Investors believing that the Fed will follow the BoE’s example continue to support the short-term gold rally. Their optimism, however, may end soon.

Tales That Fail

With gold, silver, mining stocks, and the S&P 500 continuing their short squeezes on Oct. 4, the Fed pivot narrative still dominates investors’ decision-making.

Moreover, with JOLTS job openings declining by more than one million month-over-month (MoM) and missing expectations, a cooler U.S. labor market has the bulls assuming inflation and future rate hikes will slow.

Please see below:

Source: Investing.com

In addition, a realization of the narrative would be profoundly bullish for the PMs. Fundamentally, fewer rate hikes should reduce real interest rates and suppress the USD Index. Therefore, the PMs’ primary fundamental adversaries would be on the defensive.

However, the narrative lacks credibility, and the post-GFC crowd is repeating the same mistake. Remember, when the headline Consumer Price Index (CPI) peaked year-over-year (YoY) in June, investors assumed the battle was won.

However, I warned on numerous occasions that peak inflation was irrelevant. What matters is how high the U.S. federal funds rate (FFR) needs to go to normalize the metric to 2%.

Thus, after the consensus came around to our way of thinking, rate hike expectations rose dramatically, and the crowd realized how silly the peak inflation narrative was. Yet, we find ourselves in a similar situation now.

For example, with the weak JOLTS data emboldening the pivot predictors, the ‘bad news is good news’ mantra was on full display. However, the reality is that there are more than four million job openings compared to the number of the unemployed Americans. As a result, the supply/demand imbalance still favors employees and supports wage inflation.

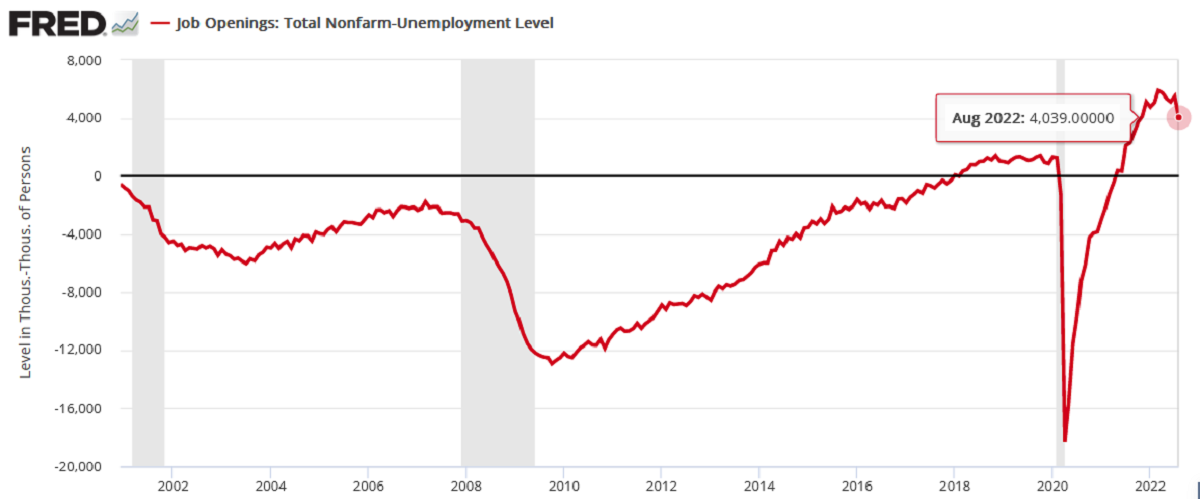

Please see below:

To explain, the red line above subtracts the number of unemployed Americans from the number of U.S. job openings. If you analyze the right side of the chart, you can see that the metric is still well above any figure realized pre-pandemic. So, while an all-time high is no longer present, the spread is far from the low inflation levels witnessed from 2000 to 2020.

Second, while investors focused all their attention on the headline figure, they ignored that quits increased by 100,000 MoM.

