The crypto market cap might tell you Bitcoin is king, but what if the real treasure lies hidden in the shadows?

Low Cap Coins, often dismissed as risky bets, hold the potential for explosive growth, dwarfing even the most impressive bull runs. Remember Ordinals? A text-based NFT project that skyrocketed from near anonymity to millions in mere weeks.

2023 served as a testament to this potential. While blue-chip titans like Bitcoin and Ethereum delivered respectable gains, the underground gems shone brighter – delivering triple-digit and even quadruple-digit returns.

How we chose the best low market cap cryptos for this list

We scoured the crypto landscape for projects with low market capitalization (<$1B) with strong fundamentals and innovative ideas. To identify these gems, we looked for projects with:

- Active Development: Is the team constantly developing and improving the project?

- Utility: Does the coin solve a real-world problem or offer a unique utility within its chosen field (e.g., DeFi, NFTs, gaming)?

- Community Engagement: Does the project have a strong and engaged community that supports its growth?

- Market Demand: Is there a growing market need for the problem the project aims to solve?

We prioritized projects with a clear roadmap, transparent teams, and a positive reputation within the crypto community.

Remember, this is a high-risk, high-reward investment sector, so always research before investing.

A carefully curated list featuring low market cap crypto options

- $PEPU is a layer-2 blockchain designed for Pepe memes.

- Lower gas fees and faster transactions than other Pepe meme coins on the Ethereum layer-1

- Staking rewards for presale buyers and holders

- ETH

- USDT

- BNB

- +1 more

- Immensely popular meme token with zero fees, AI-driven trading, and MEV protection.

- As a PoS token $WAI can be staked to earn 142% p/a passive rewards.

- WienerAI's AI-powered predictive technology gives crypto enthusiasts exclusive insights to help find the next 100x gems.

- ETH

- USDT

- BNB

- +1 more

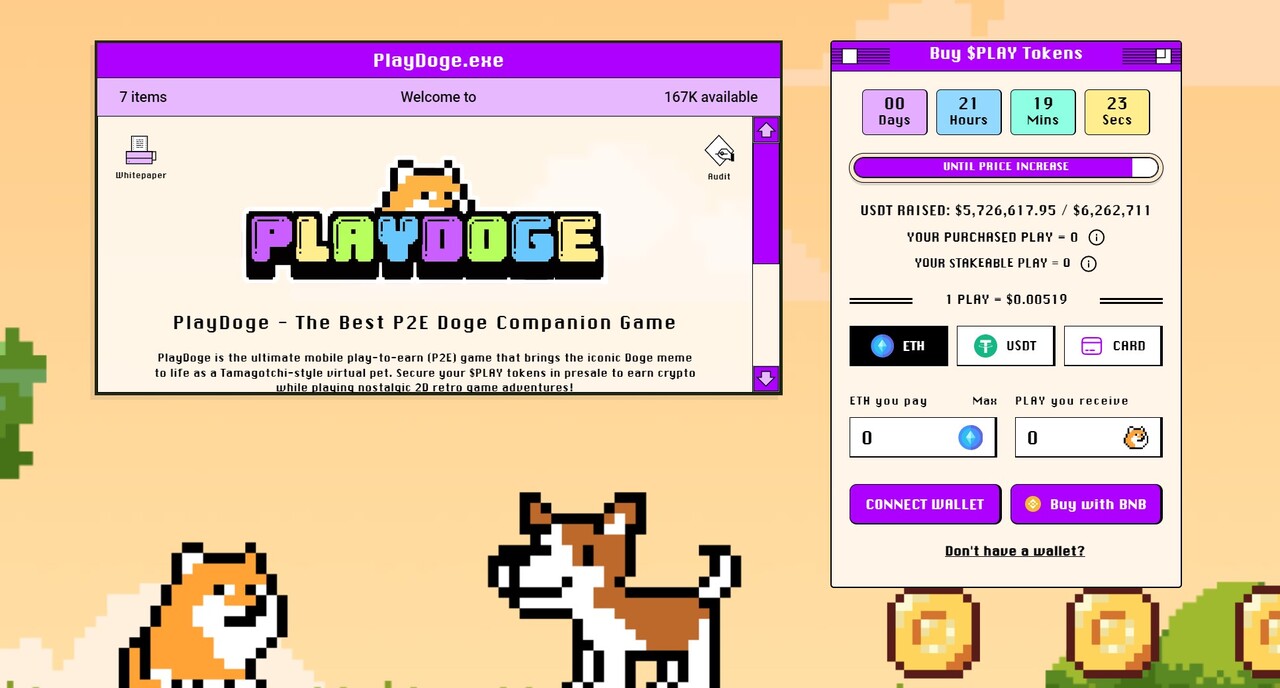

- An upcoming play-to-earn game which combines Doge Memes with Tamagotchi-style game play

- Stake your presale tokens and earn APR though the presale period and beyond

- $PLAY is the in-game currency for transactions and unlocking special features

- BNB

- ETH

- USDT

- Shiba-themed meme coin project with Wild West-inspired challenges and perks.

- Offers 'Lucky Lasso Lottery' with big crypto prizes up for grabs.

- Buy and stake $SHIBASHOOT tokens to earn 2288% APY passive rewards.

