When used correctly, balance transfer cards can be a smart way to manage debt – especially if you’re currently paying high-interest rates. Many balance transfer cards offer 0% APRs for extended periods, often for at least 12 months.

But which balance transfer card is best for your circumstances?

This guide compares the 10 best balance transfer cards for 2024. Our methodology ranks the top credit cards for balance transfer fees, limits, interest-free time frames, eligibility, rewards, and more.

Best Balance Transfer Cards Reviewed for 2024

Read on to discover the best balance transfer cards 2024.

1. Citi Simplicity® Card: Overall Best Balance Transfer Card

Our top pick is the Citi Simplicity® Card. In a nutshell, you’ll get 21 months of 0% interest on balance transfers. The balance transfer should be made within four months of opening the account. Fees amount to the greater of $5 or 3%. This increases to 5% if you fail to make the transfer within four months.

In addition, the Citi Simplicity® Card offers 0% APRs on purchases for the first 12 months. There are no annual, late, or penalty fees with this card. After the interest-free period expires, you’ll pay an APR of between 19.24% and 29.99%, depending on your credit score. The main drawback of this balance transfer card is that it doesn’t offer rewards.

Nonetheless, you’ll have access to 24/7 customer support, flexible payment dates, and 0% liability on unauthorized charges. The latter offers full protection if your credit card information is stolen. The minimum credit limit available is $500. That said, Citi will offer a credit limit that aligns with your creditworthiness at the time of the application.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Citi Simplicity® Card | 0% on balance transfers for 21 months. 0% on purchases for 12 months | 19.24% – 29.99% | $5 or 3% (the greater of) | 4 months | None |

Pros

- In our view, the overall best balance transfer card for 2024

- 0% APR on balance transfers for 21 months

- 0% APR on purchases for 12 months

- No application or annual fees

- 4 months to make the balance transfer

Cons

- No guidance on available credit limits or eligibility

2. U.S. Bank Visa® Platinum Card: Best for Credit Scores of Good to Excellent

If you sit within the ‘Good’ to ‘Excellent’ credit range, the U.S. Bank Visa® Platinum Card could be the best balance transfer card for you. Once approved, you’ll get 0% APR for 21 billing cycles. Not only on balance transfers but purchases too. Make sure the balance transfer is made within 60 days of opening the account to avail of this offer.

In terms of fees, you’ll pay the greater of $5 or 3% of the balance transfer amount. There are no annual fees on this balance transfer card. That said, avoid using the card abroad as a 3% foreign transaction fee applies. After the 21-month introductory period, standard APRs of between 18.74% and 29.74% will apply.

The U.S. Bank Visa® Platinum Card comes with one of the fastest application processes available; you’ll receive a decision within 60 seconds. Although the card doesn’t come with rewards, some benefits are offered to cardholders. This includes a U.S. Bank ExtendPay® Plan for increased flexibility. You’ll also get $600 worth of cell phone protection.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| U.S. Bank Visa® Platinum Card | 0% on balance transfers and purchases for 21 months | 18.74% – 29.74% | $5 or 3% (the greater of) | 60 days | None |

Pros

- 0% APRs for 21 months

- Interest-free offer includes balance transfers and purchases

- 60 days to complete the balance transfer

- Includes a U.S. Bank ExtendPay® Plan for increased flexibility

- Ideal for credit scores in the ‘Good’ to ‘Excellent’ range

Cons

- 3% foreign transaction fee when using the card overseas

3. BankAmericard® Credit Card: Best for High Credit Limits

The BankAmericard® Credit Card is one of the best balance transfer cards for securing high credit limits. Although Bank of America doesn’t directly provide a limit range, some cardholders claim to have received over $15,000. That said, this balance transfer card is only suitable for those with an ‘Excellent’ credit score.

Nonetheless, the BankAmericard® Credit Card offers 0% APRs for the first 18 months. This includes balance transfers and purchases. Bank of America requires cardholders to complete their balance transfer within 60 days of being approved. There is a 3% balance transfer fee, which aligns with the industry average.

No application or annual fees are charged. After the 18-month introductory period, standard APRs of 16.24% to 26.24% will apply. The specific rate depends on your creditworthiness. In terms of benefits, The BankAmericard® Credit Card comes with monthly FICO® Score updates, a 0% liability guarantee on fraudulent transactions, and a native mobile app for added convenience.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| BankAmericard® Credit Card | 0% on balance transfers and purchases for 18 months | 16.24% – 26.24% | 3% | 60 days | None |

