Let’s face it, the metals are not having an easy time breaking out. Short-term rallies end up going nowhere and bearish signs are still in abundance.

Q3 2021 hedge fund letters, conferences and more

Yesterday’s session was once again quite informative, and so is today’s pre-market trading. In yesterday’s analysis, I emphasized the importance of the relative weakness that we just saw in mining stocks, so let’s start with taking a look at what mining stocks did yesterday.

A Look At Gold Miners' Performance

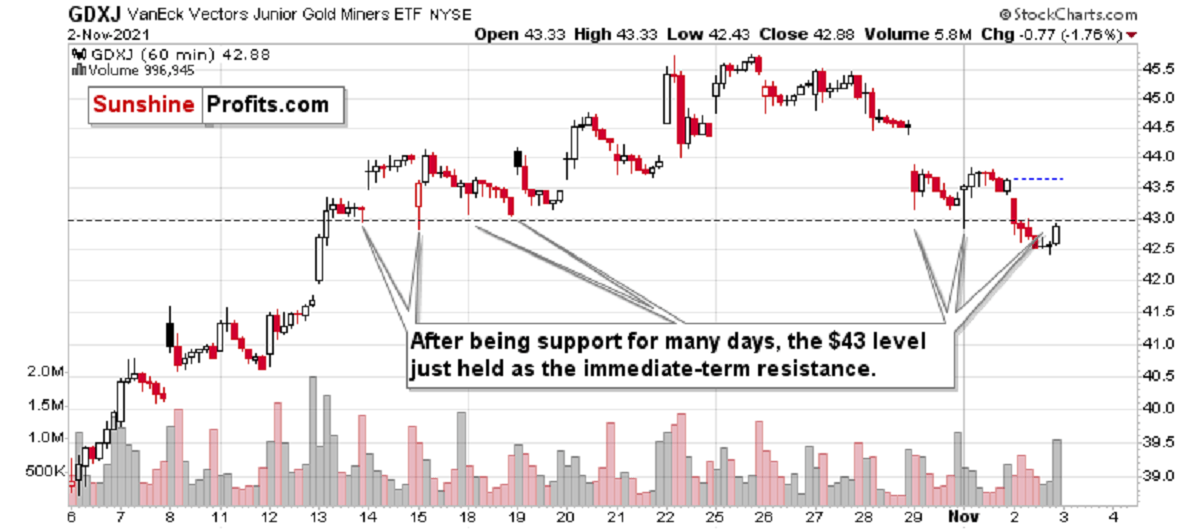

At first glance, yesterday’s performance might look like a bullish reversal, but zooming in clarifies that something else was actually in the works. Let’s take a look at the GDXJ 1-hour candlestick chart for details.

Yesterday’s “reversal” was actually a breakdown below the previous (mid-October) intraday lows along with the verification thereof. The GDXJ moved below the above-mentioned lows and – while it moved back up – it ended the session below them.

This is a bearish type of session.

Also, if you were wondering about the high volume in the final hour of trading – that’s relatively normal as that’s when bigger trades tend to take place.

And while mining stocks were busy verifying the breakdown, gold tried to break above its declining, red resistance line, and verify that breakout.

While yesterday’s session didn’t bring much lower gold prices (and the invalidation), today’s pre-market trading makes it clear that the attempt to break higher failed. Just like I had indicated yesterday.

This time the rising short-term support line is not there to prevent further declines as the breakdown below it was also confirmed.

What does it mean? It means that gold is likely to fall, and quite likely it’s going to fall hard.

