Every dog needs a job. It’s how they make sense of their place in the pack. It’s the key to a Good Dog.

You don’t have to tell dogs what their job is. They tell you. Maggie the German Shepherd? Her job is to protect. Sam the Sheltie? His job is to herd. Not sheep, of course, because that would be too useful. Nope, just squirrels. Turns out it’s not easy to herd squirrels, but that doesn’t stop our “special” dog from giving it his all, every day, rain or shine. Eco the Golden Retriever, pictured above? His job was to love, which he did with grace and abandon for 12 years. Rest in peace, old friend. You were a Good Dog, and I miss you.

Check out our H2 hedge fund letters here.

A dog knows perfectly well when she’s done a Good Job. You can see it in her gait, in her tail, in her ears … everything about the way she carries herself says, “yep, I done good. did you see how good I done? ‘cause I done good.” Conversely, a dog also knows when she hasn’t performed up to snuff. The hangdog look is a real thing. A dog knows honor and a dog knows shame, and there is no more important example that any animal can set for us poor benighted humans.

Why? Well, this is the money quote from Sheep Logic:

Because with no sense of shame there is no sense of honor. There is no mercy. There is no charity. There is no forgiveness. There is no loyalty. There is no courage. There is no service. There are no ties that bind us as citizens, as fellow pack members seeking to achieve something bigger and more important than our ability to graze on as much grass as we can. Something bigger like, you know, liberty and justice for all.

Unlike dogs, humans have a hard time knowing whether or not they’ve done a Good Job. We consistently overestimate our competence at tasks, and when we fail, we evince befuddlement — as if we’re looking for the Restore Saved Game function — rather than remorse or apology. We humans are more Yogi Bear than Lassie.

It’s a widespread behavioral phenomenon at every age and demographic category. But it’s endemic in the young.

I think our notions of what it means to do a Good Job are so stunted for three reasons.

We’ve trivialized honor.

We’ve personalized shame.

We’ve redefined pride.

We trivialize honor through our constant celebration of mere engagement as some sort of actual achievement. We give ourselves and our children these faux “Certificates of Achievement” in one form or another all the time, and once you start looking for them you will see them everywhere.

This is how the Nudging State and the Nudging Oligarchy bring us into the fold. This is how they neg us.

This is how our children become Industrially Necessary Eggs.

We personalize shame by attaching it to identity rather than to behavior. Shame over behavior is ephemeral and corrective. Shame over identity is existential and utterly self-destructive.

The personalization of shame is a merciless goal of the Nudging Oligarchy because we will pay any price to “fix” ourselves. And our children are their primary targets.

Wait, your body isn’t “perfect” like a Victoria’s Secret model? What a shame. But don’t worry, we can help you with that.

We redefine pride when we confuse it for participation and belonging, when we treat it as the opposite of shame rather than what it really is — the foremost of the Seven Deadly Sins.

Like honor and shame, pride has been reattached from behavior to identity by the Nudging State and the Nudging Oligarchy. Like honor and shame, our children are their primary targets.

As Hieronymus Bosch knew well, the demon holding up the mirror of Pride isn’t a fable. The demon is us.

We’ve turned honor into a cheap candy, shame into an existential identity crisis, and pride into a virtue.

- No wonder hospital admissions for suicidal teenagers have doubled over the past ten years.

- No wonder our girls cut themselves and our boys shoot themselves.

- No wonder my Twitter timeline is, day in and day out, a dumpster fire.

- No wonder our 2016 election was a Sophie’s Choice.

By the way, the right answer to a Sophie’s Choice is NO. The right answer to an impossible dilemma is simply this: Homey don’t play that game.

Whee! I bet you’re a real hoot at cocktail parties, Ben. But can we come back to Planet Earth now?

Yeah, sorry about that. Actually, sorry not sorry. But in any event we’ve got to answer this question:

So what DOES it mean to do a Good Job?

Here’s what it means to any self-respecting dog. Which is to say, here’s what it means to all dogs:

You know what your job is.

The job is in service to the pack.

You do the job better than the average dog.

That’s it. That’s the Good Dog’s definition of a Good Job. Like all old wisdom, it’s deceptively simple. Like all old wisdom, it’s applicable across time and endeavor. This is an algorithm, by the way.

I’ll discuss two applications of the Good Dog’s definition of a Good Job in this essay: professional sports and professional investing. In both fields, there’s a LOT of money at stake with answering our question du jour — what does it mean to do a good job? — and in both fields there’s a clear notion of what “the pack” represents — the team in professional sports and the portfolio in professional investing. Given these similarities, it surprises me that there’s not a commonly held language to address the issue.