- ETH

- BNB

- USDT

- +1 more

- Multi-chain functionality

- Generous token allocation for community rewards

- Full token audit published

- SOL

- ETH

- BNB

- +2 more

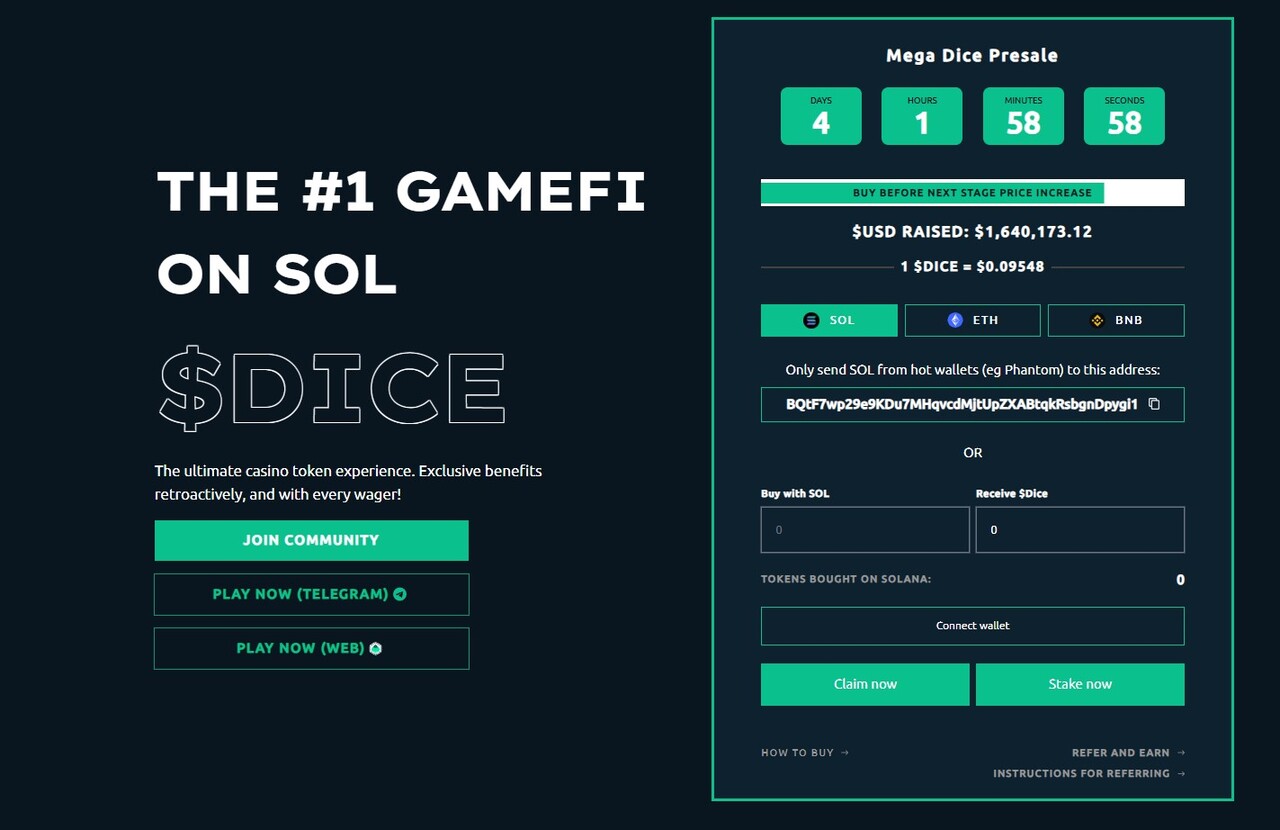

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

- SOL

- ETH

- BNB

- +1 more

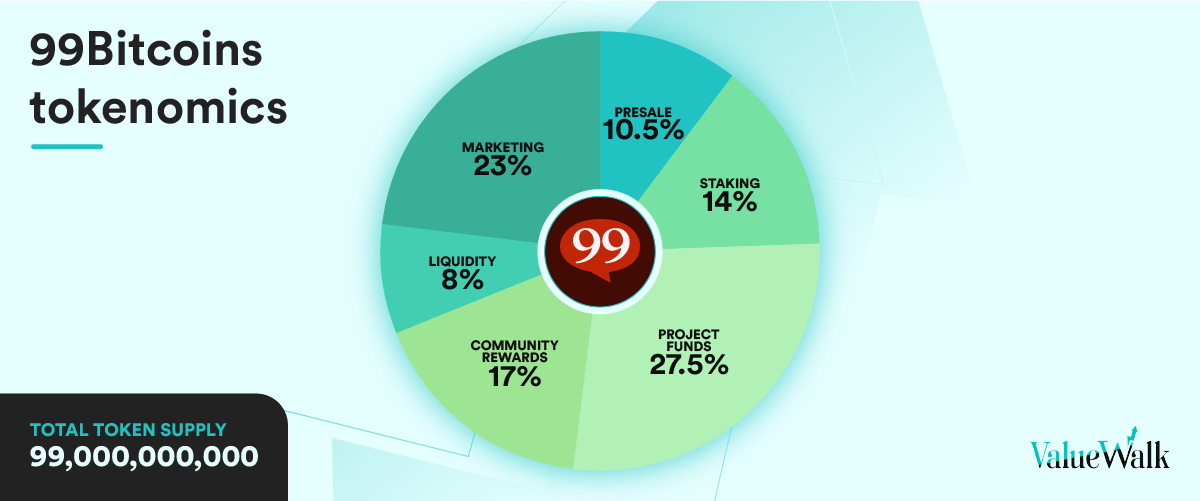

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

- ETH

- USDT

- BNB

- +1 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

- ETH

- USDT

- Debit

Recommended low market cap crypto to monitor in 2024

Astute investors seek opportunities beyond established players as the cryptocurrency landscape evolves. This section goes another route – focusing instead on the burgeoning and drama-filled realm of low-cap crypto projects, each selected for their potential to disrupt and deliver in 2024.

- Pepe Unchained (PEPU) is a low market cap crypto with viral potential and Layer 2 blockchain. It raised close to $5M in its presale.

- The Meme Games (MGMES) is a new crypto with gamified presale bonus and generous staking yields. Over $200K raised within a few days.

- WeinerAI (WAI) is a dog-themed meme coin and AI bot that finds trading opportunities for investors. It has raised over $7M in its presale, with 150% APY rewards.

- PlayDoge (PLAY) Doge memes and play-to-earn game with a nostalgic Tamagotchi 90s twist raises over $5M within a couple months.

- Shiba Shootout (SHIBASHOOT) a community-centric meme coin with generous rewards and utility. Over $700K raised in the presale so far.

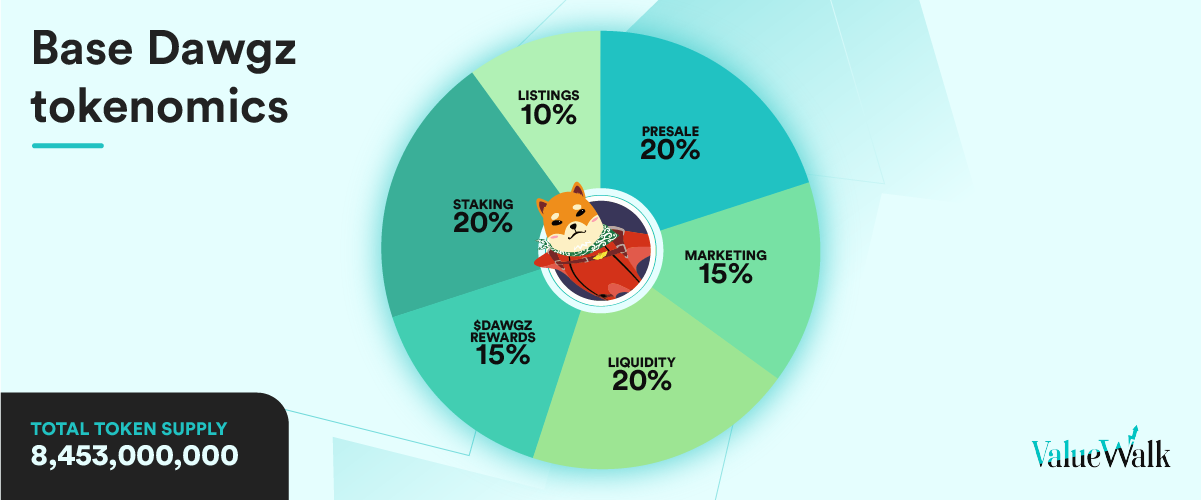

- Base Dawgz (DAWGZ) Multi-chain meme coin with generous share-to-earn rewards, raised $2.6M within a month.

