A new white paper by Ampersand Portfolio Solutions, Enhanced Portfolio Diversification: The Power of &, provides an in-depth look at the details associated with structuring overlays as a way to hedge equity-related risk. In prior white papers, The Risk Contribution of Stocks, Parts 1-3 and Looking Under the Hood, Ampersand introduced a concept to diversify beyond stocks and bonds without having to sell the stock/bond portfolio holdings. The latest paper delves deeper and illustrates how equity risk can be managed or mitigated using creative enhanced diversification solutions. Ampersand Portfolio Solutions, a division of Equinox, collaborates with select asset managers to construct bespoke investment solutions.

Q2 hedge fund letters, conference, scoops etc

Ampersand’s white paper, Enhanced Portfolio Diversification: The Power of &, the fifth in a series, recaps the risks associated with a 60/40 stock/bond portfolio, showing that 92% of the risk is contributed by stocks. Diversifying the portfolio by adding another asset class such as managed futures, other alternative investments, or “hedge fund strategies” can help to mitigate risk, provide a smoother ride for investors, and enhance performance.

Here are some key highlights from Enhanced Portfolio Diversification:

- One of the few strategies that provides the benefits of non-correlation and has stood the test of time in terms of providing reasonably good risk-adjusted returns over multiple market cycles (including the Global Financial Crisis of 2008) is managed futures.

- By creating a variety of hypothetical portfolios using allocations to stocks/bonds/alternatives, the paper’s illustrative charts reveal that an investment of 30% equities, 20% bonds, and 50% managed futures handily outperforms all other portfolios on all metrics. The worst drawdown (loss) is about half as deep as an example using a 48/32/20 ratio. In fact, the 30/20/50 portfolio is very close to the efficient frontier as defined by Modern Portfolio Theory.

- In the real world, it is extremely rare to find investment portfolios with allocations as high as 50% to alternative strategies. Most portfolios continue to be significantly under-diversified.

- Ampersand analyzes “extended diversification” which allows for diversifiers to be added without selling any stocks and bonds in the original portfolio. This is possible through an “overlay” approach, where the alternatives are overlaid on top of the stock/bond portfolio, without the need to sell any stocks or bonds.

- Using the power of “&” an investor can continue to have a 60/40 exposure to stocks and bonds as well as adding 50% (or even higher) to alternatives and truly harness greater benefits of diversification as espoused by Modern Portfolio Theory. The 60/40/50 portfolio provides a much higher return, higher reward/risk ratio, and shallower drawdowns. Detailed examples of how this solution works using allocations to managed futures ranging from 0% to 100% are provided in the paper with striking visuals.

- The dominance of the “&” portfolios over traditional portfolios (in which the allocation to stocks, bonds, cash, and managed futures adds up to exactly 100% is remarkable. For any level of risk from around 4% to 15%, significantly higher returns may be achieved using an “&” approach.

-

- For example: a 22/78/47 portfolio has a return of about 9.3% for 6.9% risk level, about 170 basis points better than a traditional 30/20/50 portfolio which offers a return of about 7.6% at that risk level.

- Another portfolio using a 48/52/127 “&” approach has the same risk level as the S&P 500 Index (about 15%) but a return of about 16.75% versus about 9.7% or 700 basis points higher.

- Using an increasingly larger overlay, it is possible for investors who are less risk averse to take on greater risk in the hope of earning higher returns. For example: a 67/33/183 “&” portfolio has a risk level of about 20.8% higher than the historical risk of the stock market and a return of about 22%.

- By using the overlay approach to gain extended diversification, investors gain the ability to reduce market risk and smooth drawdowns while potentially improving the portfolio’s risk-adjusted return. Investors can diversify without having to sell their core stock and bond holdings and they can choose a level of risk suitable for their needs. That, in short, is the power of “&”.

Enhanced Portfolio Diversification: The Power of &

Most investors, whether institutional or individual, tend to believe that stocks are a good—perhaps even the best—investment in the long run. However, the reason for expecting good performance from stocks is perhaps not always clearly articulated: Quite simply, it is because they are risky.

The Return–and Risk–of Stocks with Bonds

This positive relationship between risk and expected return is quite intuitive. If you decided to lend money to the US Government or to your brother-in-law, would you charge them the same rate of interest? The latter proposition is clearly more risky, and a rational investor would expect to be compensated appropriately for bearing that additional risk. If the expected return on US Treasury bonds is 2%, for example, you may decide to charge your brother-in-law a 6% rate of interest (remember that this is the expected return at the time you make the loan: there is a chance your entire loan may not be repaid, which would reduce your realized return. That’s what risk implies: the possibility of getting less than you expected).