I think that professional sports is actually more advanced in their language on this than professional investing, or at least more cohesive, so I’ll start there. This is particularly true in the major professional sport most similar to professional investing in terms of its research methodology and sheer number of observable score/price events — baseball.

The modern methodology of baseball analysis goes by the name sabermetrics, coined by the Godfather of modern baseball statistics, Bill James, and named after the Society for American Baseball Research. I’m not sure if my dad started getting the Bill James Abstract in 1980 or 1981, but it was definitely before James hit the (well-deserved) big time in the mid-80s. In his own way, I’d say that Bill James has been the most influential data scientist in the world over the past 40 years. Certainly he’s had a huge impact on my career. Many others who work with data for a living, like Nate Silver, say the same thing.

The central question that Bill James set out to answer in the late 1970s is the Good Job question: You say that Ted Williams was a great baseball player. How do you know? Compared to who? What does that statement even mean? What’s the relationship between the greatness of Ted Williams and the performance of the Boston Red Sox?

These are exactly the questions that investors should be asking about active asset management, too.

There’s an enormous body of work developed in the sabermetric community to answer the Good Job question, but here I want to focus on one specific thread — the idea of Wins Above Replacement (WAR). It’s an approach largely credited to Keith Woolner (he calls it Value Over Replacement Player, or VORP), although as with all great concepts there are plenty of parents and plenty of variations on this theme.

Here’s what WAR seeks to measure: if you were replaced with an average player for your specific position, how many fewer games would your team win?

This is a perfect application of the Good Dog’s definition of a Good Job, all in convenient algorithm form!

- You know what your job is. We compare shortstops to shortstops, left fielders to left fielders, relief pitchers to relief pitchers. We take into account all aspects of the job, including defense.

- The job is in service to the pack. We measure players in terms of how they contribute to winning games for the team. We care about individual statistics only as they relate to team outcomes, not as ends in themselves.

- You do the job better than the average dog. You and your major league peers are, by definition, above average. We have the performance data for easily available replacement players (minor league call-ups, mostly), and we’re going to use that as your performance benchmark.

WAR is the Good Job algorithm for baseball. Today, WAR and its variants are the foundation for almost every economic decision that general managers make, from drafts to trades to contracts, in how they structure their team. Not just in baseball, but in every professional team sport.

So what’s the equivalent of WAR for investing?

Well, there’s no snappy acronym in investing, so I’m going to make one up.

Let’s call it PAR — Performance Above Replacement.

In WAR we want to compare the offensive and defensive stats of a professional position player, like a left fielder, to a readily available replacement position player, like a AAA call-up.

In PAR we want to compare the offensive and defensive stats of a professional active manager, like a long/short equity hedge fund manager, to a readily available replacement manager, like an ETF.

What do I mean by offensive and defensive stats? I mean making a distinction between the investment manager’s performance when the market is up and when the market is down. Makes sense, right? There are bull market managers and there are bear market managers and there’s a lot of muddy area in-between. Let’s measure how active managers perform across this crucial dimension for your portfolio so that we don’t miss some skill that might otherwise get lost in the shuffle. This is particularly important for long/short equity and global macro investors because they’re constantly changing their gross and net exposures, and it is the driving force behind the most commonly uttered phrase of active managers trying to explain how they do a Good Job: “We capture x% of the upside in our market but only y% of the downside!” where, of course, x is greater than y. If you haven’t heard (or used) that line 5 bazillion times in your investing career, then … lucky you. In more technical terms (and I’m sorry to do this, but I promise you there will be a payoff), these active managers are saying: “I am doing a Good Job because my performance demonstrates convexity.”

The concept of convexity is at the heart of Performance Above Replacement.

Convexity? Woof … that’s a ten-dollar word if there ever was one.

Let’s say you’ve got an area of your portfolio — call it your “tactical overlay” portion of the portfolio — where you’d like to give active management a shot. You’ve identified an active manager who runs a long/short global macro fund, you’ve decided that this is potentially a “real” diversifying strategy, and now you want to look at the manager’s PAR. Since this manager plays in the Everything sandbox, you’re going to use a global 60/40 investable index (or better yet a global risk parity strategy … yes, I went there) as the “replacement player”, and you’re going to separate out how the manager performs in up markets versus down markets, using the S&P 500 for that distinction because that’s your benchmark.