Pros

- 0% on balance transfers for 18 months

- 0% offer extends to purchases

- No annual or penalty fees

- High credit limits are available

- Includes monthly FICO® Score updates

Cons

- An ‘Excellent’ credit score will be required

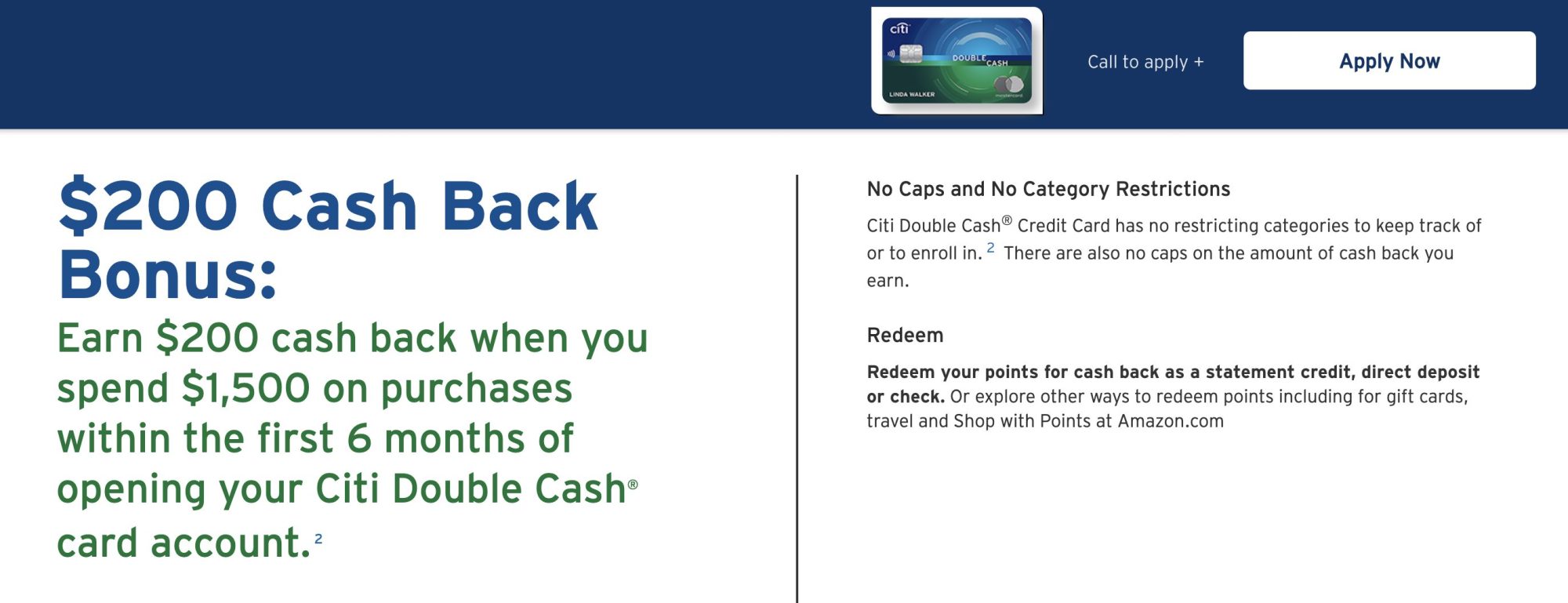

4. Citi Double Cash® Card: Best for Earning Unlimited Cash Back

We rate the Citi Double Cash® Card as the best balance transfer card for earning cash back. Put simply, you’ll earn 2% cash back on all purchases making it one of the top cash back credit cards available today. There are no cash back limits, nor any restrictions on spending categories. Citi credits the first 1% when making the purchase. Once you settle your monthly statement, the additional 1% will be added.

What’s more, the Citi Double Cash® Card offers a generous introductory offer. You’ll receive 20,000 points after spending $1,500 within the first six months. The points can be redeemed for $200 cash back. This spending threshold is also eligible for the standard 2% cash back rate.

In terms of balance transfers, you’ll get 0% APRs for the first 18 months. The main drawback is that the interest-free period doesn’t include purchases. Nevertheless, balance transfer fees amount to the greater of $5 or 3%. This increases to 5% if you don’t complete the transfer within four months of opening the account.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Citi Double Cash® Card | 0% on balance transfers for 18 months | 19.24% – 29.24% | $5 or 3% (the greater of) | 4 months | Unlimited 2% cash back on all purchases. The introductory offer includes $200 cash back after spending $1,500 on purchases within six months. |

Pros

- One of the best balance transfer credit cards for rewards

- Unlimited 2% cash back on all purchases

- Get $200 cash back after spending $1,500

- 0% APR on balance transfers for 18 months

Cons

- No interest-free period on purchases

5. Discover it® Balance Transfer: Best for Credit Scores of 670+

With an estimated credit score eligibility of 670, the Discover it® Balance Transfer has slightly lower requirements than other balance transfer cards. This option comes with 0% APR on balance transfers for 15 months. The 0% introductory offer also covers credit card purchases.

The introductory period lasts for four months and includes a reduced transfer fee of 3%. After that, the transfer fee increases to 5%. What’s more, standard APRs of 17.24% to 28.24% will kick in. Although there are no annual fees, late payments attract a $41 charge. That said, the first late payment fee is waived.

