WEST LAFAYETTE, Ind. – Reported food insecurity has reached 17%, matching the rate last reached in March 2022, according to the June Consumer Food Insights Report. The new report also includes consumer changes in food spending as a result of a hypothetical recession and sentiments on artificial intelligence.

The survey-based report out of Purdue University’s Center for Food Demand Analysis and Sustainability assesses food spending, consumer satisfaction and values, support of agricultural and food policies, and trust in information sources. Purdue experts conduct and evaluate the survey, which includes 1,200 consumers across the U.S.

“Overall, there continues to be a similar narrative of extended upward pressure on food prices as we try to discern whether this stress has led to a tipping point where consumers are struggling to buy the foods that they want,” said Jayson Lusk, the head and Distinguished Professor of Agricultural Economics at Purdue, who leads the center.

Food Insecurity Rate Rises

“The 17% food insecurity rate is up from 14% just two months ago, which is not necessarily far outside of the normal variation we have measured. However, this increase could be concerning given the sum of external pressures being exerted on more vulnerable consumers,” Lusk said.

He noted that pandemic-related boosts to the Supplemental Nutrition Assistance Program (SNAP) ended in March. The insecurity rise could be a lag from households adjusting to this policy change.

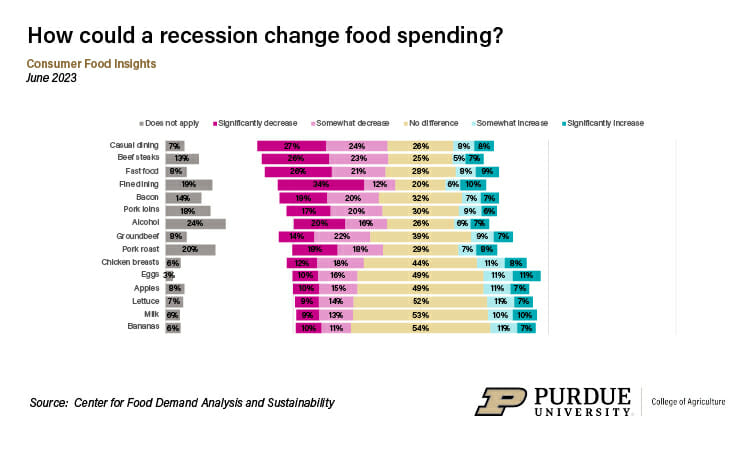

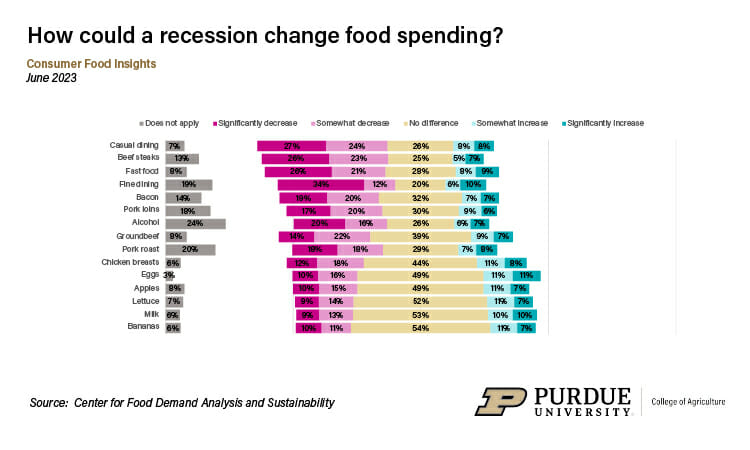

In the event of a recession, consumers report that they would cut back most on steak, pork and dining out. These results align with what Lusk would expect to occur if incomes fell.

“Discretionary spending on eating out will go first if consumers have to face a recession. Then people will cut back on more expensive items that they can easily substitute in their diets. Steak and bacon, for example,” Lusk said. “It is interesting to see that the items with a large share of ‘does not apply’ are also largely items that will be cut back the most as many people are already choosing to forgo them.”

Additional key results include:

- Reported food spending has risen by 2.1% from last June, which is much less than the 6.7% government estimate of food inflation.

- Households making less than $50,000 annually are buying groceries online at a higher rate than other households.

- The report noted that the pandemic opened the online option to SNAP recipients, which evidently remains a key tool for a range of shoppers.

- Households making more than $100,000 annually are slightly greater risk-takers, which is reflected by a higher willingness to eat unwashed fruits and undercooked meat.

- Consumers largely have positive or neutral feelings about applying artificial intelligence (AI) in the food and agriculture sectors.

“The artificial intelligence questions are much more speculative since there are not yet widely known examples of AI being used across the food system,” said Sam Polzin, a food and agriculture survey scientist for the center and co-author of the report. “People really do not have enough information about AI to have thoughtful positions, as seen in the large share of indifference.”

Surprisingly to Polzin, 50% of consumers said they would be OK with AI helping them make food choices, which is generally considered a personal decision. “This proportion might be indicative of how eager people are to make the ‘best’ choices,” Polzin said.

According to the U.S. Bureau of Labor Statistics, annual inflation for food-at-home fell below inflation for food-away-from-home (FAFH) this spring, he noted. This poses the question: Will consumers continue to spend at faster rates on dining out?

“The highest earners are driving a larger share of the increase in FAFH spending and have no clear reason to slow down. We will keep track of whether two different patterns emerge in which higher-income households continue to thrive while lower-income households might be forced to pull back,” Polzin said.

The report’s results about food behaviors align with other research showing that high-wage consumers take higher risks than those earning less. “The fact that higher earners report eating unwashed fruits, undercooked meat and raw dough slightly more often could reflect this risk-taking,” Polzin said.

Other reported food behaviors are fairly expected. High-income households, for example, will choose premium local and organic products more often than lower-income households. They also often have more resources to track and understand food labeling or follow recycling and composting practices.

Lusk further discusses the report in his blog.

The Center for Food Demand Analysis and Sustainability is part of Purdue’s Next Moves in agriculture and food systems and uses innovative data analysis shared through user-friendly platforms to improve the food system. In addition to the Consumer Food Insights Report, the center offers a portfolio of online dashboards.