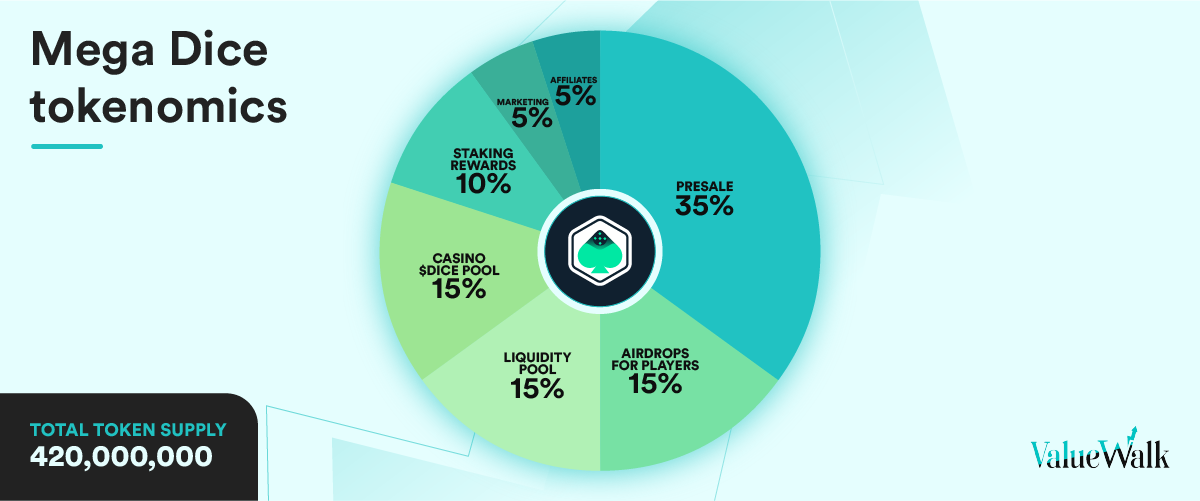

- Mega Dice Token (DICE) Popular GambleFi token with high staking rewards for $DICE holders. Raised over $1.6M in presale.

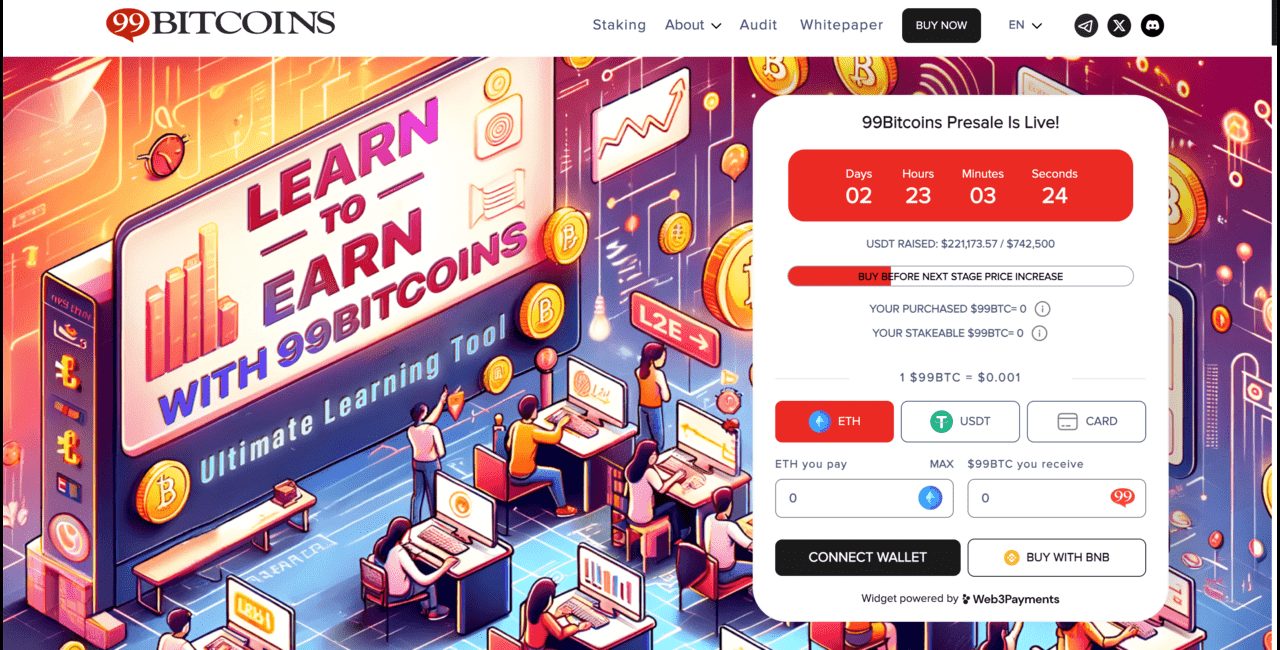

- 99Bitcoins (99BTC) transforms crypto learning into an engaging game. As you master the art of cryptocurrency, complete quests, conquer challenges, and earn $99BTC tokens.

- Sponge ($SPONGEV2) Upgraded meme coin with 100x growth in 2023; offers P2E game and Stake-to-Bridge model.

- xMoney (UTK) UTK token incentivizes users and businesses to adopt the platform. Liechtenstein’s government adopting xMoney for public services highlights its potential for mainstream adoption.

- Gods Unchained (GODS) is a free-to-play tactical card game in which players own their in-game items. Players earn GODS tokens through gameplay to buy, sell, or trade cards on the marketplace.

- Verasity (VRA) uses blockchain to fight ad fraud, reward viewers, and provide secure payments. Their VeraWallet allows staking and secure storage, while VeraViews tackles fraudulent views in online ads.

