The world of decentralized finance (DeFi) is booming. With the total value locked (TVL) surpassing $100 billion as of March 2024, demand for DeFi products and services is undeniable.

This growth coincides with the emergence of DeFi 2.0, an evolution promising to address challenges and unlock new possibilities. But which DeFi 2.0 tokens hold the most promise? Let’s explore the best contenders in this exciting new landscape.

We updated this page in May 2024 to add PlayDoge and remove some old listings.

Finding DeFi 2.0 gems: Our selection process

To select the most promising DeFi 2.0 tokens, we employed a multi-factor approach:

- Established DeFi 1.0 Leaders: We considered prominent DeFi 1.0 protocols with solid track records and loyal communities, prioritizing tokens with confirmed upgrades or migrations to DeFi 2.0 functionalities.

- Innovation and Utility: We evaluated projects that push the boundaries of DeFi 2.0, offering unique features like interoperability, advanced lending options, or unexplored DeFi niches.

- Market Performance and Traction: We analyzed token price performance alongside key metrics like Total Value Locked (TVL) and user growth to identify DeFi 2.0 projects gaining significant traction.

- Community and Development Activity: We assessed the project’s team expertise, community engagement, and ongoing development activity to gauge its potential for long-term success.

Combining these factors, we aimed to create a well-rounded list of DeFi 2.0 tokens positioned for significant growth in 2024.

- $PEPU is a layer-2 blockchain designed for Pepe memes.

- Lower gas fees and faster transactions than other Pepe meme coins on the Ethereum layer-1

- Staking rewards for presale buyers and holders

- ETH

- USDT

- BNB

- +1 more

- Immensely popular meme token with zero fees, AI-driven trading, and MEV protection.

- As a PoS token $WAI can be staked to earn 142% p/a passive rewards.

- WienerAI's AI-powered predictive technology gives crypto enthusiasts exclusive insights to help find the next 100x gems.

- ETH

- USDT

- BNB

- +1 more

- An upcoming play-to-earn game which combines Doge Memes with Tamagotchi-style game play

- Stake your presale tokens and earn APR though the presale period and beyond

- $PLAY is the in-game currency for transactions and unlocking special features

- BNB

- ETH

- USDT

- Shiba-themed meme coin project with Wild West-inspired challenges and perks.

- Offers 'Lucky Lasso Lottery' with big crypto prizes up for grabs.

- Buy and stake $SHIBASHOOT tokens to earn 2288% APY passive rewards.

- ETH

- BNB

- USDT

- +1 more

- Multi-chain functionality

- Generous token allocation for community rewards

- Full token audit published

- SOL

- ETH

- BNB

- +2 more

- Established online casino with $50 million in monthly volume and 50,000 players

- Daily rewards for $DICE stakers based on casino performance

- $DICE holders eligible for 25% revenue share for referring new users to the platform

- SOL

- ETH

- BNB

- +1 more

- New token with Learn to Earn (L2E) model with exclusive courses

- Integration with BRC-20, opening the ability to build on top of the Bitcoin network

- Stakers enjoy high staking rewards every Ethereum block

- ETH

- USDT

- BNB

- +1 more

- A meme token with up to 257% in rewards

- CEX listing and a play to earn game on the roadmap

- Sponge V1 made 100x in 2023. Join V2 presale

- ETH

- USDT

- Debit

Listing our 7 best DeFi 2.0 tokens for 2024

This section explores DeFi 2.0’s hottest tokens, helping you diversify your decentralized finance portfolio. Get ready to explore the future of finance with our top picks for the year’s hottest DeFi 2.0 tokens.

- PlayDoge (PLAY): Brand new play-to-earn (P2E) mobile game replicating the style of classic 90s gaming franchise, Tamagotchi. The project is powered by the $PLAY token, which is designed to have both in-game and wider market value.

- eTukTuk (TUK): Combats air pollution and carbon emissions on a global scale by replacing gasoline-powered tuk-tuks with electric vehicles (EVs) and building sustainable charging infrastructure, specifically in developing nations.