Another drawback is the lack of credit card rewards. There’s no cash back or an ability to earn points on purchases. Moreover, the Discover it® Balance Transfer comes with limited perks. Other than real-time transaction alerts and access to a US-based customer service team, cardholders have no other benefits.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Discover it® Balance Transfer | 0% on balance transfers and purchases for 15 months | 17.24% – 28.24% | 3% | 4 months | None |

Pros

- Estimated acceptance score of 670

- 0% APR includes balance transfers and purchases

- The introductory period lasts for 15 months

- US-based customer service team

Cons

- $41 late payment charge (first time is waived)

6. Chase Freedom Unlimited®: Best for Earning Rewards on Everyday Purchases

The Chase Freedom Unlimited® is not only one of the best credit cards for balance transfers but also for earning rewards. This option comes with 0% APR on balance transfers and purchases for the first 15 months. After the introductory period, standard APRs of 20.49% to 29.24% will apply.

To avail of the 0% APR period, the balance transfer needs to be made within 60 days. A balance transfer fee of 3% or $5 is charged (the greater of). In terms of rewards, Chase Freedom Unlimited® offers a $200 cash back bonus after spending just $500 within the first three months.

What’s more, you’ll earn 5% cash back on grocery and gas station purchases (up to $12,000 in the first year). You’ll also earn 3% on travel purchases made through Chase Ultimate Rewards, plus drugstore and dining purchases. All other purchases earn an unlimited 1.5% cash back. Other card benefits include trip cancellation and interruption insurance.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Chase Freedom Unlimited® | 0% on balance transfers and purchases for 15 months | 20.49% – 29.24% | $5 or 3% (the greater of) | 60 days | Cash back of between 1.5% and 5% depending on the spending category. The introductory offer includes $200 cash back after spending $500 on purchases within three months. |

Pros

- 0% APR on balance transfers and purchases for 15 months

- Get $200 cash back after spending just $500

- Earn 5% cash back on gas and grocery purchases

- Other spending categories earn 1.5% to 3%

Cons

- Walmart and Target purchases are not eligible for cash back

7. Bank of America® Travel Rewards Credit Card: Best for Combining 0% Balance Transfers With Travel Points

Another good option, especially when it comes to the travel credit card department, to consider is the Bank of America® Travel Rewards Credit Card. Making a balance transfer within 60 days will secure a 0% APR for the first 15 billing cycles. You’ll pay a 3% balance transfer charge and no annual fees apply. The 0% rate also includes purchases without any restrictions on spending categories.

In terms of rewards, this is one of the best balance transfer cards for frequent travelers. You’ll earn 1.5 points for every $1 spent. All purchases are eligible and the points never expire. What’s more, you’ll avoid foreign transaction fees when using the card overseas. The Bank of America® Travel Rewards Credit Card also offers 25,000 bonus points to first-time applicants.

Simply make $1,000 worth of purchases within 90 days of opening the account. That said, unlike other travel-related cards, you won’t get airport lounge access or bonus points when booking flights and hotels. After the introductory period, the Bank of America® Travel Rewards Credit Card comes with standard APRs of between 18.24% and 28.24%.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Bank of America® Travel Rewards Credit Card | 0% on balance transfers and purchases for 15 months | 18.24% – 28.24% | 3% | 60 days | Earn 1.5 points for every $1 spent without spending category restrictions. The introductory offer includes 25,000 points after spending $1,000 on purchases within 90 days. |

Pros

- Best balance transfer card for frequent travelers

- 25,000 points when spending $1,000

- Earn 1.5 points for every $1 spent

- 0% APR on balance transfers and purchases for 15 months

Cons

- Balance transfer fee increases to 5% after 60 days

8. Chase Slate Edge℠: Best for Automatically Increasing Your Credit Line

Chase Slate Edge℠ is a popular credit card that offers several benefits. First, the introductory offer comes with 0% APR on balance transfers for 18 months. This offer also extends to credit card purchases. Balance transfer fees amount to the greater of $5 or 3%. The transfer should be made within 60 days of being approved.

Another benefit is that cardholders can automatically increase their credit limit. Simply spend $500 within the first six months. Do note that credit limits are not guaranteed. In addition, Chase helps you stay on top of your credit score with regular updates and critical alerts.

That being said, the Chase Slate Edge℠ doesn’t offer credit card rewards like cash back or points. After the introductory period, standard APRs of between 20.49% and 29.24% will apply, depending on your creditworthiness. Your variable score can be reduced by 2% when paying on time. Flexible payment plans can also be set up via My Chase Plan®.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Chase Slate Edge℠ | 0% on balance transfers and purchases for 18 months | 20.49% – 29.24% | $5 or 3% (the greater of) | 60 days | None |

Pros

- Introductory offer of 0% APR for 18 months

- Interest-free offer includes balance transfers and purchases

- Automatically increase your credit limit after six months

- Flexible payments via My Chase Plan

Cons

- No credit card rewards and limited benefits

9. Bank of America® Unlimited Cash Rewards Credit Card: Best for Unlimited Cash Rewards

Another option that combines rewards and balance transfers is the Bank of America® Unlimited Cash Rewards Credit Card. Starting with the balance transfer side of things, you’ll get 0% APR for 15 months. Make sure the balance transfer is made within 60 days to secure the introductory offer.

