Travel credit cards come with many perks, including zero foreign transaction fees, insurance, airport lounge access, and priority boarding. You’ll also earn rewards every time the card is used, allowing you to accumulate hotel points, air miles, and more.

This guide reveals the best travel credit card for 2024. Read on to discover the top-rated travel cards for rewards, benefits, APRs, introductory offers, eligibility, and credit limits.

Best Travel Credit Cards Reviewed

The 10 best travel credit cards are reviewed in the sections below.

1. Bank of America® Travel Rewards Credit Card: Overall Best Credit Card for Travel Benefits

Our top pick is the Bank of America® Travel Rewards Credit Card. This credit card is great for earning rewards; you’ll get 1.5 points for every $1 spent. Most importantly, there are no restrictions on spending categories. This means you’ll not only earn points while traveling but also on everyday purchases at home.

The Bank of America® Travel Rewards Credit Card also offers an introductory offer for new cardholders. After spending $1,000 on purchases within 90 days, you’ll receive 25,000 bonus points. Points can be used for statement credits or booking travel via the Bank of America portal.

The latter is often the best option, as you’ll get a better points-to-dollar ratio. New cardholders will also receive 15 months of interest-free purchases and balance transfers. Standard APRs on this card are between 18.24% and 28.24%. Other cardholder perks include zero foreign transaction fees and fraud guarantee protection.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Bank of America® Travel Rewards Credit Card | 25,000 points after spending $1,000 on purchases within 90 days. 0% on balance transfers and purchases for 15 months. | Earn 1.5 points for every $1 spent without spending category restrictions or limits. | $95 | 18.24% – 28.24% |

Pros

- In our view, the overall best travel credit card

- Earn 1.5 points for every $1 spent

- No category restrictions or spending limits

- Get 15 months of interest-free purchases and balance transfers

- No foreign transaction fees

Cons

- $95 annual fee

2. Platinum Card® from American Express: Best for Business Owners

Business owners might consider the Platinum Card® from American Express. For a start, this is a charge card, meaning it comes without spending limits. The only condition is that the monthly statement is settled in full each month. The Platinum Card® from American Express comes with a high annual fee of $695.

However, when you factor in the benefits, the annual fee more than pays for itself. This includes $200 in hotel credits, $200 in airline credits, $155 in Walmart credits, and $240 in digital entertainment credits. This is also the best travel credit card with lounge access. You’ll also get a complimentary Priority Pass Prestige (worth $469).

This is in addition to ‘Gold’ member status with Marriott Bonvoy and Hilton. The Platinum Card® from American Express also offers up to 5x points for every $1 spent. First-time applicants will receive 80,000 bonus points after spending $8,000 in the first six months. Crucially, there are no fees when using the card overseas.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Platinum Card® from American Express | 80,000 points after spending $8,000 on purchases within six months. | Earn up to 5x points for every $1 spent. Benefits include global airport lounge access, travel insurance, over $1,500 worth of credits from multiple categories, and no foreign transaction fees. | $695 | 21.24% – 29.24% |

Pros

- Best business travel credit card

- No spending limits

- Earn up to 5x for every $1 spent

- 80,000 bonus points for new applicants

- Huge range of travel perks including global airport lounge access

Cons

- Monthly statements must be settled in full every month

3. Discover it® Miles: Best for Unlimited Air Miles

The Discover it® Miles is the best credit card for travel miles. Put simply, you’ll earn 1.5x miles for every $1 spent. You can earn an unlimited number of air miles and there are no spending category restrictions. What’s more, there’s no pressure to redeem the points as they never expire.

At the end of the first year, the Discover it® Miles offers a like-for-like match. So, if you earned 50,000 miles, you’ll get another 50,000 miles added to your account. If you’re currently holding balances on other credit cards, the Discover it® Miles also offers 0% balance transfers for 15 months.

This will cost you 3% of the total transfer amount. You’ll also get 0% APR on purchases for the same period. We also like that the Discover it® Miles comes without annual or foreign transaction fees. However, do note that standard APRs are between 17.24% and 28.24%.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Discover it® Miles | Unlimited like-for-like air miles match at the end of year one. 0% on balance transfers and purchases for 15 months. | Unlimited 1.5x air miles for every $1 spent. | None | 17.24% – 28.24% |

