Credit cards serve many purposes, from managing debt and earning cash back to improving credit scores. But which credit card is right for you? This guide compares the 10 best credit cards for 2024.

We rank the top-rated credit cards based on interest rates, eligibility, rewards, credit limits, suitability, and more. We also explain how to select a credit card and what strategies to deploy to maximize cardholder benefits.

Best Credit Cards Reviewed for 2024

The 10 best credit cards to apply for in 2024 are reviewed below.

1. Citi Double Cash® Card: Best for Credit Card Rewards

We rank the Citi Double Cash® Card as one of the best-rated credit cards for earning rewards. This credit card allows you to earn unlimited cash back. You’ll get 2% cash back on all transactions without any restrictions. This covers everything from gas and dining to travel, groceries, and streaming services.

1% cash back will be added to your account once the payment is made. It can then be redeemed against your statement balance. Once you settle the respective transaction, the next 1% will be credited. What’s more, you can earn 5% cash back when making purchases on the Citi Travel portal.

Another benefit is that the Citi Double Cash® Card comes with 0% APR on balance transfers for 18 months. Standard APRs on purchases are 19.24% to 29.24%. After spending $1,500 on purchases within six months, new cardholders will receive a $200 bonus. There are no annual fees with this credit card.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Citi Double Cash® Card | $200 cash back after spending $1,500 on purchases within six months. 0% on balance transfers for the first 18 months. | Unlimited 2% cash back on all purchases. 1% is paid when making the purchase, while the other 1% is paid when settling the transaction. 5% cash back on Citi Travel bookings. | None | 19.24% and 29.24% |

Pros

- One of the best credit cards for rewards

- Earn 2% cash back on all purchases

- No cash back limits or restrictions on spending categories

- New customers receive $200 after spending $1,500

- 0% interest on balance transfers for 18 months

Cons:

- No interest-free introductory rates on purchases

2. Citi Simplicity® Card: Best for Balance Transfers

Citi also makes our number two spot with the Citi Simplicity® Card. We found that this is one of the best balance transfer cards in the market. You’ll get an industry-leading 0% APR for 21 months. Just make sure you complete the transfer within the first four months to lock in this introductory rate.

If you don’t, you’ll revert to the standard APR of 19.24% – 29.99%. Like most balance transfer cards, the Citi Simplicity® Card charges a 3% fee when completing the transfer. This will be added to your statement balance, meaning it also benefits from 0% interest.

The Citi Simplicity® Card comes without annual or late payment fees. However, ensure you pay at least the minimum to avoid losing your 0% rate. Another benefit is that you’ll get 0% APR on purchases for 12 months. That said, this credit card comes without any rewards.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Citi Simplicity® Card | 0% on balance transfers for 21 months. 0% on purchases for 12 months. | None | None | 19.24% – 29.99% |

Pros

- Best card for balance transfers

- 0% APR on balance transfers for 21 months

- Make purchases at 0% APR for 12 months

- No annual or late payment fees

Cons:

- You won’t earn any card rewards

3. U.S. Bank Cash+® Visa Signature® Card: Best for Cash Back

Next is the U.S. Bank Cash+® Visa Signature® Card, which is one of the best cash back credit cards. This credit card offers up to 5% in cash rewards on select spending categories. U.S Bank selects a different category every three months and you’ll need to opt in to secure the 5% rate.

Eligible purchases within the respective category are capped at $2,000. All other purchases benefit from a 2% cash back rate without limits. As a new cardholder, you’ll receive a $200 cash back offer after spending $1,000. The spending target must be met within 120 days of receiving the card.

New members also receive 0% APR on purchases and balance transfers for 15 months. There are no annual fees with this card. After the introductory period, you’ll pay standard APRs of between 19.49 and 29.74%. After making an application, you should receive a decision within 60 seconds.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| U.S. Bank Cash+® Visa Signature® Card | $200 cash back after spending $1,000 on purchases within 120 days. 0% APR on balance transfers and purchases for 15 months. | 5% cash on selected categories, up to $2,000 every quarter. Up to 2% cash back on other purchases. | None | 19.49% – 29.74% |

Pros

- Best card for cash back

- Earn 5% cash back on select categories

- All other purchases earn 2% cash back without limits

- No annual fees

- 0% APR for 15 months on purchases and balance transfers

Cons:

- Quarterly categories might not align with your spending habits

4. Capital One Venture Rewards Credit Card: Best for Travel Rewards

We rate the Capital One Venture Rewards Credit Card as the best option for travel rewards. This credit card offers 2x miles for every $1 spent. There are no spending category restrictions. That said, you can increase your rewards to 5x per $1 when using the Capital One Travel portal.

This allows you to book discounted flights, hotels, rental cars, and more. There are no limits to how many air miles you can earn. What’s more, new cardholders receive 75,000 bonus miles. You’ll need to spend at least $4,000 within three months to qualify.

You’ll also get $100 in TSA PreCheck or Global Entry credit. The Capital One Venture Rewards Credit Card is also ideal for traveling overseas; there are no foreign transaction fees when making purchases. However, this credit card comes with an annual fee of $95. Standard APRs are between 19.99% and 29.99%.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Capital One Venture Rewards Credit Card | 75,000 miles after spending $4,000 on purchases within three months. | Unlimited 2x miles for every $1 spent. Increased to 5x miles when booking hotels or car rentals via the Capital One Travel portal. | $95 | 19.99%, 26.24%, or 29.99%, based on your creditworthiness. |

Pros

- Best card for travel rewards

- Earn 2x miles per $1 spent

- New cardholders get 75,000 bonus miles after spending $4,000

- No foreign transaction fees

- Receive $100 in TSA PreCheck or Global Entry credit

Cons:

- Annual fee of $95

5. Wells Fargo Active Cash® Credit Card: Best for 0% Purchases

Wells Fargo Active Cash® Credit Card is one of the best credit cards for making 0% purchases. New cardholders receive a 0% APR introductory offer for the first 15 months. The 0% offer also extends to balance transfers. You’ll need to complete the transfer process within 120 days of opening the account.