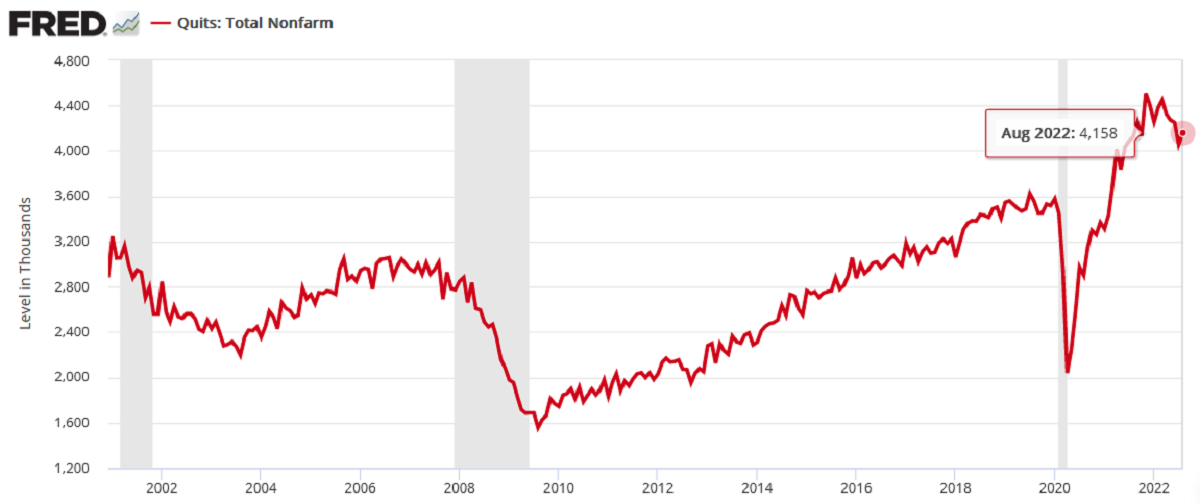

Please see below:

To explain, the red line above tracks the number of Americans that quit their jobs each month. If you analyze the right side of the chart, you can see that the metric is down from its all-time high but increased in August.

Therefore, with more Americans resigning MoM, the data highlights how job opportunities remain plentiful. Think about it: employees don’t voluntarily leave their jobs unless better opportunities await them elsewhere. Moreover, the deciding factor is often higher pay.

Thus, with the JOLTS spread and quits still well above their pre-pandemic norms, the small progress is not enough for the Fed to pivot.

To that point, New York Fed President John Williams said on Oct. 3:

“Clearly, inflation is far too high, and persistently high inflation undermines the ability of our economy to perform at its full potential (…). We need to make sure that we take the actions to get inflation turned around, start bringing it back to our 2% goal.”

Also, when asked about Treasury market illiquidity and the stress of higher interest rates, Williams largely brushed off the issue. He said:

“We’ve seen enormous volatility in these markets, not just because of monetary policy, but because of the uncertainty around the outlook, global events. Hopefully, the volatility that we’ve seen in the last few weeks will come down somewhat, and that will help with that situation. But right now, I would say that trades are being made, market liquidity is definitely lower, but it’s still functioning.”

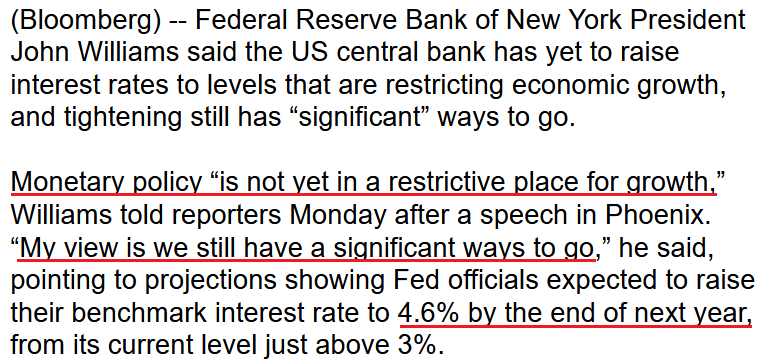

As such, while the consensus assumes the Bank of England’s (BoE) QE flinch will be mirrored by the Fed, Williams said that interest rate hikes still have a “significant ways to go.”

Please see below:

Source: Bloomberg

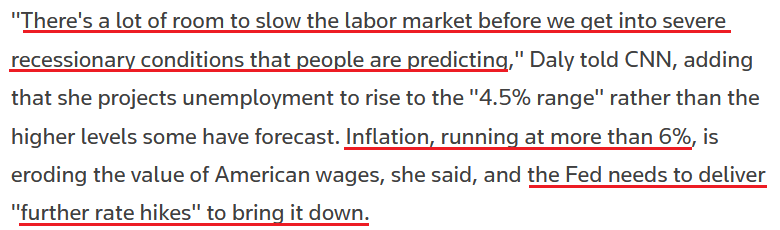

Likewise, San Francisco Fed President Mary Daly said on Oct. 4:

Inflation is a “corrosive disease; it is a toxin that erodes the real purchasing power of people. An inclusive economy goes both ways. It doesn’t mean just jobs, it means jobs and price stability.”

As a result, Daly projects a much higher FFR and wants the Fed to hold the policy in place until “we are truly done.”

