ValueWalk’s Raul Panganiban interviews Crescat Capital’s Kevin Smith And Tavi Costa, discussing their trade of the century idea. In this part, Tavi and Kevin discuss the Chinese currency bubbles and banking Ponzi scheme, how high can consumer confidence go, and buying the dip.

Q4 2019 hedge fund letters, conferences and more

Raul Panganiban: Yeah, definitely. Getting back to China’s banking, and you mentioned the depositors will feel it the most or in the positives would be the consumers. So would the consumer sector would that be a good place to start looking at the short in China, as that unfolds?

Kevin Smith: Potentially, we have a number of ADR short short positions in our fund in China. Some consumer oriented. And I don’t know that we want to get into specific names in this call, but you can look at my hand here. Now, there’s some pretty big ones out there that one can can look at.

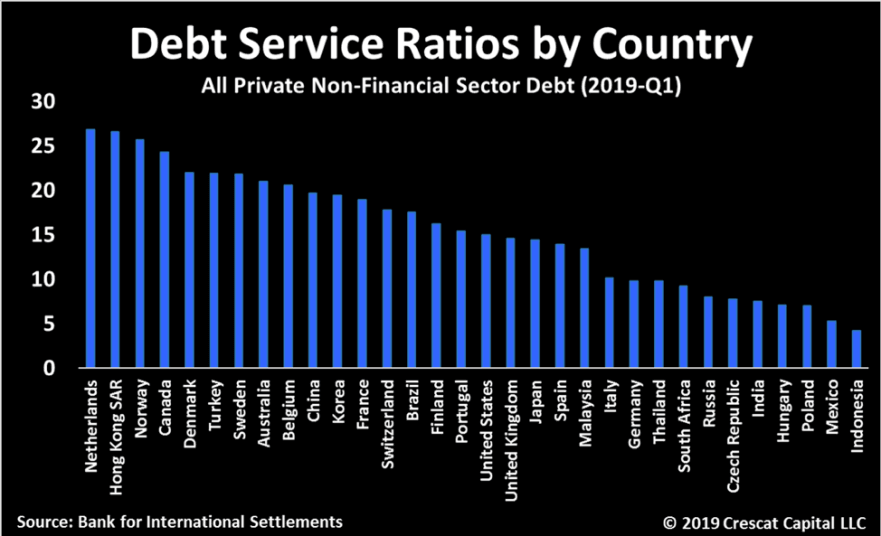

Tavi Costa: Yeah, and I think that the, you know, in terms of deposits on the banks, you can see, especially in Hong Kong and Canada, related to China, you can start to see some, some of that starting to dry out significantly. It’s decelerating growth in a level that we haven’t seen in many, many years. And in the industry that is interesting in China, it’s a little more difficult to short, but it’s it’s it’s also tallying from a macro perspective here is the home builders, I mean, you look at the homebuilders since await in you accumulate the free cash flow.

They have generated or First of all last because they haven’t generated any free cash flow at all, they lost close to 300 billion of dollars accumulated since away at the same time as they accumulated close to $600 billion of net debt. So that’s that side. That’s an example of an industry of a failing industry and very similar looks a lot similar, very similar to the to the Home Builders here in the US, I should say, the property developers, it’s what’s called in China really, but that whole industry is I mean, it’s in our view its falling apart.

And it’s only not falling apart more because of the government intervention. And the more you see that and it’s where we see the pain in the currency side and why we think that especially at the currency is where becomes even more attractive. And as people begin to find other reasons, other other places too, in terms of safe havens of investees. I mean, we saw jewellery demand picking up in China recently, we post a chart on Twitter recently in its or I should say the prices of jewellery have been rising significantly in China. And that’s just one way to go attack overdue, correct Yeah.

Which is just a way to to protect your your wealth if you’re if you’re in the communist place you can get your money out and you can’t really buy assets, they’re relatively cheap. So, you know, that’s all sort of failing and it’s an industry that again, it’s a failing industry that has just just be bleeding and is just bleeding cash every quarter for four years for over a decade and I think that’s not going to change.