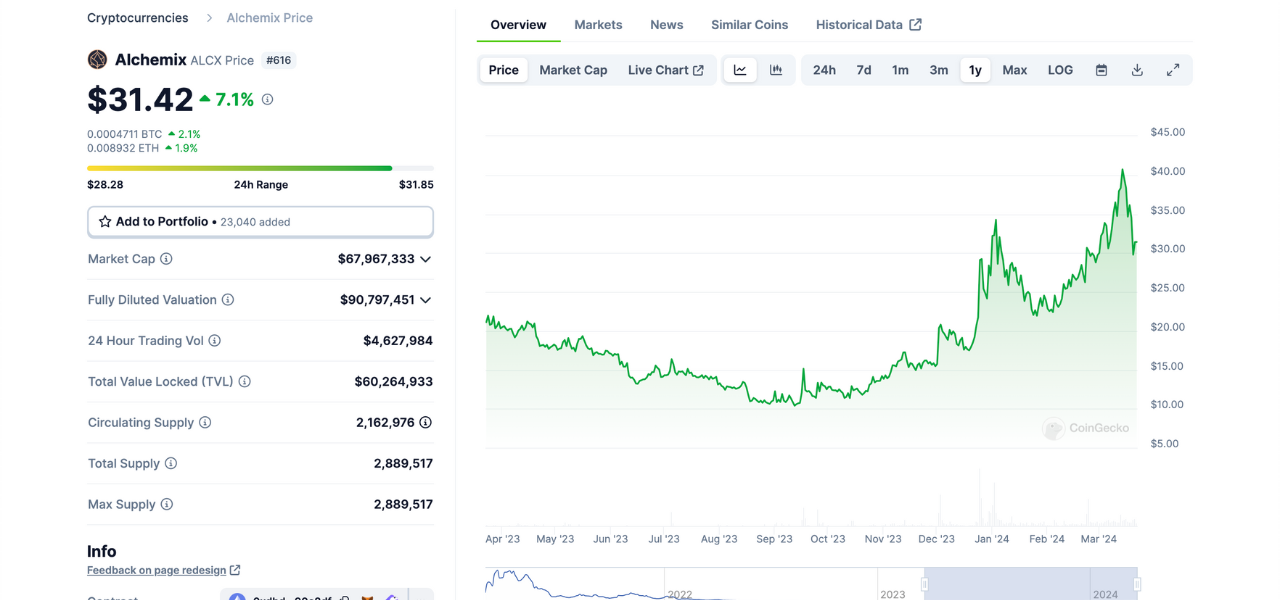

- Alchemix (ALCX) is a DeFi 2.0 protocol that lets users borrow against the future yield of their DAI deposits. By minting alUSD, a synthetic token, users gain immediate access to capital while their DAI generates yield in a Yearn vault. This yield automatically repays the loan over time, offering a unique lending experience.

