The latest issue of ‘The Globe’, Eurizon’s publication describing the Company’s investment view. In this issue, a focus is dedicated to “inflation is the culprit.”

Scenario

Government bond yields on the rise across maturities, most markedly on the short end of the curve, in a context of still high inflation, resilient growth, and aggressive Central Bank actions.

Fed funds futures now point to rates peaking in the 4.7% area next spring, from 3% at present, and subsequently dropping back. Similar course for ECB rates, now at 1.25% and forecast at over 3% by mid-2023. These expectations anticipate a drop in inflation and a contraction in growth between the end of 2022 and the opening months of 2023.

Q2 2022 hedge fund letters, conferences and more

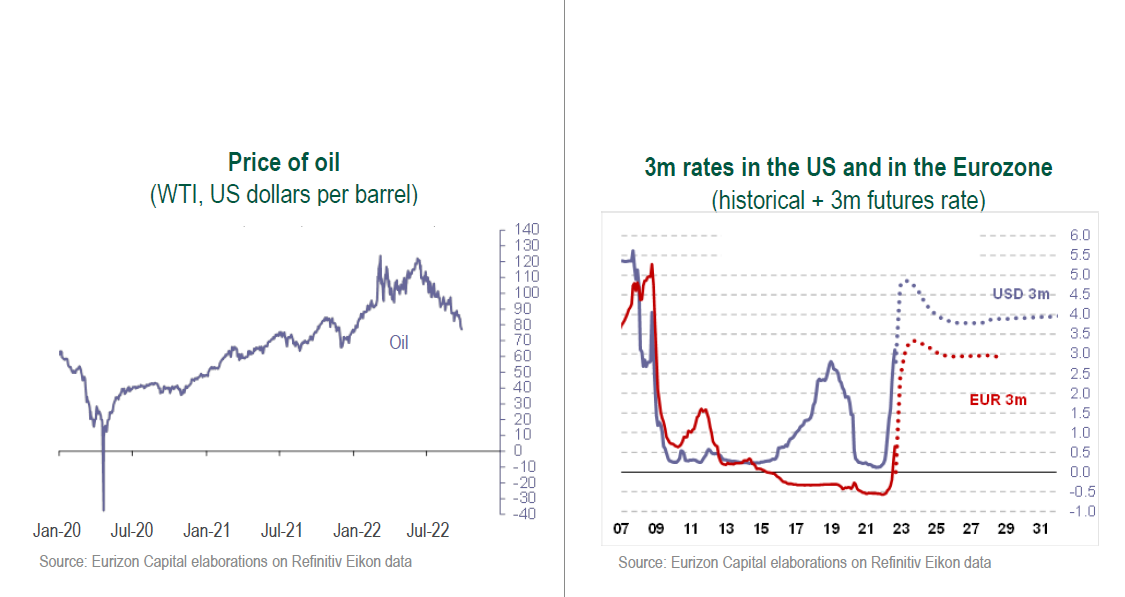

The moderation would be welcome, although until there is clear evidence in this direction the Central Banks will not be prepared to slow their tightening process. However, on a positive note, the price of oil has been dropping stably since June, and the natural gas prices have also recently dropped.

The outcome of the Italian election was in line with pre-vote expectations. The spread, that had already risen over previous months following the ECB’s change in stance, was subject to no further tensions, neither before nor after the vote, thanks to an election campaign in which euro-scepticism was reduced to a minimum.

In China, the economy is reaccelerating after slowing sharply due to the lockdowns imposed in the second quarter of the year, and anticipation is mounting ahead of the Congress of the Chinese Communist Party on 16 October.

Macro Economy

- US inflation is moderating thanks to the energy component, although core items are still rising at sharp rates. The global economy is proving more resilient to rate hikes than expected (for now).

- Fed fund futures are pricing in further rate hikes worth 170 basis points, with a peak at 4.7% in the spring of 2023. The ECB envisages a further 200 basis points worth of hikes, and a peak at 3.2% in mid-2023.

