Kerrisdale Capital is short shares of Carvana Co (NYSE:CVNA), a $4bn market cap online platform for buying and selling used cars. Originally hyped up as an innovative disruptor, Carvana is now recognized to be just a poorly run auto retailer struggling under the challenges of a severe industry downturn and the unsustainable burden of $6.5bn in debt.

While many have shared concerns over Carvana’s business before, we voice ours at a time when shares have risen 165% in only a month on misguided optimism for profits that amount to little more than buffing the paint job on a totaled car.

Over its history of burning billions of dollars of investor capital to manufacture topline growth, Carvana has never generated sustainable profits or free cash flow. Even during the pandemic, when Carvana was virtually the only online option for scores of desperate car buyers willing to pay any price, the company failed to turn an annual profit.

As the prospect of bankruptcy loomed, last year management began slashing costs, shrinking its operations and finessing working capital to try to generate positive free cash flow, and still failed. The company is pursuing a last-ditch attempt to sell markets on a new narrative, but ultimately, the business can’t escape the following reality:

1) whether a small local dealer or a tech-driven online platform, flipping used cars is a tough, capital-intensive business with lousy margins and,

2) any company can grow quickly and take share if run irresponsibly on costs, especially if capital markets are willing to foot the bill.

Rather than representing true disruptive change, Carvana is a flawed player, armed with tools no better than the competition it seeks to disrupt and led by a management team which lacks seasoned automotive, operational experience.

Carvana didn’t make money even when cars sold themselves, interest rates were low and used car prices were skyrocketing. Today, none of that is true anymore, and the company has no hope but to eventually restructure its massive debt load.

Carvana’s fundamental fate was sealed last May. In an epic blunder, Carvana management misread the sustainability of pandemic-induced industry conditions and issued billions in high yield debt to finance the purchase of additional capacity, just as macro and industry conditions began choking demand.