Pros

- Best travel credit card with no annual fee

- 1.5x air miles per $1 spent without restrictions

- Receive a like-for-like match at the end of the first year

- No annual or foreign transaction fees

- 0% balance transfers and purchases for 15 months

Cons

- Limited cardholder perks when compared to other travel cards

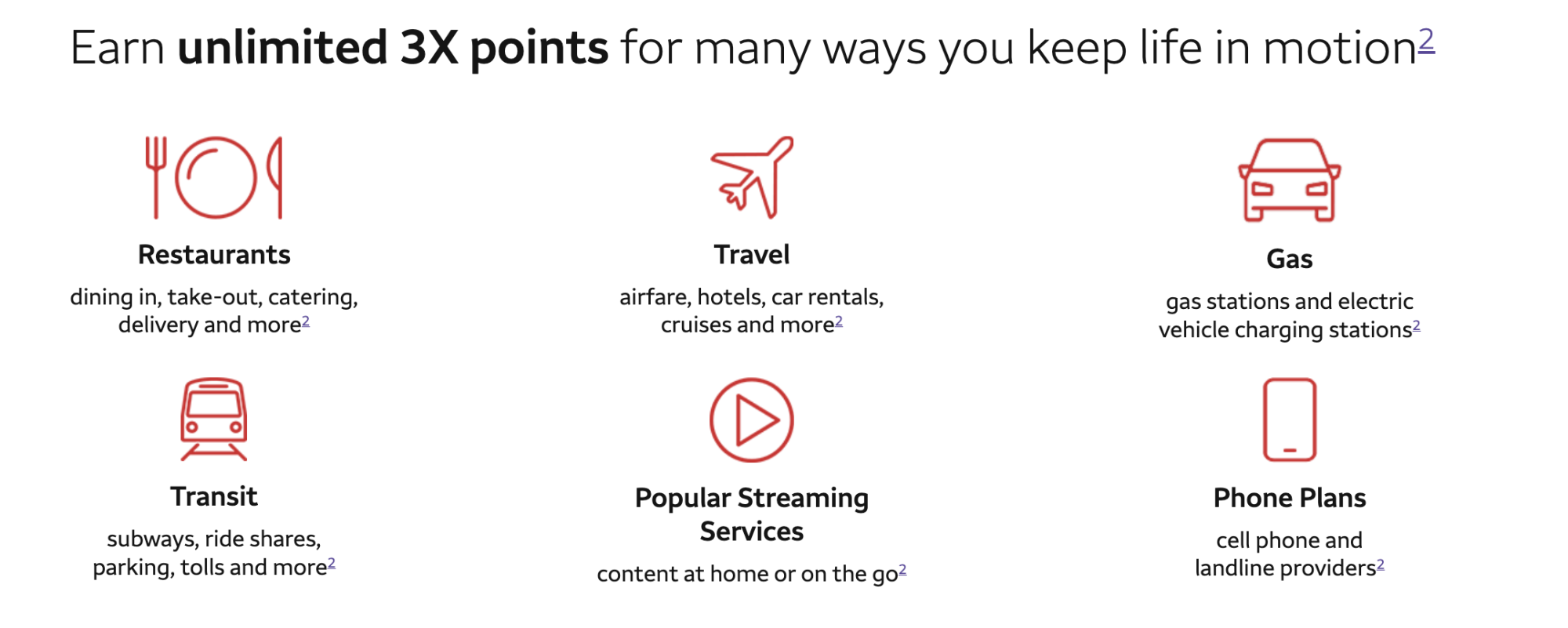

4. Wells Fargo Autograph℠ Card: Best for Accumulating Rewards

The Wells Fargo Autograph℠ Card is one of the best credit cards for rewards. First, you’ll get 30,000 bonus points after spending $1,500. Valued at $300, you’ll have three months to hit this target. You’ll also earn 3x points for every $1 spent on the following categories; travel, gas, transit, streaming services, dining, and phone plans.

This means you’ll earn points even when you’re not traveling. All other spending categories earn 1x points per $1 spent. You can redeem points for statement credits or gift cards. That said, redeeming points via the Wells Fargo travel portal offers the highest redemption rate.

This travel credit card can be used overseas without incurring foreign transaction fees. There are no annual fees either. New cardholders will receive 12 months of 0% interest, covering purchases and balance transfers. After that, you’ll pay standard APRs of between 20.24% – 29.99%.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Wells Fargo Autograph℠ Card | 30,000 points after spending $1,500 on purchases within three months. 0% on balance transfers and purchases for 12 months. | Unlimited 3x points for every $1 spent on travel, gas, transit, streaming services, dining, and phone plans. 1x points on all other spending categories. | None | 20.24% – 29.99% |

Pros

- Best travel card for accumulating rewards

- Unlimited 3x points on selected categories – including travel

- 30,000 bonus points after spending $1,500

- No foreign transaction fees

- 0% APR on purchases and balance transfers for 12 months

Cons

- Standard APRs of up to 29.99%

5. Chase Freedom Flex®: Best for Earning Cash Back

The Chase Freedom Flex® Credit Card allows you to combine cash back and travel perks. This card offers 5% cash back on travel purchases made through Chase Ultimate Rewards. 5% cash back is also offered on rotating bonus categories, which change every quarter.

Other spending categories earn 1-3% cash back. New cardholders get an extra $200 cash back after spending $500 within three months. You’ll also get a 5% cash back boost on gas and grocery purchases – up to the first $12,000.

Although the Chase Freedom Flex® comes without annual fees, you’ll be charged 3% when using the card overseas. What’s more, there’s a standard APR of between 20.49% – 29.24%. Fortunately, first-time applicants get 15 months of interest-free purchases and balance transfers.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Chase Freedom Flex® Credit Card | $200 cash back after spending $500 on purchases within three months. 0% on purchases and balance transfers for the first 15 months. | 5% cash back on gas and grocery purchases in the first year (excluding Target and Walmart, up to the first $12,000). Standard cash back of 1-5% depending on the spending category. | None | 20.49% – 29.24%. |