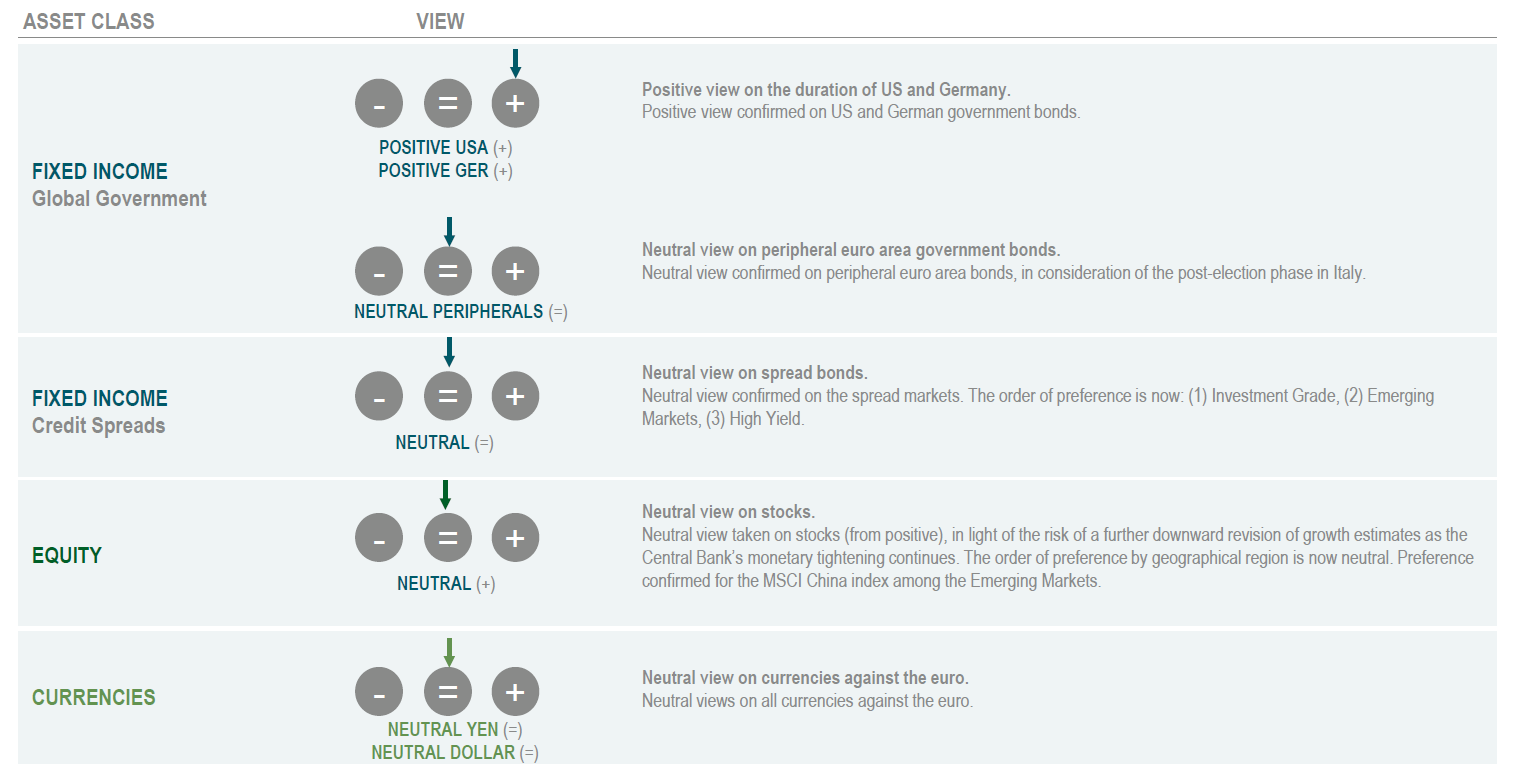

Asset Allocation

- The autumn should bring signals of a downturn of inflation and/or of a macro slowdown, to the advantage of a stabilization of medium and long-term yields.

- Overweight position confirmed on the government bonds of the United States and Germany, exposure to stocks lowered to neutral.

FixedIncome

- Overweight position confirmed of US and German government bonds, that could benefit both from easing inflation and the slowdown in growth.