A 3% fee applies when making the transfer. You’ll get 0% APR on purchases for 15 months. The introductory offer also includes $200 cash back after spending $1,000. You’ll have 90 days to meet this target. In addition, the Bank of America® Unlimited Cash Rewards Credit Card offers unlimited cash back of 1.5%.

All spending categories are eligible, whether that’s groceries, gas, or dining. No annual fees are charged on this credit card. However, after the 15-month introductory period, standard APRs of 18.24% to 28.24% apply. Moreover, there’s an initial late payment fee of $29. Any other late payments within six months will be charged $40.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Bank of America® Unlimited Cash Rewards Credit Card | 0% on balance transfers and purchases for 15 months | 18.24% – 28.24% | 3% | 60 days | Earn unlimited 1.5% cash back without spending category restrictions. The introductory offer includes $200 cash back after spending $1,000 on purchases within 90 days. |

Pros

- Great balance transfer card for earning cash back

- Unlimited 1.5% cash back on all spending categories

- $200 cash back when spending $1,000 within 90 days

- 0% APR on balance transfers and purchases for 15 months

Cons

- Standard APR of up to 28.24% after the introductory period

10. Wells Fargo Active Cash® Card: Best for Simple Rewards Redemptions

The final option to consider is the Wells Fargo Active Cash® Card. This balance transfer card offers 0% APR for the first 15 months. You’ll have 120 days to complete the transfer after being approved. The card also offers 0% APR on credit card purchases, also for 15 months.

The balance transfer fee is 3% or $5 (the greater of). This increases to 5% after the 120-day grace period. There are no annual fees charged on this card. That said, the card won’t be suitable for frequent travelers, considering the 3% foreign transaction fee. Nonetheless, the Wells Fargo Active Cash® Card comes with generous rewards.

You’ll earn an unlimited 2% cash back on all purchases. You won’t need to select specific categories; all transactions are eligible. First-time applicants will also receive $200 cash back. Simply spend $500 within the first 90 days of receiving the card. Standard APRs after the introductory period are 20.24%, 25.24% or 29.99%.

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards |

| Wells Fargo Active Cash® Card | 0% on balance transfers and purchases for 15 months | 20.24%, 25.24% or 29.99% | $5 or 3% (the greater of) | 120 days | Earn unlimited 2% cash back without spending category restrictions. The introductory offer includes $200 cash back after spending $500 on purchases within 90 days. |

Pros

- Earn 2% cash back on all purchases

- No limits or spending category restrictions

- $200 cash back when spending $500

- 0% APR on balance transfers and purchases for 15 months

Cons

- Credit limits start from just $1,000

Balance Transfer Card Comparison

Here’s a summary of the 10 best balance transfer credit cards for 2024:

| Balance Transfer Card | Intro APR | Regular APR | Balance Transfer Fee | Time to Make Balance Transfer | Rewards | Learn More |

| Citi Simplicity® Card | 0% on balance transfers for 21 months. 0% on purchases for 12 months | 19.24% – 29.99% | $5 or 3% (the greater of) | 4 months | None | Check Eligibility |

| U.S. Bank Visa® Platinum Card | 0% on balance transfers and purchases for 21 months | 18.74% – 29.74% | $5 or 3% (the greater of) | 60 days | None | Check Eligibility |

| BankAmericard® Credit Card | 0% on balance transfers and purchases for 18 months | 16.24% – 26.24% | 3% | 60 days | None | Check Eligibility |

| Citi Double Cash® Card | 0% on balance transfers for 18 months | 19.24% – 29.24% | $5 or 3% (the greater of) | 4 months | Unlimited 2% cash back on all purchases. The introductory offer includes $200 cash back after spending $1,500 on purchases within six months. | Check Eligibility |

| Discover it® Balance Transfer | 0% on balance transfers and purchases for 15 months | 17.24% – 28.24% | 3% | 4 months | None | Check Eligibility |

| Chase Freedom Unlimited® | 0% on balance transfers and purchases for 15 months | 20.49% – 29.24% | $5 or 3% (the greater of) | 60 days | Cash back of between 1.5% and 5% depending on the spending category. The introductory offer includes $200 cash back after spending $500 on purchases within three months. | Check Eligibility |

| Bank of America® Travel Rewards Credit Card | 0% on balance transfers and purchases for 15 months | 18.24% – 28.24% | 3% | 60 days | Earn 1.5 points for every $1 spent without spending category restrictions. The introductory offer includes 25,000 points after spending $1,000 on purchases within 90 days. | Check Eligibility |

| Chase Slate Edge℠ | 0% on balance transfers and purchases for 18 months | 20.49% – 29.24% | $5 or 3% (the greater of) | 60 days | None | Check Eligibility |

| Bank of America® Unlimited Cash Rewards Credit Card | 0% on balance transfers and purchases for 15 months | 18.24% – 28.24% | 3% | 60 days | Earn unlimited 1.5% cash back without spending category restrictions. The introductory offer includes $200 cash back after spending $1,000 on purchases within 90 days. | Check Eligibility |

| Wells Fargo Active Cash® Card | 0% on balance transfers and purchases for 15 months | 20.24%, 25.24% or 29.99% | $5 or 3% (the greater of) | 120 days | Earn unlimited 2% cash back without spending category restrictions. The introductory offer includes $200 cash back after spending $500 on purchases within 90 days. | Check Eligibility |

What to Know About Balance Transfer Cards

Balance transfer cards are a type of credit card aimed at managing debt. More specifically, they enable you to transfer balances from other credit cards to reduce the interest you pay. This is because more balance transfer cards offer 0% Annual Percentage Rate (APR) for extended periods.