Kevin Smith: But the yeah the bigger issue regarding the the banking and currency bubble that we see in China and it’s really a banking Ponzi scheme at its core is that is that the depositors are the are the car the ultimate creditors, to the banks that that and You know what a communist queen is a large communist system going through an economic downturn, that seeing rising domestic inflation that that has, you know, that is at the same time as its economy is going through a downturn and likely to see rising unemployment and you know, it’s almost as if coronavirus was an excuse to put everyone on furlough temporarily. What you have is a potential for the collapse of an entire country or economic system not unlike unlike the the USSR or other other emerging market or communist countries. I mean, let’s let’s be honest, when you when a highly indebted emerging market or communist country gets into an economic crisis, and you know, the problem we have is bank runs.

The problem you have is capital flight. And in China’s case, the money has been The you know, the elite money has been getting out of the country already now for decades. That’s why you have these housing bubbles, you know, with this is what’s been adding to these housing bubbles in Canada, Australia, Hong Kong.

But the book with capital controls, the average citizen of China is not able to get their money out day they’ve got they’ve got to, you know, buy, you know, hoard gold domestically, I mean, they also have to buy food and they have living expenses. They’ve been hoarding apartments because you know, apartments, do nothing but go up in price and you know, what’s going to happen when, when departments start going down in price, and, and when they try to get their money out of out of the banking system just to pay for basic needs. And as inflation is, is rising

. What you have is the potential for bank runs. And, you know, and the type of social unrest that we’re seeing already in Hong Kong because They don’t want to become a commie his tough dominated country and and so look at what’s happening there this the same same type of risk exists throughout throughout greater Mainland China and this is where we are today.

Tavi Costa: The timing for this investment thesis layout has never been greater in our view I mean the virus outbreak there’s never a great time in a great place for that to happen obviously that’s an awful thing for for for the for the world. But if there was a bad time in a bad place for that to happen, it’s China at you know, perhaps the largest bubble we’ve seen in history. At the same time as you had already a political crisis ongoing in places like Hong Kong related to China too. And and now you have the that pork prices were rising significantly or surging issues say for some time and now causing food prices to rise, you know, cause inflation rising and remember, we have a credit bubble, you have to think about the cost of capital structure that what what’s going to cause that to rise in order to pop the bubble? Well, either is inflation or you have defaults.

And I think we have a combination of the two today with the virus outbreak, a lot of those companies not being able to pay employees, or the whole economy is halted. You have empty roads, no consumption, production is completely stopped for a few months or a few weeks or so. And I think that that’s all going to have a huge impact and the economy is already faltering significantly in tumbling in our view.

So I think the timing has never been greater. If you look at the policies in terms of monetary policies, especially, you can see very clearly that they had been losing a policy significantly to stimulate the economy regardless if it is printing, you know, $400 billion dollars in the month or reducing rates in general that you can see Scheiber rates negative rates today in turn have real racing in China never made me know 10 year yields is, in real terms. It’s the lowest level since the global financial crisis. Another reason to own precious metals here. But anyways, I think the timing has never been greater for that thesis to play out.

Raul Panganiban: With what’s going on in China and around the world, how does that affect us here in the US and there’s a couple charts that I like that you guys put on the tide is going out letter, the equity earnings versus job openings, and then the consumer confidence versus misery index nd if you guys can comment on those?

Tavi Costa: Sure. I think that that’s the idea of that was exactly what I mentioned earlier, which was, those are the two things that have not really break out in a big way was the consumer confidence and labour markets in general. Some parts of the labour market started to break. We’ve had a you know plunging job openings, numbers, as we stated that many times, you had jobs, continuing jobless claims beginning to, to rise in a year over year basis. No. First time since the global financial crisis two, I think that uh, but you know that that that really was the idea of that ratio was to look for Okay, well, how low can unemployment rates go?

And how high can consumer confidence really go? If we look at a ratio of that, you know, how high is it relative to history? And is it it is at its highest level since the global since the tech bubble in the 1973-74, right prior to those recessions as well. But we have, you know, even prior to the outbreak here of the virus, we’ve had a lot of macro deterioration in general a minute, we’ve had earnings were contracting significantly. Even prior to that we had the yield curve inversions, which we even we didn’t even touch much here. But [inaudible] inversions is critical. I mean, we calculate a different way resident looks If one or two or three spreads, we looked at the all the spreads all the possible 45 spreads in the yield curve, and calculate how many of those are actually inverted.