Pros

- One of the best cash back credit cards

- Get 5% cash back on gas and grocery purchases

- Book travel via Chase to earn 5% cash back

- New cardholders get a $200 cash back bonus

- 0% APR on balance transfers and purchases for 15 months

Cons

- Purchases made overseas are charged 3%

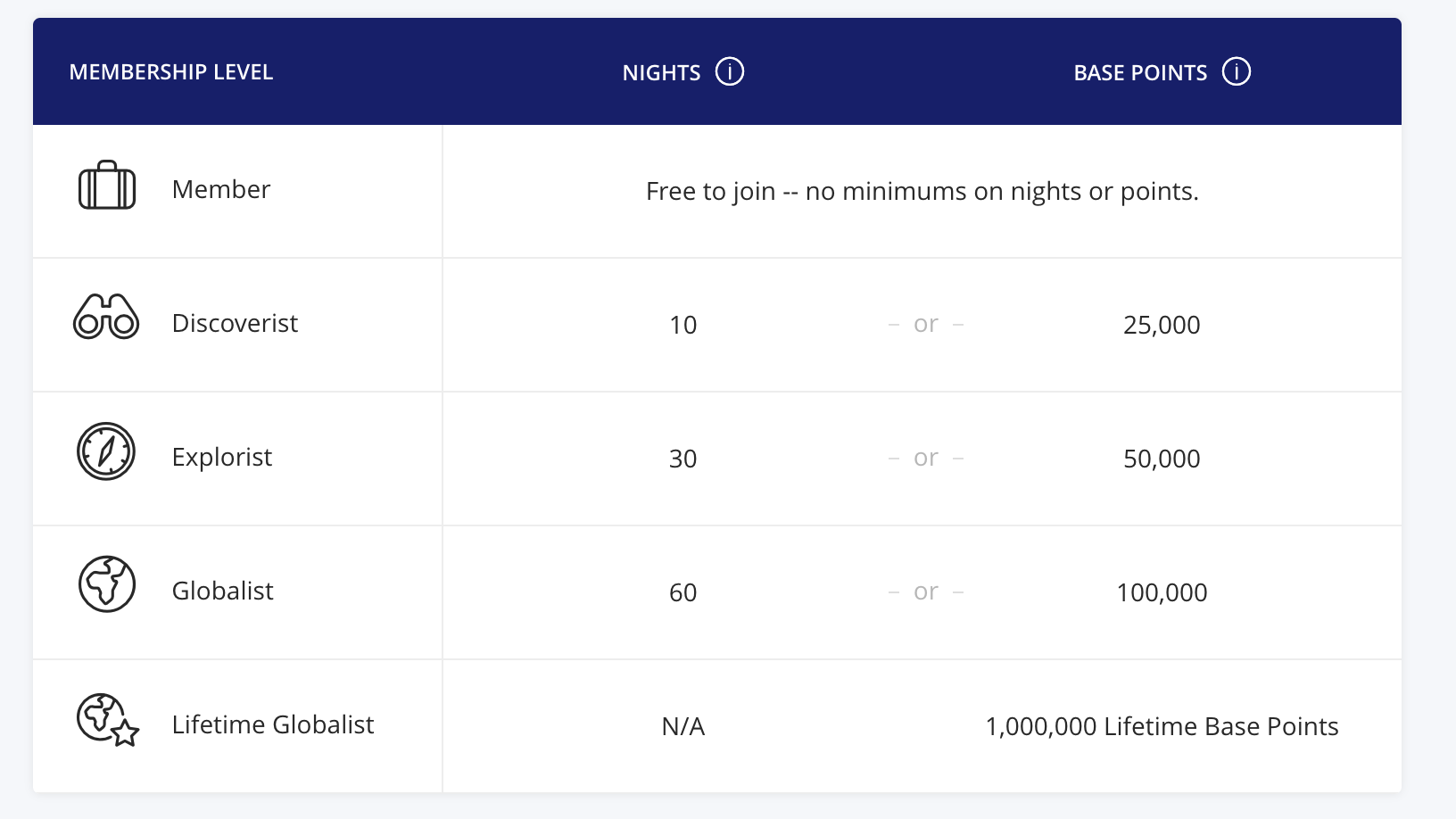

6. World of Hyatt Credit Card®: Best for Hotel Rewards

The World of Hyatt Credit Card® is the best travel credit card for hotel rewards. Although there’s an annual fee of $95, this travel card comes packed with rewards and benefits. This includes one free hotel stay per year and immediate Discoverist status.

Spend at least $15,000 in the first year to get an extra free night. That said, if you reach the spending target within six months, you’ll get 30,000 Hyatt points. This is in addition to the 30,000 Hyatt points awarded when opening the account. For every $1 spent in Hyatt properties, you’ll get 9 Hyatt points.

Selected spending categories earn 2 points per $1, including travel, fitness, and dining. Everything else earns 1 point per $1. There are no foreign transaction fees when using the card abroad. The World of Hyatt Credit Card® comes without a 0% introductory rate. Standard APRs of between 21.49% – 28.49% apply.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| World of Hyatt Credit Card® | Up to 60,000 Hyatt points after meeting minimum spending requirements. | 9 points per $1 spent in Hyatt hotels and resorts. Up to 2 points per $1 on other spending categories. Cardholders receive World of Hyatt Discoverist status, one free stay, and five qualifying nights. | $95 | 21.49% – 28.49% |

Pros

- Best travel card for hotel rewards

- Start your Hyatt journey with Discoverist status

- Get up to two free nights per year

- New members get up to 60,000 Hyatt points

- Earn 9 points for every $1 spent in Hyatt properties

Cons

- No interest-free introductory periods

7. Capital One Venture Rewards Credit Card: Best for Big Spenders

If you’ve got a solid credit score and typically spend large amounts each month, consider the Capital One Venture Rewards Credit Card. After spending $4,000 within the first three months of opening the account, you’ll receive 75,000 bonus miles.

According to some estimates, Capital One miles are worth up to 1.85 cents when redeemed with certain partners. This values the introductory offer at over $1,387. Not only that but the Capital One Venture Rewards Credit Card offers unlimited 2x miles for every $1 spent.

This covers all purchases without any spending categories. You can increase your rewards to 5x miles when booking travel via the Capital One portal. This travel credit card comes with an annual fee of $95. Benefits include zero foreign transaction fees and $100 in TSA PreCheck credit. APRs range from 19.99% – 29.99%.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Capital One Venture Rewards Credit Card | 75,000 miles after spending $4,000 on purchases within three months. | Unlimited 2x miles for every $1 spent. Increased to 5x miles when booking hotels or car rentals via the Capital One Travel portal. | $95 | 19.99% – 29.99% |

Pros

- Unlimited 2x miles for every $1 spent

- No restrictions on spending categories

- 75,000 bonus miles after spending $4,000

- No foreign transaction fees

- $100 in TSA PreCheck credit

Cons

- An ‘Excellent’ credit rating is needed

8. Citi Premier® Card: Best for Introductory Bonuses

The Citi Premier® Card is the best travel credit card for earning introductory bonuses. New cardholders receive 60,000 bonus points after spending $4,000. This needs to be achieved within three months of opening the account. 60,000 points can be redeemed for $600 worth of travel rewards on Thankyou.com.