This is often at least 12 months but some balance transfer cards, such as the Citi Simplicity® Card and the U.S. Bank Visa® Platinum Card, extend this to 21 months. This means that once the transfer is made, you won’t pay any interest on the credit card balance for the entire introductory period.

This is one of the most effective ways to avoid paying interest on outstanding debt.

For example:

- Let’s suppose you’ve got $4,000 worth of debt on a credit card at an APR of 25%. This means after one year, you’ve paid $1,000 in interest.

Now consider a 0% APR balance transfer card.

- You transfer the $4,000 balance to your new card.

- You get 12 months at 0% interest

- After the introductory period of 12 months, you haven’t paid any interest

The smartest way to use a balance transfer card is to try and clear the debt before the introductory period finishes. Sticking with the example above, this means paying $333.34 every month for 12 months. In doing so, you’ve cleared your $4,000 debt with manageable payments without paying any interest.

Crucially, balance transfer cards should never be used after the introductory period. This is because the card moves to the standard APR. According to the Federal Reserve Bank of St. Louis, the average credit card APR is 21.19%. If the balance isn’t cleared at this point, it could be worth transferring it to another 0% card.

How Much Can I Save With a 0% Balance Transfer?

The amount of money you can save when using a balance transfer card will depend on several factors.

First, you’ll need to assess how much interest you’re currently paying on your other credit cards. This should be stated on your monthly credit card statement. What’s more, you’ll need to consider what credit limit the balance transfer card offers. Ideally, the credit limit will cover all of your credit card balances.

If not, then you should prioritize credit cards with the highest interest rates.

For example, let’s suppose you’ve got three outstanding credit card balances:

| Card | Outstanding Balance | APR |

| 1 | $3,000 | 30% |

| 2 | $2,000 | 25% |

| 3 | $4,000 | 15% |

- Now let’s say you’ve been approved for a 0% balance transfer card with a $5,000 credit limit.

- As per the table above, your total credit card balances amount to $9,000.

- In this instance, you’d first want to transfer the $3,000 balance from Card 1, as this has the highest APR of 30%.

- The next $2,000 should be transferred from Card 2, as the APR is the next highest at 25%.

Once the $5,000 has been transferred to your balance transfer card, you instantly begin saving money. This is because you’re no longer paying 25-30% APR. Instead, the entire balance is interest-free until the introductory period ends. This enables you to create a repayment plan accordingly.

However, there’s one more important metric to consider; the balance transfer fee.

The 10 best balance transfer cards ranked on this page each charge a 3% fee. This is based on the total amount transferred to the card. So, if you transferred $5,000, that’s a fee of $150. Fortunately, this is usually added to the outstanding balance, meaning it still benefits from the 0% introductory APR.

Nonetheless, this should be included in your calculations when assessing how much money you’re saving.

What Happens if I Miss a Payment on a Balance Transfer Card?

You must always meet your minimum statement balance every month. If you don’t, the consequences can be severe. In most cases, you’ll immediately lose your 0% introductory interest rate. This means that the entire balance will now be subject to the standard APR. As we mentioned, this currently averages 21.19%.

Other consequences should also be considered.

For a start, even the best balance transfer cards charge late payment fees. This will be added to your outstanding balance. And, considering you’ll lose your introductory offer, the late payment fee will also attract interest. If a payment isn’t made within 30 days, it will then be classed as a missed payment.

Missed payments will usually be reported to the main credit bureaus. This means that your credit score will likely be impacted. In turn, this will hinder your chances of applying for balance transfer cards in the future.

Do Balance Transfer Cards Hurt My Credit Score?

Some consumers are concerned about applying for balance transfer cards because of the potential impact on their credit scores.

Here’s what you need to know.

First and foremost, applying for a balance transfer card can temporarily impact your score. This isn’t exclusive to balance transfers but all forms of credit. According to Experian, a FICO score decline from a credit card application is minimal, often just a few points.

Nonetheless, it’s wise to start the process with a ‘soft’ credit check. This will help you understand how likely you are to be approved, without the application impacting your credit score.

If you’re approved for a balance transfer card and you always meet your payments, this can improve your credit score. This is because the credit bureaus will see that you’re reducing your debt.

Can Balance Transfer Cards Only be Used for Credit Card Debt?