- Among spread bonds, a preference goes to Investment Grades, while the picture remains uncertain for High Yield and Emerging bonds. Neutral positions on Italian government bonds.

Equity

- Stock market valuations have dropped to historically appealing levels but could be confirmed volatile in case of a sharp macroeconomic slowdown. On the other hand, a swifter recovery could materialize in case of signals of easing inflation.

Currencies

- The Fed’s hawkish turn has widely been priced in by the dollar, that could take a breather in the upturn observed since the beginning of 2021. However, for the euro to recover, the energy crisis will necessarily have to improve.

Investment View

The baseline scenario contemplates further Central Bank rate hikes, in waiting for more evident signals of an easing of inflation. As the monetary restriction continues, so will the downward revision of economic growth forecasts.

In this context, medium and long-term rates should stabilize on fears of a slowdown. However, uncertainty on the resilience of the economic growth should in any case extend volatility on the stock markets.

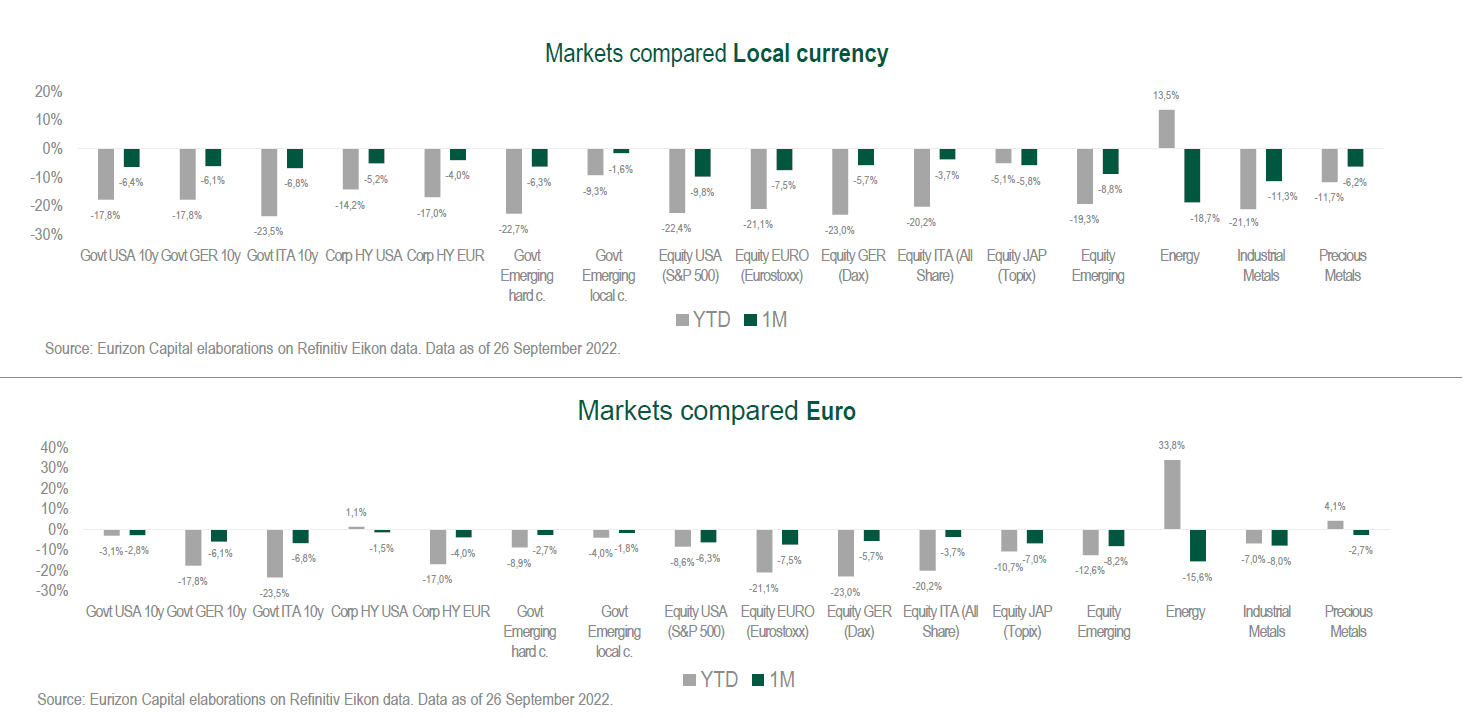

Asset Classes compared

Government bond yields on the rise to new year-to date highs. Sharp inversion of the curve in the US, flat curve in Germany.