This logic can be extended to other investments. Let’s limit ourselves to stocks and bonds.1 US Government debt is generally viewed as being risk-free, if we ignore inflation risk. A US investor would rank investment-grade senior corporate debt as slightly more risky than Treasury bonds, followed by subordinated debt, preferred stock, and common stock. The reason stocks are the riskiest is that they are at the bottom of the pecking order in terms of their claim on the company’s profit or cash flow. But the reason they can also be the most rewarding is that they are entitled to all residual profits, after paying off the other more senior claims in the corporate capital structure.

Historically, the performance of equities has varied widely over time and from country to country. Nevertheless, it would not be inaccurate to say that, over long enough periods (although it is not clear exactly how this should be defined), stocks have generally earned “reasonably good” returns. Modern Portfolio Theory (MPT), however, tells us that returns must be assessed relative to risk. While most of the widely-used metrics of risk are not perfect, the standard deviation of returns (often called volatility) and their maximum peak-to-trough drawdown(s) are generally considered fairly adequate risk proxies for most traditional asset classes.

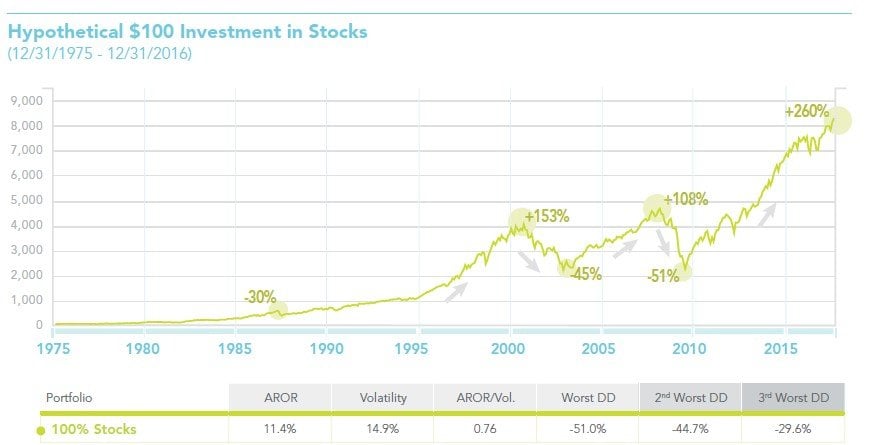

As shown in the chart below, $100 invested in the S&P 500® Index on December 31, 1975 would have grown to more than $8,200 at the end of 2016. This represents a compounded annual return of 11.4%, and bolsters the case for stocks in the long run. Of course, the underlying assumption is that you stayed invested in the stock market throughout these 41 years. There were at least a couple of times when some investors may not have had the fortitude to do so. Consider what happened in August 2000, after the four year bull market during which investors earned a cumulative return of about 150%. The dot-com bust saw the market drop by −45%, wiping out almost the entire gain. Investors who stayed in experienced another bull run of more than 100% and recouped all their losses. That was followed by the worst drawdown in recent history, as the market fell by more than −50% and once again wiped out the entire recent gain.2 Overall, in the twelve years from 1997 to 2008, stock market investors would have barely broken even!

At the time this is written, the market is up more than 250% from its low in early 2009, and some investors are becoming increasingly nervous.

Stocks have clearly been very risky, especially during the last two decades. Whether the returns investors earned were adequate compensation for bearing that risk is a difficult question to answer, even with the benefit of hindsight. The specific historical time-period used in the analysis clearly influences the results dramatically. Expected returns are notoriously difficult to forecast, whereas risk appears to be relatively more stable and somewhat predictable. In this paper, we shall therefore try to focus on addressing the question of how equity risk can be managed or mitigated.

Diversifying Stocks with Bonds

It is quite clear that stocks have historically been volatile and have experienced sudden and sharp declines at times. Looking back today, we can say that they did in fact bounce back, although the timing and length of the recovery period were both uncertain and unpredictable.

Unfortunately, many investors have been known to display a lack of tolerance for the pain, and have tended to bail out during downturns, often close to the bottom, thereby forgoing the benefits of the eventual recovery.3

Psychologically, it has been shown that a 20% loss of wealth, say, causes individual investors much more pain than the pleasure provided by a 20% gain. Professional and institutional investors often face the additional risk of being fired when performance is negative, even though it may be market-driven rather than a reflection on their abilities.

See the full PDF here.