In general, balance transfer credit cards can only be used for debt held on other credit cards. However, some providers also allow other forms of debt. This can include loans, lines of credit, and store cards.

If the provider does permit other debt sources, the same introductory terms, fees, and limits should apply. This means you’ll also get 0% APRs. If you do want to transfer non-credit card debt, speak with the card issuer to see what’s allowed.

Using a 0% Balance Transfer Credit Card

We’ve established that the best balance transfer cards can help you manage debt. They can also help you avoid credit card interest. However, you must use balance transfer cards correctly. Failing to do so can have severe consequences.

This section will guide you through the balance transfer card process, ensuring that you maximize the benefits and reduce the risks.

Step 1: Evaluate What Credit Card Debts Are Outstanding

Before applying for a balance transfer card, it’s important to assess what outstanding debts you have with other credit cards. This will give you an understanding of how much debt you need to transfer.

If the balance transfer card doesn’t offer a high enough limit to cover all debts, you can then prioritize credit cards with the highest APRs. You should also make a note of the required repayment dates for each outstanding credit card.

This is because the balance transfer process can take up to 14 days to complete. In the meantime, you might still need to make a repayment to ensure you avoid a late payment.

Step 2: Start With a Soft Credit Check

Most major credit card providers have an eligibility checker on their websites. This allows you to see which balance transfer cards you’re eligible for without the application impacting your credit score. This is because soft credit checks do not appear on your credit report.

The process should take less than five minutes. Simply enter some personal and financial information. You’ll be told which balance transfer credit cards you’re pre-qualified for, if any. You might also be told what credit limit you could be eligible for.

Step 3: Apply for a Balance Transfer Card

The next step is the actual application process. This will require a lot more information, such as your employment status, salary, outstanding debts, net worth, and everything in between. Make sure you enter your information correctly.

The credit card company will check the data with third-party sources, including credit bureaus. Any discrepancies can result in delays, as the lender might request documents. If everything matches and your credit score is suitable, you could be approved within seconds.

You won’t be able to request a limit when completing the application. If approved, your credit limit will be determined by the lender based on your affordability. Ideally, this will be enough to cover all of your outstanding debts.

Step 4: Begin the Balance Transfer Process

After you’ve been approved, you’ll need to wait for the credit card to arrive before you can start the balance transfer process. This shouldn’t take more than a few days.

You’ll likely need to activate the card too. This can usually be done on the provider’s website or mobile app. This is also where you’ll need to request a balance transfer.

Step 5: Provide Account Details for the Cards Being Transferred

You will need to provide the issuer with details for each credit card you want to transfer.

This usually includes:

- Name of Credit Card: E.g. Chase Freedom Unlimited®

- Account Number: This is your unique account number with the respective credit card provider

- Amount: This is the total amount that you want to transfer from the credit card

Make sure the provided details are correct. Mistakes will invariably lead to delays. Do note that there is no requirement to contact the old credit card companies about the balance transfer. This is taken care of by your new provider.

Step 6: Monitor You Accounts and Continue Making Payments

We mentioned earlier that balance transfers can take up to 14 days to complete. Therefore, you must continue making payments in the meantime.

This ensures you avoid late payments. Most consumers will pay the minimum, as the debt will soon be transferred to the 0% introductory rate.

It’s wise to keep monitoring your credit card accounts to see when the transfer is complete. That said, most providers send an email.

Step 7: Stash the Old Card, But Keep it Open

Once the balance has been transferred, we’d suggest keeping your old credit card(s) open. This can be beneficial for your credit score. The reason is that your ‘credit utilization’ ratio will decrease. This is viewed positively by the credit bureaus, as it shows you’re responsible with credit.

- For instance, suppose you initially had $6,000 worth of debt on your old credit card. Your credit limit was $10,000, meaning a credit utilization score of 60%.

- Your new balance transfer card has a credit limit of $15,000. You still have $6,000 worth of debt, which is transferred to the new card.

- However, your total credit limit is now $25,000 ($10,000 + $15,000), meaning your credit utilization ratio has been reduced to just 24% ($25,000 / $6,000).

According to Equifax, your credit utilization score should never exceed 30%, so this is something to keep in mind. However, under no circumstances should you use the old credit card. Simply keep the account open.

If you’re asking the question “How many credit cards should I have?“, there isn’t a definitive number. As we mentioned, credit utilization is the more important factor. That said, applying for too many credit cards will hurt your score, at least temporarily. Therefore, it’s best to focus on one balance transfer card that covers all of your outstanding balances.

Step 8: Create a Repayment Plan to Become Debt-Free

The final step is to create a repayment plan. This is very important, as it will allow you to clear your debt in full. Crucially, you should aim to do this within the 0% introductory period. Otherwise, you’ll begin paying interest again.

- First, assess how much you owe in total on the new balance transfer card. This should include the transferred balance and the transfer fee.

- For instance, suppose you transfer $10,000 worth of debt and pay a 3% fee. This means your total balance is $10,300 ($10,000 + $300).