Please see below:

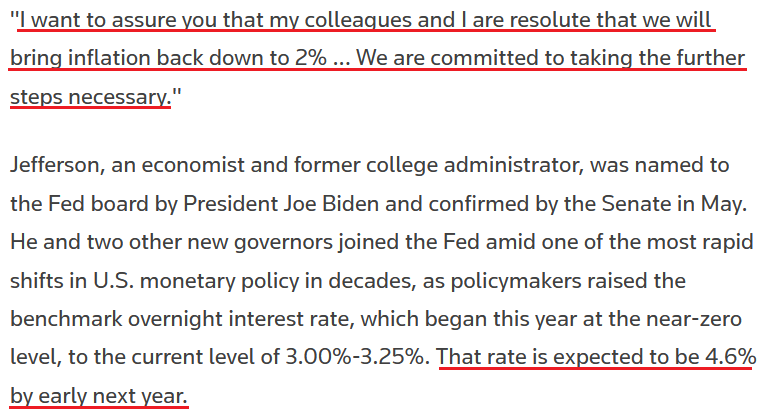

Source: Reuters

Making three of a kind, Fed Governor Philip Jefferson said on Oct. 4 that reducing inflation is paramount and economic growth could be an unfortunate casualty.

“Inflation remains elevated, and this is the problem that concerns me most,” he said. “Inflation creates economic burdens for households and businesses, and everyone feels its effects.”

He added:

“Restoring price stability may take some time and will likely entail a period of below-trend growth (…). [But] it is important that we get back to [a stable] kind of economy, and that is what I think the intent of the Fed is.”

So, while the bulls price in a dovish pivot, Fed officials’ consistent hawkish message signals the exact opposite.

Please see below:

Source: Reuters

Thus, while the crowd engages in wishful thinking, the harsh truth is that inflation remains problematic and the U.S. labor market remains resilient. Furthermore, when data points decline from their cycle highs, the battle is not won. Sure, the financial markets react as if it’s a major victory.

However, since it’s taken 12 25 basis point rate hikes for the headline CPI and JOLTS job openings to come down from their peaks, investors underestimate how difficult it will be to bring them back to pre-pandemic levels.

Therefore, the FFR should rise materially in the months ahead, and the USD Index and the U.S. 10-Year real yield should be substantial beneficiaries. In contrast, gold, silver, and mining stocks should head in the opposite direction.

Why All of the Short-Term Optimism?

Because asset prices don’t move in a straight line, countertrend moves are an unfortunate byproduct of medium-term investing. So, while the GDXJ ETF’s recent uprising is far from fun, bear market rallies are commonplace along the journey to a final low.

To that point, with precious metals pessimism increasing dramatically in recent weeks, the reversal should fail once sentiment normalizes.

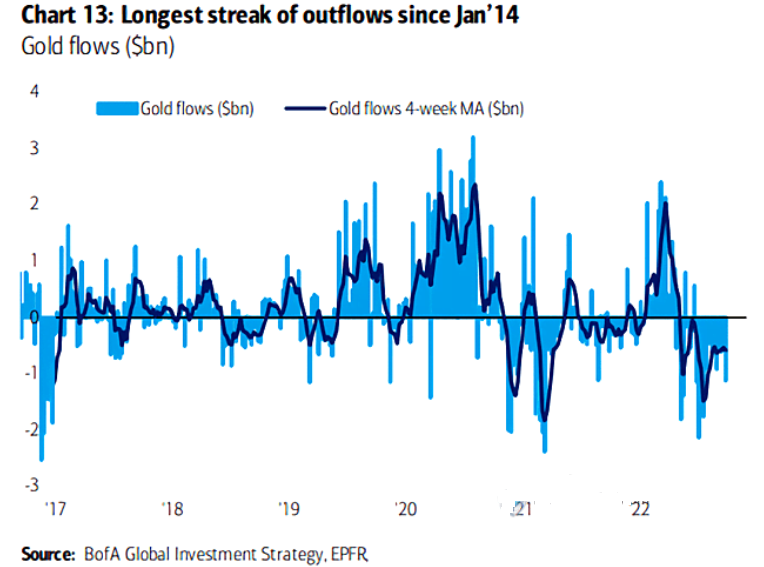

Please see below:

To explain, the light blue bars above track weekly gold flows, while the blue line above tracks the four-week moving average. According to Bank of America, before the squeeze started on Oct. 3, gold funds suffered their longest streak of outflows since January 2014. As a result, the yellow metal was profoundly out of favor.