The Wells Fargo Active Cash® Credit Card also doubles up as a top-rated cash back card. You’ll get an unlimited 2% cash back on all spending categories. What’s more, first-time applicants receive a $200 cash back bonus. Simply spend $500 within three months of receiving the card.

There are no annual fees with this credit card. However, you’ll revert to standard APRs of between 20.24% and 29.99% if you make a late payment. Moreover, the Wells Fargo Active Cash® Credit Card comes with a 3% foreign transaction fee, so isn’t the best option for using overseas.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Wells Fargo Active Cash® Credit Card | $200 cash back after spending $500 on purchases within three months. 0% on purchases and balance transfers for the first 15 months. | Unlimited 2% cash back on all purchases. No restrictions on spending categories. | None | 20.24%, 25.24%, or 29.99% |

Pros

- Best card for making 0% purchases

- Extended 0% APR for 15 months

- Unlimited 2% cash back on all spending categories

- Receive $200 cash back after spending $500

- No annual fees

Cons:

- 3% fee when using the card overseas

6. Chase Freedom Unlimited®: Best for Gas and Supermarket Purchases

Chase Freedom Unlimited® is a great option for earning rewards on everyday purchases. For instance, purchases made in drugstores and dining establishments (including takeout) earn 3% cash back. The 3% cash back rate comes without earning limits.

You will also get 5% cash back when making purchases in supermarkets and gas stations. However, this is capped at $12,000 in the first year. Furthermore, Walmart and Target transactions are not eligible for the 5% rate. All other spending categories earn an unlimited 1.5% cash back.

You will also receive a $200 cash back bonus after opening the account. Just $500 needs to be spent within three months to qualify. Chase Freedom Unlimited is also one of the best credit cards for low interest; you’ll get 0% APR for 15 months. This covers purchases and balance transfers. Standard APRs sit between 20.49% and 29.24%.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Chase Freedom Unlimited® | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on supermarket and gas purchases (up to $12,000). 3% on dining and drugstore purchases. 1.5% on other spending categories. | None | 20.49% – 29.24% |

Pros

- Best card for earning rewards on everyday purchases

- 5% cash on supermarket and gas station transactions

- Earn 3% cash back on drugstore and dining purchases

- $200 cash back bonus after spending $500

- No interest on purchases and balance transfers for 15 months

Cons:

- Walmart and Target purchases are ineligible for the 5% rate

7. Discover it® Cash Back: Best for High Rotating Bonus Rewards

Discover it® Cash Back is a solid all-arounder, especially when it comes to rewards. This is a ‘rotating bonus’ credit card, meaning that reward categories change every quarter. For instance, you might earn 5% cash back on dining in quarter 1. And then in quarter 2, you might get 5% cash back on gas station purchases.

You must opt-in every quarter to be eligible for the bonus rewards. Purchases made outside of the selected bonus category earn 1%. New cardholders will receive one of the best introductory offers in the market. At the end of the first year, Discover it® Cash Back offers a dollar-for-dollar cash back match.

For example, if you earn $2,500 in cash back rewards, Discover it® Cash Back will double it to $5,000. The introductory offer also includes 0% APR for 15 months. This covers balance transfers and purchases. Those with an ‘Excellent’ credit rating could be eligible for standard APRs of 17.24%. The highest APR charged is 28.24%.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Discover it® Cash Back | Dollar-for-dollar cash back match at the end of the first year. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on one rotating spending category each quarter. 1% on all other purchases. | None | 17.24% – 28.24% |

Pros

- Best card for rotating bonus categories

- Earn 5% on selected spending categories every quarter

- Receive a dollar-for-dollar match at the end of the first year

- No interest on balance transfers or purchases for 15 months

- No annual fees

Cons:

- Standard cash back rate of 1%

8. Bank of America® Customized Cash Rewards Card: Best for Choosing a Rewards Catagory

The Bank of America® Customized Cash Rewards Card is a great option for earning rewards on your preferred spending category. Unlike rotating credit cards, Bank of America allows you to stick with the same category every quarter. In doing so, you’ll earn 3% cash back on purchases you would have made anyway.

Category options include everything from dining and drugstores to online shopping and gas stations. The 3% cash back rate is capped at $2,500 every three months. After that, you’ll revert to 1%. That said, grocery and wholesale club purchases automatically earn 2% cash back.

Moreover, you’ll earn a $200 cash back bonus once you spend $1,000. This needs to be achieved within 90 days of opening the account. New cardholders also benefit from 0% interest for 15 months. This covers purchases and balance transfers made within 60 days. There are no annual fees with this credit card.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| Bank of America® Customized Cash Rewards Card | $200 cash back after spending $1,000 within 90 days. 0% APR on balance transfers and purchases for the first 15 months. | 3% cash back up to $2,500 every quarter on a selected spending category. 2% on grocery and wholesale purchases. 1% on everything else. | None | 18.24% – 28.24% |

Pros

- Best card for choosing a spending category

- 3% cash back on one spending category every quarter

- Automatically earn 2% cash back on grocery and wholesale purchases

- Earn $200 cash back after spending $1,000

- No interest on purchases and balance transfers for 15 months

Cons:

- The 3% bonus rate is capped at $2,500 every quarter

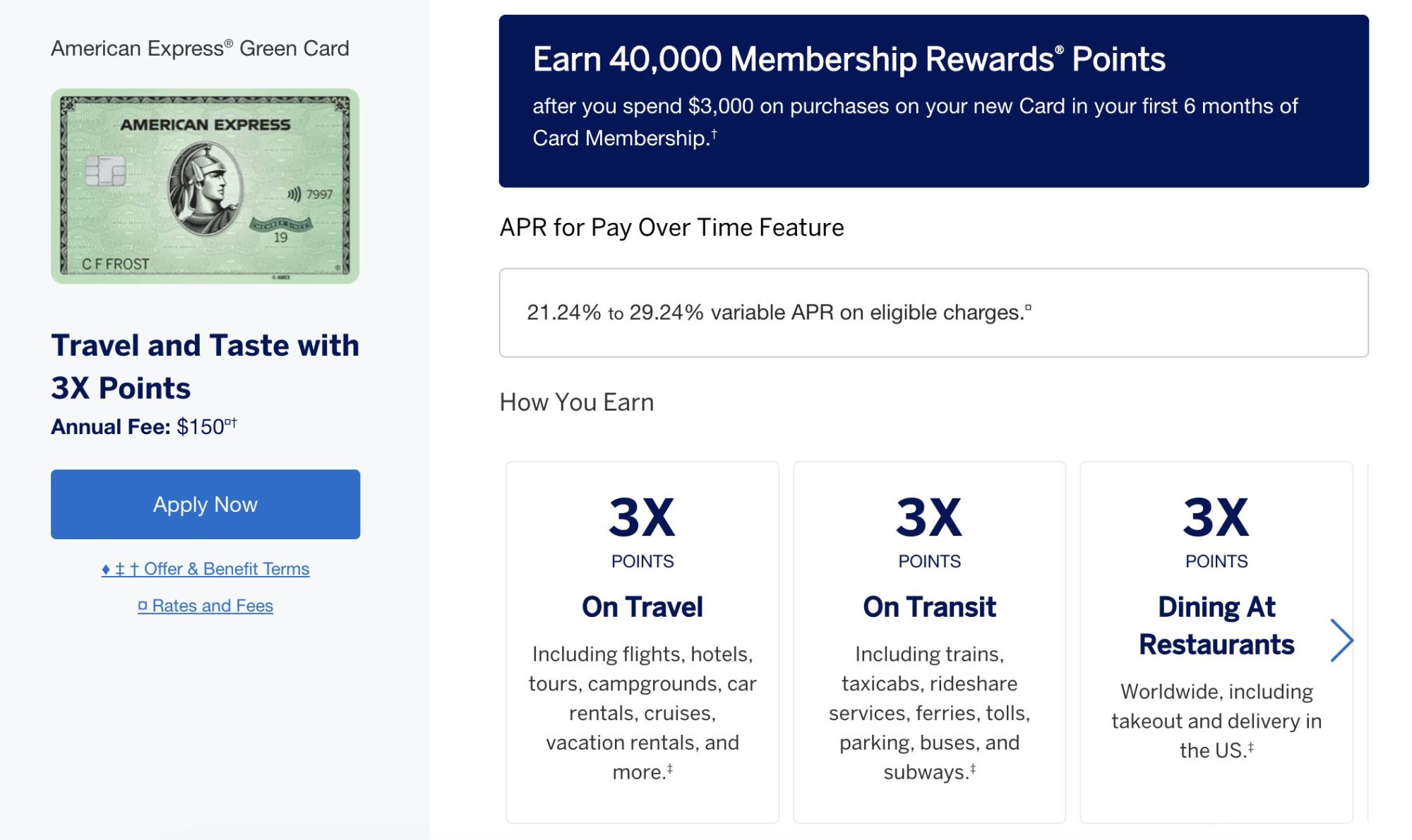

9. American Express® Green Card: Best for Business Travelers

If you frequently travel for business, the American Express® Green Card could be the best option. This credit card comes with many benefits that justify the $150 annual fee. For a start, new cardholders receive 40,000 reward points. Although you’ll need to spend $3,000 to qualify, you’ll have six months.

In addition, you’ll receive a $189 CLEAR® Plus credit, not to mention $100 worth of airport lounge access. Cardholders also get trip delay insurance and fee-free foreign transactions. The American Express® Green Card also comes with a great points reward program.

You’ll get 3x points for every $1 spent on travel. This includes flights, hotels, tours, car rentals, and more. 3x points will also be earned on transit purchases. This includes buses, subways, parking, trains, and even rideshare services like Uber. This credit card comes with standard APRs of 21.24% – 29.24%.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| American Express® Green Card | 40,000 reward points after spending $3,000 within six months. | 3x points on travel and transit purchases without limits. $189 CLEAR® Plus credit. $100 airport lounge credit. No foreign transaction fees. | $150 | 21.24% – 29.24% |

Pros

- Best card for traveling on business

- No foreign transaction fees

- Lots of cardholder benefits – including insurance and CLEAR® Plus credit

- Earn 3x reward points on travel and transit purchases

- Get 40,000 bonus points after spending $3,000

Cons:

- No 0% APR introductory period

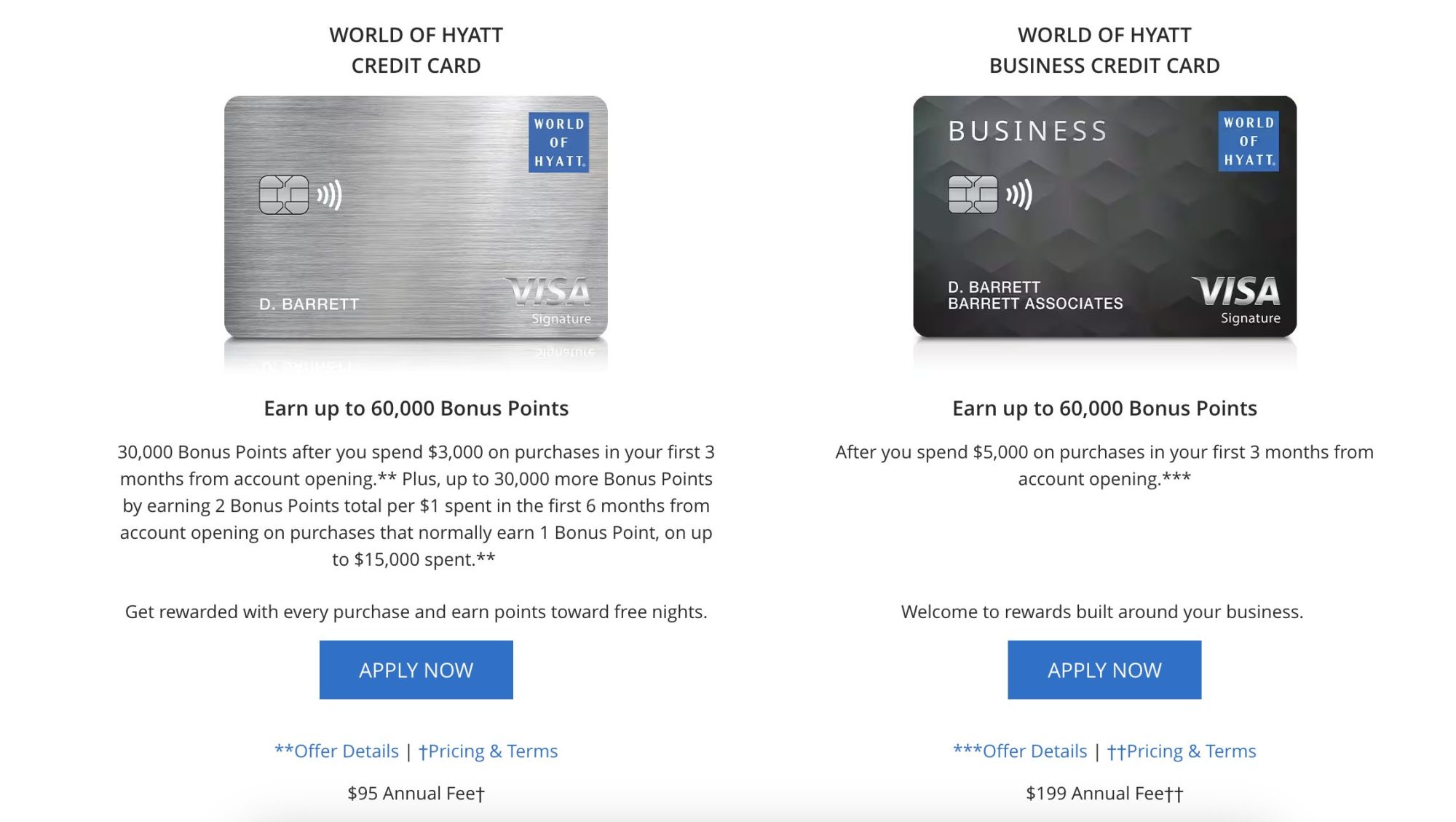

10. World of Hyatt Credit Card®: Best for Hotel Points

We rank the World of Hyatt Credit Card® as one of the best options for hotel points. This credit card comes with many benefits, including complimentary Discoverist status. Ordinarily, you’d need 10 qualifying nights to achieve this. What’s more, you’ll get 1 free hotel stay per year.

This is increased to two nights when spending $15,000 throughout the year. New cardholders also receive 60,000 bonus points. The minimum spend is $15,000 within the first six months. You’ll get an extra 9x points for every $1 spent with Hyatt.

Selected spending categories earn 2x points, including dining, gas, utilities, and car rentals. All other categories earn 1x per $1. The World of Hyatt Credit Card® is ideal for using overseas, considering the lack of foreign transaction fees. However, this credit card comes with an annual fee of $95.

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR |

| World of Hyatt Credit Card® | Up to 60,000 Hyatt points after meeting minimum spending requirements. | 9x points per $1 spent in Hyatt hotels and resorts. 2x points on dining, gym, and airline purchases. 1x points for other spending categories. Additional perks include World of Hyatt Discoverist status, one free stay, and five qualifying nights. | $95 | 21.49% – 28.49% |

Pros

- Best card for hotel points

- New cardholders get 60,000 points

- Earn up to 9x points per $1 spent

- No foreign transaction fees

- 1 free hotel stay per year

Cons:

- You’ll need to spend $15,000 to maximize the welcome offer

Credit Card Comparison

Here’s a recap of the 10 best credit cards for 2024:

| Credit Card | Introductory Offer | Rewards | Annual Fee | APR | Learn More |

| Citi Double Cash® Card | $200 cash back after spending $1,500 on purchases within six months. 0% on balance transfers for the first 18 months. | Unlimited 2% cash back on all purchases. 1% is paid when making the purchase, while the other 1% is paid when settling the transaction. 5% cash back on Citi Travel bookings. | None | 19.24% and 29.24% | Check Eligibility |

| Citi Simplicity® Card | 0% on balance transfers for 21 months. 0% on purchases for 12 months. | None | None | 19.24% – 29.99% | Check Eligibility |

| U.S. Bank Cash+® Visa Signature® Card | $200 cash back after spending $1,000 on purchases within 120 days. 0% APR on balance transfers and purchases for 15 months. | 5% cash on selected categories, up to $2,000 every quarter. Up to 2% cash back on other purchases. | None | 19.49% – 29.74% | Check Eligibility |

| Capital One Venture Rewards Credit Card | 75,000 miles after spending $4,000 on purchases within three months. | Unlimited 2x miles for every $1 spent. Increased to 5x miles when booking hotels or car rentals via the Capital One Travel portal. | $95 | 19.99%, 26.24%, or 29.99%, based on your creditworthiness. | Check Eligibility |

| Wells Fargo Active Cash® Credit Card | $200 cash back after spending $500 on purchases within three months. 0% on purchases and balance transfers for the first 15 months. | Unlimited 2% cash back on all purchases. No restrictions on spending categories. | None | 20.24%, 25.24%, or 29.99% | Check Eligibility |

| Chase Freedom Unlimited® | $200 cash back after spending $500 on purchases within three months. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on supermarket and gas purchases (up to $12,000). 3% on dining and drugstore purchases. 1.5% on other spending categories. | None | 20.49% – | Check Eligibility |

| Discover it® Cash Back | Dollar-for-dollar cash back match at the end of the first year. 0% APR on balance transfers and purchases for the first 15 months. | 5% cash back on one rotating spending category each quarter. 1% on all other purchases. | None | 17.24% – 28.24% | Check Eligibility |

| Bank of America® Customized Cash Rewards Card | $200 cash back after spending $1,000 within 90 days. 0% APR on balance transfers and purchases for the first 15 months. | 3% cash back up to $2,500 every quarter on a selected spending category. 2% on grocery and wholesale purchases. 1% on everything else. | None | 18.24% – 28.24% | Check Eligibility |

| American Express® Green Card | 40,000 reward points after spending $3,000 within six months. | 3x points on travel and transit purchases without limits. $189 CLEAR® Plus credit. $100 airport lounge credit. No foreign transaction fees. | $150 | 21.24% – 29.24% | Check Eligibility |

| World of Hyatt Credit Card® | Up to 60,000 Hyatt points after meeting minimum spending requirements. | 9x points per $1 spent in Hyatt hotels and resorts. 2x points on dining, gym, and airline purchases. 1x points for other spending categories. Additional perks include World of Hyatt Discoverist status, one free stay, and five qualifying nights. | $95 | 21.49% – 28.49% | Check Eligibility |

What to Know About Credit Cards

This section explains everything there is to know about credit cards. First-time applicants should read on to understand the basics.