- Let’s say that your 0% introductory rate lasts for 18 months. To become debt-free within the interest-free period, you’d need to make 18 monthly payments of $572.23.

In doing so, you’ll clear the entire balance without paying a cent of interest.

How to Compare Credit Cards for Balance Transfer

There are many balance transfer credit cards to choose from. This section will help you select the best option for your financial goals and creditworthiness.

Determine Eligibility

First, it’s important to be realistic with eligibility. We found that some of the best balance transaction cards are aimed at consumers with ‘Good’ or ‘Excellent’ credit scores. Not all credit card providers display their eligibility requirements. Although secondary sources provide minimum score estimations, they’re often unreliable.

As such, we’d suggest assessing the following for a more accurate idea of what cards you’re likely to be approved for:

- Credit Score: A good starting point is to retrieve your FICO score from one of the three main credit bureaus (Equifax, Experian, and TransUnion). If you’re currently sitting at 700 or more, you’ll likely have access to the best cards.

- Assess Debt-to-Income: Even with a high FICO score, you might not be approved for a balance transfer card. This could be because of your debt-to-income ratio, so check this before applying. This simply means how much debt you currently have in relation to your income.

- Check the Lender’s Website: Some lenders indicate what scores they generally accept. This is usually applicable for all cards, rather than a specific one.

- Use Pre-Qualification Tools: Ideally, the lender will offer pre-qualification tools. This enables you to assess eligibility without a hard credit check. As such, the search won’t impact your credit score.

0% Introductory Period

You’ve now created a shortlist of balance transfer cards you think you could be eligible for. Next, check how long the 0% introduction period lasts. It’s best to prioritize providers with the longest time frame.

This will give you the best chance of clearing your outstanding debt before the introductory period ends. All of the balance transfer cards ranked on this page offer between 15 and 21 months at 0%.

In addition to balance transfers, it’s worth seeing if your 0% introductory rate covers purchases. This will help you spread out large purchases without paying interest. However, be mindful of increasing your debt. After all, balance transfer cards should be used to get you debt-free.

Balance Transfer Fees

It’s crucial to check how much you’ll be charged in balance transfer fees. The vast majority of providers charge 3% of the transfer amount. Anything more than this is considered expensive.

Looking for the best balance transfer cards with no transfer fee? Your options will be limited. For example, while the Navy Federal Credit Union Platinum Credit Card doesn’t charge transfer fees, the introductory APR is 0.99%. Similarly, the Boeing Employees Credit Union Credit Card offers 0% transfer fees. However, you’ll either need to be a Boeing employee, a member of a credit union, or associated with select universities.

Transfer Time Frame

You should also check how much time you have to complete the balance transfer. This can vary widely depending on the provider. For example, The Citi Double Cash® Card and the Discover it® Balance Transfer give you 4 months.

However, this is reduced to just 60 days when using the Bank of America® Unlimited Cash Rewards Credit Card and the Chase Slate Edge℠. If you don’t complete the transfer within the stated time frame, you won’t get the 0% introductory rate. What’s more, you’ll pay a higher transfer fee.

Fees

The best balance transfer cards do not charge annual fees. However, this isn’t always the case, so it’s important to check.

If you’re planning to travel, you should also check whether fees are charged when using the card overseas. Unless you’re getting a travel-specific balance transfer card, foreign transaction fees of 3% will likely apply.

Although you should strive to at least pay the minimum, you should also be aware of late and missed payment fees.

Credit Limit

You’ll want to choose a balance transfer card that offers a sufficient credit limit. The limit should cover all of your outstanding debts held on other cards. This means you’ll no longer need to pay interest, as the debts will move over to your 0% introductory rate.

For example, suppose you’ve got three credit cards each with $2,000. Ideally, your selected balance transfer card should offer a credit limit of at least $6,000.

Unfortunately, we found that most credit card providers only state the minimum limit that they can offer. The actual limit you get will depend on your creditworthiness. This will be determined when the lender checks your credit history with third-party sources.

Websites like Credit Karma and FicoForums allow existing cardholders to share their experiences. Many will share their credit score and the limit they received from the respective lender. This should give you an idea of what to expect.

Rewards

If you have a ‘Good’ or ‘Excellent’ credit limit, you’ll likely have access to the best balance transfer cards. Moreover, some of the top-tier options double up as rewards credit cards. This means you can manage your debt while earning perks like cash back and air miles.

For example, the Citi Double Cash® Card offers unlimited 2% cash back on all credit card purchases. There are no spending restrictions, meaning you’re effectively reducing your cost of living by 2%. This is in addition to 18 months of 0% interest on balance transfers.

Most rewards cards also come with introductory offers, allowing you to earn bonus points when meeting a spending target. For instance, the Wells Fargo Active Cash® Card offers $200 cash back when spending $500 within the first 90 days of being approved.