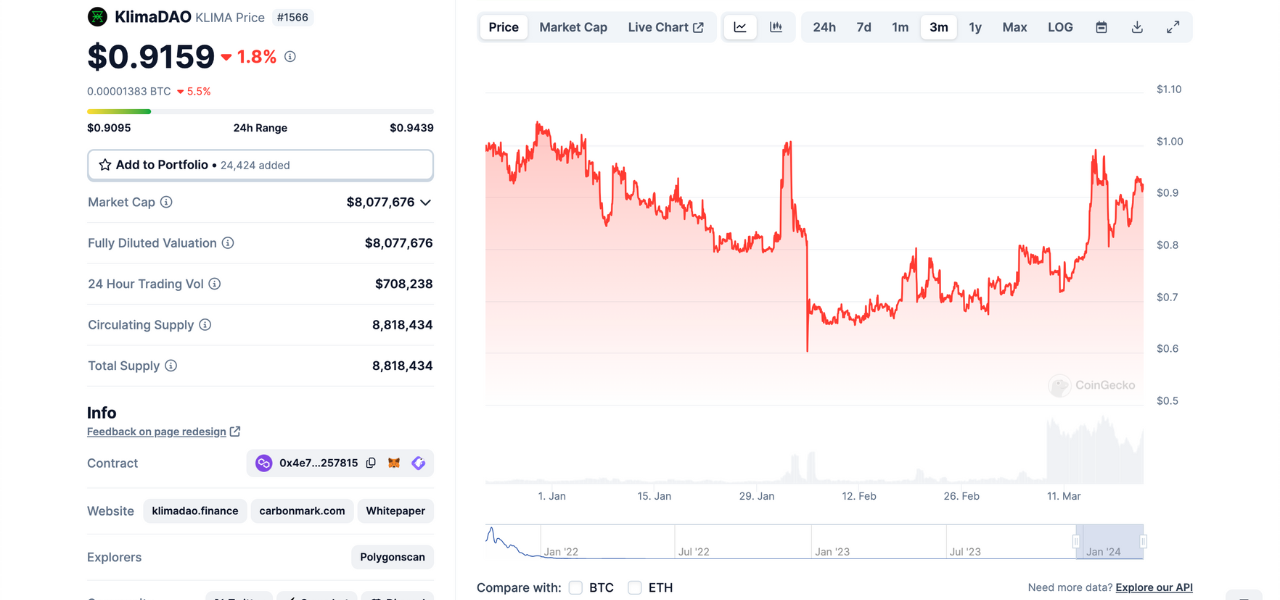

- KilmaDAO (KLIMA) is a decentralized collective that tackles climate change by building a robust Digital Carbon Market. Their online platforms and tools aim to create a transparent and efficient voluntary carbon market, accelerating global climate finance by trading digital carbon assets.

- Abracadabra (SPELL) takes a novel approach to DeFi 2.0 by enabling users to put their income-generating holdings to work. Unlike conventional DeFi lending platforms, Abracadabra allows users to borrow stablecoins using interest-bearing tokens (ibTKNs) as collateral.

What is DeFi 2.0?

Decentralized finance (DeFi) is leaping forward with DeFi 2.0. This next generation tackles the growing pains of DeFi 1.0, specifically scalability, compatibility between blockchains, and long-term viability.

DeFi 2.0 achieves this by leveraging advanced technologies like layer 2 solutions and bridges between blockchains. The focus of DeFi 2.0 is on providing secure and efficient financial services like lending, borrowing, trading, and yield farming.

These projects prioritize user experience, security, and interoperability for DeFi applications. This results in benefits such as lower fees, faster transactions, and less network congestion for users.

Balancing risks and rewards

While DeFi 2.0 builds on the foundation of DeFi 1.0, it embraces a higher risk tolerance. This allows for more experimentation and innovation for decentralized applications within the finance space, and projects are more willing to explore new approaches, even if they carry some risk.

This fosters a dynamic environment where groundbreaking ideas can take root and promising DeFi applications emerge – all while staying true to the core principles of decentralization and trustless operation.

In essence, DeFi 2.0 retains the familiar mechanisms of DeFi 1.0 but injects them with innovation, paving the way for a more robust and user-friendly future for decentralized finance.

How DeFi 2.0 improves on DeFi 1.0

| DeFi 1.0 Limitation | DeFi 2.0 Solutions |

| Scalability: Low liquidity in DeFi markets leads to volatile price swings during token swaps. | Explores faster, cheaper blockchains and Layer 2 scaling. |

| Liquidity: The difficulty of providing sufficient funds for seamless trading causes slippage and price volatility in decentralized exchanges. | It uses Protocol-Controlled Liquidity (PCL) mechanisms where protocols lock their tokens to create deeper liquidity pools. |

| Centralization: Single oracles or controlled governance models may have centralized elements | Prioritizes DAOs and community governance to distribute power |

| Security risks: Bugs in smart contracts can result in hacks and loss of funds | Emphasizes audits and multi-signature security to reduce vulnerabilities |

| Capital inefficiencies: Locked DeFi capital reduces market efficiency. | Introduces innovative solutions like fractionalized lending protocols |

Best DeFi 2.0 tokens to watch in 2024

The DeFi 2.0 ecosystem is experiencing an exciting wave of innovation, with numerous groundbreaking projects emerging rapidly.