-

- 1. Pepe Unchained ($PEPU): Best low cap crypto with Layer 2 blockchain utility and viral potential

- Pros

- Cons

- 2. The Meme Games ($MGMES): Latest low cap meme coin with a gamified presale bonus and staking rewards

- Pros

- Cons

- 3. WienerAI (WAI): Altcoin with bundled AI trading bot brings 150% APY in rewards

- Pros

- Cons

- 4. PlayDoge ($PLAY): Tamagotchi 2.0 as a crypto companion with over $5.7 million raised

- Pros

- Cons

- 5. Shiba Shootout (SHIBASHOOT): Community-centric meme coin with various rewards and token utility

- Pros

- Cons

- 6. Base Dawgz ($DAWGZ): Doge meme coin with cross-chain availability

- Pros

- Cons

- 7. Mega Dice Token (DICE): Popular GambleFI token with high Staking rewards for $DICE holders

- Pros

- Cons

- 8. 99Bitcoins (99BTC): The ultimate Bitcoin learning platform

- Pros

- Cons

- 9. Sponge ($SPONGE): Meme coin with 100X growth in 2023 reveals stake-to-bridge model and upcoming P2E game

- Pros

- Cons

- 10. xMoney (UTK): Streamlined crypto payments and low fees for businesses & consumers

- Pros

- Cons

- 11. Gods Unchained (GODS): Free tactical card game with blockchain-owned items

- Pros

- Cons

- 12. Verasity (VRA): Blockchain ads, user rewards, fraud protection

- Pros

- Cons

- Show Full Guide

-

- 1. Pepe Unchained ($PEPU): Best low cap crypto with Layer 2 blockchain utility and viral potential

- Pros

- Cons

- 2. The Meme Games ($MGMES): Latest low cap meme coin with a gamified presale bonus and staking rewards

- Pros

- Cons

- 3. WienerAI (WAI): Altcoin with bundled AI trading bot brings 150% APY in rewards

- Pros

- Cons

- 4. PlayDoge ($PLAY): Tamagotchi 2.0 as a crypto companion with over $5.7 million raised

- Pros

- Cons

- 5. Shiba Shootout (SHIBASHOOT): Community-centric meme coin with various rewards and token utility

- Pros

- Cons

- 6. Base Dawgz ($DAWGZ): Doge meme coin with cross-chain availability

- Pros

- Cons

- 7. Mega Dice Token (DICE): Popular GambleFI token with high Staking rewards for $DICE holders

- Pros

- Cons

- 8. 99Bitcoins (99BTC): The ultimate Bitcoin learning platform

- Pros

- Cons

- 9. Sponge ($SPONGE): Meme coin with 100X growth in 2023 reveals stake-to-bridge model and upcoming P2E game

- Pros

- Cons

- 10. xMoney (UTK): Streamlined crypto payments and low fees for businesses & consumers

- Pros

- Cons

- 11. Gods Unchained (GODS): Free tactical card game with blockchain-owned items

- Pros

- Cons

- 12. Verasity (VRA): Blockchain ads, user rewards, fraud protection

- Pros

- Cons

Explaining the various market cap levels of cryptocurrencies

Market capitalization is a key concept in the world of cryptocurrency. It refers to the total value of all coins circulating for a specific cryptocurrency.

This value is akin to the height of a financial skyscraper, offering insight into the overall investment in that particular digital currency. By comparing the “heights” of different cryptocurrencies, we can better understand their relative size and potential influence in the market.

| Name | Value | Explanation |

|---|---|---|

| Mega-caps | Over $100 billion | Blue-chip stocks of the market, attracting investors seeking stability. |

| Large-caps | $10 billion—$100 billion | Established projects with large communities and significant adoption. |

| Mid-caps | $1 billion – $10 billion | Promising projects with innovative ideas, often compared to emerging growth companies. |

| Low-caps | Below $1 billion | Crypto underdogs, full of potential but also high risk. |

| Micro-caps | Below $100 million | True frontier coins, often with unique concepts in their infancy. |

| Nano-Caps | $1M —$10M | Niche-focused projects with the potential to become dominant players within their specific markets. |

Note: It’s important to consider market cap a dynamic indicator, not a static label. Like the city’s skyline changes with new construction and renovations, the market cap fluctuates constantly based on price movements.

Our favourite low-market cap cryptocurrencies

While established giants have their place, the exciting world of cryptocurrencies also offers vast potential for growth in smaller projects. Forget the big names for a moment.

Let’s explore the world of low-cap cryptos, where hidden gems and explosive growth potential collide.

Pepe Unchained is an exciting new meme coin with a low market cap with massive potential to soar and become viral. That’s because it uses the Pepe mascot, which is already popular among meme coin traders with the original Pepe Coin trading at over $5 billion market cap. By adding utility to the coin, Pepe Unchained could surpass Pepe in the future.

Trade faster and cheaper on the Pepe Chain

Trading on Ethereum can be a hassle because the blockchain can process 15 transactions per second with a transaction costing around $1 in gas fees at low congestion. The Pepe Chain groups multiple transactions into one and send it to Ethereum Mainnet for settlement. As a result, trading on Pepe Chain can be 100x faster and cheaper than Ethereum.

With instant bridging, meme coin traders can use the Pepe Chain to trade efficiently and then bridge their assets to Mainnet whenever they want. This utility comes on top of generous staking APY of over 300% dynamic, allowing early investors to stack up before the presale ends.

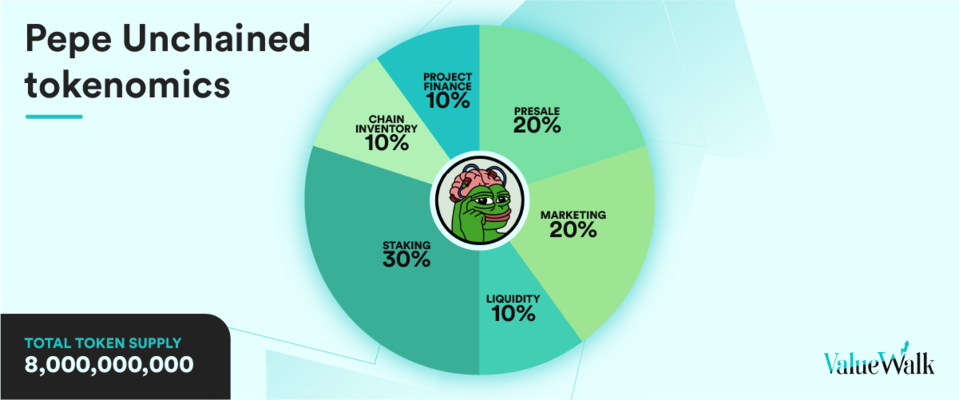

Tokenomics: The total token supply is capped at 8 billion. The presale gets 20% of the tokens, while staking rewards get 30%. This should allocate half the token supply to early investors and believers in the project. The remaining tokens are allocated for marketing, exchange liquidity, project finance and chain inventory.

