In his Daily Market Notes report to investors, while commenting on China struggling to become green, Louis Navellier wrote:

Q2 2021 hedge fund letters, conferences and more

The fourth quarter – like the conclusion of sporting events or Broadway plays – is where the drama lies. Similarly, the third quarter is where the doldrums often occur, making the fourth quarter’s performance all the more refreshing.

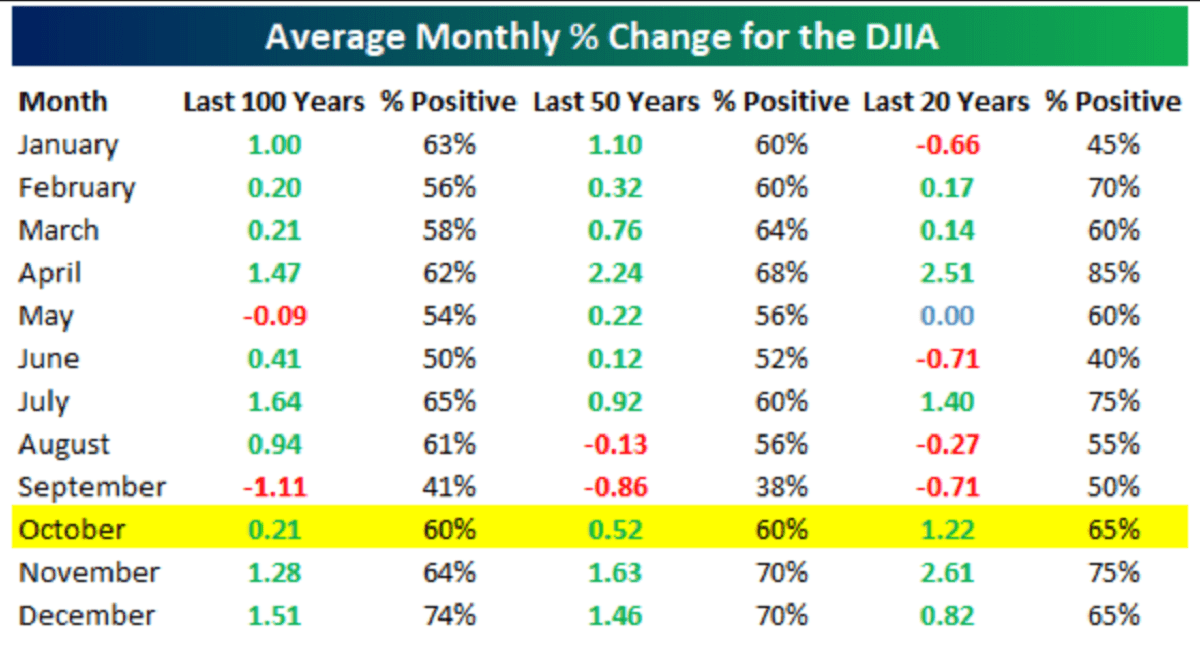

September ends a stretch of seasonal weakness for the market that typically begins in May. According to Bespoke Investment Group, over the last twenty years, the Dow has only averaged gains in one month (July) between May and September, and September has historically been the weakest month of the year whether you go back 100 years, 50 years, or 20 years.

October Tailwinds

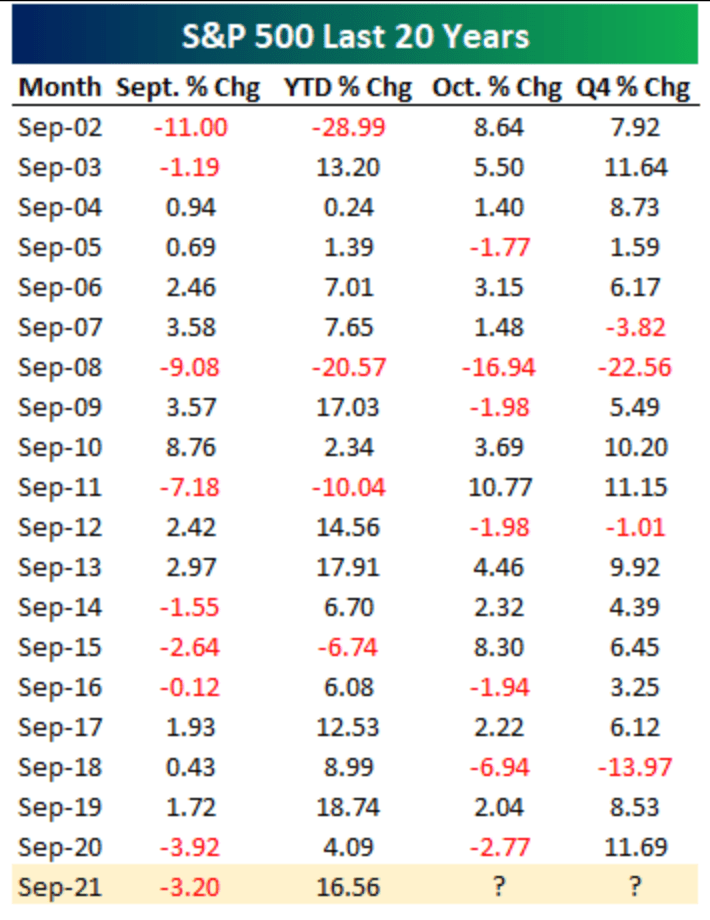

Fortunately for investors, seasonal headwinds turn to tailwinds once the calendar turns to October. While October is also a notorious month for the market given the crashes of 1929 and 1987, those years were outliers rather than the norm. Over the last 100, 50, and 20 years, the Dow has averaged gains in October, and the last 20 years have been especially positive with an average gain of 1.22% and positive returns 65% of the time.