This section highlights seven DeFi tokens that deserve your attention. These projects were chosen based on their potential to bring about significant changes, the strength of their teams, and the level of engagement within their communities.

1. PlayDoge (PLAY): P2E game fusing the Doge meme with 90s nostalgia

With memes and gaming both proving highly popular trends in the crypto world, brand new project PlayDoge has created a fusion of the two.

This play-to-earn project takes the familiar Doge meme and turns it into a digital pet in the style of the beloved 90s gaming franchise, Tamaochi. In this 2D world, players must feed, train and play with their Doge pet while participating in additional mini games to earn $PLAY tokens.

However, the catch is that, much like a real dog, the in-game Doge could run away (or worse) if neglected, thus incentivizing players to remain active.

Beyond acting as a reward token, $PLAY can also be staked for generous passive rewards. At present, annual rewards are estimated to be around 8,000%, with more than 2.2 million $PLAY tokens having been staked in less than 24 hours.

The PlayDoge roadmap consists of 4 phases, with phase 1 allocated for the token contract audit, the beginning of the $PLAY presale, and marketing efforts. Future phases will see the beginning of development for the P2E game, the end of the presale, and the launch of $PLAY on decentralized exchanges.

The developers of PlayDoge have also confirmed the breakdown of the project’s tokenomics model, with 50% of the 9.4 billion allocation being set aside for the presale.

For more information, visit the official PlayDoge website.

| Ticker | TUK |

| Max. Supply | 9.4 billion |

| Blockchain platform | BNB Smart Chain (BEP-20) |

| Inception | 2024 |

Pros

- Follows on from Doge and P2E hype

- Nostalgic theme

- Generous staking rewards

Cons

- P2E game not yet in development/li>

2. eTukTuk (TUK): Sustainable TukTuks + solar charging stations + DeFi staking

eTukTuk directly addresses the challenges of air pollution and financial exclusion in developing economies. Their solution is a comprehensive ecosystem that combines:

- Solar-powered Charging Stations: A network of conveniently located stations powered by renewable energy ensures easy access to charging.

- Affordable Electric TukTuks: Designed for local manufacturing, focusing on lower costs and increased driver earnings.

- $TUK Token: This is the utility token of the eTukTuk ecosystem. It fuels transactions, incentivizes network participation, and unlocks “Power Staking” features.

eTukTuk’s mission aligns perfectly with the global push for Zero Emission Vehicles (ZEVs), making it a timely and impactful project.

Affordable EVs, shared economy model

eTukTuk goes beyond eco-friendly transportation. Here’s what sets them apart:

- Disruptive affordability: eTukTuk’s locally manufactured EVs aim to be significantly cheaper than traditional gasoline-powered TukTuks.

- Shared economy integration: The network promotes efficient resource utilization through strategically placed charging stations and ZEVs.

- DeFi-powered Staking (“Power Staking”): Users who stake TUK tokens contribute to the network’s growth and earn rewards in return. This fosters a financially inclusive model for all participants.

Project review

eTukTuk merges eco-conscious goals with innovative DeFi features. By enabling users to participate in the network’s success through staking, eTukTuk creates a financially inclusive future for sustainable transportation. This positions eTukTuk as a strong Best DeFi 2.0 tokens category contender.

| Ticker | TUK |

| Max. Supply | 2,000,000,000 |

| Blockchain platform | Binance Smart Chain (BSC) |

| Inception | 2024 |

Pros

- Potential for First-Mover Advantage

- Combines Clean Energy with Eco-Friendly Transport

- Empowers Local Manufacturing and Economic Development

Cons

- Battery Range Limitations May Affect Usability

- Reliance on Government Support for ZEV Policy Implementation

- Competition from Established Transportation Providers

3. Alchemix (ALCX): DeFi Innovation with self-paying loans

Alchemix is a DeFi 2.0 protocol shaking things up with synthetic assets. Liquidity providers deposit DAI stablecoins to mint alUSD, a synthetic token representing a future yield on the deposit. This unlocks immediate access to the value of their deposit without waiting for yields to accrue.