Pros and Cons of Balance Transfer Credit Cards

Here’s what pros and cons to consider when exploring the best credit cards for balance transfers:

Pros:

- Avoid paying interest on outstanding credit card balances

- Many 0% introductory rates last for 15-18 months

- One of the most effective ways of becoming debt-free

- Balance transfer cards rarely come with annual fees

- Some cards offer rewards like cash back and hotel points

- The majority of the transfer process is taken care of by the lender

Cons:

- The best transfer balance credit cards require ‘Good’ or ‘Excellent’ credit

- Most cards come with a 3% balance transfer fee

- You’ll lose your 0% rate if you miss a payment

- High interest rates are charged after the introductory period

- Not suitable for very large debts

Alternatives to 0% Balance Transfer Cards

Balance transfer cards are just one option when consolidating debt. Here are some alternatives to consider before proceeding.

Debt Consolidation Loan

Debt consolidation loans allow you to consolidate multiple debts into one loan. There are several reasons why this could be more suitable than balance transfer cards.

First, if you have a very large amount of outstanding debt with high interest, a balance transfer card likely won’t suffice. This is because limits will be much lower when compared to a debt consolidation loan.

Second, debt consolidation loans usually come with much longer repayment terms. This is often multiple years. In contrast, the longest 0% balance transfer period we found was 21 months. This might not be enough time if you have a lot of debt.

Third, debt consolidation loans are easier to get if you have bad credit. This isn’t the case with balance transfer cards. As we’ve established, the best 0 APR credit cards for balance transfers require at least ‘Good’ credit. Top-tier cards require an ‘Excellent’ score.

All that being said, debt consolidation loans will attract interest, meaning you won’t get a 0% introductory rate. You should, however, get lower APRs than you’re currently paying elsewhere.

Home Equity Line of Credit (HELOC)

Another alternative to balance transfer credit cards is a Home Equity Line of Credit (HELOC). Put simply, a HELOC is a secured loan against the equity in your home. For instance, suppose your home is worth $400,000 and you owe $150,000 on your outstanding mortgage. This means your equity is $250,000, which you can use to secure a loan.

A HELOC is a better option than a balance transfer card if you have large debts. As we mentioned, credit limits on balance transfer cards can be modest. What’s more, HELOC loans come with longer repayment terms, often at favorable rates.

After all, the loan is secured by your home. Although you’ll get 0% APR with a balance transfer card, this is only for a limited amount of time. After that, you’ll revert to high APR. Moreover, in some cases, a HELOC loan can be tax deductible.

Methodology

Our primary goal is to help consumers select the best credit products. Therefore, to rank the best 0 balance transfer credit cards, we developed a solid methodology. We initially focused on non-negotiable metrics, such as 0% APR introductory rates for at least 15 months.

What’s more, we only considered cards offering balance transfer fees of 3% or less. After that, we explored variable metrics, such as estimated credit limits, eligibility, and benefits. We also assessed the application process and how long it takes to complete the balance transfer.

Additional preference was given to balance transfer cards offering rewards, such as air miles and cash back. All that being said, consumers are advised to perform their own research when selecting a card. After all, many balance transfer cards didn’t make our cut but could still be suitable.

Conclusion

We’ve ranked the best balance transfer cards for 2024. Each option offers 0% interest for at least 15 months without any annual fees. Before proceeding, make sure you have a solid plan. You should only use a balance transfer card to consolidate debt and avoid paying interest.

Never keep an open balance once the 0% introductory period is over. Moreover, never miss a payment, as you’ll lose your introductory rate, not to mention hurt your credit score.

References

- https://fred.stlouisfed.org/series/TERMCBCCALLNS#0

- https://www.experian.com/blogs/ask-experian/what-is-difference-between-late-payment-missed-payment/

- https://www.experian.com/blogs/ask-experian/does-applying-credit-cards-hurt-credit/

- https://www.equifax.com/personal/education/debt-management/articles/-/learn/credit-utilization-ratio/

- https://www.irs.gov/faqs/itemized-deductions-standard-deduction/real-estate-taxes-mortgage-interest-points-other-property-expenses/real-estate-taxes-mortgage-interest-points-other-property-expenses-2

FAQs

Do balance transfers affect your credit score?

Applying for a balance transfer card can cause a temporary drop in your credit score. But over time, balance transfers can improve your score, as you’ll be reducing your debt.

What is the best credit card to transfer funds to?

Citi Simplicity® Card is one the best 0 APR balance transfer credit cards. You’ll get 18 months of 0% interest and 4 months to make the transfer.

Who is offering 0% on balance transfers?

Some of the best balance transfer credit cards offering 0% APR include the Citi Simplicity® Card, U.S. Bank Visa® Platinum Card, and BankAmericard® Credit Card. The Citi Double Cash® Card and Discover it® Balance Transfer are also worth considering.

Is it a good idea to keep transferring credit card balances?

Making another balance transfer before your 0% introductory rate expires can be worthwhile. However, it’s best to try and clear your debt in full.

What are the best balance transfer cards with no transfer fee?

One of the best balance transfer credit cards with no fee is the Boeing Employees Credit Union Credit Card. However, eligibility is limited to Boeing employees and credit union members. Most balance transfer cards charge a 3% transfer fee.