How Credit Cards Work

Put simply, credit cards are issued by banks and other financial institutions. They enable you to make purchases with ‘credit’, meaning you aren’t initially using your own money. This is in contrast to debit cards, which only allow you to spend what you have in your account.

Most credit cards come with a pre-agreed credit limit. You can spend any amount up to this limit, which will vary depending on your creditworthiness. At the end of each billing cycle, you’ll receive a monthly statement from the credit card company. This outlines your monthly transactions and how much you need to repay.

Paying the monthly statement in full is recommended. In doing so, you won’t pay any interest – regardless of the card’s APR. Moreover, this will help you increase your credit score over time. This is because lenders will see that you’re responsible with credit and always repay what you owe every month.

Credit cards are usually issued by Visa or MasterCard, meaning you can use them anywhere. This includes online and in-store purchases. Although credit cards can also be used at ATMs this isn’t recommended. Not only will you pay a cash advance fee (usually 3-5%), but withdrawing cash with a credit card can hurt your score.

How Credit Card Rewards Work

Many consumers will take out a credit card to earn ‘rewards’. This means you’ll earn rewards simply for using the card. This can make financial sense if you’re using the card for everyday purchases.

There are many different types of rewards offered by credit card companies. Let’s break down the most common.

Cash Back Rewards

Cash back rewards allow you to earn cash rebates when making purchases with your credit card.

For example, suppose you’re using the Chase Freedom Unlimited®. Using the card for gas and grocery purchases will earn 5% cash back. In essence, you’re securing a 5% discount on these purchases you would have made anyway. Upon receiving your monthly statement you’ll see 5% worth of credits.

- For instance, suppose you spent $3,000 on gas and groceries throughout the month. No other transactions were made. Your $3,000 will include a $150 statement credit. This means you only owe $2,850 to the credit card company even though you spent $3,000.

You should understand the terms of cash back credit cards before proceeding.

For example, although some cards offer high rates on everyday purchases, this can be capped. For example, the Bank of America® Customized Cash Rewards Card offers 5% cash back on your chosen spending category. However, this is limited to $2,500 every three months. Any transactions over this amount will receive 1% cash back.

Air Mile Rewards

Air miles are another popular reward type offered by travel credit cards. Instead of earning statement credit, you’ll generate points. These points can be converted into flight purchases, business class upgrades, airport transfers, and other perks.

Some air mile credit cards need to be used with selected airlines. If you don’t have a preferred airline, opt for a flexible redemption credit card. This means you can use your air miles with any airline of your choosing.

In addition, make sure you understand the value of your air miles. For instance, suppose you earn 3 air miles for every $1 spent. If a one-way flight from New York to Las Vegas requires 600 air miles, you’re effectively paying $200. This would value each air mile at $0.33.

Hotel Rewards

Also within the travel category are hotel reward credit cards. These are usually aimed at specific hotel chains, such as Hyatt, IHG, Hilton, or Marriott Bonvoy. You’ll earn points for your chosen hotel brand every time you use the credit card. For example, the World of Hyatt Credit Card® offers up to 9 Hyatt points per $1.

Hotel reward credit cards usually give you a complimentary loyalty status. For instance, the Marriott Bonvoy® Amex Card offers gold status. Ordinarily, this would require at least 25 hotel stays.

Introductory Rewards

If your chosen credit card comes with rewards, you’ll likely receive an ‘introductory’ offer. This offers bonus rewards after meeting a minimum spend requirement.

For instance:

- Chase Freedom Unlimited® offers a $200 cash back bonus after spending $500 within three months of opening the account.

- American Express® Green Card offers 40,000 rewards points after spending $3,000 within three months.

- World of Hyatt Credit Card® offers 60,000 Hyatt points to new cardholders, although you’ll need to spend $15,000 within six months.

The best credit card offers are almost always worth claiming. The spend-to-rewards ratio will be much more favorable than the standard rewards structure. In fact, it can make sense to take out a credit card solely for the introductory offer – even if an annual fee is charged.

- For example, we mentioned that the World of Hyatt Credit Card® offers 60,000 Hyatt points to new members.

- According to Hyatt, category 1 hotel rooms start from 3,500 per night.

- Therefore, you could get 17 free nights simply for holding the card.

- This is in addition to Discoverist status, one free night, and other perks.

- This is certainly worth the $95 annual fee.

How Credit Card Interest Works

Credit card companies are in the business of making money. They generate revenue from the interest you pay on outstanding balances. This is known as the Annual Percentage Rate or APR. According to CNN, the average APR on credit cards is 22.77%. This is a very high interest rate to be paying.

Moreover, interest rates will vary depending on your credit score. The better your credit history, the lower the APRs you can secure. For example, those with an ‘Excellent’ credit score can get APRs from 17.24% when using the Discover it® Cash Back. However, this credit card comes with an upper APR threshold of 28.24%.

So how does credit card interest work?

In simple terms, you’ll only pay interest on amounts you carry over to the next month. For example, let’s suppose you spend $5,000 on your credit card in January 2024. At the end of the billing cycle, you’ll receive a monthly statement. If you settle the $5,000 statement in full, you won’t pay any interest.

This is the case regardless of the APR. However, let’s suppose you only pay $1,000. This means you’re carrying over $4,000 into the next billing cycle. So, when you receive your statement for February 2024, it will include the interest you’ve incurred over the prior month.

0% Introductory Rates

If there’s a chance you won’t be settling your statement in full each month, look for credit cards offering a 0% introductory rate.