Borrowing with future yield

Alchemix offers a unique take on lending. Deposit DAI and borrow up to 50% of its value as alUSD.

Alchemix automatically puts your DAI in a Yearn vault, generating a yield (around 12% APY) that seamlessly repays your loan over time. Borrowers can use alUSD for purchases or stake it within Alchemix for even more returns.

Additionally, Alchemix boasts:

- Vaults: Similar to other DeFi platforms, Alchemix offers Vaults to generate yield advances. These Vaults currently accept DAI as collateral.

- Transmuter: This built-in tool ensures a 1:1 peg between alUSD and DAI, allowing users to redeem their synthetic tokens for the underlying asset anytime.

Project review

This DeFi protocol is a pioneering platform that brings innovation to decentralized finance (DeFi) lending. Through Alchemix, users can swiftly access the capital they deposit while earning yield.

The platform’s automatic yield-based repayment system streamlines loan management. With its distinctive features, Alchemix stands out as a formidable contender in the category of Best DeFi 2.0 Tokens.

| Ticker | ALCX |

| Max. Supply | 2.89M |

| Blockchain platform | Ethereum |

| Inception | 2021 |

Pros

- Composability Potential: Integrates with DeFi tools like Yearn, opening doors for future innovation

- Reduced Leverage Risk: Borrowing only 50% of DAI value mitigates over-leveraging

- Algorithmic Improvement Potential: The Transmuter system offers room for future optimization

Cons

- Smart Contract Risk: Relies on secure smart contracts, vulnerabilities could lead to hacks

- Yield Dependence: Repayment relies on consistent Yearn vault yield, a drop could cause issues

- Limited alUSD Use Case: Currently, alUSD’s function is mainly for borrowing, broader adoption is needed

4. KlimaDAO (KLIMA): Building a global marketplace for climate action with DeFi 2.0

KlimaDAO is a frontrunner in DeFi 2.0, building the infrastructure for a transparent and global Digital Carbon Market. Their KLIMA token fuels this marketplace, aiming to accelerate climate finance through DeFi mechanisms.

Accelerating climate finance

KlimaDAO’s innovation lies in using DeFi 2.0 to create a market for real-world carbon credits.

Their Carbonmark platform simplifies institutional access to carbon credits and KlimaDAO’s infrastructure. Partnering with Circle, Carbonmark allows institutions secured custody and easy USD conversion for institutions.

In 2022, KlimaDAO processed over $4 billion in carbon credit trades. Its treasury also grew to over $100 million, demonstrating a robust foundation for future growth.

Project review

KlimaDAO’s impact is undeniable—their protocol powers platforms like Carbonmark and partners with organizations like Polygon and Circle.

This empowers airlines, automakers, and even celebrities like Mark Cuban to meet sustainability goals. With over 100,000 token holders and a proven track record, KlimaDAO is a key player in shaping the future of DeFi 2.0 and sustainable finance.

| Ticker | KLIMA |

| Max. Supply | 8.82M |

| Blockchain platform | Ethereum |

| Inception | 2021 |

Pros

- First-mover advantage: KlimaDAO’s early entry into carbon DeFi leads them in partnerships and brand recognition

- Strong community: Over 100,000 token holders fuel project growth and advocacy

- Major player integrations: Partnerships with Polygon, Circle, and others position KlimaDAO for mainstream adoption

Cons

- Regulatory uncertainty: New carbon credit market regulations could hinder KlimaDAO’s growth

- Volatile underlying asset: KLIMA token value relies on carbon credit prices, introducing market fluctuations

- Manipulation risk: Digital carbon markets can be vulnerable to price manipulation

5. Abracadabra (SPELL): Unlocking leverage for DeFi 2.0

Abracadabra stands out in the crowded DeFi 2.0 landscape by unlocking liquidity for yield farmers. This innovative platform lets users collateralize interest-bearing tokens (ibTKNs) – like those earned from Curve, Yearn, or SushiSwap – to borrow stablecoins.