And we realised that about 73% of them are exactly 72% of yield curve. The US yield curve was inverted, back in August of 2019. And every time we hit the handle of 70%, we’ve had a recession all the way back to the 70s a perfect track record, either preheated a recession or coincided with one, it’s proving right. Again, I think that this this indicator is going to be right, in my view, and again, when you looked at what are the best holdings, what are the best assets to own during those times, and if you do the empirical analysis of that, you realise that it’s owning gold and selling stocks, you know, in other words is owning the go to s&p 500 ratio, and that you know, tends to even double in a two year horizon regardless if it is because of gold prices rising significantly or just stock prices.

Is plunging you know 50-60% depending on the levels and now we have this sort of a massive commodity to equity ratio distortion going back in history, especially with precious metals, and that gives another conviction to to go there and implement that trade. But you know, so you know, combining that with or 16 factor macro model there was also signalling that we’re very late in the business cycle I think that all kind of signal that we’re you know, that the markets are very close to falling apart.

And then when the virus outbreak started, you had copper prices and oil prices completely plunging, number one you had gold and and in treasuries rally significantly, especially in the first part of it, even prior to the equity markets declining. And that really kind of preceded the whole situation in our view, and and now everything is unfolding very quickly. This bizarre disorderly sell off that we’re seeing I mean, it’s it’s, you know, we’re overdue for that.

And it’s incredible that when you start seeing that people remember of December 2018, that that whole sell off that happened back then. And now it’s even worse than that. But as people remember that they really, you know, they really embrace that idea and start getting risk off the table. And that’s how you see this playing out so quickly. I think it’s just the beginning. Really, I mean, this. Now, in our view, this is a trend that is going to go a lot lower. We’re way too far in terms of valuations.

Kevin Smith: Sure, we’re going to see bounces like we seen this morning. And know, we asked some hedges for those types of events. And, you know, we original question that led into this was, you know, is is China going to be contagious on the on the rest of the world? And absolutely, it’s been responsible for more than 50% of global GDP growth since the global financial crisis. Now look at what’s happened to oil prices here recently, as this downturn has has China has accelerated with Coronavirus. And so, yes, it’s going to be contagious. It’s the housing bubbles in the other countries that we’ve already talked about that have been related to the capital outflows from from China. We look back to 1989 here in the US when when we had a real estate bubble here back then that was a derivative of the Japanese equity and property bubble and you know, Japan was going to take over the world at that time.

And yet, you know, they had a an ageing workforce population problem and domestic equity and real estate bubbles that were, you know, very similar to China and you know, both the demographic of their of their age group as well as, as the bubbles now, it’s not not so much an equity bubble in China, as it was in Japan but, but in terms of all the capital that is spilled out all over the world to feed other real estate bubbles out that was very similar one huge difference with Japan and and in China today and why we’re so bearish on the Chinese currency is that all that money that in Japan that went out over the world you know came back and so their their currency was was okay meanwhile their equity and real estate local real estate bubbles collapsed and and really never recovered for 30 years and it’s been amazing an amazing amazing macro story there but with with China we don’t think the money is coming back and that’s the big difference.

The money because you know it’s a communist, totalitarian communist country that that money the left China it does not want to come back it’s trying to get away and it’s trying to protect itself. But there’s but when the currency goes You know, all that, ultimately in China when the one devalues all that, that capital flight that’s been coming to help to, to stimulate the rest of the world economy, whether it’s China buying oil and copper and iron ore, or whether it’s it’s the money that’s been been spilling out buying real estate, that is gone, and that’s gone. And so that that is is one huge reason why the China bust is going to be globally contagious.

Tavi Costa: And I think it’s also important to the for the, you know, our Look, the difference between the, you know, like, wait, for instance, was a result of credit bubble. And, you know, in terms of asset price, relative to fundamental, especially on the equity side, it wasn’t so extreme and that we view in the world today here is that China is that credit bubble that we saw really back in, in a way here in the US, but here in the West, where we see the issue is a lot more in asset prices in terms of the distortion of prices to fundamentals and In almost like a euphoric bull market that we’ve seen, since always sort of driven to through Central Bank policies in number one.