Redemption options include flights, hotels, car rentals, and experiences. The Citi Premier® Card also offers unlimited 3x points for every $1 spent on select categories. This includes travel, gas stations, groceries, and dining. All other purchases earn 1x points per $1.

Cardholders also get $100 off hotel bookings of $500 or more. Not to mention zero foreign transaction fees when using the card overseas. You’ll also get $0 liability protection if your credit card information is stolen. In terms of drawbacks, you’ll pay $95 annually and there’s no 0% introductory offer. APRs range from 21.24%- 29.24%.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Citi Premier® Card | 60,000 bonus points after spending $4,000 on purchases within three months. $600 redemption on travel rewards at Thankyou.com. | Unlimited 3x points for every $1 spent on travel, gas stations, groceries, and dining. Unlimited 1x points on all other spending categories. | $95 | 21.24%- 29.24% |

Pros

- Best travel card for introductory bonuses

- Get 60,000 bonus points valued at $600

- Unlimited 3x points on selected categories – including travel

- $0 liability protection

- No fees to use the card overseas

Cons

- $95 an annual fee

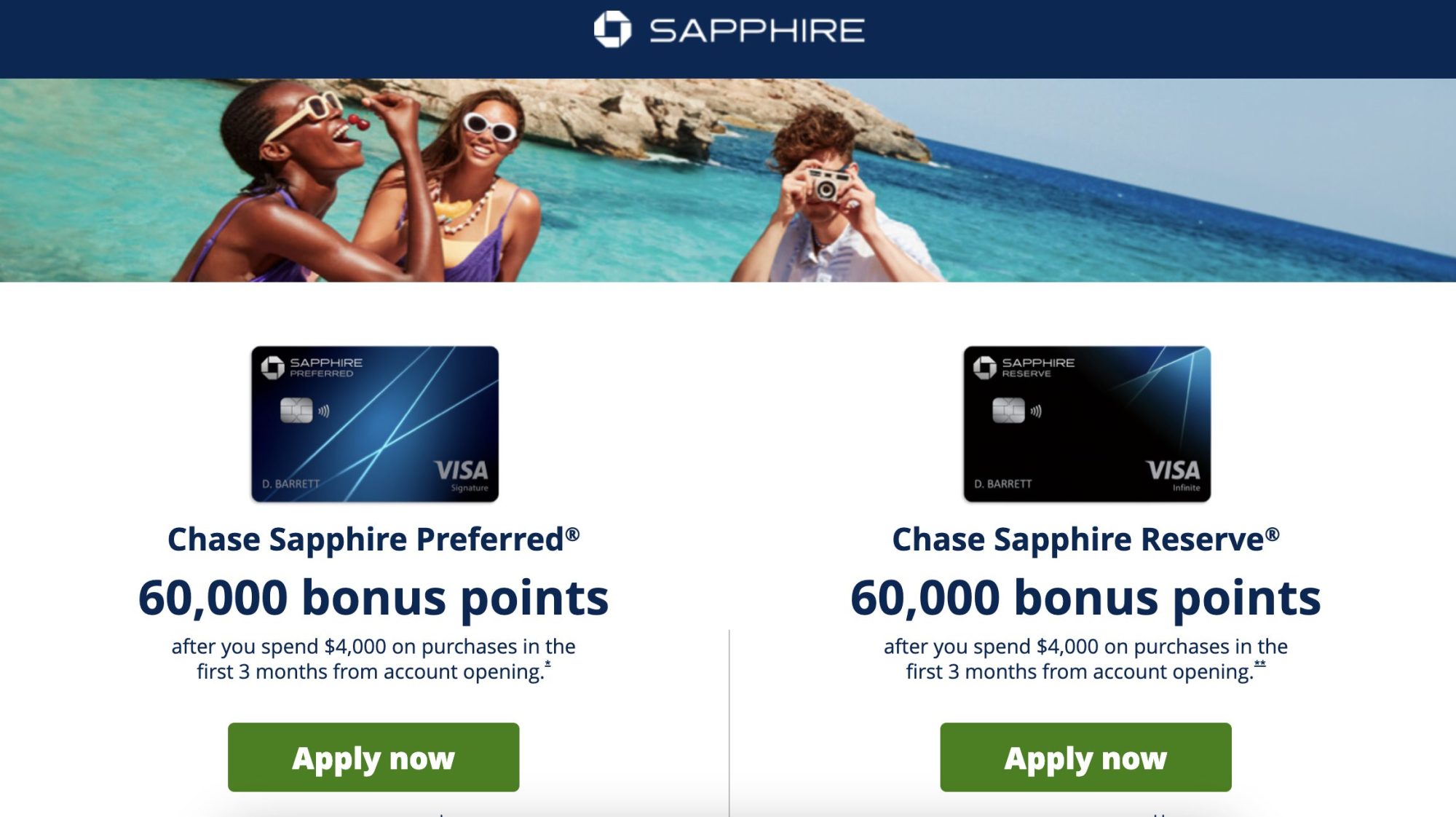

9. Chase Sapphire Reserve®: Best for Travel Credits

The Chase Sapphire Reserve® is a top-rated travel credit card with plenty of benefits. It comes with an introductory offer of 60,000 bonus points. This gets you $900 worth of travel credit when redeeming via the Chase Ultimate Rewards portal.

