invests with a time horizon based in decades. The firm can invest in all parts of the market, which Eric believes gives “us a competitive advantage over many of our larger institutional peers.” In the interview, he presents two stock recommendations that large firms can’t buy.

We hope you enjoy this issue of Hidden Value Stocks, and if you have any questions or comments, please feel free to contact us at [email protected].

Sincerely,

Rupert Hargreaves & Jacob Wolinsky.

Updates From Previous Issues: Hayden's Investment In Afterpay

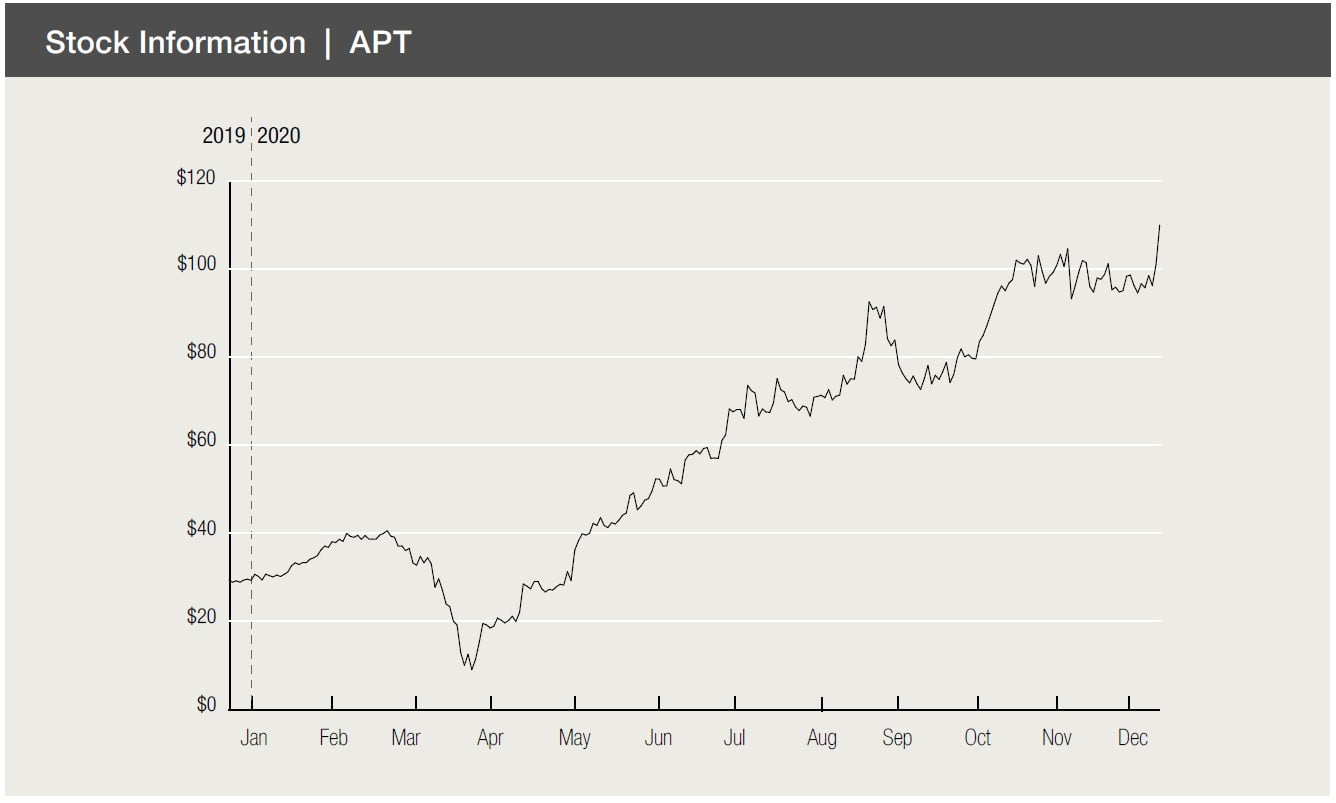

The December 2017 issue of Hidden Value Stocks featured an interview with Fred Liu, CFA, the founder and portfolio manager of Hayden Capital. This year Hayden has returned nearly 200% for its investors. One of the stocks that has helped contribute to this staggering performance is Australia-based company Afterpay.

Liu described why he liked the company in his Q3 letter to investors. There’s also a link for readers who want to read the full thesis.

Afterpay is a global leader in the buy-now-pay-later (“BNPL”) payments space, and benefits as younger consumers (Millennials & Gen-Z) around the world eschew credit cards in favor of debit / cash payments. Afterpay differentiates itself from competitors by focusing on the Fashion & Beauty categories (although it is leveraging customer’s trust to expand into other categories, in its most mature market of Australia).

The company is changing consumer behavior, and merchants who implement it realize +25% larger order sizes, +20% in conversion rates, and +20% in purchase frequency. These are significant figures for retailers, and more than justify Afterpay’s higher fees (3 – 6% of total order values).

The company is growing revenues +112% y/y, and I expect it to continue growing 50 – 100% annually over the next 3 years, while also eventually increasing take-rates (as merchant mix shifts from large national retailers to SMEs). The company has already proven to be highly profitable in Australia (~40% margins), and I expect the U.S. will eventually realize the same. Afterpay is already a verb in its Australian home market (“Why don’t you Afterpay it?”). In fact, Afterpay is so dominant, that Afterpay counts ~20% of the total Australian & New Zealand population between the ages of 18 – 65 as customers (3.4M customers out of 17.3M people).

As such, our thesis and investment edge come from the nascent U.S. market, where Afterpay entered two years ago and is already showing rapid adoption (+330% y/y GMV growth in FY 2020). The U.S. market is 10x – 11x the size of the Australian market, and it’s just getting started. If Afterpay can follow the Australia blueprint to replicate its success in the U.S. market, the investment has the potential to be a “10-bagger” for our partners (it’s almost a ~3-bagger already).