Interested investors can buy the $PEPU token at a discounted price during the presale, using ETH, BNB, USDT or a card. Note, the staking rewards aren’t available for purchases made with BNB.

Learn more about the project by reading the Pepe Unchained whitepaper. Follow Pepe Unchained on X to get the latest updates.

Pros

- Opportunity for considerable profits: If the token surges after the presale ends, this could be a profitable investment.

- Layer 2 blockchain: Massive token utility with by utilizing its own blockchain layer on Ethereum.

- Generous staking rewards: Increase your token holdings with a generous dynamic APY during the early presale stages.

Cons

- New project: With high reward potential comes a high risk of failure.

- Staking limitations: Staking is only available on the Ethereum blockchain for purchases made with ETH, USDT, or a card.

| Project | Pepe Unchained |

| Ticker | PEPU |

| Price (July, 2024) | $0.008596 |

| Max. Supply | 8B |

| Blockchain network | Ethereum |

| Inception | 2024 |

2. The Meme Games ($MGMES): Latest low cap meme coin with a gamified presale bonus and staking rewards

The Meme Games is the latest low market cap crypto that brings the excitement and joy of the Summer Olympic Games into its presale. The way it works is investors who buy the $MGMES token can choose one of the five popular meme characters. The selected character then competes in a 169m dash. If it wins, the investor gets a 25% token bonus on top of their purchase.

Select a meme athlete and compete for a token bonus

All races are randomized and give every meme character an equal chance of winning. There are also no limits on how many times an investor can try and win the bonus. All they have to do is make another $MGMES token purchase to start the race.

During the presale, investors can earn a dynamic staking APY of over 1,200%. This can quickly grow the token holdings. However, staked tokens will be claimable seven days after the presale ends, while unstaked tokens will be claimable right away.

Tokenomics: The Meme Games has a total token supply of 2.024 billion tokens. A huge chunk of 38% is allocated to the presale and 9.30% for gaming rewards, while staking gets 10%. The rest is distributed between project funds, liquidity and marketing.

The presale is planned to end on September 10, two days after the closing ceremony of the Paralympic Games. Those looking to buy the presale can use ETH, USDT, BNB, or a card. With over $200,000 raised within a couple of days, the Meme Games shows strong investor demand.

Read the Meme Games whitepaper for more information. Also, follow Meme Games on X and join their Telegram group to stay up to date.

Pros

- Viral potential: Using several meme characters and the appeal of the Olympics, this meme coin has a potential to go viral after launch.

- Gamified presale bonus: Earn bonus tokens by winning a 169m dash with your meme athlete.

- High staking APY: Earn over 1,200% dynamic staking APY during the early presale stages.

Cons

- Meme coin volatility:Meme coins are riskier investments than altcoins like Ethereum and Solana.

- Vesting period for staked tokens: Tokens that are staked will be claimable seven days after the presale ends.

| Project | The Meme Games |

| Ticker | MGMES |

| Price (July, 2024) | $0.00905 |

| Max. Supply | 2.024B |

| Blockchain network | Ethereum |

| Inception | 2024 |

3. WienerAI (WAI): Altcoin with bundled AI trading bot brings 150% APY in rewards

WienerAI presents a compelling opportunity within the cryptocurrency landscape; this dog-themed meme coin harnesses the power of AI to serve its community. Portraying itself as a groundbreaking AI trading bot, it is actively seeking new opportunities in the market.

According to its website, 68% of the acquired tokens have already been staked, totaling 5,023,002,897 tokens. Through this staking mechanism, WienerAI has given its community rewards amounting to 676,973,704 $WAI tokens.

Valued at $0.00073 per token, there are 69 billion WAI tokens; 30% was allocated for the presale. 20% is designated for community rewards, while another 20% is dedicated to incentivizing staking activities.

The remaining tokens are allocated for marketing endeavors (20%) and securing listings on both centralized (CEX) and decentralized (DEX) platforms (10%).

For further insights into WienerAI, interested investors can follow its updates on X (Twitter) and join its Telegram channel for community engagement and discussions.

Pros

- Textbook familiarity: Displays equivalent traits as Scotty AI, which amassed millions in just a few weeks.

- Upgradeability for longevity: The modular design allows WienerAI to integrate future advancements in AI, ensuring its technology stays relevant.

- Strong development foundation: Built on the established Ethereum blockchain provides security and stability for transactions.

Cons

- Meme coin dependence: WienerAI’s success relies heavily on the unpredictable nature of meme coin trends, which can be fleeting.

- Potential for scams: The meme coin market attracts a higher risk of copycat scams or rug pulls.

| Project | WienerAI |

| Ticker | WAI |

| Price (July, 2024) | $0.00073 |

| Max. Supply | 69,000,000,000 |

| Blockchain network | Ethereum |

| Inception | 2024 |

4. PlayDoge ($PLAY): Tamagotchi 2.0 as a crypto companion with over $5.7 million raised

PlayDoge is a mobile-based play-to-earn (P2E) game built on Binance Smart Chain. It combines the iconic Doge meme with a Tamagotchi-style virtual pet, offering a nostalgic gaming experience with cryptocurrency rewards. Players care for their digital Doge by feeding, training, and entertaining it while navigating 2D adventures.

Train your Doge, earn, and play all day

Doge Dash combines classic fun with modern features. Players embark on a side-scrolling adventure reminiscent of 90s classics with a twist! You aren’t just playing a game; you’re caring for your digital Doge.

By feeding, training, and playing with your pet, you’ll build a bond and earn $PLAY tokens. These tokens have value within the game but can also be used in the broader crypto market. On top of that, Doge Dash fosters a sense of community, allowing you to connect, compete, and share the fun with other players.

Tokenomics: The overall supply of $PLAY tokens in PlayDoge amounts to 9.4 billion. The distribution of these tokens involves setting aside 50% for presale, while the remaining tokens are designated for staking, project funds, community rewards, liquidity, and marketing.

Precedence Research predicts that the global video game market will reach $665 billion by 2033. Given this projection, is now a good time to invest in mobile Play-to-Earn (P2E) games? The Play-to-Earn gaming category on CoinMarketCap has seen significant growth, with its market cap surpassing $13 billion in May 2024.

PlayDoge is a promising low market cap crypto in 2024. Its unique blend of nostalgic gameplay and modern P2E mechanics, supported by strategic tokenomics, makes it an attractive option for gamers and investors.