You’ll need to spend $4,000 within three months of opening the account to qualify. All cardholders get an additional $300 worth of travel credit every year. You’ll also get 10x points when booking travel through Chase. 3x points are earned on dining and other travel purchases.

What’s more, the Chase Sapphire Reserve® comes with global airport lounge access. Other perks include TSA PreCheck® or Global Entry credit, dining experiences, and extended warranty protection. Do note that a huge annual fee of $550 applies. Plus, you’ll need an ‘Excellent’ credit score to be eligible.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Chase Sapphire Reserve® | 60,000 bonus points after spending $4,000 on purchases within three months. Redeem for $900 travel credit via Chase. | Unlimited 1-10x points for every $1 spent, depending on the category. Perks include global airport lounge access and $300 in annual travel credits. | $550 | 22.49% – 29.49% |

Pros

- Best travel card for earning travel credits

- $300 travel credit every year

- Introductory bonus of 60,000 points ($900 credit value)

- 10x points per $1 when booking travel via Chase

- Global airport lounge access

Cons

- Huge annual fee of $550

10. Delta SkyMiles® Gold American Express Card: Best for Airline Loyalty Perks

The Delta SkyMiles® Gold American Express Card is a great option for airline loyalty perks. Cardholders get priority boarding on all domestic and international Delta flights. You’ll also get a 20% discount when using the card on-board and the first checked bag is always free.

This is in addition to a $100 credit for Delta flights. The Delta SkyMiles® Gold American Express Card also doubles up as a top-rated rewards travel card. The introductory bonus offers 40,000 bonus miles when spending $2,000 within six months.

You’ll also get 2x miles when using the card on dining (including takeout), grocery, and Delta purchases. Everything else earns 1x miles. This credit card comes with a $99 annual fee, although this only kicks in from year two. Standard APRs range from 20.99% – 29.99%.

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Delta SkyMiles® Gold American Express Card | 40,000 miles after spending $2,000 on purchases within six months. | 2x miles with Delta on US dining and supermarket purchases. 1x miles on all other spending categories. Additional perks include priority boarding, one free checked bag, and in-flight discounts. | $99, but waived for the first year. | 20.99% – 29.99% |

Pros

- Best travel card for airline loyalty perks

- Get priority boarding, free checked baggage, and in-flight discounts

- 40,000 miles credited after spending $2,000

- Earn up to 2x miles for every $1 spent

- No annual fees in the first year

Cons

- Standard APRs start from 20.99%

Travel Credit Card Comparison

Still not sure about the best credit card for travel points? We’ve summarized the top 10 travel cards in the table below:

| Travel Credit Card | Introductory Offer | Rewards | Annual Fee | APR | Learn More |

| Bank of America® Travel Rewards Credit Card | 25,000 points after spending $1,000 on purchases within 90 days. 0% on balance transfers and purchases for 15 months. | Earn 1.5 points for every $1 spent without spending category restrictions or limits. | $95 | 18.24% – 28.24% | Check Eligibility |

| Platinum Card® from American Express | 80,000 points after spending $8,000 on purchases within six months. | Earn up to 5x points for every $1 spent. Benefits include global airport lounge access, travel insurance, over $1,500 worth of credits from multiple categories, and no foreign transaction fees. | $695 | 21.24% – 29.24% | Check Eligibility |

| Discover it® Miles | Unlimited like-for-like air miles match at the end of year one. 0% on balance transfers and purchases for 15 months. | Unlimited 1.5x air miles for every $1 spent. | None | 17.24% – 28.24% | Check Eligibility |

| Wells Fargo Autograph℠ Card | 30,000 points after spending $1,500 on purchases within three months. 0% on balance transfers and purchases for 12 months. | Unlimited 3x points for every $1 spent on travel, gas, transit, streaming services, dining, and phone plans. 1x points on all other spending categories. | None | 20.24% – 29.99% | Check Eligibility |

| Chase Freedom Flex® Credit Card | $200 cash back after spending $500 on purchases within three months. 0% on purchases and balance transfers for the first 15 months. | 5% cash back on gas and grocery purchases in the first year (excluding Target and Walmart, up to the first $12,000). Standard cash back of 1-5% depending on the spending category. | None | 20.49% – 29.24%. | Check Eligibility |

| World of Hyatt Credit Card® | Up to 60,000 Hyatt points after meeting minimum spending requirements. | 9 points per $1 spent in Hyatt hotels and resorts. Up to 2 points per $1 on other spending categories. Cardholders receive World of Hyatt Discoverist status, one free stay, and five qualifying nights. | $95 | 21.49% – 28.49% | Check Eligibility |

| Capital One Venture Rewards Credit Card | 75,000 miles after spending $4,000 on purchases within three months. | Unlimited 2x miles for every $1 spent. Increased to 5x miles when booking hotels or car rentals via the Capital One Travel portal. | $95 | 19.99% – 29.99% | Check Eligibility |

| Citi Premier® Card | 60,000 bonus points after spending $4,000 on purchases within three months. $600 redemption on travel rewards at Thankyou.com. | Unlimited 3x points for every $1 spent on travel, gas stations, groceries, and dining. Unlimited 1x points on all other spending categories. | $95 | 21.24%- 29.24% | Check Eligibility |

| Chase Sapphire Reserve® | 60,000 bonus points after spending $4,000 on purchases within three months. Redeem for $900 travel credit via Chase. | Unlimited 1-10x points for every $1 spent, depending on the category. Perks include global airport lounge access and $300 in annual travel credits. | $550 | 22.49% – 29.49% | Check Eligibility |

| Delta SkyMiles® Gold American Express Card | 40,000 miles after spending $2,000 on purchases within six months. | 2x miles with Delta on US dining and supermarket purchases. 1x miles on all other spending categories. Additional perks include priority boarding, one free checked bag, and in-flight discounts. | $99, but waived for the first year. | 20.99% – 29.99% | Check Eligibility |

What to Know About Travel Cards

Read on to learn how travel credit cards work in 2024.