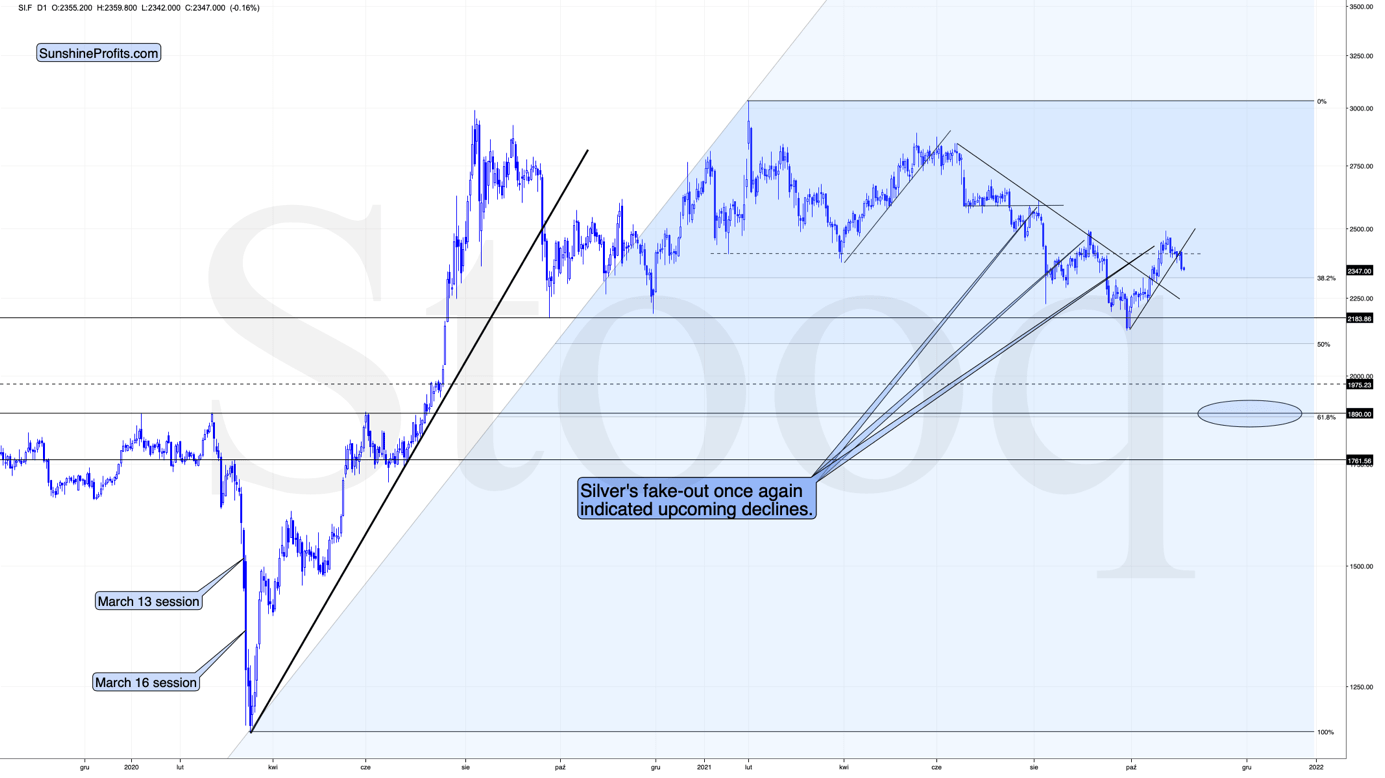

Besides, silver price is after a major short-term breakdown, too.

Silver's Reversal

After a powerful short-term rally, silver had reversed, and now it broke below its rising support line. That’s yet another bearish indication. Please note that at first silver was reluctant to decline while mining stocks moved decisively lower, which was normal during the early part of a given decline. Silver did some catching-up action yesterday, but since miners are not showing strength, I’d say that we’re getting to the regular part of a short-term move, not close to its end.

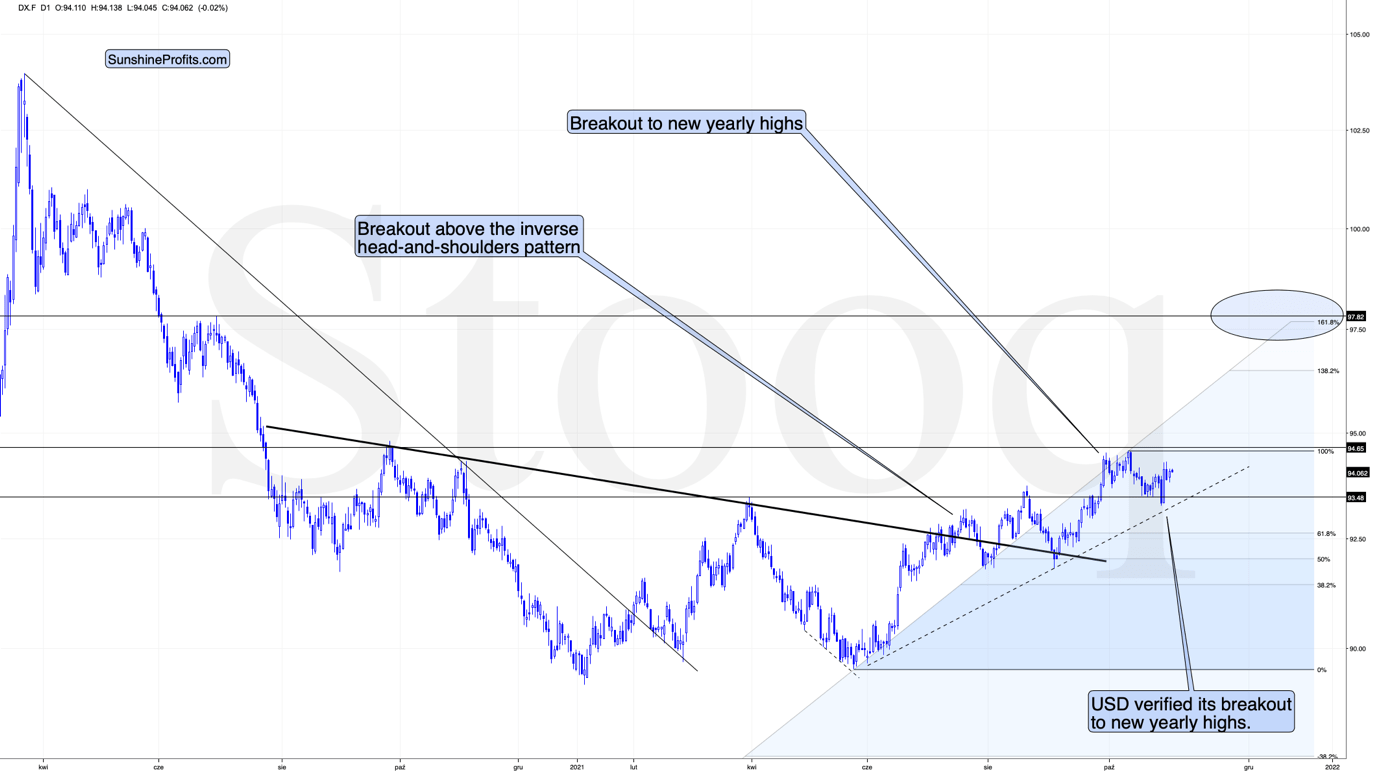

And the move lower is likely to continue, just as the move higher is likely to continue in case of the USD Index.

The USDX is after a verification of the breakout to new 2021 highs and after an about monthly consolidation above them. This is a perfect starting point for a major upswing, and we’re likely to see one soon.

All in all, while the outlook for the precious metals sector is very bullish for the following years, it’s very bearish for the following weeks.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.