Follow PlayDoge on X (formerly Twitter) or join its Telegram channel for additional information and updates.

Pros

- Opportunity for considerable profits: Attain noteworthy rewards by exhibiting proficient gameplay and attentive pet care.

- Minimal entry eequirement: Engage in the PlayDoge presale for a possibility of early involvement.

- Merges trends: Capitalizes on the popularity of Doge memes and the P2E gaming boom.

- Unique tokenomics: Well-defined token allocation ensures project sustainability.

Cons

- New project:Limited track record compared to established P2E games.

- Market volatility: Crypto market fluctuations could impact $PLAY token value.

| Project | PlayDoge |

| Ticker | PLAY |

| Price (July, 2024) | $0.00521 |

| Max. Supply | 9.4B |

| Blockchain network | Binance Smart Chain |

| Inception | 2024 |

5. Shiba Shootout (SHIBASHOOT): Community-centric meme coin with various rewards and token utility

Shiba Shootout is a popular low-market-cap crypto that is focused on its community. There are many ways to earn the $SHIBASHOOT token for free, including the referral program where both the referrer and the new investor earn free tokens, as well as the campfire stories where community members with the best story revolving around their crypto experiences and meme coin trading will earn $SHIBASHOOT tokens.

Recently, the team announced a play-to-earn mobile game that will act both as a sink for the token where players can use the token to maximize their stats, and also as an earning mechanism depending on how good the player is.

The token will have multiple use cases. $SHIBASHOOT holders can vote in the governance and guide the project. The token can also be used in the “Lucky Lasso Lotteries” to win crypto prizes.

During the presale, investors can stake their tokens to earn over 1,300% dynamic APY. Being dynamic means the APY will drop as more tokens are locked. This will give early investors the highest rewards.

Read the Shiba Shootout whitepaper to learn more about the project. Also, follow Shiba Shootout on X and join their Telegram group to stay up to date.

Pros

- Community rewards: Refer other investors to earn tokens and share your crypto experience in a storytelling format to win $SHIBASHOOT.

- Play-to-earn game: The team will launch a mobile play-to-earn game that will allow users to earn tokens and spend them in game.

- Staking rewards: Stake your tokens during the presale to earn generous staking APY.

Cons

- Meme coin volatility: Meme coins are inherently volatile investments that comes with high risk and high reward.

- Staking APY is dynamic: The staking APY will drop during the presale.

| Project | Shiba Shootout |

| Ticker | SHIBASHOOT |

| Price (July 2024) | $0.0196 |

| Max. Supply | N/A |

| Blockchain network | Solana |

| Inception | 2024 |

6. Base Dawgz ($DAWGZ): Doge meme coin with cross-chain availability

Base Dawgz is one of the few Doge-themed meme coins that jumps across multiple blockchains. Because of that and because of its generous rewards – $DAWGZ is one of the best low market cap crypto in 2024.

Meme coin with generous community rewards

Thanks to its base jumping skills, and Wormhole and Portal Bridge technologies, $DAWGZ is available across the top five blockchains: Base, Solana, Ethereum, Binance, and Avalanche. Whichever of these blockchains you prefer, you can buy, hold, and trade $DAWGZ once the presale ends with ease. This cross-chain compatibility is one of the reasons why $DAWGZ could explode after listing on exchanges.

Other reasons include the generous community rewards. Pioneering the share-to-earn concept, community members who connect their X account and share $DAWGZ memes and related content will earn points. These points are redeemable for $DAWGZ tokens. Moreover, there is a generous referral program that rewards 10% paid in USDT of the amount invested.

Pros

- Wider audience reach: By being available on multiple blockchains, Base Dawgz can attract users who prefer specific blockchains or have limited experience with other networks

- Reduced reliance on single chain: Mitigates risk associated with any single blockchain facing congestion or security issues

- Generous rewards: Share-to-earn and referral rewards await those who actively spread the word

Cons

- Security concerns: Security vulnerabilities can potentially exist in bridge protocols used for inter-chain transfers

- Meme coin volatility: Meme coins are inherently volatile, making them a high-risk/high-reward investments.

| Project | Base Dawgz |

| Ticker | DAWGZ |

| Price (July 2024) | $0.006405 |

| Max. Supply | 8,453,000,000 |

| Blockchain network | Multi-chain |

| Inception | 2024 |

7. Mega Dice Token (DICE): Popular GambleFI token with high Staking rewards for $DICE holders

Another low-cap crypto to watch is the Mega Dice Token. It’s a popular crypto casino that is changing how people think about GambleFi tokens.

At press time, the platform’s native $DICE tokens were selling for only $0.09548. Token holders can receive benefits like cashback when playing at the casino, free tokens via an airdrop, and special rewards if they have their NFTs.

The $DICE token is unique, and many traders are comparing it to similar tokens that did well when they launched, like Rollbit and TG.Casino.

Mega Dice Casino is already quite successful, with 50,000+ players and $50 million average monthly bets. The platform’s recently launched presale raised over $1.6M, showing strong community support.

You can also earn a massive 10% referral commission on the amount invested by anyone you’ve referred to in the ongoing presale.

Moreover, Mega Dice has a special daily rewards system based on the casino’s performance, which no other casino currently offers.

They also have limited edition NFTs and a $2.25 million airdrop program for its presale buyers. Follow Mega Dice on X (Twitter) or join its Telegram channel to get updates on token listings.

Pros

- Win from an airdrop prize pool

- Free tokens for early private sale investors

Cons

- Yet to launch many platform features

- New token can attract initial volatility

| Total Tokens | 420 Million |

| Tokens Available in ICO | 147 Million |

| Blockchain | Solana |

| Token type | SPL |

| Minimum Purchase | N/A |

| Purchase With | SOL, ETH, BNB |

8. 99Bitcoins (99BTC): The ultimate Bitcoin learning platform

The cryptocurrency world can feel like a complex maze of jargon and technical concepts. But what if learning about crypto was as engaging as your favorite game?

99Bitcoins is revolutionizing crypto education with a gamified approach, making the journey to crypto mastery fun and rewarding.

Levelling up crypto knowledge

The 99Bitcoins platform functions like a giant, interactive game. Users embark on quests, complete challenges, and answer quizzes, all while acquiring valuable knowledge about cryptocurrency.

Each completed activity earns them experience points (XP) and $99BTC tokens, just like in a video game.

Gamification isn’t just about fun; it fosters deeper engagement and knowledge retention. By incorporating elements like leaderboards, badges, and progressive difficulty levels, 99Bitcoins keeps users motivated and constantly pushing themselves to learn more.