Many economists now expect that China will fall into a recession as the Evergrande Property Services Group Ltd (HKG:6666) continues to miss its interest payments on its bonds. Interestingly, the Communist Party wants Evergrande to finish its real estate projects, even though many contractors have not been paid. The reason that there are an estimated 60 million vacant high-rise apartments in China is that many middle-class citizens view these apartments as an investment. Nonetheless, the unrestrained lending in China is now expected to ebb as Evergrande sells assets as strives to restructure its debt. So far the Evergrande crisis appears to be contained in China, despite the fact, the company is expected to miss interest payments on its debt, which is denominated in both Chinese yuan and U.S. dollars.

China Struggles To Become Green

China’s National Bureau of Statistics reported on Thursday that its purchasing managers index declined to 49.6 in September. High energy prices and electricity rationing are now apparently curtailing production. Since any reading below 50 signals a contraction, China is now slipping into a recession. China is now experiencing increasing electricity outages in many provinces as it struggles with high coal prices and is also striving to curb energy consumption to reduce carbon emissions. So just like California, Britain, and Germany, China is struggling to become increasingly “green” as hydroelectric output drops and does not have the ability to switch to natural gas.

Fortunately, here in the U.S., we are in much better economic shape. As an example, the Commerce Department announced that durable goods orders rose 1.8% in August to a record $263.5 billion, which was substantially better than economists’ consensus expectation. Another example of the big order backlog is that just this year, durable goods orders are up 24.7%, while shipments rose only 14.1%. There is no doubt that the shipping crisis and bottlenecks at the ports are contributing to this massive order backlog, which is great news for GDP growth.

The Conference Board on Tuesday announced that its consumer confidence index declined to 109.3 in September, and is now at the lowest level in seven months. The present situation component declined to 143.4 in September, while the expectations component declined to 86.6 in September. Lynn Franco, the Senior Director of Economic Indicators at The Conference Board, said “Consumer confidence dropped in September as the spread of the Delta variant continued to dampen optimism.”

Interestingly, the Atlanta Fed lowered its third-quarter GDP estimate to an annual pace of 3.2%. Weaker than expected home sales seem to be the primary culprit behind the Atlanta Fed’s downward GDP revision. Overall, the U.S. seems constrained by ongoing port bottlenecks, which are getting worse as retailers strive to stock up on merchandise for the holidays.

It will be interesting where natural gas prices end up if we have a cold winter in both Europe and the U.S. While Germany is embracing natural gas as a clean fuel in its green movement, the U.S. remains somewhat hostile to natural gas and is just viewing it as a “transition fuel” until the U.S. has no carbon emissions in 2050 or later. The problem of course is that it is hard to generate “green energy” in the dark winter months. The fact that the wind turbines froze last winter during Europe’s big freeze just exasperates the green energy conundrum. As a result, as Brent crude oil crosses over $80 per barrel and natural gas prices continue to soar, it appears that a new energy crisis is evolving and being implemented by governments that are hostile to fossil fuels.

In the meantime, inflation persists, which is great news for growth stocks, since they are a natural inflation hedge. Another good inflation hedge is residential real estate. As an example, on Tuesday, S&P CoreLogic updated their 20-city Case-Shiller National Home Index, which rose 19.7% in the past 12 months through July. Home price appreciation only slowed in 3 of 20 major metropolitan areas, namely Cleveland, Detroit, and Washington D.C. Phoenix remained the metropolitan area with the fastest appreciation for the 26th straight month, where median home prices have soared 32.4% in the past 12 months. Clearly, housing inflation persists but should cool off in 2022 as affordability issues curtail many prospective home buyers.

New Weekly Unemployment Claims Rise

Finally, the Labor Department on Thursday reported that new weekly unemployment claims rose to 362,000 in the latest week. This was the third straight week that weekly unemployment claims rose. These increases in new claims may persist since companies are now laying off unvaccinated workers due to the Biden Administration’s vaccination mandate for companies with 100+ employees. Interestingly, most of these unvaccinated workers may not be eligible for unemployment.

Heard & Notable:

Q2 2021 share repurchases were $198.8 billion, increasing 11.6% from Q1 2021’s $178.1 billion expenditure, and up 124.3% from Q2 2020’s recent low of $88.7 billion. Total shareholder return of buybacks and dividends in Q2 2021 was $322.2 billion, up 6.7% from Q1 2021’s $302.0 billion and up 55.1% from Q2 2020’s $207.7 billion (Q4 2018 holds the record, at $342.8 billion). Source: S&P Dow Jones Indices.