What is a Travel Credit Card?

Travel credit cards are aimed specifically at frequent travelers. There are many different types of travel cards, each offering its own perks. For instance, most travel credit cards allow you to earn rewards on purchases. Depending on the card, this can include cash back, air miles, or points.

Rewards can then be exchanged for travel-related purchases, such as flights, hotel bookings, or business class upgrades. The best travel cards also come with benefits. This can include airport lounge access, travel insurance, hotel statuses, and zero transaction fees when using the card overseas.

Travel credit cards sometimes offer 0% interest to new members. This is often for at least 15 months, allowing cardholders to spread out their repayments. That said, do note that some travel cards come with an annual fee. You’ll need to assess whether the fee is worth paying after exploring the card’s benefits.

Types of Travel Credit Card Rewards

One of the main perks of using a travel credit card is that you can earn rewards. The type of reward varies depending on the card. Let’s explore the most common travel rewards in more detail.

Cash Back

Some travel credit cards offer cash back rewards. You’ll receive a certain percentage back on all transactions. You can then use the cash back for statement credit. This will reduce your travel outgoings every month.

For instance, suppose you get 4% cash back and spend $3,000 in the first month. You’ll receive a statement credit of $120. So, when you receive your monthly statement, you’ll only owe $2,880.

We found that the Chase Freedom Flex® is the best travel credit card for earning cash back. It comes with an unlimited cash back of between 1-3%, depending on the spending category. Every quarter, selected spending categories earn 5% cash back.

Hotel Points

If you frequently stay in hotels, there are many travel credit cards worth considering. That said, we’d suggest focusing on one major hotel group, as you’ll be able to maximize your rewards.

For example, the World of Hyatt Credit Card® offers up to 9x points for every $1 spent. Points can be used to book Hyatt hotel stays – starting from 3,500 points per night. New cardholders receive up to 60,000 bonus points, not to mention up to two free hotel stays.

The main drawback is that you might be inclined to pay more to stay in Hyatt hotels, even when there are better deals elsewhere.

Air Miles

Air miles are another reward type offered by travel credit cards. This option will suit frequent flyers, as air miles can be redeemed for flights. Not only new bookings but business and first-class upgrades.

- We found that the best travel credit card for air miles is Discover it® Miles.

- You’ll earn an unlimited 1.5x air miles for every $1 spent.

- No spending category restrictions are in place, so you’ll continue earning air miles even when you’re not traveling.

- What’s more, you can redeem air miles for any airline of your choosing, meaning you aren’t tied to a single provider.

That said, if you regularly fly with the same airline, it could be worth seeing if they offer a travel rewards card. This is because you’ll often get additional perks that aren’t available elsewhere.

The Delta SkyMiles® Gold American Express Card is a good example. In addition to air miles, cardholders get free checked baggage, in-flight discounts, priority boarding, and a $100 credit. Of course, these benefits are only available on Delta flights.

General Cardholder Perks

While you might be focused on travel credit cards with the highest rewards, don’t forget to explore what cardholder benefits are available. These can be worthwhile, even if you’re paying an annual fee.

For example, the best travel credit card for benefits is the Platinum Card® from American Express. Although you’ll pay $695 per year, the benefits are worth several thousand dollars. For a start, you’ll get over $1,500 in credits, covering airline, Walmart, digital entertainment, and other purchases.

You and a guest will also have access to over 1,500 airport lounges in more than 140 countries. Other benefits include travel insurance and zero transaction fees on overseas purchases. This is in addition to 80,000 reward points after spending $8,000.

Choosing the Best Travel Credit Card

Choosing the best travel credit card requires some effort. Consider the following factors when making a decision:

Assess Your Travel Habits

You’ll want to choose a credit card that aligns with your spending and travel preferences. In other words, you should never use a credit card because of the rewards on offer. Instead, let the credit card work for you, meaning you’ll earn rewards on transactions you were going to make anyway.

For example, it doesn’t make sense to get the Delta SkyMiles® Gold American Express Card if you rarely fly with Delta. Similarly, the World of Hyatt Credit Card® only makes sense if you regularly stay at Hyatt hotels. Therefore, a good starting point is to evaluate where your travel-related purchases generally go.

For instance, suppose that on average, you spend $4,000 per month on flights and hotel bookings. You also spend $3,000 per month on day-to-day purchases, such as gas and dining. Having reviewed your prior transactions, you find that there are no standout airlines or hotel chains.

As such, a general travel rewards card will be the best option. The Wells Fargo Autograph℠ Card meets this criteria; you’ll earn unlimited 3x points for every $1 spent on travel. You also get the same for gas, transit, dining, and streaming purchases. At $7,000 per month, this amounts to 21,000 points.

Calculate Rewards Earning Potential

Once you know the type of travel credit card that’s most suitable, you’ll want to do some calculations. This will help you assess which travel cards offer the highest earning potential.

Once again, the best strategy is to look at your general spending habits. Consider splitting your purchases over the prior 12 months by the category. You can then see how much you would have earned had you used a travel credit card.

For example, let’s say you spent $50,000 on travel bookings and $20,000 on overseas transactions. You’d want to choose a credit card issuer that has its own travel booking portal. The reason is that you’ll often earn the highest rewards.

- For instance, the Chase Sapphire Reserve® offers 10x points when booking travel via Chase.

- At $50,000, that’s 500,000 worth of reward points.

- You’d also get up to 3x points on worldwide spending. So potentially, that’s another 60,000 points on a $20,000 spend.

- This is in addition to the 60,000 points you get signing up.

