Discusses 5 attractive dividend paying stocks from the Fintel platform

This year’s market rout has savvy investors playing defense and buying dividend-paying, steady performers over momentum growth stocks.

Fintel research highlights five stocks whose dividends may offer what today’s investor seeks.

The dividend score combines a stock’s dividend yield and growth rate to generate a score of up to 100, based on its ranking against screened peers.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Commodity firms that benefited from rising commodity prices this year dominated the list.

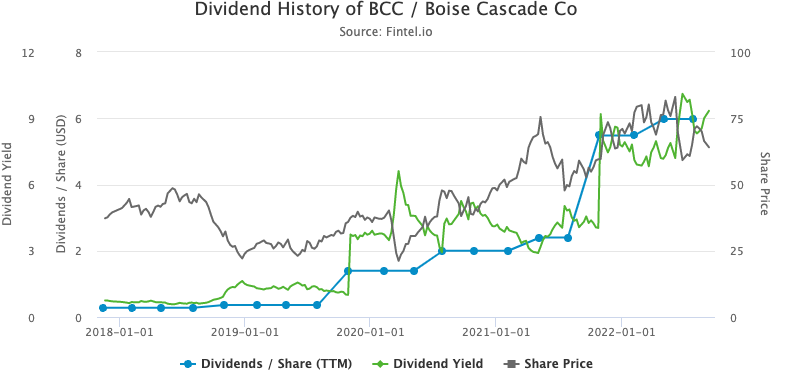

Integrated wood products manufacturer Boise Cascade (NYSE:BCC), with a score of 97.64, ranks fifth on Fintel's US leader board with a rolling dividend yield of 10.13%. The stock has experienced dividend growth of 1.99% over the last two years.

BCC has paid special and ordinary dividends for the last five years. Despite the stock's weak performance, including the $5.98 of cash dividends paid in the previous 12 months, the stock has returned 18.9% to investors since September 2021.

The street remains 'neutral' rated on BCC with a target price of $72.

American coal mining company Arch Resources (NYSE:ARCH) ranks in fourth place with a dividend score of 97.82. Arch Resources' share price and earnings exploded this year after the miner reaped profits from high coal prices.

Arch sports a 10.9% trailing dividend yield, including a recent special dividend.

Arch analysts remain bullish and have a mean "buy" call. The average price target among them is $196 a share.

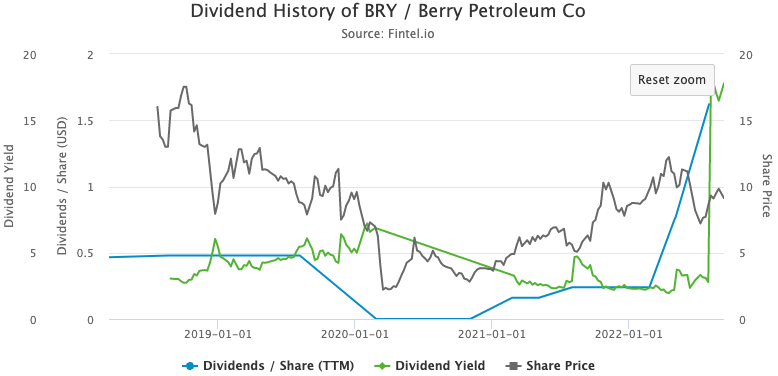

Oil & Gas producer Berry Petroleum's (NASDAQ:BRY) 97.95 dividend score ranked it third on the list.

Berry share rose 7% year to date but lagged peers.

The company benefited from skyrocketing energy prices because of the Ukraine war. Its shareholders like its trailing 7.6% dividend yield.

Analysts produce an overweight consensus rating and a $12.30 Berry price target.

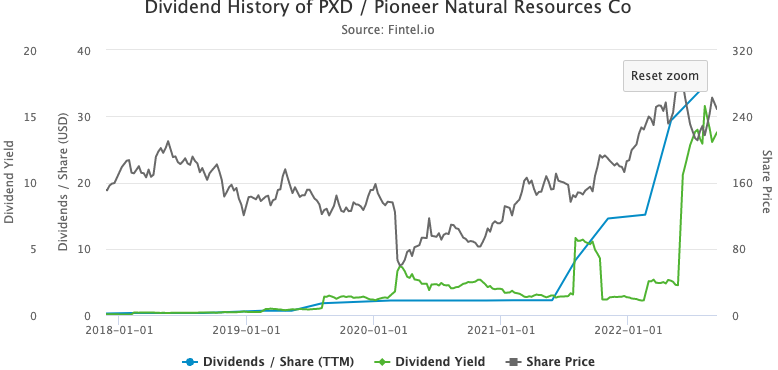

American natural gas explorer and producer Pioneer Natural Resources (NYSE:PXD) ranks second on the dividend list, scoring 98.85.

Despite its 35% gain this year, the company's stock still carries a 13.6% trailing yield.

PXD shared its peers' success in the oil fields as commodity prices soared. It sports a two year dividend growth rate of 14.58%.

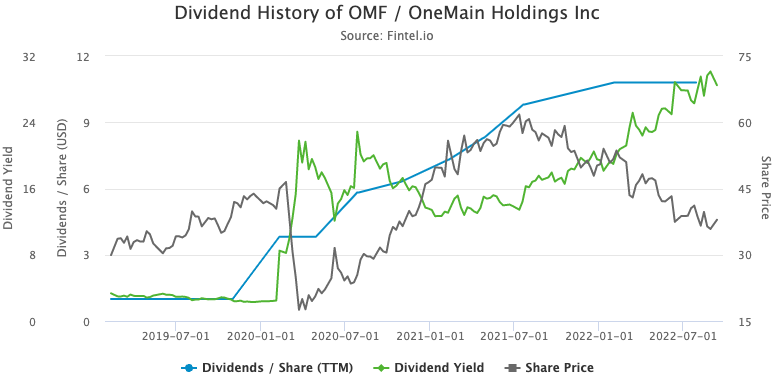

American consumer finance company OneMain Holdings (NYSE:OMF) stands out as the most attractive income payer, with a bullish dividend score of 99.50.

OneMain holdings consistently grew quarterly dividends over the past three years and had an annualized dividend rate of 31.13% based on the amount paid over the last 12 months.

OMF's 2-year dividend growth rate is 0.86%.

In the past, OMF distributed surplus capital to holders with a special dividend but ended that practice this year amidst challenging market conditions.

OMF shares this year gave back all gains they made since December 2020, just ahead of the pandemic. They're down 31.3% this year and trade with just a 4.2 price to earnings (PE) ratio, significantly below the S&P 500.

Analysts remain bullish on the company with a consensus 'buy' rating and a $52 target on the stock, well above the $34.69 last traded price.

The chart below shows the stock's dividend growth over time against the share price. It illustrates the inverse relationship between the dividend yield and the stock price.

Article by Ben Ward, Fintel