Hedge funds ended 2020 recording their best performance in over a decade with 12.3% return and $3.5 trillion in assets

Q4 2020 hedge fund letters, conferences and more

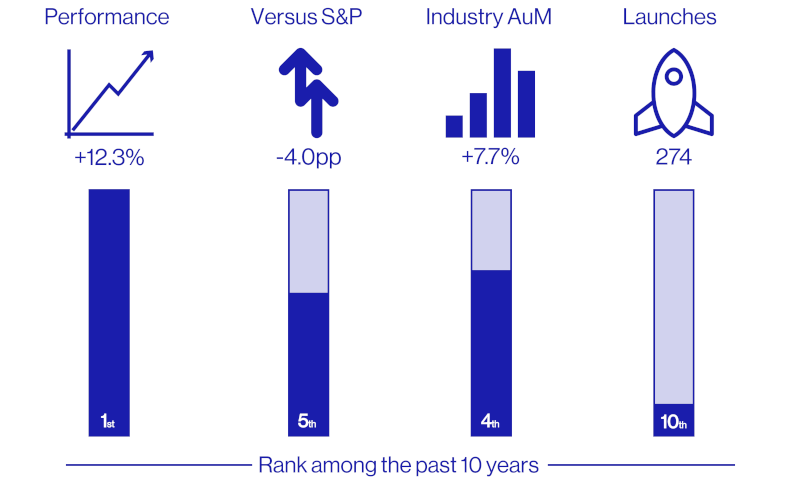

The first spotlight report of 2021 from HFM Insights covers last quarter data and sums up a landmark year for the performance of hedge funds in 2020. Hedge funds ended 2020 on the front foot, recording their best performance in over a decadea as the HFM Global Index returned 12.3%. Investors are readying new allocations and, while launch activity hit an all-time low in Q4, there is pent-up demand for when global restrictions ease.

A summary of the key highlights is included below.

Overview

Inflows and outperformance as hedge funds end 2020 on front foot

After a particularly difficult start, the hedge fund industry finished 2020 with some of its best headline numbers in a decade. The average fund returned over 12% (the highest since 2009), the average equity fund outperformed the S&P 500 and industry assets reached an all-time high ($3.5trn). Moreover, investors have taken note. New mandates from larger allocators surged in Q4, accounting for more than 60% of the 2020 total, while most private wealth investors surveyed in Q4 planned to increase their allocations to the asset class. Flows turned positive in November – dramatically so, at over $30bn – and the early signs are that the trend will be similar in December. Of course, this is not to say that there are not significant challenges ahead. Investor meetings will continue to prove difficult as the next wave of global restrictions bite. Indeed, launch activity is at an all-time low. But as 2021 begins, it is clear that many allocators have looked at the data and decided hedge funds are well placed to help them manage those challenges. -- Tony Griffiths, Head of Research, HFM Insights

2020 at a glance

(Source: HFM Insights)