This platform offers comprehensive courses, insightful tutorials, and in-depth explorations of various crypto topics. Users can choose between bite-sized learning modules or delve deeper into specific areas of interest.

Pros

- Multiple earning opportunities: Combine staking rewards, airdrop participation, and Learn-to-Earn activities to maximize your earnings

- Accessibility: The platform caters to all experience levels, making cryptocurrency education inclusive for beginners and advanced users alike

- Bridge to the future: Be part of pioneering a new Learn-to-Earn model that incentivizes crypto education and empowers investors

Cons

- Reliance on platform success: Earning potential hinges on the overall success and user base of the 99Bitcoins platform

- Staking volatility: The value of your staked tokens can fluctuate based on market conditions, potentially impacting your passive income

| Project | 99Bitcoins |

| Ticker | 99BTC |

| Price (Apr, 2024) | $0.001 |

| Max. Supply | 99,000,000,000 |

| Blockchain network | Ethereum → Bitcoin Network |

| Inception | 2013 |

9. Sponge ($SPONGE): Meme coin with 100X growth in 2023 reveals stake-to-bridge model and upcoming P2E game

Next on our list of best low-cap cryptos is Sponge V2 ($SPONGEV2). It is the latest, more upgraded version of the massive successful $SPONGE meme coin. After witnessing high investor support, the original SPONGE token saw over 100x growth in 2023.

Building on previous successes

This new upgraded version of Sponge offers a Play-to-Earn (P2E) game to improve utility and user interaction. This gives users a unique way to earn more tokens within the Sponge ecosystem.

Sponge V2 offers a ‘Stake-to-Bridge’ model to transition from Sponge V1 to V2 smoothly. Users can stake their V1 tokens to receive V2 tokens, which will be permanently locked.

It is worth noting that much of Sponge’s token supply is reserved for P2E rewards and staking. This approach can boost the token’s utility and incentivize user participation.

$SPONGE summary

Sponge V2 has vast community support of 30,000+ members is expected to drive broader adoption and engagement through targeted marketing campaigns.

The project also offers an attractive minimum APY of 40% over four years. It offers a high APY of over 170% at press time for early stakers.

Due to its proven high returns, added value in the form of utility by the P2E game, and strong community, Sponge V2 is one of the best low-cap cryptos to buy right now.

Note: Sponge V1 has been discontinued.

Users should follow Sponge V2 on X (formerly Twitter) and join its Telegram channel for additional information and updates.

Pros

- Building on Success: Original $SPONGE coin experienced significant growth, generating excitement for V2

- Lower Transaction Fees: Switching to Polygon enables faster, more affordable transactions

- Staking Rewards: V2 offers staking opportunities, incentivizing users to hold onto their tokens for passive income

- Play-to-Earn Potential: Allocation of tokens for game development suggests a potential future revenue stream and coin utility

Cons

- Security Complexity: Multi-chain architecture adds security challenges, potential vulnerabilities might emerge under stress

- Hype vs. Reality: Initial excitement doesn’t guarantee success. Long-term adoption and real-world use cases are key

| Project | Sponge V2 |

| Ticker | SPONGEV2 |

| Price (July 2024) | $0.000095 |

| Max. Supply | 1,500,000,000 |

| Blockchain network | Ethereum |

| Inception | 2024 |

10. xMoney (UTK): Streamlined crypto payments and low fees for businesses & consumers

xMoney (UTK), formerly Utrust, aims to bridge the gap between traditional finance and cryptocurrency payments. Their platform provides businesses and consumers secure, fast, and affordable crypto transactions.

Secure crypto payments

xMoney tackles challenges like underdeveloped payment security and high fees in the crypto space. It offers features like buyer protection, refunds, and protection from crypto volatility for sellers.

Additionally, their strategic partnership with MultiversX leverages advanced tech to optimize payment processes.

$UTK Summary

UTK token incentivizes users and businesses to adopt the platform. Liechtenstein’s government’s adoption of xMoney for public services highlights its potential for mainstream adoption.

With a focus on innovation and solving real-world problems, xMoney (UTK) could be an interesting option for investors seeking significant growth potential within the low-cap crypto market.

Pros

- Fiat-crypto bridge: Seamless movement between fiat and crypto simplifies transactions for new users

- DeFi-TradFi bridge: Merges TradFi features (buyer protection) with DeFi benefits (fast, secure transactions)

Cons

- MultiversX reliance: Scalability depends on the MultiversX network’s performance

- Crypto adoption challenge: Success hinges on widespread crypto use

| Project | xMoney |

| Ticker | UTK |

| Price (Mar, 2024) | $0.1185 |

| Market Cap (Mar, 2024) | $59,123,372 |

| Max. Supply | 500,000,000 |

| Blockchain network | Ethereum |

| Inception | 2017 |

11. Gods Unchained (GODS): Free tactical card game with blockchain-owned items

Gods Unchained is a free-to-play tactical card game with a twist: players truly own their in-game items.

The development team has experience building an automated capital gains tax platform at KPMG, licensed to Australia’s largest cryptocurrency exchange.

Other founding members have led software development teams at billion-dollar e-commerce companies.

Owning your in-game assets

Unlike traditional games, Gods Unchained lets you trade, sell, and use your cards freely on the blockchain marketplace. This “play-to-earn” model incentivizes playing by granting ownership of valuable digital assets.

Earn GODS tokens through gameplay to buy sellable cards, increasing your potential return on investment (ROI).

$GODS Summary

Gods Unchained is a low market-cap crypto with a unique approach to gaming. By combining strategic gameplay with real ownership of in-game items, Gods Unchained offers a chance to earn while playing and potentially benefit from the rising value of the GODS token.

Further boosting its appeal, Gods Unchained’s in-game content is now available to Amazon Prime members.

Prime members can connect their accounts to gain monthly access to exclusive in-game items, adding another layer of value to the Gods Unchained experience.

Pros

- Gaming veterans lead the project: Combining experience in traditional gaming with blockchain could be a recipe for success

- Bridging the gap: Collaboration with Amazon Prime Gaming shows potential to attract new players unfamiliar with crypto

- Scholarship potential: Play-to-earn opens doors for innovative features like investors loaning assets to new players, creating a vibrant in-game economy

Cons

- Cryptocurrency volatility: The value of GODS tokens and in-game items is tied to the volatile crypto market, posing a risk to potential investors

- Newcomer complexity: The play-to-earn model and blockchain tech might be complex for new players, requiring a user-friendly interface to avoid losing them

| Ticker | GODS |

| Price (Mar, 2024) | 0.3065 |

| Market Cap (Mar, 2024) | $86,596,192 |

| Max. Supply | 500,000,000 |

| Blockchain network | Ethereum |

| Inception | 2018 |

12. Verasity (VRA): Blockchain ads, user rewards, fraud protection

Verasity is a blockchain project tackling ad fraud in the online advertising industry. Their ecosystem uses AI and machine learning to combat fraudulent views and offers rewards to users for watching videos.