One of the best credit card deals is the Citi Simplicity® Card. After opening the account, you’ll get 21 months of interest-free payments. This is the case even if you carry balances over to the next billing cycle.

This is on the condition you:

- Make at least the minimum payment. In general, the minimum credit card payment is 1-4% of the total outstanding balance.

- You make the minimum payment on time. This means on or before the monthly repayment date. This can be found on your monthly statement.

If the above conditions aren’t met, you’ll immediately lose your 0% introductory offer. The standard APR will kick in, meaning high interest payments.

0% Balance Transfers

If you’re coming to the end of your 0% period and you still have a large balance, it could be worth getting a balance transfer credit card. These come with 0% interest for extended periods. Meaning – you’ll remain on a 0% APR with the new credit card issuer.

The only drawback is the balance transfer fee, which averages 3% of the amount being transferred. Nonetheless, this is still a better option than paying standard APRs. As we mentioned, this currently averages 22.77%.

Here’s an example of why balance transfers can be beneficial:

- You currently have $10,000 worth of debt on a credit card. The 0% introductory offer will expire next month. Standard APRs of 25% will then be charged on your $10,000 balance.

- You apply for a balance transfer card offering 0% APR for 18 months.

- You use the balance transfer card to pay the $10,000 debt in full. You pay a 3% fee on the $10,000 transfer, which is $300.

- You now owe $10,300 on the new credit card. However, you won’t pay any interest for 18 months – provided you at least pay the minimum and on time.

As the above example shows, had you remained on the original credit card, you’d be paying 25% interest on a $10,000 balance. However, for a small fee of 3%, you’ve secured another 18 months of interest-free payments.

Different Types of Credit Cards

There are many different credit card types to choose from.

Here’s a recap of the most common:

- Rewards Cards: Earn rewards every time you make a purchase. Rewards cover cash back, hotel points, air miles, and more.

- Purchase Cards: Make purchases at 0% interest for extended periods, often between 12-21 months. Ideal for making big-ticket purchases.

- Balance Transfer Cards: Carry over outstanding credit card balances at 0%. Similar to purchase cards, you’ll get 0% interest for at least one year.

- Travel Cards: In addition to hotel and air mile rewards, travel cards come with other benefits. This can include zero foreign transaction fees, travel insurance, and TSA PreCheck credits.

- Charge Cards: This card type often comes with enhanced rewards and unlimited credit limits. That said, you’ll need to settle your statement in full every month.

- Secured Cards: Requires an upfront deposit, which determines the credit limit. For instance, if you deposit $2,000, your credit limit is also $2,000. Ideal for bad credit consumers wanting to improve their FICO.

- Store Cards: These are issued by retailers, such as Amazon or Costco. You’ll earn extra rewards every time you use the card with the respective retailer.

Do note that some credit cards cover more than one metric. For instance, there are balance transfer cards that also offer cash back rewards and 0% purchases.

Choosing the Best Credit Card for You

Researching the best credit cards can be a daunting process.

Here’s some guidance on choosing the right card for your goals.

Check Your Credit Score

Before getting started, it’s crucial to assess your credit score. After all, credit card issuers have eligibility requirements. The most important metric is your FICO score. This ranges from 300 to 850. The higher your FICO the more chance you have of being approved by the top-tier credit cards.

There are many ways to check your FICO score. This can be done with the three main credit reporting agencies; TransUnion, Experian, and Equifax. Alternatively, many US banks have partnered with FICO, meaning you’ll likely get monthly updates. You can also register with the FICO website directly.

Just remember that credit scores are just one metric that credit card issues look at. The debt-to-income ratio is also important. This looks at your total outstanding debts against your annual salary. If you have high debts and a low income, your debt-to-income ratio will be poor.

In addition, credit card issuers also look at your credit utilization ratio. This looks at how much of your available credit has been used. For example, if you have $10,000 worth of debt and credit lines of $50,000, your credit utilization ratio is 20%.

Assess Your Spending Habits

We’d suggest looking at your day-to-day spending habits. This will enable you to choose the best credit card company for your circumstances. For instance, suppose most of your monthly outgoings go on groceries, gas, and dining. In this instance, you’d want a credit card that offers cash back rewards on these spending categories.

The Chase Freedom Unlimited® would be a good option, considering it offers 5% cash back on supermarket and gas purchases. And on dining purchases – including takeout, you’ll get 3% cash back.

If you’re frequently overseas, you’ll want a credit card that’s focused on travel. This should include zero foreign transaction fees, travel insurance, and a complimentary hotel status. You’ll also want the credit card to pay rewards on travel-related purchases, such as hotels and flights.

Alternatively, suppose you’re looking to make a large purchase, such as home renovations or a family vacation. You’d want a credit card offering 0% purchases for the longest period. And if you already have outstanding debts with other credit cards, you’ll also want 0% APR on balance transfers.

Narrowing Down Your Options

You should now have an idea of what credit cards you’re eligible for based on your credit score. You should also know the type of credit card that aligns with your spending habits. This will enable you to create a shortlist of the best credit cards for your circumstances.

You can then narrow down your options based on the overall best value. For example, suppose you’re looking at three credit cards that all offer 0% purchases for 18 months. They also offer $0 annual fees and 3% unlimited cash back on all purchases.

You can then look at what other perks each card offers, such as insurance, fraud protection, and 24/7 customer support. You’d also want to consider the introductory offer and which card you have the greatest chance of being approved for.

How to Compare Credit Cards

Let’s take a much closer look at how to compare the best credit cards for 2024.

Introductory and Standard Interest Rates

First, explore what interest rates your chosen credit cards charge. This will be shown as an APR range, such as 19.49% – 29.74%. You won’t know what APR you’ll be offered until you’re approved for the card.

That said, we prefer credit cards that offer a 0% APR introductory rate. This means you won’t pay interest even if you don’t settle your monthly balance. Many 0% credit cards cover purchases and balance transfers.

If you’re not eligible for a 0% introductory offer, you can still avoid credit card interest. Simply pay your monthly statement in full before the due date. In doing so, no interest will be charged.