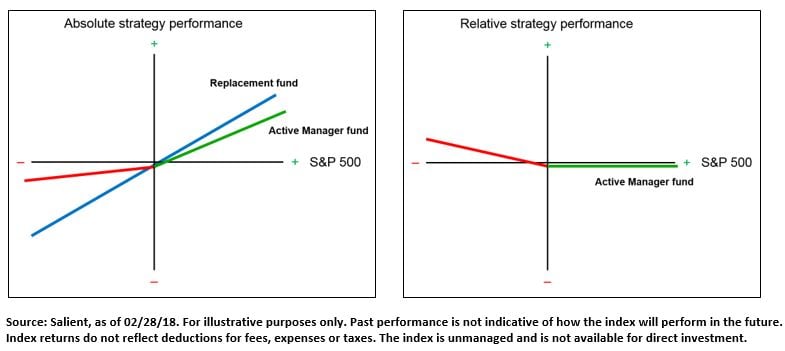

Here are some stylized absolute return profiles on the left, and the corresponding relative return profile on the right. I’m simplifying things here by drawing straight lines instead of what would be a smattering of point observations (monthly performance numbers, for example), but you can use a linear regression to create the lines. Actually you’re running two linear regressions, one for the manager’s offensive stats (performance when the S&P 500 is up, in green) and one for the manager’s defensive stats (performance when the S&P 500 is down, in red). The blue line is the performance of the replacement strategy (a global 60/40 or risk parity fund). Both funds cross the y-axis slightly below zero (more so for the active manager) to reflect the management fees and expenses associated with the funds.

When you “normalize” the active manager’s performance versus the replacement strategy and the S&P 500, which is what the right-hand graph is doing, you see that this manager nicely outperforms the replacement strategy in difficult markets without underperforming nearly so much when markets are rocking, creating a shallow V-shape or upward bend to the performance line. THIS is convexity.

This manager clearly has positive PAR, meaning that she improves the performance of your portfolio versus what you would have done with a passive replacement strategy, once you take into account both offensive and defensive stats. This manager is like a talented defensive catcher (i.e., a position where it’s important to play good defense) who is a so-so offensive player. That’s a classic player type, and there are plenty of teams who would find a spot on their roster for that.

There are dozens of different tools and well-known performance analytic statistics (Sortino ratio, Jensen’s alpha, upside/downside capture) that will do some variant of this PAR calculation for you, and they’re all designed to capture different aspects of convexity. This sort of exercise is the mother’s milk of consulting gigs, and every consultant in the world would look at this data and tell you that this manager is doing a Good Job.

Pretty exciting, right? Here’s a methodology that clearly works in professional sports and can be directly brought over to professional investing. It’s empirically driven and mathematically sound.

But it doesn’t work.

Or at least it doesn’t work anymore. Like so many other aspects of our investing lives, these mathematically sound and empirically driven efforts to answer the Good Job question for active management have collapsed under the chaotic gravitational pull of The Three-Body Problem.

In exactly the same way that Quality has been absolutely useless as an investment factor for the past eight and a half years, so have our traditional measurements of active manager skill.

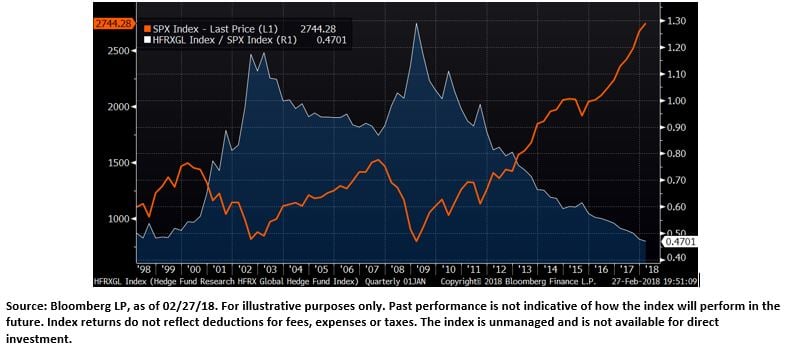

The orange line in the chart below is the S&P 500 Index from 1998 to today. The white line and blue-shaded area is the HFRX Global Hedge Fund Index divided by the S&P 500 Index. It represents the relative underperformance or outperformance of hedge funds versus the S&P 500, and today we are at all-time underperformance lows. There is no convexity here! At least not in the aggregate. It skipped town in March 2009, just as the Central Bank Brigade rode in to save the day.

Managers who used to “capture” more upside than downside don’t. Managers who used to demonstrate convexity in their results don’t. They still have lots of stories to tell you about how they manage gross and net exposure, lots of stories to tell you about volatility and risk management, and lots of stories to tell you about thematic opportunities. Most still express a great deal of pride in their investment process.

