As we move further into 2018, business owners and corporations are looking ahead to how the newest tax reforms will impact them.

What Changed?

In 2017, Congress passed the “Tax Cuts and Jobs Act” in an effort to stimulate the growth of small businesses. How will these reforms affect your business in 2018? We’ll take a close look at what the new tax rules mean for you and your business.

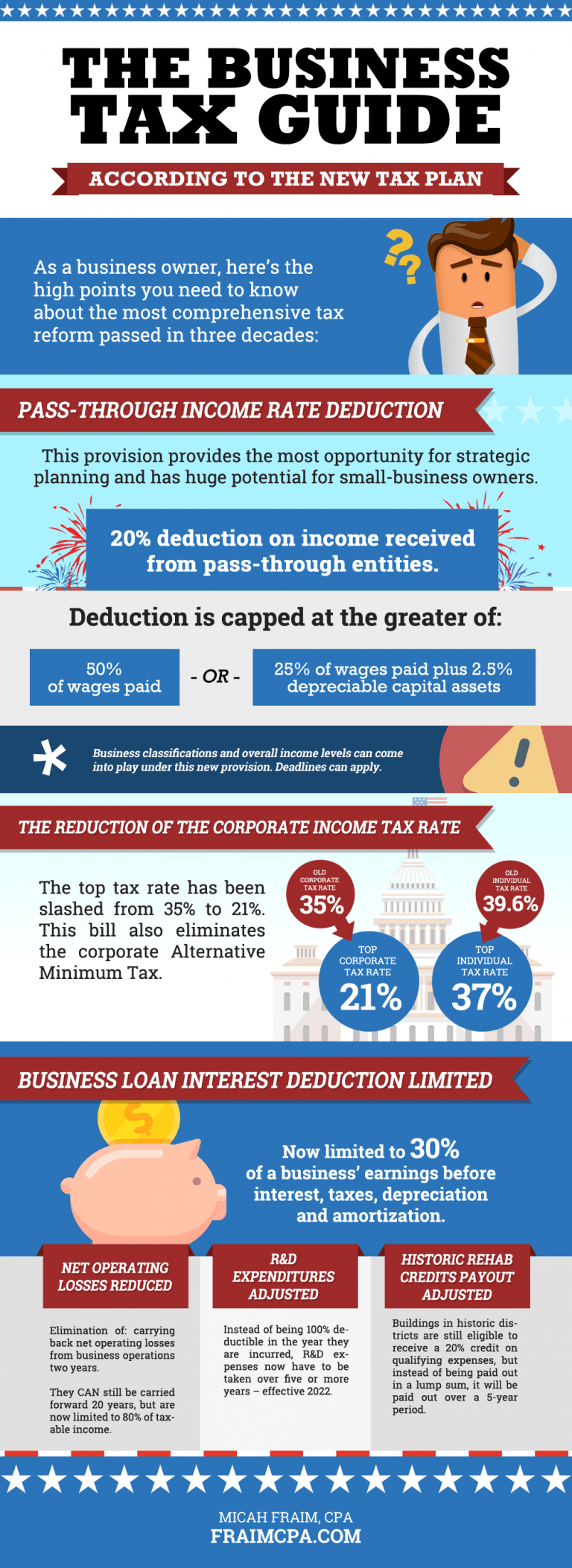

With the new tax reform, there are three big changes that business owners need to be aware of: the pass-through tax deduction, the new flat rate for corporate taxes, and the business loan interest deduction limit.

Pass-Through Tax Deduction

The new pass-through tax deduction is considered to be the most impactful for small businesses. With 95 percent of businesses in the U.S. being operated as pass-through entities, this can have a huge effect on stimulating the economy.

“Companies are referred to as pass-throughs because expenses and revenues for these organizations are passed through to the owner's personal tax returns at individual rates. This differentiates them from the well-known C Corporations that pay a lower tax rate,” says Bryce Welker, contributing writer for Forbes.

If your business qualifies as a pass-through entity, you can now deduct 20 percent of your Qualified Business Income. Matt Evans, with SCORE explains, “if your business is a sole proprietorship, partnership, LLC, or S-corporation, it’s considered a pass-through entity.”

When calculating taxes for a pass-through entity, you’ll deduct from the profit amount of your business (if you meet the appropriate criteria).

Corporate Income Tax Rate Reduction

Corporations are expected to see a significant financial boost, as the top corporate tax rate has been cut from 35 percent in recent years to a new flat rate of 21 percent. The Alternate Minimum Corporate Tax has also been eliminated beginning in 2018. Whereas many of the other new tax-law changes will expire in 2025, this new corporate tax rate will last beyond this expiration date for business owners.

Business Loan Interest Deduction Limited

Business loan interest is now limited to a maximum of 30 percent of a business’ earnings before taxes, amortization, interest, and depreciation. According to Forbes’ Tony Nitti, “the interest limitation rules represent the largest source of complexity and confusion on the domestic side of the Act.”

Each of the tax changes will affect businesses differently depending on a variety of factors. It’s important that you consult with your tax attorneys and accountants to determine what impact the new laws will have on you and your company.

Article by by Micah Fraim, CPA - Fraim CPA