Now compare the same spending habits when using the Discover it® Miles. You only get 1.5x miles for every $1 spent across all categories. Plus, Discover doesn’t have its own travel booking portal, so you’re losing out on extra rewards.

Factor in the Introductory Offer

Travel cards operate in a competitive landscape. Therefore, we found that introductory offers are becoming more and more lucrative. This should be factored in when selecting the best travel credit card.

The first thing to consider is what bonus rewards you’ll receive, whether that’s air miles, cash back, or general points. Next, assess how much you need to spend and in what time frame to qualify for the introductory bonus. This can vary widely depending on the card.

For example, casual spenders might prefer the Chase Freedom Flex® Credit Card. After spending just $500, you’ll get $200 worth of cash back. However, this is minute when compared to the Platinum Card® from American Express.

New cardholders receive 80,000 points. Although you’ll need to spend at least $8,000 within six months, American Express points are worth at least 0.6 cents each when used as statement credit. This increases to 1 cent per point when booking travel via the American Express portal. This values 80,000 points at $800.

Only choose an introductory offer if you can afford the minimum spending requirement.

Understand the Redemption Value

You should understand the redemption value when choosing a travel credit card. Cash back is the most straightforward option, as you’ll always know exactly what your rewards are worth. This is because cash back is usually redeemed against your monthly statement at a flat rate.

For example, the Chase Freedom Flex® Credit Card offers 5% cash back on travel purchases (via the Chase portal). So, if you spend $10,000 in the first month, you’ll receive $500 in cash back. The $500 cash back is subtracted from your $10,000 statement, leaving a balance of $9,500. This values the redemption value at $1.

However, air miles and hotel points are more difficult to value. The value will vary depending on what you redeem the points for.

- For instance, suppose you need 20,000 Marriott Bonvoy points to book a one-night stay. Using cash costs $200. This would value each Marriott Bonvoy point at 1 cent.

- However, on the same day, another Marriott Bonvoy hotel is available for 20,000 points but the cash rate is $400. This would value Marriott Bonvoy points at 2 cents each.

This is also the case with air miles, as the point-to-cash ratio can vary considerably – even for the same routes. Therefore, you’ll need to look at various examples to estimate the redemption value.

Consider Annual Fees

Annual fees should also be built into your calculations when researching the best travel credit card. On the one hand, paying annual fees can make sense. But only if the credit card rewards exceed the fee that you pay. In many cases, the fees pay for themselves after you’ve claimed the introductory bonus.

- For example, the Delta SkyMiles® Gold American Express Card costs $95 annually (waived in the first year).

- New cardholders receive 40,000 miles after spending $2,000. According to Time, Delta air miles are valued at 1.16 cents. This means the introductory bonus is worth $464 once redeemed.

- After subtracting the annual fee of $95, this leaves you with a net gain of $369.

- In addition, spending $2,000 with the Delta SkyMiles® Gold American Express Card will get you up to 2x miles per $1. That’s potentially another $4,000 points, or $46.40.

- You’ve then got all of the cardholder benefits, such as free checked baggage and priority boarding.

This highlights that annual fees can work when the benefits are worthwhile. However, if you fail to meet the minimum spending target, you won’t get the introductory bonus.

Avoid Foreign Transaction Fees

Travel credit cards are not only useful for booking flights and hotels. They’re also ideal when making purchases overseas. However, your chosen credit card mustn’t charge foreign transaction fees. If they do, this can wipe out any rewards and benefits you’ve already earned.

According to Capital One, foreign transaction fees can cost 3% of the total purchase amount. So, if you spend $3,000 while overseas, that’s an extra $90.

How to Compare Credit Cards for Travel

We’ll now explain how to compare the top travel credit cards for 2024. This will ensure you choose a card that aligns with your spending preferences.

Rewards Rates

First, you’ll want to shortlist travel credit cards that offer the highest reward rates. This will allow you to maximize the rewards you receive, based on transactions you expect to make in the future.

Most travel credit cards display the reward rate for every $1 spent. For instance, if you’re earning 2x points on purchases, a $1,000 transaction would get you 2,000 points. Although you’ll want the highest conversion rates, you also need to check whether there are any limits.

For example, while the Chase Freedom Flex® Credit Card offers 5% cash back on gas and grocery purchases, there are some unfavorable terms and conditions. Not only is the offer capped at $12,000 annually but Walmart and Target purchases don’t qualify.

- Similarly, the highest rates might only be available on selected categories.

- If these don’t align with your spending habits, the travel credit card won’t be suitable.

- The World of Hyatt Credit Card®, for example, offers 9x points on purchases made with Hyatt properties.

- However, using the credit card in another hotel chain – such as Marriott Bonvoy or Hilton earns just 1x points per $1.

It can make sense to choose an unlimited travel credit card if you’re not loyal to any particular brand. The Discover it® Miles offers unlimited 1.5x miles for every $1 spent without any spending category restrictions.

Bonus Points

Calculating the value of an introductory bonus is crucial. Not only in terms of how much the rewards are worth but how much you need to spend to qualify. After all, you mustn’t make irrational purchases just to meet the spending requirements. Only use the travel credit card for purchases you would have made anyway.

- For example, suppose you spend an average of $4,000 per month. Not only on travel but everyday purchases, such as dining and gas.

- In this instance, the Chase Sapphire Reserve® could be a good option – which offers 60,000 bonus points after spending $4,000.

- Although $4,000 is considered high, you’ll have three months to achieve the target. Most importantly, this is well within your average quarterly spend.

However, consider someone who spends just $1,000 per month on their credit card. The Chase Sapphire Reserve® introductory bonus won’t be suitable, considering the required spend. Instead, the Wells Fargo Autograph℠ Card could be a better option, as you’ll receive 30,000 points after spending $1,500 within three months.