Borrow USD coins with interest-bearing tokens

Abracadabra.money offers a unique twist on DeFi lending:

- Collateralize ibTKNs: Unlike most platforms, Abracadabra accepts ibTKNs, which continuously generate returns, as collateral for loans. This frees up liquidity trapped in these tokens.

- Mint Magic Internet Money (MIM): Abracadabra’s native stablecoin, MIM, is pegged to the US dollar and can be minted using ibTKNs as collateral. MIM boasts multi-chain functionality, allowing easy transfer across various blockchains.

- Governance via SPELL: SPELL token holders have a say in Abracadabra’s future. They can vote on proposals to shape the platform’s development.

Project review

This lending platform‘s ability to leverage ibTKNs creates a unique niche in DeFi 2.0. This innovation allows users to amplify their returns by borrowing MIM against their ibTKNs and deploying those borrowed funds into additional yield-generating opportunities.

However, users should carefully consider the added risks involved. Leverage can magnify profits and losses; even small price swings can trigger collateral liquidation. It’s crucial to properly size your positions and constantly monitor market conditions to avoid these pitfalls.

| Ticker | SPELL |

| Max. Supply | 210M |

| Blockchain platform | Multichain protocol (On Ethereum (ETH), Avalanche (AVAX), Fantom (FTM), and Arbitrum) |

| Inception | 2021 |

Pros

- First-mover advantage: KlimaDAO’s early entry into carbon DeFi leads them in partnerships and brand recognition

- Strong community: Over 100,000 token holders fuel project growth and advocacy

- Major player integrations: Partnerships with Polygon, Circle, and others position KlimaDAO for mainstream adoption

Cons

- Regulatory uncertainty: New carbon credit market regulations could hinder KlimaDAO’s growth

- Volatile underlying asset: KLIMA token value relies on carbon credit prices, introducing market fluctuations

- Manipulation risk: New markets like the Digital Carbon Market can be vulnerable to price manipulation

Earning with DeFi 2.0

DeFi 2.0 opens doors to potentially lucrative returns on your crypto assets. Here’s a roadmap to navigate these opportunities:

- Staking: Become a network validator by locking your Best DeFi 2.0 tokens in a smart contract. This contributes to network security and earns you rewards.

- Liquidity Provision: Think of yourself as a market maker—supply tokens to decentralized exchanges (DEXs) to create liquidity pools facilitating trading. In return, you collect a portion of the swap fees generated.

- Yield Farming: This strategy involves strategically moving your crypto holdings between DeFi platforms to maximize interest earned. It’s akin to constantly seeking the best savings account rates but on steroids. However, yield farming can be complex and carries higher risks due to its dynamic nature.

The decentralized finance landscape is rife with innovation but also potential pitfalls. Avoid projects that lack a clear path to revenue generation. These can operate similarly to unsustainable Ponzi schemes, where early investors are paid with funds from later entrants.

Focus on DeFi 2.0 projects with real-world utility and a well-defined token economic model. These factors can increase your chances of finding sustainable DeFi 2.0 tokens with long-term earning potential.

DeFi 2.0 vs. GameFi

DeFi 2.0 aims to revolutionize traditional finance. Its tokens aim to improve lending, borrowing, and trading protocols on the blockchain, making them faster, more adaptable, and more efficient. DeFi 2.0 is essentially an upgrade for core financial services on the blockchain.

GameFi, however, takes a different approach. It merges gaming with decentralized finance, creating a “play-to-earn” model. Gamers can earn cryptocurrency through gameplay and by owning digital assets within the game itself. This creates a new kind of in-game economy where players have a stake in the game’s success.