I would say, and also through the capital outflows of China, overall in the globe, especially in real estate markets, like Australia and Canada, in Hong Kong, but that’s a little bit of the difference between the two, I would say, but it’s, it’s how it you know, in terms of of gravity, you would expect that the asset prices, especially in the US, as everything starts to unfold, you would expected that that would be the biggest place here. It would be in the short side of equity markets in the US.

Raul Panganiban: Yeah. And then, so we, you know, like the headlines and saying that everything’s going down. And then you always hear people saying, oh, buy the dip. So, what are your thoughts on that when people say buy the dip right now? Are we at the bottom or its gonna keep coming down?

Kevin Smith: I think you know, for short term hedge, you know, and we have put some short term hedges on, you know you after you get a big short 20% correction that happens it’s just a matter of a couple of weeks you know, it’s time to put some hedges on we and yesterday we added as an edges in the, in the in the oil patch and you know we also of course have the long precious metals, which we we’ve added to those companies recently as well and they they pull back here here too. It’s you know, it’s important to point out that we are not perma bears, we are tactical bears and and you know when is the time to really step up and buy in in the midst of all this and that’s where the you know, things like our macro model become very important because we want to be aggressive buyers at the depths of the recession, but but we much prefer to be acknowledged that there is a business side And, and and there is a lot of downside, we think still ahead for stock prices.

You look at reversion to the to the to the mean, you look at median valuations and and when you get into a big global crisis, economic downturn like the one we think we are going to see here, mainly because of China blowing up. We, you know, we expect this to be one that goes beyond the mean. And but just a reversion to the mean is this is a it’s like a 50 is high 50% correction from these resistance recent market top in terms of s&p valuations.

And, you know, if you go one standard deviation below the mean, which we’ve seen in history, it’s like a 70 plus percent, you know, you know, decline and so, we need to let the economic downturn play out before we become too aggressive of a virus here, we think there’s substantially more opportunity on the short side of the market. And the scary thing is that there’s so many passive investors out there today that you know, I went to University of Chicago and there’s a huge contingent of efficient market folks there, you know, really, that have been drumming this, this you know, you can’t, you can’t time the market, you can’t beat the market, just buy and hold by the passive indexes, low fees, and then, you know, it’s great.

It works great during during bull markets. But I don’t know that the average investor really has the fortitude to be able to hang with it like they’ve been taught to and so they’re going to be taught to their advisors are going to be calling them on the phone and say, you got to hang in there, you got to hold on, you know, if you got cash, it’s time to buy the dip. But this is unfortunately just one of the things that is going to make this downturn even more even more brutal, I’m afraid And I believe it because we are in a passive investing bubble. And you know, there there there is a business cycle and I just don’t think the average investor can get hang in there and so it will make the bear market more of a grinding one as as these investors do capitulate ultimately, but we think it’s a lot of them that much lower prices.

Tavi Costa: And also if I could add more market the equity markets fall I think that it becomes precious metals become more of a smart hedge here, as the narrative shifts towards the we’re gonna have to see in order to for equity markets to really rally here we’re going to have to see some some significant innovation and I think that that’s what makes precious metals become even more attractive going forward, especially when you rely on or empirical analysis of the yield curve inversion and really think about that go to s&p 500 ratio, go back to that ratio in which You know, sometimes parts of the lag will work you know the words right now we had precious metals didn’t work so well but the the equity shorts really offset the losses and or massive losses more recently but the losses on the on the precious metals side.

But you know that that’s I think that’s important part is to look for those smart hedges I think that ratio overall will continue to rise going forward as we get into regardless of you know, such as steep downturn that we had in such a short term really 20% almost decline in a few days, or one to two weeks.

And it’s so i think that i think precious metals are becoming an incredibly interesting hedge and I think favouring a basket of companies they’re afraid favouring a diversify way of, of putting that trade on implementing that trade regardless if it is gold, platinum, silver, and is an important way to rather than just take a concentrated position here. And I think that that’s that will be a smart way hopefully to hedges during those periods and it’s not going to be a straight line down. But as that plays out, I think the precious metals will become more and more of could hatch here.

See the full transcript here