In his Daily Market Notes report to investors, while commenting on Sinic Holdings (Group) Co Ltd (HKG:2103) being downgraded by the S&P Global Ratings, Louis Navellier wrote:

Q3 2021 hedge fund letters, conferences and more

Bullish Retail Investors

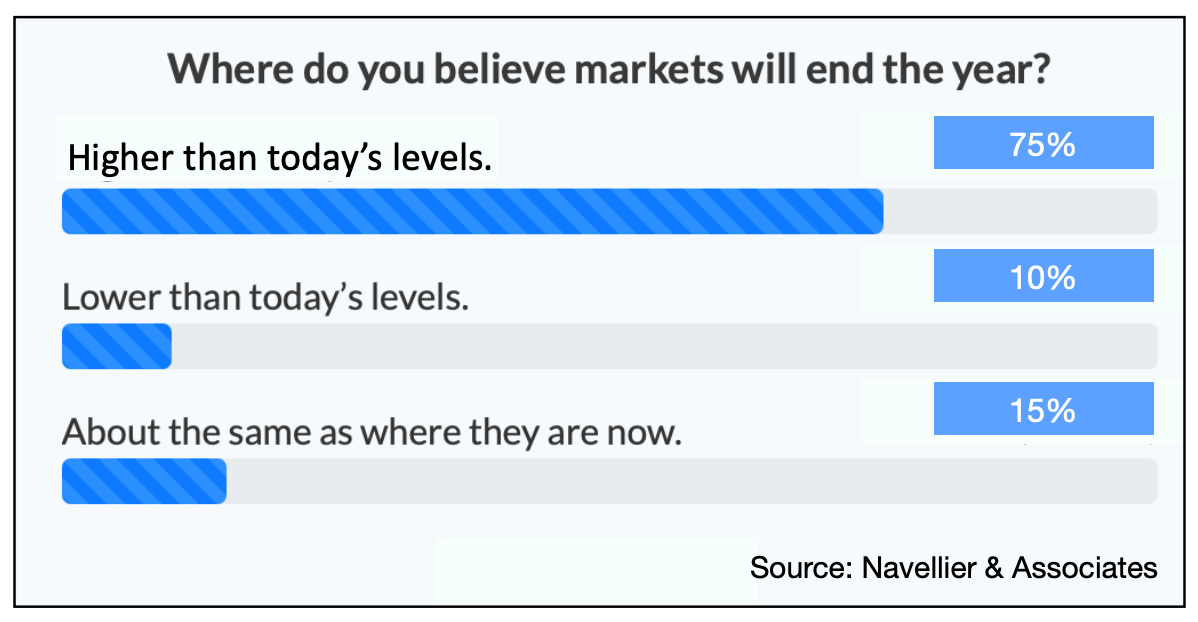

Our recent survey indicates retail investors are bullish heading into the fourth quarter. While there are many crosscurrents in the markets which could provoke concern, the survey results and associated commentary suggests that investors are buoyed by the prospect of a robust earnings season.

That more investors were uncertain about the direction of the market, 15%, than were bearish, 10%, is notable. Undecided investors are like swing voters in an election. Ultimately, these swing investors will swing bullish and provide an important lift to the market. Many of the immediate concerns — bottlenecks, energy pricing, inflation — will moderate as the year comes to a close, ultimately adding some optimism to the ‘undecided’ investors.

China’s National Bureau of Statistics announced that GDP grew at a 4.9% annual pace in the third quarter. Between a domestic real estate bubble bursting, the Evergrande debt crisis, electricity power outages, plus negative service and manufacturing PMIs in September, the deceleration in the Chinese domestic economy has been very swift. I am a bit skeptical that China’s GDP expanded at a 4.9% annual pace in the third quarter since the latest PMI data signaled a recession.