Annual Fees

Not all credit cards come with annual fees, but some do. This should be factored in when choosing a credit card. Ideally, you’ll select a card that offers $0 annual fees. That said, it can still make sense to pay annual fees if the benefits outweigh the costs.

- For example, consider the American Express® Green Card, which costs $150 per year.

- Once you’ve spent $3,000 (within six months), you’ll receive 40,000 reward points.

- According to American Express, reward points can be redeemed for statement credit at 0.6 cents each. This amounts to $240 worth of statement credits, which more than covers the $150 annual fee.

- What’s more, points are valued at 1 cent each when making travel bookings via American Express Travel®. This values the introductory offer at $400.

- The American Express® Green Card comes with many other benefits, including $189 CLEAR® Plus credit and no fees on foreign transactions.

However, there might be times when the annual fee doesn’t make sense – especially if you rarely travel.

Other Fees

Other fees to look for when comparing credit cards include:

- Late Payment Fees: Charged when you fail to pay at least the minimum statement credit before the due date.

- Missed Payment Fees: If you fail to cover the late payment within 30 days, a missed payment fee can be charged.

- Foreign Transaction Fees: Charged when you use the credit card outside of the US. Averages 3% of the transaction amount and will also attract interest.

- Balance Transfer Fees: Credit card companies usually charge a fee when you make a balance transfer. This is usually 3% of the amount being transferred.

- Cash Advance Fees: Charged when you use the credit card to withdraw cash from an ATM. Cash advance fees average 3-5% and will immediately incur interest. Turning credit into cash can also hurt your credit score.

Most credit card issuers are transparent about what fees they charge. The information is usually displayed on the lender’s website.

Rewards

Choosing a credit card based on rewards can be smart. However, only if you’re confident you’ll settle monthly statements in full every month. This is because you’ll avoid paying interest. After all, if you do pay interest, this will likely be more than the rewards are worth.

It’s also important to choose the right rewards for your spending habits. As we mentioned, frequent travelers should look for travel-related rewards, such as air miles or hotel points. Alternatively, those spending most of their money on day-to-day purchases should look for cash back rewards.

When comparing the best credit cards for rewards, it’s wise to do some calculations.

For instance, suppose that on average, you spend $2,000 per month on groceries. The Wells Fargo Active Cash® Credit Card offers 2% cash back, so that’s $40. However, you’ll get 5% with the Chase Freedom Unlimited®, which increases the monthly cash back to $100.

It’s crucial to factor in annual fees when choosing a credit card for rewards. You should also check whether there are any limits on how much cash back can be earned. Some credit cards offer high cash back rates up to a certain amount each month or quarter. Purchases over these limits will get a much smaller cash back rate.

Cardholder Benefits

Top credit cards usually come with additional cardholder benefits.

This can include:

- Travel Insurance

- Fraud Protection

- Breakdown Protection

- Extended Warranty Protection

- Hotel Loyalty Statuses

- Discounts With Select Retailers

- Concierge Service

- Free Credit Tracking Tools

- Cell Phone Insurance

- Airport Lounge Access

Whether or not these cardholder benefits are worthwhile will depend on your circumstances. But they should be factored in nonetheless.

Credit Building

Some consumers will take out a credit card to improve their credit score. This might be because they have poor credit or simply no credit at all.

It’s important to check whether the credit card issuer regularly reports payments. Ideally, it will report payments once per month to the three main credit agencies. In doing so, this will enable you to build your credit score over time.

Credit Limits

Limits should also be considered when comparing credit cards. There are several reasons why securing a high credit limit can be beneficial. For a start, you’ll be able to maximize rewards each month. This will also make it easier to hit spending targets on an introductory offer.

What’s more, high credit limits enable you to minimize your credit utilization ratio. As we mentioned, this is a key metric that credit card lenders look at.

For example, suppose you’re planning to spend $3,000 per month on day-to-day purchases, such as groceries, dining, and gas. If the credit card comes with a limit of $4,000, your credit utilization is 75%. This is very high. If the limit was at $10,000, the utilization score would be reduced to 33%.

We found that lenders usually list the minimum credit limit available for each card they offer. However, maximum credit limits are rarely provided. In most cases, you won’t know until you apply.

How the Application Process Works

We’ll now break down the credit card application process for beginners.