Performance

A strong Q4 helps hedge funds to their best returns since 2009

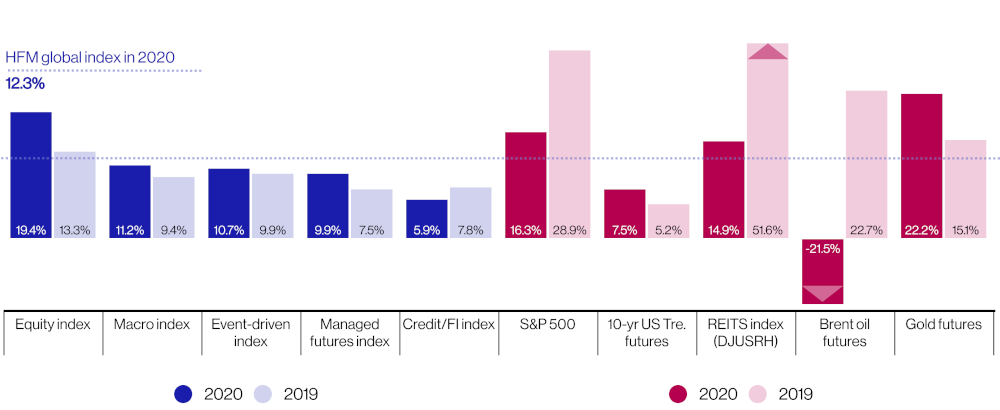

Hedge funds continued their recent positive trajectory into December 2020, with HFM’s global composite index finishing the year with its best return since 2009. Furthermore, all of HFM’s top-level indices in 2020 outperformed 2019’s results, as strategies benefited from ongoing government fiscal interventions and central bank support that sustained the equity market rally and underpinned equity hedge returns. At year-end, European fund performance continued to trail that in North America and Asia-Pacific, with the latter region ending the year slightly up on North America. This is a harbinger of the geopolitical and economic rivalry that will impact markets in the near and mid-term. The unexpected collapse of Brent Oil in 2020 (-21.5%) illustrates this correlation between asset prices and international power struggles. Given the incoming Biden administration’s clear commitment to further economic intervention in its first 100 days, investors can expect equity markets to continue to rise during Q1 2021 despite continuing Covid-19 turmoil.

Hedge fund returns and selected benchmarks, 2020 vs. 2019

(Source: HFM Insights)

Hedge fund performance matrix, Q4 2020*

(Source: HFM)

| HFM Index | Oct-20 | Nov-20 | Dec-20 | Q4 2020 | Q4 Sharpe | 2020 | 2019 | 5-yrs cumulative |

| Global Index | 0.0% | 4.9% | 3.3% | 8.4% | 3.6% | 12.3% | 9.7% | 35.6% |

| Equity Index | 0.4% | 8.1% | 5.1% | 14.0% | 3.9% | 19.4% | 13.3% | 52.4% |

| Event-driven Index | 0.3% | 7.1% | 3.8% | 11.5% | 3.6% | 10.7% | 9.9% | 48.1% |

| Managed futures Index | -0.6% | 1.9% | 4.1% | 5.5% | 2.4% | 9.9% | 7.5% | 19.2% |

| Macro Index | -0.4% | 3.3% | 3.9% | 6.9% | 3.2% | 11.2% | 9.4% | 29.6% |

| Credit/FI Index | 0.4% | 3.2% | 2.7% | 6.3% | 4.4% | 5.9% | 7.8% | 40.1% |

| North America Index | 0.1% | 5.8% | 4.8% | 10.9% | 3.9% | 14.6% | 10.7% | 52.0% |

| Europe Index | -0.5% | 4.2% | 3.6% | 7.3% | 3.0% | 9.8% | 8.3% | 23.1% |

| Asia-Pacific Index | 0.6% | 5.2% | 4.0% | 10.0% | 4.4% | 11.5% | 11.5% | 41.0% |

*Analyst note/source: All performance data from 11 January. The performance indices represent the mean average return of the relevant funds that report to the HFM database. To view HFM’s median indices, please visit the HFM database. Indices are based on reported data at time of publication and are subject to future revision. RFR applied to the Sharpe is 2%.