Stocks back down to the lows hit in June. Spreads stable at high levels for peripheral Eurozone bonds and credits (Investment Grade, High Yield, Emerging Markets). Dollar strong against all the other currencies, at 0.98 against the euro.

Theme Of The Month - Inflation Is The Culprit

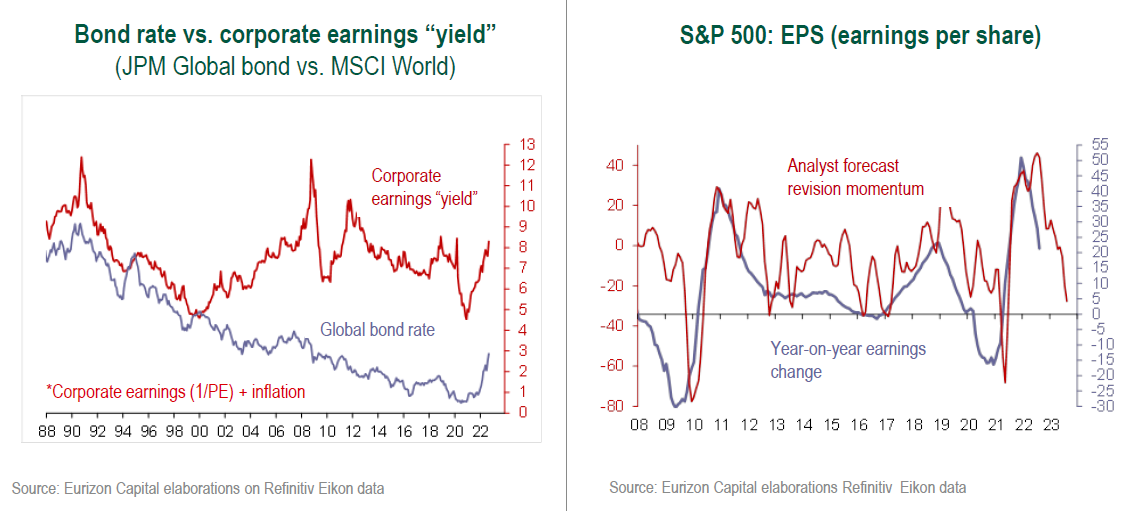

The (negative) trend of the markets in the course of this year may be explained by a single variable: the flare up of inflation, a true bane for investors, that have to tackle rising rates and falling stock indices.

Going forward, the good news is that inflation is starting to drop. The bad news is that the decline is not enough for the time being to allow the Central Banks to declare victory against surging prices.

At least two of the three components of inflation are on the decline. The supply-side bottlenecks that took shape during post-Covid reopenings are easing, as made evident by the drop of international forwarding prices, nonetheless still higher than they were before Covid.

Commodity-induced inflation is declining: industrial metals prices have actually been falling since March, the price of oil has dropped below 80 dollars per barrel, after stopping just short of 115 dollars in June, and the price of natural gas, one of the main drivers of inflation in Europe, is also decreasing.

However, second level effects are still in place, as price increases are being transferred downstream by the business sectors affected, fueling core inflation.

This is the reason for which, at their September meetings, the Fed and ECB not only hiked rates again, by 75 basis points, but confirmed their intention to proceed in this direction in the months ahead.

For the time being, near-term Fed funds futures are pricing in yields of between 4.5% and 5% by the spring of 2023 followed by a 100 basis points decline to contain the economic slowdown once inflation will have been reined. The ECB envisages a point of arrival at above 3%.