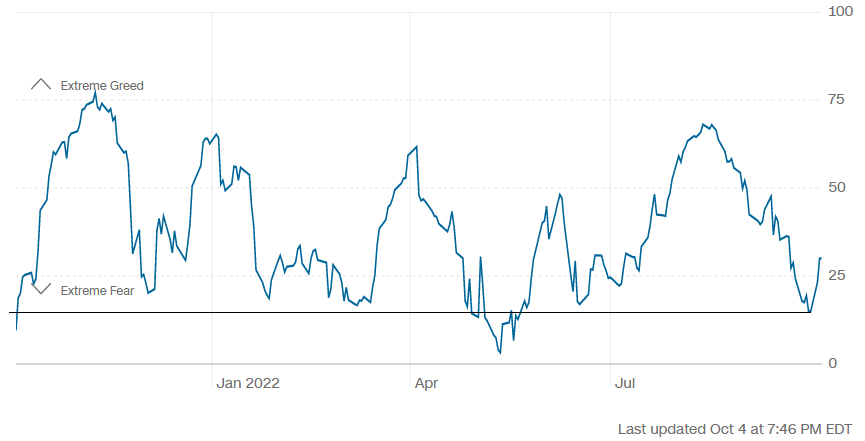

Second, CNN’s Fear & Greed Index hit abnormally low levels, which signaled extreme fear in the financial markets.

Please see below:

Source: CNN

To explain, the blue line above tracks CNN’s Fear & Greed Index. If you analyze the horizontal black line, you can see that the index ended September at its lowest level since May. Thus, over-positioning helped fuel the S&P 500’s squeeze higher.

Finally, while the gold permabulls are perpetual predictors of a Fed pivot, disappointment should confront the hyper-inflationists in the months ahead.

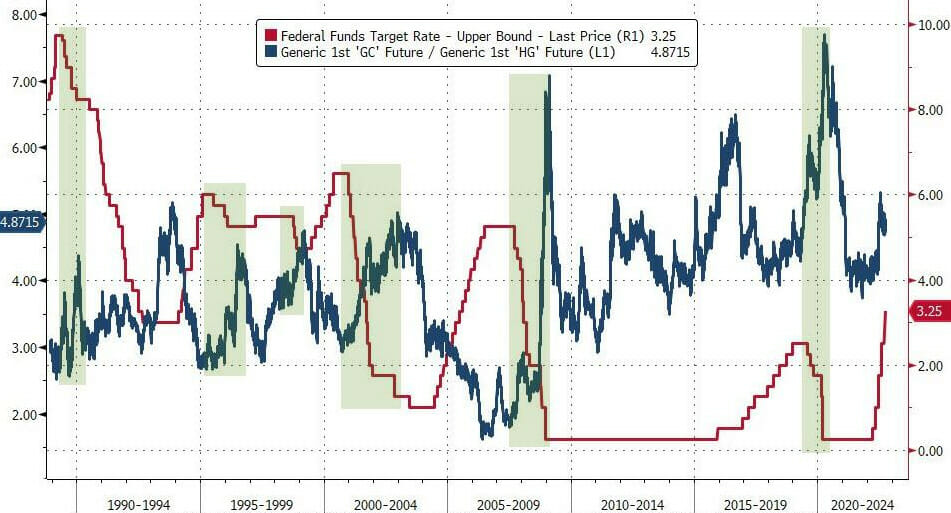

Please see below:

Source: Bloomberg/ZeroHedge

To explain, the blue line above tracks the gold/copper futures ratio, while the red line above tracks the FFR. If you analyze the vertical gray rectangles, you can see that gold often outperforms copper when the Fed cuts interest rates. Or, when the red line peaks and declines, the blue line often rises.

Therefore, it’s no surprise that hopes of a dovish pivot have investors piling into the PMs. However, the FFR has not peaked, and the permabulls have lost money repeating this bet throughout 2022. Likewise, since inflation doesn’t die easily, the FFR should continue its ascent, and gold should hit lower lows before it’s all said and done.

The Bottom Line

While gold, silver and mining stocks continued their uprisings on Oct. 4, their rallies are built on foundations of sand. Moreover, while the pivot predictors gain confidence, the latest iteration is no different than their previously poor forecasts. In reality, inflation is nowhere near 2%, and Fed officials are united in supporting a higher FFR.

As a result, risk assets’ recent strength is more about positioning than medium-term fundamentals or technicals; and while the short term is always unpredictable, more reality checks should emerge in the months ahead.

In conclusion, the PMs rallied on Oct. 4, as the shorts ran for cover once again; and while positioning imbalances can fuel short-term upswings, 2022 highlights how these rallies fail when the fundamentals and the technicals don’t participate. As such, the bear market should resume sooner rather than later.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice.

Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported.

The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor.

By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss.

Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.