Interestingly, the line between DeFi 2.0 and GameFi isn’t always clear-cut. Some innovative GameFi projects leverage DeFi 2.0’s infrastructure to create their in-game economies. Here’s how:

- Earning & lending: DeFi 2.0’s lending protocols can be integrated into GameFi, allowing players to earn interest on their crypto earned through gameplay. Imagine storing your in-game tokens and generating passive income!

- NFT utility: DeFi 2.0’s focus on NFTs (non-fungible tokens) perfectly complements GameFi’s reliance on in-game assets. These NFTs, representing unique digital items within the game, can be collateral for loans within DeFi 2.0 protocols.

This synergy between DeFi 2.0 and GameFi creates a dynamic ecosystem where players can enjoy the game and potentially earn a return on their investment and in-game assets.

So, how do you choose? DeFi 2.0 beckons if you’re interested in financial innovation. If the thrill of playing to earn and exploring new gaming experiences is more your style, then GameFi might be the better fit.

Comparison chart: Our best DeFi 2.0 tokens side-by-side

| Token | Chain | Supply | Inception |

| PLAY | Binance | 9.4B | 2024 |

| ALCX | Ethereum | 2.89M | 2021 |

| KLIMA | Polygon | 8.82M | 2021 |

| SPELL | Multichain [Ethereum (ETH), Avalanche (AVAX), Fantom (FTM), Arbitrum] | 210M | 2021 |

FAQs

What is DeFi?

DeFi stands for Decentralized Finance. It’s a growing ecosystem of financial products and services built on blockchain technology. Unlike the traditional financial system, DeFi aims to remove intermediaries like banks, making finance more open and accessible.

What is DeFi 2.0 investment?

DeFi 2.0 investment involves buying tokens associated with DeFi 2.0 protocols. These tokens can potentially increase in value but are also subject to price fluctuations.

Are DeFi 2.0 tokens profitable?

DeFi 2.0 tokens have profit potential, but there are no guarantees. They often power DeFi 2.0 protocols, and their value can be tied to their success. Don’t mistake high APYs for free money.

Where to buy DeFi 2.0 tokens?

Many cryptocurrency exchanges offer DeFi 2.0 tokens. Look for reputable exchanges with a strong track record and security measures.

What are the risks of DeFi 2.0?

DeFi 2.0 is a new and evolving space with inherent risks. These include scams, hacks, high volatility, and complex protocols. Only invest what you can afford to lose and do your own research.

Is there a limit on how many tokens I can buy?

Limits on DeFi 2.0 token purchases typically depend on the exchange you use and any regulations in your area. Some exchanges may have minimum or maximum buy-in amounts.

What is the DeFi 2.0 protocol?

A DeFi 2.0 protocol is a set of rules that govern a DeFi 2.0 application. These protocols enable various DeFi functions like lending, borrowing, and trading. Understanding the protocol is crucial before investing in its token.

Are DeFi projects good or bad?

DeFi protocols have the potential to revolutionize finance by making it more inclusive and efficient. However, it’s a complex and risky space. Carefully weigh the potential benefits and risks before getting involved.

What is the market capitalization DeFi?

The decentralized finance (DeFi) cryptocurrency market is currently valued at $90.78 billion and is projected to grow at a compound annual growth rate (CAGR) of 39.5% from 2022 to 2027. In comparison, centralized finance (CeFi) has a market cap of approximately $324 billion, as CoinMarketCap and BCC Research reported.

Is DeFi still profitable?

DeFi can be profitable, but it’s not guaranteed to make money. The profitability of DeFi 2.0 tokens and a surge of the DeFi crypto market cap depend on various factors, including market conditions and individual project success.

Sources

- https://www.coinchange.io/blog/defi-research-news-january-2024

- https://www.statista.com/statistics/426469/active-virtual-reality-users-worldwide/

- https://www.bccresearch.com/market-research/finance/global-decentralized-finance-market.html

- https://www.spglobal.com/en/research-insights/featured/markets-in-motion/understanding-voluntary-carbon-markets

- https://www.gemini.com/cryptopedia/abracadabra-money-spell-token-abracadabra-crypto-lending#section-leveraged-yield-farming-on-abracadabra-money