Billion Dollar Club

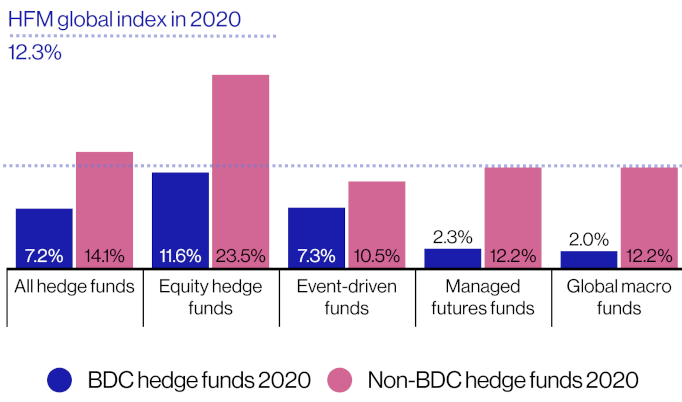

Billion Dollar Club (BDC) managers underperformed their smaller rivals in 2020

With only event-driven BDC funds able to get within five percentage points of their non-BDC counterparts. Similarly to Q3, equity funds saw the biggest difference in performance, but with the percentage gap doubling through Q4. In a significant development, non-BDC equity hedge funds outperformed the S&P 500 in 2020, 23.5% to 16.3%. This means it was smaller managers, not BDC firms, who were responsible for the wider equity hedge fund index’s outperformance of the S&P 500, offering a timely reminder of the capabilities and purpose of both the long/short strategy and emerging managers. Smaller funds, in particular, benefited from the heightened market volatility that has accompanied the disparate, massive governmental stimulus packages that are still filtering into the global economy. During Q1 2021, this trend will be tempered by news of a variant of the virus and the immediate installation of further lockdowns across the world, frustrating investor hopes of a v-shaped recovery

Ex. 4: BDC funds vs. non-BDC funds performance, 2020

(Source: HFM Insights)

Industry Assets

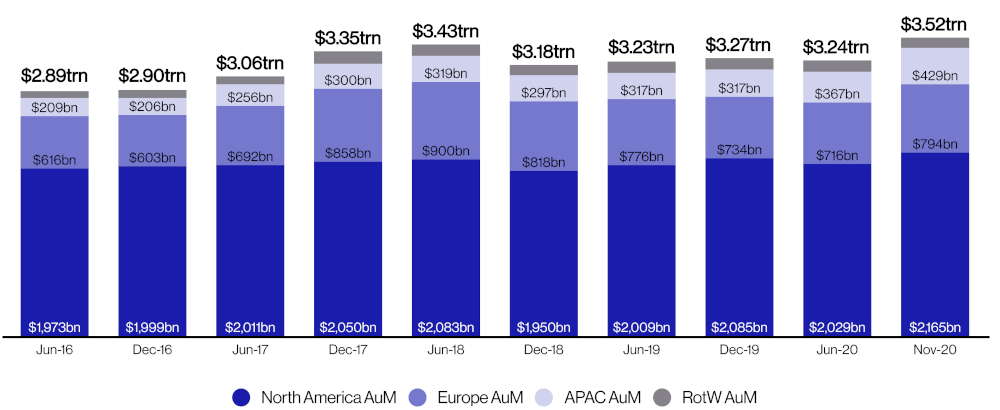

New peak in Q4 as assets under management pass $3.5trn

The later part of Q4 saw the hedge fund industry continue the recovery started in Q3 by adding $300bn between September and November (up from $3.22trn in August). Most was due to performance, although inflows have started to pick up again, with over net $30bn added in November. HFM estimates that total industry AuM was $3.52trn at the end of November, exceeding the previous high mark of June 2018. Indeed, investor sentiment and a favourable trading environment suggests $4trn could be breached as soon as Q1. Credit/fixed income remains the sole strategy that is net positive for the year, despite steady withdrawals through Q4. Macro continues to trail other strategies significantly, caused in part by withdrawals from Bridgewater Associates earlier in 2020. By region, investor inflows in Q4 primarily benefited managers based in Asia-Pacific and North America, despite the latter still being $57bn in net negative outflow for the year. Both Europe and Asia-Pacific remain, just, in net positive inflow for 2020, which should give managers confidence despite the new regional lockdowns.