I’m not saying that these “proprietary processes” will never work again. I’m not saying that they’re not working now. I’m saying that if they’re working, they’re working very very faintly. So faintly that you have to believe in the story to stay the course, because it’s sure not in the aggregate results. I’m saying that the processes and the skills and the performance convexity of professional active investors are swamped by the gravitational pull of $20 TRILLION of central bank balance sheets, as are the traditional tools we’ve used to measure all that. Because that’s the point of the Three-Body Problem – any algorithmic understanding of the system will fail to predict what’s next.

So what’s to be done? Do we just give up trying to answer the Good Job question? If our evaluative tools for active managers are non-predictive, do we just throw ourselves onto the waves of the S&P 500 and hope for the best? Because that’s what a lot of investors are doing, including giant pension funds who should know better, even though doing so is an active management decision of the first order!

Here’s the thing. Yes, It’s more difficult than ever to answer the Good Job question regarding active investment management. It’s also never been more important.

Because while I have no way to predict what’s next in the Three-Body System, I can tell you with absolute certainty that there IS a next, and it will NOT look like now.

Because you ARE the active manager when you select this passively managed fund over that passively managed fund, and you are not as good of an active manager as you think you are.

As wonderful as it would be for investors to style themselves as baseball general managers, poring over advanced performance statistics to pick this or that great fund manager in some sabermetric nirvana, that’s just not in the cards. We have to find a better way, a way to answer the Good Job question in a Three-Body system. Because we’re not getting away from active management even if we wanted to.

Our answer, I think, is to go back to first principles, to go back to the code of the Good Dog. The answer, I think, is in convexity, but not in the mathematical over-scientificized cartoon of the word.

The answer, I think, is in convexity as a philosophy.

Convexity as a philosophy is about identifying what you are particularly good at, and then executing on THAT. It’s the key to unlocking a much more stable notion of identity — a Good Dog’s notion of identity. Good Dogs know what they’re good at, and I don’t need to calculate a Sortino ratio to know if they’re doing a Good Job.

We can do the same with our evaluation of active managers. We can tell when an active manager is doing a Good Job. We can see it in her demeanor, we can see it in her temperament, we can see it in her bravery, both personally and professionally. Every Good Dog is a Brave Dog. It’s the same with investment managers. We can see it in her humility — the virtuous opposite of sinful pride. We can see it in her sense of shame when a behavior is not up to snuff. Not identity, behavior. There’s no shame in identity. Ever.

There’s a sine qua non for adopting convexity as a philosophy in evaluating active managers, and it’s as simple as it is difficult: courage, both personally and professionally. We’ve got to be Brave Dogs, too.

To be clear, the behavioral attributes associated with a Good Dog’s notion of a Good Job are a necessary condition for approving an active manager, not a sufficient condition. Sam the Sheltie does a Good Job, too, but I wouldn’t exactly recommend an accomplished squirrel herder as a must-have addition to your farm. Even Maggie the German Shepherd, who does a Good Job of protecting the farm and is a player everyone would want on their team, has “regimes” where her above-replacement performance vanishes. I’ll put it this way … she apparently dislikes chickens almost as much as I do, such that if you’re a fox and you want to chow down on a free range hen or two, picnic-style in the middle of a grassy field while Maggie sits there and watches you eat … well, come on over. And that gets me to the second sine qua non of adopting convexity as a philosophy in our manager selection — we must have the process and the fortitude to scale our active risk allocations up and down based on what is working, including the ability to take risk completely away from our managers. Maggie is a VERY Good Dog. But when the chickens are loose her risk allocation here at the farm goes to zero. We find protection somewhere else.

Convexity as a philosophy is also at the heart of how we improve ourselves and our children as citizens.

Always be yourself. Unless you can be Batman. Then always be Batman.

It’s maybe the funniest movie line I know. Why is this funny? Because we have made a political and social fetish out of identity, out of the New Commandment to ALWAYS BE YOURSELF. Unless you can be Batman.

At the same time, we’ve attached pride and shame to identity, rather than to behavior where they belong, training ourselves and our children to be absurdly self-assured and prideful, and yet existentially ashamed all at the same time. ALWAYS BE YOURSELF is the most powerful story we tell ourselves. And the most dangerous if attached to pride and shame wrongly understood.

We can tell ourselves a new story. A story, dear Brutus, where the fault is not in our stars, but in ourselves. As is the achievement. As is the honor.

Find your pack. Here and here and here are some ideas on how to do that. And then do a Good Job with your service to the pack, no matter how big, no matter how small. You’ll figure it out.

Every dog needs a job to make sense of its place in the world. So does every human.

Article by W. Ben Hunt, Ph.D., Salient Partners