Happy New Year, this is the last update of the third quarter financial statements for US companies now complete. It was the first quarter when average cash flow growth declined. That goes a long way to explain why stocks performed well this year despite an overall decline in the value of assets.

Share prices are a function of interest rates and corporate growth. Until the third quarter SEC financial reports, companies were reporting lower sales growth but better profit margins and persistently rising growth in cash.

Q4 2022 hedge fund letters, conferences and more

That came to an end in the most recent reports with gross profit margins down on average and CFROI (cash profitability) also down. In the next few weeks, as companies report their annual results for 2022, we will get a gauge of how steeply growth will fall.

Consumer Goods Remains Strong

A typical recession in the US is brought on by lower demand for big ticket consumer goods, autos and housing. So far, we have not seen a slowdown in either. The big jump in interest rates has caused a buy-now frenzy producing high and higher sales growth in both industries.

Only when those industries peak can we expect a sufficient slowdown to moderate inflation. Until then, inflation will remain high and interest rates will go higher. Asset prices will drop and stocks will perform poorly.

Energy And Growth

It is the direction of energy prices that will determine the growth outcome. For now, flat energy costs year over year will cause measured inflation to fall. But only temporarily. The US economy is still overheated and the re-emergence of the Chinese after their lockdown will push oil prices up.

Capital expenditures at oil companies are declining relative to sales. Historically this is a cycle trough indicator showing that supply growth is constrained. With demand growth increasing, oil prices will rise. There is lots of disruption recently and manipulation of oil prices by governments leaves plenty of room for volatility.

Stock Market Volatility

We will use this volatility to navigate our way through a very risky period for the next few quarters. Your portfolio avatar now complete for the quarter displays the rising growth attributes of your portfolio companies as a tall green Money-tree in a golden pot.

Rising growth protects the portfolio from the negative effects of high inflation. The very small number of companies with rising growth attributes is reflected in our large cash positions.

Look at accelerating companies in their acceleration phase, such as FactSet Research Systems Inc. (NYSE:FDS).

Factset Research Systems Inc. (FDS) $404.460 BUY This Rich Company Getting Better

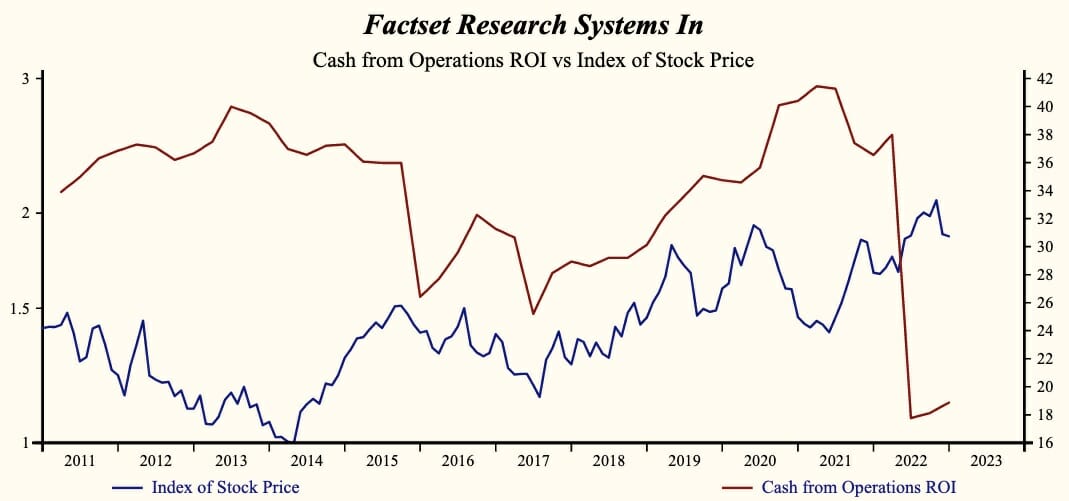

Factset Research Systems Inc. (NADAQ:FDS) has been an exceptionally profitable company with persistently high cash return on total capital of 32.9% on average over the past 20 years. Over the long term the shares of Factset Research Systems have advanced by 62% relative to the broad market index.

The shares have been very highly correlated with trends in Financial Condition Factors. The dominant factor in the Financial Condition group is shareholders capital(inverted) which has been 96% correlated with the share price with a five-quarter lead.