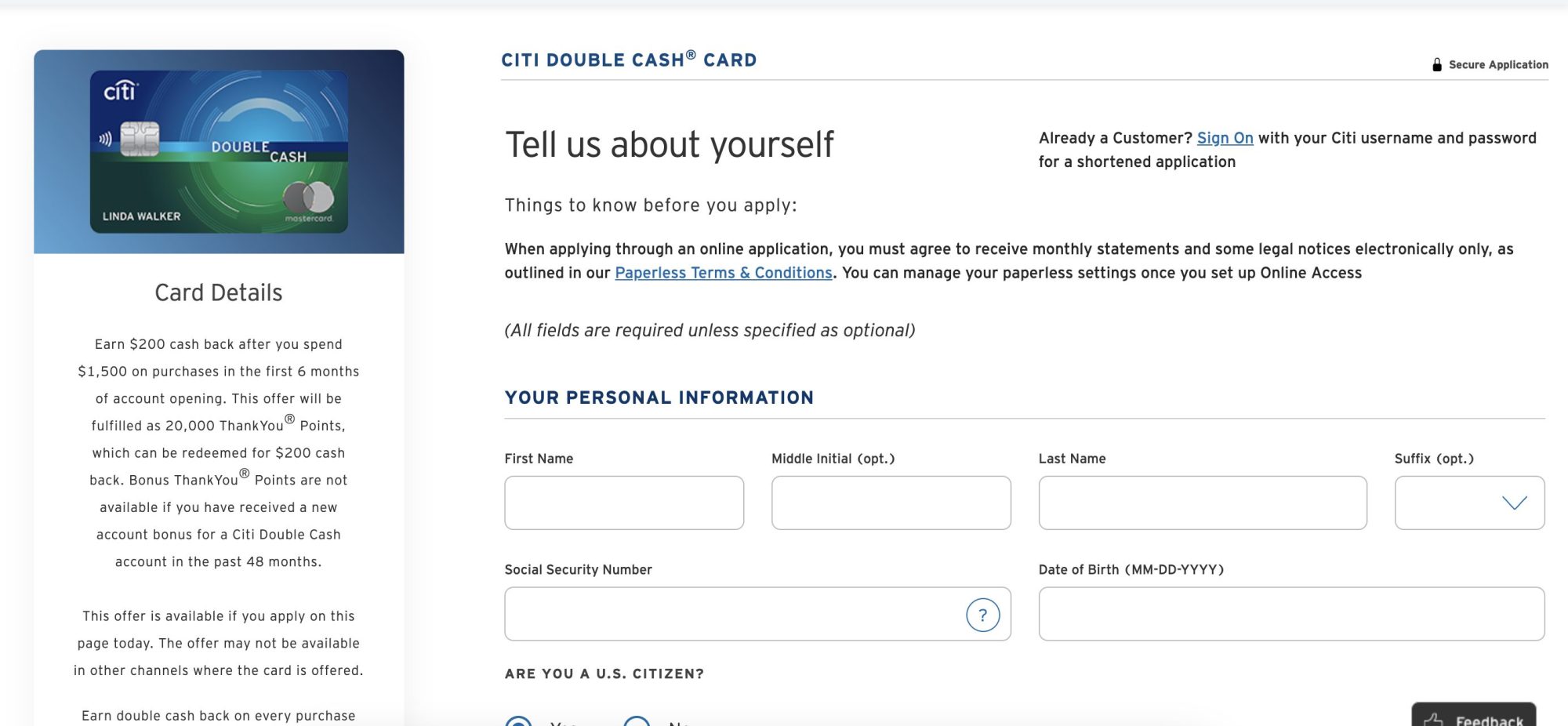

Fill Out the Application Form

Assuming you’ve selected the best credit card for you, the first step is to visit the lender’s website. There should be an ‘Apply’ button next to the card you’re interested in.

You’ll now see an application form. This initially requires some personal information, such as your full name, home address, date of birth, and social security number. You’ll also need to provide an email and cell phone number.

Next, the lender will ask for some financial information. For example, your employment status (e.g. full-time, part-time), the name of your employer, how long you’ve worked there, and your total income.

From start to finish, the application process shouldn’t take more than a few minutes.

Hard Credit Check

Once you’ve completed and submitted the application form, the credit card issuer will run a ‘hard’ credit check. This means it will retrieve information from the main credit reporting agencies; TransUnion, Experian, and/or Equifax.

This is for two key reasons.

- First, the credit card issuer will attempt to verify your personal information. This removes the need to upload ID verification documents.

- Second, the issuer will look at your creditworthiness. It will assess your FICO score, credit utilization, debit-to-income ratio, and other financial metrics.

Within 1-2 minutes, you should receive a decision. This is usually one of three potential outcomes:

- Approved

- Declined

- Request for More Information (e.g. payment slips, bank statements, government-issued ID)

Hard credit checks can hurt your credit score. However, this is often minimal. Plus, the credit score decline is usually temporary.”

Credit Card Agreement

If you’re approved, you’ll be presented with a credit card agreement on-screen. This will outline the terms and conditions of the credit card, such as APRs, rewards, late payment fees, etc. You’ll also be informed of your credit limit.

It’s important to read through the terms before proceeding. If you’re happy to proceed, you’ll need to sign the credit card agreement electronically.

Receive and Activate Credit Card

After you’ve signed the credit card agreement, the issuer will post the card to your registered address. You should receive it within a few business days. You should also receive a separate letter that contains your PIN.

Finally, you’ll need to activate the credit card. This can usually be done on the lender’s website or mobile app. The credit card is then ready to use.

Pros and Cons of Credit Cards

Consider the following benefits and drawbacks before applying for a credit card:

Pros

- Never pay interest when settling monthly statements in full

- Earn credit card rewards on purchases

- Spread large payments with 0% introductory offers

- Manage debt through 0% balance transfers

- Improve your credit score by always paying on time

- Get cardholder benefits like insurance and airport lounge access

Cons

- Carrying balances to the next billing cycle can result in high interest payments

- Missing a payment can hurt your credit score

- Having access to credit can lead to irrational spending

- Some credit cards come with annual fees

- The best credit cards to have require an ‘Excellent’ credit score

Methodology

We've ranked the 10 best credit cards to get in 2024 based on an impartial and transparent methodology. We initially shortlisted the most popular credit cards and analyzed their key metrics. This included standard APRs, estimated credit limits and required FICO scores, and fees (including foreign transactions).

We also evaluated whether each credit card comes with rewards, such as air miles, travel points, or cash back. This was in addition to cardholder benefits, like insurance and fraud protection. We also explored introductory offers, including the spending requirements and the estimated reward value.

Our methodology also considered the target audience, ensuring that we revealed a credit card for each purpose. This included the best credit cards for balance transfers, purchases, rewards, travel, business owners, and much more.

That said, there is an element of subjectivity when ranking credit cards, so ensure you do your own research to pick the best option. There might be a credit card that's right for your circumstances but not listed on this page.

Conclusion

We've ranked the best credit cards for 2024 across many use cases, from balance transfers and 0% purchases to cash back and credit building. It's important to assess your spending habits, affordability, financial goals, and FICO score before proceeding.

You should also consider an eligibility checker, allowing you to browse which credit cards you've got a solid chance of being approved for.

FAQs

What's the easiest credit card to get approved for?

How many credit cards should you have?

What credit card is the best one to get?

What's the best credit card available right now?

Which card is best for an excellent credit score?

What is the best card to build credit with?

References

- https://www.cnbc.com/select/can-you-withdraw-money-from-credit-card/

- https://www.cnn.com/cnn-underscored/money/average-credit-card-apr

- https://www.fico.com/en/products/fico-score

- https://www.americanexpress.com/en-us/credit-cards/credit-intel/american-express-points-value/

- https://www.cnbc.com/select/what-is-a-cash-advance-and-how-do-they-work/

- https://www.experian.com/blogs/ask-experian/does-applying-credit-cards-hurt-credit/