Total hedge fund industry assets by region, 2015–2020

(Source: HFM Insights)

Hedge fund investor flows in 2020 and Q4*

(Source: HFM)

| Oct-20 ($bn) | Nov-20 ($bn) | Q4 2020* ($bn) | 2020* ($bn) | |

| Global | -1.6 | 31.5 | 29.9 | -49.2 |

| Equity | -8.2 | 13.9 | 5.7 | -10.0 |

| Event-driven | 14.1 | 5.9 | 20.0 | -3.2 |

| Managed futures | -1.1 | -0.4 | -1.5 | -3.0 |

| Macro | -1.5 | 2.1 | 0.6 | -29.4 |

| Credit/fixed income | -4.0 | -0.2 | -4.2 | 9.3 |

| North America | 0.7 | 15.2 | 15.9 | -57.2 |

| Europe | -1.6 | 5.7 | 4.1 | 5.8 |

| Asia-Pacific | -0.7 | 10.7 | 10.0 | 2.4 |

*Analyst note: Flows are based on reported data at time of publication and are subject to future revision. *All data to the end of November.

Launches

Activity hits new low as restricted investors focus on exisiting funds

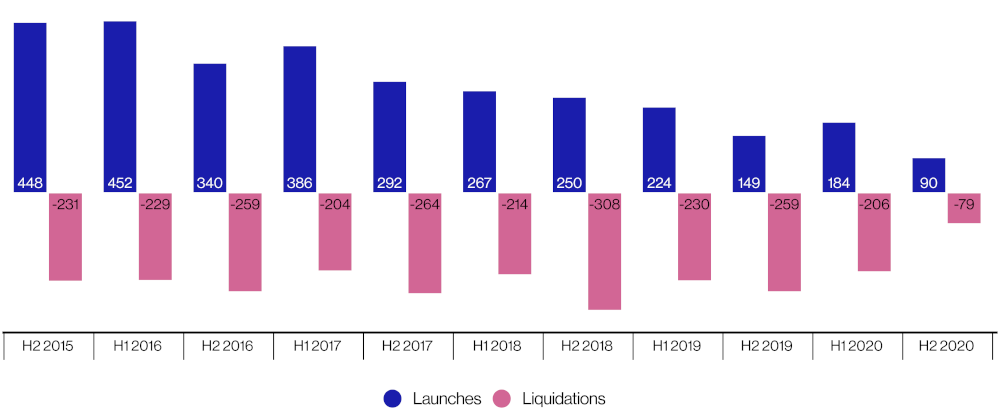

Launch activity all but ground to a halt in 2020, with fewer new funds tracked by HFM in Q4 than any other quarter on record. HFM data suggests approximately 35 funds launched between October and December, which, when added to Q3’s revised estimate, takes the H2 total to 90 and the annual total to 274. In the final year standings, there was a single Q4 fund in the top 10 hedge fund launches: equity-focused Anomaly Capital. In some ways, this was not a surprise. First, the final quarter tends to be the lull in the calendar year’s launch activity. And second, the ongoing and dramatic effects of the Covid-19 pandemic has made raising capital for new businesses, when so much depends on familiarity and face-to-face contact, increasingly difficult. And with restrictions tightening, the effects will likely be felt into Q1. A caveat: emerging manager performance was particularly strong in 2020. And with private wealth investors increasingly keen to put capital to work into hedge funds, and increasingly comfortable with virtual due diligence, the Q1 lull may not be quite as dramatic as once thought.

Hedge fund launches and liquidations tracked by HFM, 2015–2020

(Source: HFM Insights)

About HFM

HFM provides hedge fund professionals with an unparalleled blend of business essential data, exclusive industry intel and market-leading events. Combining 22 years of industry heritage with a cutting-edge platform, to create true business intelligence; the intelligence needed to raise assets, allocate funds or source new business opportunities. Insights is the research and analysis service from Pageant Media, sitting within the company’s hedge fund intelligence network, HFM. The division produces research reports and analytical articles on a variety of topics in the global hedge fund industry, including business operations, investor relations, technology and regulation. Leveraging Pageant’s wealth of data and news sources, and with access to the HFM network’s vast membership, Insights is uniquely positioned, offering exclusive surveys and expert commentary. Learn more about HFM.