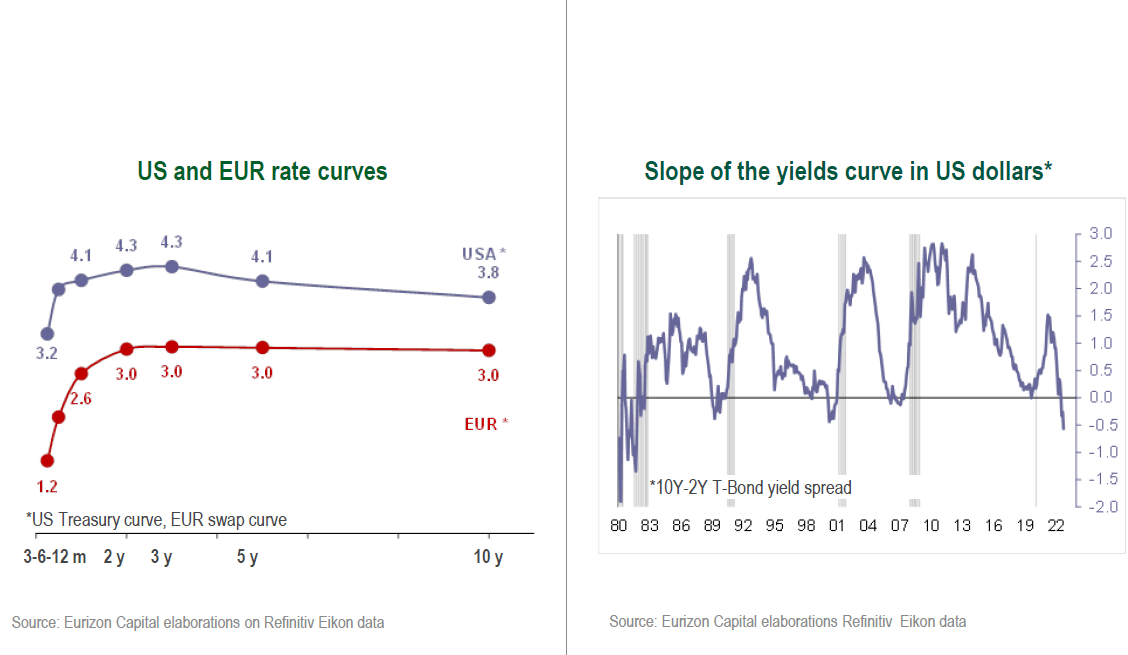

Short-term yields at these levels are already being priced in on the medium and long ends of the curve. In the United States, the 2-year yield has grown to 4.3%, close to the level priced in by Fed funds as the point of arrival.

The 10-year yield has risen to 3.8% and, with an inverted curve, is starting to price in the fact that the monetary tightening will not only bring inflation back under control, but also slow growth.

In its present configuration, the US curve seems to have reached its maximum inversion (the 10-year yield is 50 basis points lower than the 2-year rate) since the early 1980s.

At the moment, the upward movements of the 2-year rate have managed to also drag up the 10-year yield, although the release of weak macro data could result in a further inversion of the curve (as a result of the decline of the 10-year rate).

On the other hand, lower than expected inflation data would stop the inversion of the curve, while shifting it downwards across maturities.

Similar considerations apply to the euro curve, flat from the 2-year maturity onwards at 3%, the point of arrival envisaged for ECB rates.

For what concerns the stock markets, this year’s decline has not been due to endogenous market factors. Businesses have kept achieving earnings growth, and equity return has risen in line with bond rates. The volatility of stocks has been historically low compared to the decline incurred by prices.

All these elements support the view that the weakness of the stock markets has been entirely imported from the repricing of the bond markets, in turn destabilisedby inflation.

Therefore, the stabilisationof bond rates is essential for stocks. If the upward path of rates is halted by a drop in inflation, the recovery of the stock markets may be immediate and swift.

If on the other hand rate hikes are interrupted by a sharp drop in economic activity, the recovery of stocks could be delayed, in waiting to verify the impact on earnings.

In this case as well, however, it is reassuring to note that analysts have already started reviewing their expectations, effectively anticipating the potential macro slowdown.