Just remember that you can only claim one introductory bonus ‘per travel credit card’. Although some lenders allow you to claim multiple bonuses, each credit card must be different.

Cardholder Benefits

Another way to compare travel credit cards is to look at cardholder benefits. These are perks that all cardholders get, simply for being a member. Each perk has a value, based on what you would have paid with cash.

For example, the Platinum Card® from American Express comes with a complimentary Priority Pass Prestige, currently valued at $469. This gets you and a guest access to over 1,500 global airport lounges.

Many travel credit cards also come with insurance. This is a solid benefit that can be costly if you’re a frequent traveler. Ultimately, a good strategy when comparing cards is to make a list of the main benefits and estimate how much they’re worth.

When choosing the best credit card for travel insurance, make sure you understand the terms and conditions. Most lenders will only accept claims if you depart and return from and to the US.

Fees

You should explore all potential fees when choosing the best travel credit card. First, explore whether an annual fee is charged. Next, check whether you’ll be charged to use the credit card overseas.

Other fees can also apply, such as being late for a payment. If you need to use the credit card to make ATM withdrawals, be aware of the cash advance fee. According to Experian, cash advance fees average 3-5%. As such, ATM withdrawals should be a last resort.

Interest Rates

Credit card companies make most of their money by charging interest. Known as the Annual Percentage Rate (APR), interest rates vary depending on the credit card and your creditworthiness. Those with an ‘Excellent’ credit score will get the lowest APRs. And those with ‘Poor’ credit will pay the highest rates.

We found that some of the best travel credit cards come with 0% introductory offers. This enables you to avoid credit card interest for extended periods.

- For example, the Wells Fargo Autograph℠ Card comes with 0% interest on purchases for 12 months.

- This is extended to 15 months when using the Bank of America® Travel Rewards Credit Card.

- However, some travel credit cards charge standard APRs from the get-go. This includes the Platinum Card® from American Express, which charges APRs of between 21.24% – 29.24%.

That said, the APR is irrelevant if you always pay your credit card bill in full each month. This is because interest is only charged on balances carried over to the next billing cycle. And, clearing your statement every month will also help you improve your credit score.

Eligibility

You should be realistic with what travel credit cards you’re likely to be accepted for. If you have bad credit or no credit history at all, you likely won’t be accepted for the next cards.

For instance, you’ll need an ‘Excellent’ credit score to get the Platinum Card® from American Express. After all, the card comes without any spending limits.

Some credit card companies allow you to perform a ‘soft’ search. This will give you an idea of what travel cards you have a chance of getting. The soft search won’t be posted to the credit agencies, meaning it won’t hurt your score.

Pros and Cons of Travel Rewards Credit Cards

The benefits and drawbacks of travel credit cards are summarized below:

Pros

- Earn travel rewards via cash back, air miles, or hotel points

- Get cardholder benefits – such as airport lounge access and travel insurance

- Avoid paying fees when using the card overseas

- Introductory bonuses can be lucrative

- Secure loyalty statuses with airlines and hotel chains

- Some travel cards offer 0% APR on purchases

Cons

- Only suitable if you frequently travel

- Standard interest rates can be high

- The best travel cards require a strong credit score

- Some cards come with high annual fees

- Redemption rates are sometimes unfavorable

Methodology

Our methodology when ranking the best credit cards covered many important variables. We shortlisted the leading travel cards based on reputation and existing customer reviews. We analyzed each card for APRs, credit limits, eligibility, international acceptance, and foreign transaction fees.

We then rated each card based on the reward structure. Not only in terms of the dollar-to-reward ratio but redemption options. We also factored in the introductory offer, including the bonus rewards and minimum spend requirements.

Our research methods also assessed cardholder benefits, placing an estimated value on each perk. We prioritized travel credit cards offering insurance, airport lounge access, fraud protection, and airline or hotel statuses. We also prefer travel credits that offer a 0% APR on purchases.

This methodology enabled us to narrow down hundreds of travel credit cards to just 10 options. That said, consumers should consider their own priorities when choosing a card. The rewards, benefits, and spending requirements should align with your normal purchasing habits.

Conclusion

Frequent travelers should choose a credit card that offers suitable rewards and benefits. These should align with your preferences, whether that’s a particular hotel status or a rewards spending category.

Consider the value of any perks offered and compare this to the annual fee and introductory spending requirements. Always settle your monthly statement in full to avoid paying interest.

FAQs

What is the best credit card to use while traveling?

The Bank of America® Travel Rewards Credit Card is the best option when traveling. You’ll avoid paying foreign transaction fees and will earn 1.5 points for every $1 spent.

Which card gives back the best travel rewards?

The Wells Fargo Autograph℠ Card is the best travel rewards credit card. It offers 3x points for every $1 spent on travel, gas, transit, and other popular categories. New members get 30,000 points after spending $1,500.

What is the best credit card for international travel?

The Platinum Card® from American Express ranks as a great option for international travel. You’ll get complimentary access to 1,500+ airport lounges, travel insurance, zero foreign transaction fees, and up to 5x points for every $1 spent.

Which credit card is best for food and travel?

The Citi Premier® Card offers unlimited 3x points on food (including dining and groceries) and travel purchases. You’ll get 60,000 bonus points after spending $4,000 – which is valued at $600.

References

- https://www.americanexpress.com/en-us/credit-cards/credit-intel/american-express-points-value/

- https://time.com/personal-finance/article/how-much-are-delta-skymiles-worth/

- https://www.capitalone.com/learn-grow/money-management/foreign-transaction-fees/

- https://www.experian.com/blogs/ask-experian/what-is-credit-card-cash-advance-fee/

- https://www.cnbc.com/select/how-to-boost-your-credit-score-fast/