Combating ad fraud using blockchain

VRA boasts a unique staking system with a guaranteed 15% yield until April 2024. Their VeraWallet lets users securely store, buy, and stake VRA tokens. Additionally, Verasity is actively developing VeraViews, an open ledger ad platform designed to eliminate fraud and provide transparency.

$VRA Summary

With a focus on solving a major industry pain point and a strong staking program, Verasity (VRA) is a low market cap crypto with the potential for significant upside, particularly for investors seeking short-term returns.

VRA is also traded on several tier-one exchanges, including KuCoin, Bithumb, OKX, Gate.io, Crypto.com, Huobi, Bybit, and Bitfinex, indicating a level of liquidity and investor interest that can be important factors to consider.

Pros

- Attention Economy Shift: Verasity positions itself to benefit from a shift in how user attention is valued, potentially creating a fairer system

- Disruption Potential: Success could disrupt online advertising, leading to a more transparent ecosystem for all parties

Cons

- Staking Competition: VRA needs a competitive edge in yields and user experience within VeraWallet compared to other crypto staking options

- Short-Term Focus: The guaranteed 15% yield (until April 2024) might attract investors seeking quick returns, potentially impacting long-term token price stability

| Ticker | VRA |

| Price (Mar, 2024) | $0.007437 |

| Market Cap (Mar, 2024) | $76,387,628 |

| Max. Supply | 100,114,152,32 |

| Blockchain network | Ethereum |

| Inception | 2019 |

Characteristics of low cap cryptos

| Feature | Explainer |

|---|---|

| Amplified Growth Potential | Smaller market caps offer the potential for significantly larger percentage gains compared to established coins. |

| Pioneering the Future | These projects often reside at the vanguard of technological advancements. |

| Portfolio Diversification | Low market cap crypto inclusions offer an avenue to diversify your portfolio. |

| Higher Risk | They lack their larger counterparts’ established track record and liquidity, making them more susceptible to volatility, scams, and even project failure. |

| Unpredictable shifts | Prices can fluctuate dramatically in response to news, hype, or even the actions of a single major investor. |

Why it’s important to secure low-cap cryptos

The cryptocurrency landscape presents an intriguing parallel to traditional financial markets and models: established, blue-chip coins offer stability akin to mature corporations. At the same time, low market cap projects embody the dynamism of early-stage startups.

While established coins like Bitcoin boast proven track records, their potential for explosive growth is inherently limited.

Investors looking for significant returns should explore low-market-cap cryptocurrencies, which can be likened to emerging companies.

These cryptocurrencies have the potential for exponential growth and innovation, as exemplified by tokens like $WIF, which has experienced a remarkable surge of over 1,400% in less than 2 months.

How to find the next low market cap crypto with huge potential

1. Keep an eye out for new crypto presales

Presales can be a launchpad for high returns. Target projects in booming sectors like DeFi or NFTs that match your investment goals.

Research their whitepaper and roadmap to grasp the problem they address and their solution. Look for clear, achievable milestones to assess the project’s potential and beware of market manipulation. Remember, presales involve risk, so only invest what you can afford to lose.

2. Scrutinize the team behind the new project

The team behind a project is its engine. A strong team with a proven track record in the blockchain industry is a major confidence booster.

Look for developers with experience building successful crypto projects and deep knowledge of the specific sector the project addresses.

A team of passionate and skilled individuals is more likely to overcome challenges, implement the project’s vision, and achieve its goals.

Well-rounded teams should also include advisors with strong financial and marketing backgrounds to guide the project toward long-term success.

3. Assess the coin’s popularity

A thriving community suggests potential user adoption.

Look for active social media channels, forums, and developer interaction. This indicates genuine interest and support for the project. But dig deeper than just popularity. Understand the project’s tokenomics.

This includes token distribution, project ecosystem utility, potential inflation and market capitalization.

Beware of excessive token issuance, which can erode the value of your holdings. Look for fair distribution models and tokens with clear utility to incentivize long-term participation.

Comparison table of the best low-cap crypto gems

| Project | Token | Total Supply | Chain | Staking | Launch |

| Pepe Unchained | $PEPU | 8B | Ethereum | ||

| The Meme Games | $MGMES | 2.024B | Ethereum | ||

| WienerAI | $WAI | 69B | Ethereum | ||

| PlayDoge | $PLAY | 9.4B | Binance Smart Chain | Yes | 2024 |

| Shiba Shootout | $SHIBASHOOT | 2.2B | Ethereum | No | 2024 |

| Base Dawgz | $DAWGZ | 8.453B | Multi-chain | No | 2024 |

| Mega Dice Token | $DICE | 420M | Solana | No | 2024 |

| 99Bitcoins | $99BTC | 99B | Ethereum | Yes | 2013 |

| Sponge V2 | $SPONGEV2 | 150B | Ethereum/Polygon | Yes | 2024 |

| xMoney | $UTK | 500M | Ethereum | Yes | 2017 |

| Gods Unchained | $GODS | 500M | Ethereum | Yes | 2018 |

| Verasity | $VRA | 100,114,152,328 | Ethereum | Yes | 2019 |

An expert verdict

Treat low market cap cryptos like a carefully chosen spice in your investment recipe. They can add excitement and potentially amplify returns, but use them sparingly and with a discerning eye.

Approach them with a venture capitalist’s mindset, understanding the inherent risks and monitoring market sentiment while acknowledging the potential for extraordinary rewards. The choice of which crypto to buy now, ultimately, rests with your individual risk tolerance and investment goals.

Monitor your investments regularly, conduct thorough research, and be prepared to adjust your strategy based on market conditions and project updates. Don’t be afraid to cut losses if a project goes against your investment decisions, its initial promise or if the market turns sour.

FAQs

What is the most promising low market cap crypto?

Is a low cap crypto a viable investment option?

Which crypto has 1000x potential?

References

- https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data

- https://coinmarketcap.com/community/articles/65d34f87df14f522a42cf39a/

- https://www.livemint.com/market/stock-market-news/2023-in-review-bitcoin-dominates-the-year-as-best-performing-asset-heres-how-equities-gold-and-bonds-performed-11703592280388.html

- https://www.coinbase.com/learn/crypto-basics/what-is-market-cap

- https://www.prnewswire.com/news-releases/amazon-prime-gaming-members-can-now-access-content-from-gods-unchained-302006384.html