S&P 500 bears missed yesterday‘s opportunity to force a decisive close lower – several key sectors led the intraday recovery even though bonds weren‘t on board. The Fed minutes‘ initial dovish interpretation duly gave way to the still accented hawkish decisions ahead – it‘s still reasonable to expect 75bp hike in Sep with perhaps 25bp in Nov while diving increasingly more into balance sheet shrinking. The focus is now shifting to the real economy performance, and it almost seems that the reverse of bad is the new good, is kicking in in stocks. At the same time, slightly better unemployment claims are helping put a floor below commodities today.

To feel the daily pulse, let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

Q2 2022 hedge fund letters, conferences and more

Gold, Silver and Miners

Precious metals couldn‘t do any better even if inflation expectations have been resilient over the latest two months. Chopping along while the bearish headwinds prevail, is the most likely outcome for the weeks ahead.

Crude Oil

Crude oil is ready to turn up next, but I wonder how long that would last, and whether any technically important levels would be conquered. For now, the focus on drawdown in inventories and Fed not yet making purely hawkish noises, can prevail.

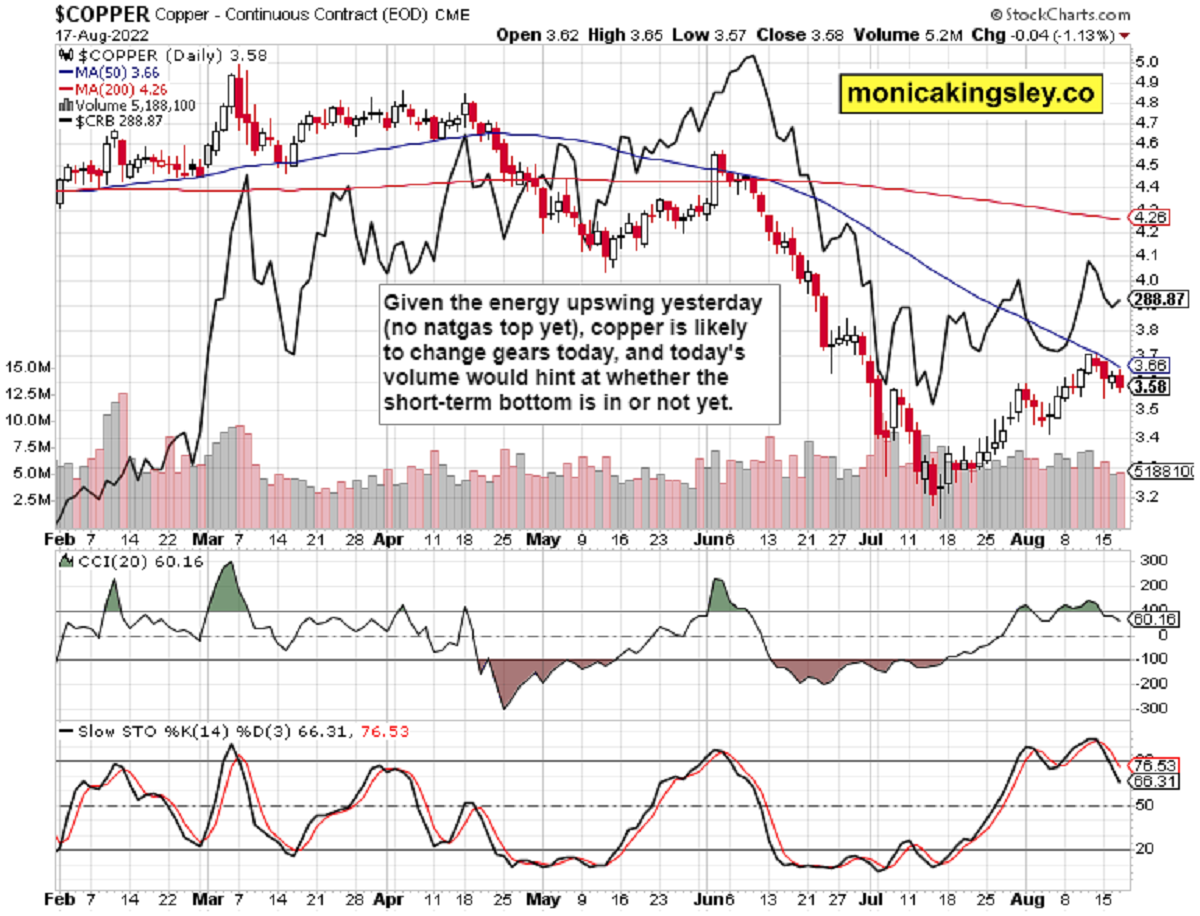

Copper

Copper may be carving out a short-term bottom, but it‘s early to tell. The intraday pause in the dollar and those marginally higher stocks and cryptos, look suspect today.

Bitcoin and Ethereum

Nothing new in cryptoland really – the bears going to turn up the heat. Underperforming on the upswings, outperforming on the downswings.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.