I should add that Evergrande’s bonds denominated in Chinese yuan made interest recently payments, but the U.S. dollar-denominated bonds are not being paid any interest. In other words, Evergrande is taking care of Chinese investors, but neglecting international investors. This is not a surprise, since Evergrande is likely taking orders from the Chinese Communist Party on how to restructure its assets and related debt. However, this action by Evergrande will now likely hurt other Chinese companies that want to sell U.S. dollar-denominated debt. Overall, Evergrande has over $300 billion in debt.

Sinic Holdings Group Downgraded

Another Chinese real estate company, Sinic Holdings Group, was downgraded by S&P Global Ratings to “selective default,” down from a CC rating. Sinic Holdings Group missed an interest payment this week on a $250 million U.S. dollar-denominated note. Like Evergrande, Sinic Holdings Group decided to default on its U.S. dollar-denominated debt first and now credit analysts are watching if the company defaults on its Chinese yuan-denominated debt. This practice of defaulting on foreign debt and trying to restructure domestic debt is common in emerging market countries, so China has clearly failed to graduate to a reliable industrial economy (e.g., like the G7 countries) due to its selective debt payments and brazen neglect of U.S. dollar-denominated debt.

Also complicating the now smaller proposed infrastructure bill are the related tax increases, where representatives in deep blue states want state and local tax deductions (SALT) deductions raised, which in turn, forces even bigger tax increases. In the end, it will be interesting if any infrastructure bill and related tax increases can pass Congress. Finally, since 2022 is a mid-term election year, there will be almost no bills passed since our elected representatives will be busy campaigning and belittling each other.

The Fed announced that industrial production declined 1.3% in September. This was the largest drop in industrial production since February and was complicated by motor vehicle production plunging 7.2% in September as supply chain glitches continue to curtail automotive production. Utility output declined 3.6% in September as mild weather helped to reduce electricity demand. Economists now expect supply chain glitches to persist through much of 2022. Until the port bottlenecks and supply chain glitches are resolved, industrial production will remain stressed. In the past 12 months, industrial production has risen 4.6%.

The Commerce Department reported on Tuesday that housing starts in September fell to a 13-month low and dropped 1.6% to an annual pace of 1.555 million. The deceleration in the housing market is much greater than economists anticipated. Affordability issues, a shortage of appliances and fear of higher interest rates have all converged to “prick the housing bubble” somewhat. This effectively leaves the stock market as most investors’ best inflation hedge.

Inflation Will Be Permanent

Speaking of inflation, it is helping companies post record earnings. As an example, Procter & Gamble (PG) announced better than expected third-quarter results on Tuesday, but the shocking news was that the company was raising prices on a variety of its goods. In other words, that 5.9% increase in social security benefits for 2022 may not be enough. There is no doubt that even when the supply shortages ease in late 2022 that inflation will be permanent. Inflation is very bullish for growth stocks, since companies, like Proctor & Gamble, will continue to raise prices to insure profitability. I should add that Proctor & Gamble will also likely repackage many of its goods in smaller packages, so consumers do not immediately realize that prices for its goods have increased.

Pending Recession

As the prices for food, energy and household goods increase, it will continue to account for a larger percent of consumer pockets, so some economists are now grumbling about the possibility of a “recession.” My favorite economist, Ed Yardeni, likes to describe the current economic environment as a “Hypersonic Business Cycle.” Even though the U.S. economy appears to have achieved “escape velocity” relative to China and other struggling economies, it is hard to fight gravity. So as the rest of the world stumbles, it is inevitable that U.S. economic growth will also slow. The advantage the U.S. has relative to the rest of the world is that the food and energy inflation can be addressed more easily since the U.S. is so vast. However, the Biden Administration must also become less hostile to fossil fuels, since many green energy initiatives have lost momentum. Overall, if the Biden Administration fails to pass its green energy initiatives in its watered-down infrastructure bill that it wants to pass in the next several weeks, then that will be a clear sign that U.S. energy policy has to pivot back to traditional fossil fuels.

Heard & Notable

The half-shredded artwork by modern artist Banksy called Love is in the Bin sold for $25.4 million at a Sotheby's auction, a more than $20 million increase compared to the auction price of the unshredded work in its original form which was called Girl with Balloon. Source: Statista