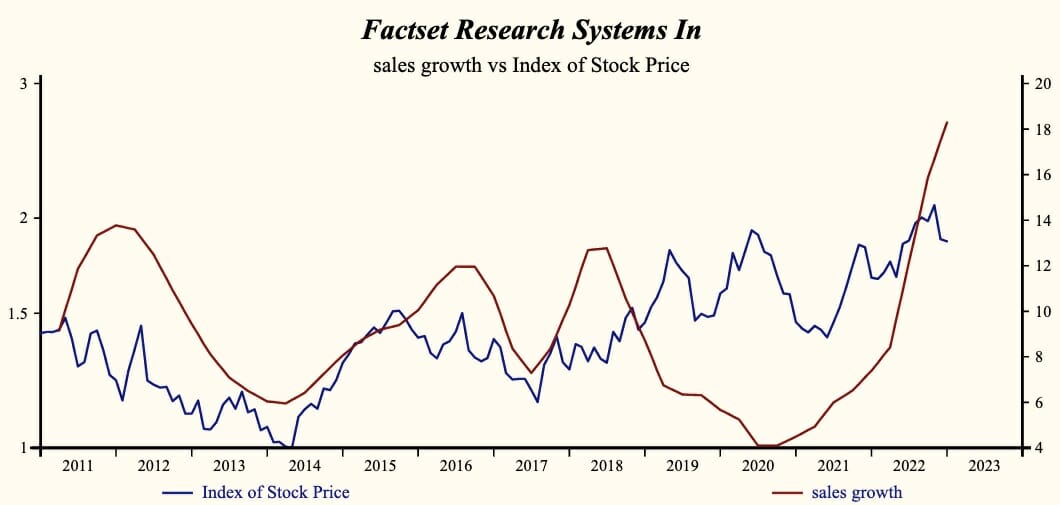

Currently, Sales Growth is 18.3% which is high in the record of the company and higher than last quarter.

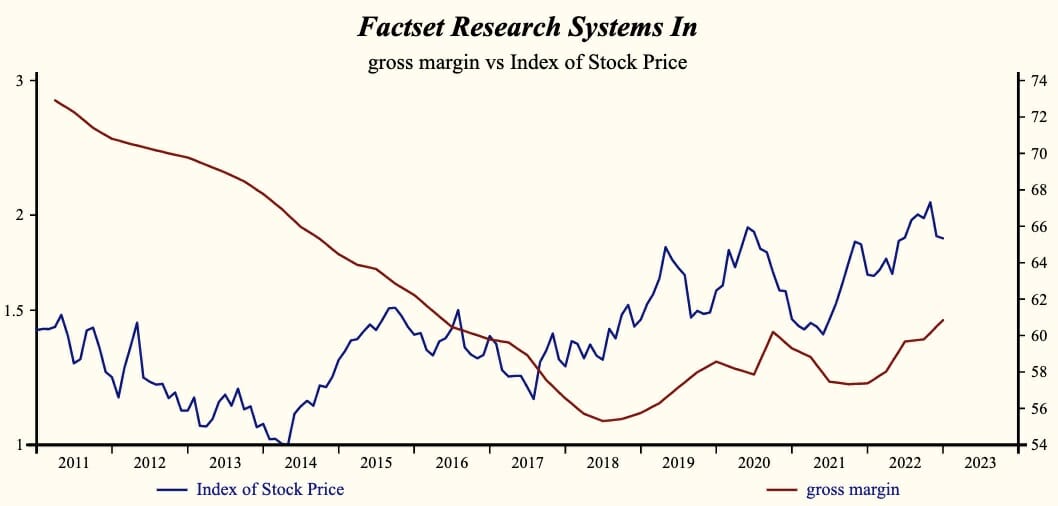

The company is recording a rising gross profit margin and SG&A expenses continue to fall producing a leveraged acceleration in EBITD relative to sales.

Margins Are Up

Rebounding from a late 2021 low, the company is now recording a high and rising gross profit margin. This is the 5th consecutive increase in the gross margin.

Cashflow Is Now Up

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. Lower capital expenditures have been supporting free cash flow for quite some time. The stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby accelerating free cash flow growth for a second consecutive quarter.

More recently, the shares of Factset Research Systems have advanced by 28% since the June, 2020 low.

The current indicated annual dividend produces a yield of 0.9%. Five-year average dividend growth is 10.9%. Current trailing operating cash-flow coverage of the dividend is 5.0 times

The shares are trading at lower-end of the volatility range in a 19-month rising relative share price trend.

Time To Buy

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.