Below is commentary by John Lynch, Chief Investment Officer for Comerica Wealth Management (Charlotte, NC) – “D.C., Jobs & EPS”

After just one week into the new year, investors have had an awful lot to digest – political tensions in Washington, a stronger than expected December Employment Report, along with expectations for a decline in fourth quarter earnings for the S&P 500® Index.

Despite these mixed messages, stocks are off to a strong start to the year, as the markets attempt to divine the implications of these early developments.

Q4 2022 hedge fund letters, conferences and more

Key Takeaways

Both the length of time and the lack of cooperation in selecting the Speaker of the House likely portends further challenges ahead for consequential budget and legislative items. Unfortunately, this environment will be accompanied by rising interest expense on federal debt, limiting the opportunity for fiscal policy and discretionary spending to help offset any economic difficulties in the months and quarters ahead.

The strong December Employment Report was well received by markets last Friday, with the Dow Jones Industrial Average soaring 700 points and the yield on the benchmark 10-year U.S. Treasury note falling by approximately 20 basis points.

However, we believe full employment complicates the Federal Reserve’s battle against inflation and that the decline in wages only serves to widen the gap between price gains and worker income.

Fourth quarter operating earnings per share (EPS) for companies in the S&P 500® Index are expected to decline by 4.0% on a year-over-year (YOY), according to FactSet. The first drop in profits since the third quarter of 2020 will likely set the stage for expense reduction, including job cuts, in the coming months.

In 2023, we look for declining but persistent price pressures, a steadfast Federal Reserve, mild recession, flat EPS, and a retest of the October equity market lows before investors begin to price in recovery in the second half of the year.

D.C. - Policy Decisions Become More Difficult with Higher Federal Interest Costs

Both the length of time and the lack of cooperation in selecting the Speaker of the House likely portends further challenges ahead for consequential budget and legislative items. Unfortunately, this environment will be accompanied by rising interest expense on federal debt, limiting the opportunity for fiscal policy and discretionary spending to help offset any economic difficulties in the months and quarters ahead.

The favorable backdrop for fiscal policy over the past few decades - a 40-year bull market in bonds, below average inflation, and the recent extremes in monetary policy accommodation - has shifted considerably this past year.

The fixed income markets struggled in 2022, with the Bloomberg Aggregate Bond Index declining 13.0% as inflation surged and the Federal Reserve aggressively raised interest rates. As a result, interest costs on federal debt could add up to $225 billion to the U.S. budget deficit this year.

The U.S. Treasury Department has already reported that interest paid on public debt exceeded $100 billion in October and November – an increase of more than 80.0% over the same period last year.

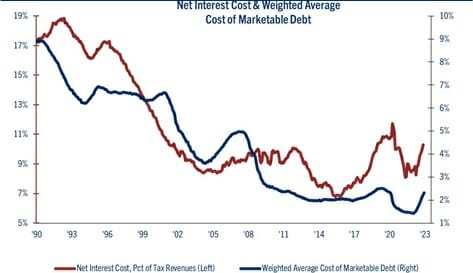

In addition, the trends for net interest cost and the weighted average cost of U.S. federal debt have both ticked higher in recent months, a pattern that we expect to intensify in 2023. See chart: Net Interest Cost and Weighted Average Cost of Marketable Debt.

Source: Strategas Research Partners

The Congressional Budget Office is expected to revise its projections this month, likely leaving the current omnibus spending proposal as the last chance for an increase in federal spending, raising the stakes for the looming debt ceiling debates in 2023.

Jobs - December Employment Report Exceeds Expectations

The strong December Employment Report was well received by markets last Friday, with the Dow Jones Industrial Average soaring 700 points and the yield on the benchmark 10- year U.S. Treasury note falling by approximately 20 basis points.

However, we believe full employment complicates the Federal Reserve’s battle against inflation and that the decline in wage growth only serves to widen the gap between price gains and worker income.

The December jobs report was stronger than expected, with solid job growth (+223K) and the unemployment rate (3.5%) falling back to a half-century low. Moreover, average hourly earnings rose a less than forecast 0.3% last month, bringing wage growth down to 4.6% YOY, well below the peak rate of 5.6% YOY in March 2022. See chart: Average Hourly Earnings YOY.

Source: Bloomberg L.P.

Comerica Bank Chief Economist Bill Adams notes that while last year was a blockbuster year for job growth, with 4.5 mm jobs created, two fifths of those jobs were either part- time or side gigs for people already working.

That reflects both the pandemic’s effect on labor force participation fading, and financial pressures on households pushing workers to seek more hours.

EPS - S&P 500® Index Profits Set to Decline for Q4

Fourth quarter operating earnings per share (EPS) for companies in the S&P 500® Index are expected to decline by 4.0% on a year-over-year (YOY), according to FactSet. The first drop in profits since the third quarter of 2020 will likely set the stage for expense reduction, including job