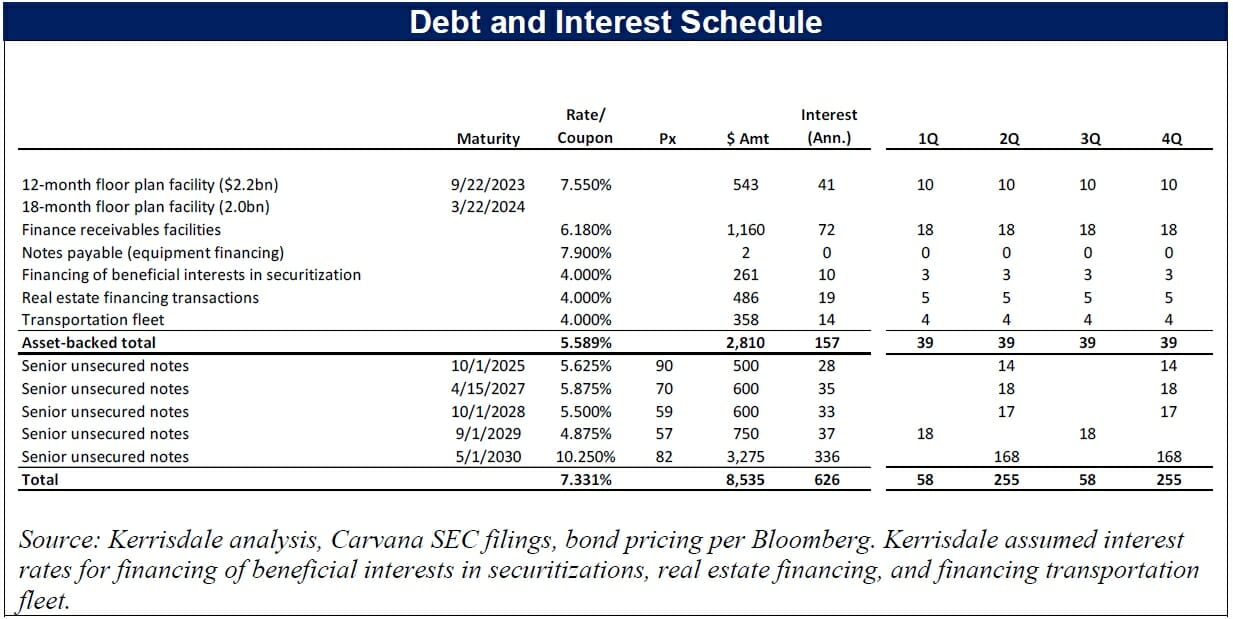

All these conditions persist today with few signs of improvement. Against this backdrop, Carvana pivoted abruptly from all-out growth to finally focusing on profitability, but it’s too little, too late. Carvana’s aggressive cost cuts may succeed in slowing the rate of cash burn, but with over $700m in annual interest expense and capex, it simply cannot generate enough profit to stop the negative cash flow.

As the year progresses, cash and liquidity will dwindle further, and Carvana will be staring at over $250m in interest payments in the 4th quarter alone, its seasonally slowest period. After repeated attempts to improve liquidity through a bond exchange failed, last week the company conveniently pre-announced “better than expected” 2Q EBITDA, not because of sustainable, fundamental improvement in its core business, but primarily due to large one-time loan sales – a move which reeks of pumping shares ahead of a potential equity offering.

Despite the stock’s fall from all-time highs, Carvana shares are worthless. Comparisons to tech/e-commerce platforms are nonsensical. Carvana should be valued like any other publicly traded auto retailer, and specifically one that is poorly capitalized and more cyclical due to a lack of diversification and subprime exposure. We view the equity as a zero and investing at current levels is a worse deal than buying a clunker from a slick used car salesman.

Executive Summary

Shares have risen on misplaced optimism regarding profitability. 1H23 results are not indicative of normalized profitability. 1Q23 was heavily distorted by unusual inventory and pricing adjustments following a disastrous 4Q22, and the recent 2Q23 pre-announced “beat” was all due to the pull-forward of loan sales which are unsustainable in the coming quarters.

We believe investors should be highly skeptical of results from a company looking to sell markets on a new narrative in order to raise equity capital to stave off the threat of bankruptcy.

Liquidity is thin and investors bear rising risk of dilution. Of Carvana’s touted $1.5bn in cash and revolving facility availability, only ~$500m is cash on hand available to pay for debt interest expense; the rest is available only to finance vehicle inventory and its auto lending arm.

Furthermore, issuing secured debt or conducting a sale leaseback of real estate, particularly the ADESA assets, bears underappreciated risks and involves incurring more debt and interest costs at a time when Carvana is supposed to be slashing both. Carvana is engaged in a protracted fight with a concentrated, coordinated group of bondholders that collectively owns 90% of the bonds.

A distressed debt exchange that would have modestly reduced the face amount of debt and avoided equity dilution was met with immediate opposition from the group and ultimately failed. The ongoing standoff, particularly as we approach 4Q23 when $255m in bond interest payments are due, increases the risk that Carvana will look to take advantage of the recent rise in its share price to issue equity.

Slashing costs is not a viable strategy to outrun balance sheet and liquidity issues. At the pace of current unit sales, Carvana would need to generate $2,300+ in EBITDA per retail unit sold to cover $700m in interest expense and capex (~300,000 vehicles x $2,300 in EBITDA per vehicle = $700m in EBITDA). This is unrealistic.

After slashing costs, and benefitting from significant abnormal valuation allowances, in 1Q23 Carvana still lost $303 in negative adj. EBTIDA per retail car sold. The vast majority of expense reductions have also come from advertising (contributing to a ~50% decline in website traffic) and headcount reductions – areas that would have to be reinvested in if Carvana were to ever resume meaningful growth.

Carvana needs much more profit as well as much more growth – not just one or the other – but doesn’t have the liquidity, capital structure, management capability or business operations to achieve much of either.

Carvana lacks the tools and talent to navigate an uncertain used car market. According to multiple former employees with experience building and operating the data platforms Carvana uses to manage inventory, Carvana’s data analytics are fundamentally flawed.

The system is simply too slow, overly reliant on historical data, and not equipped to capture myriad macro changes to drive reliable decisions in anything but stable, predictable environments.

Those flaws were exposed by the pandemic and its aftermath and are compounded by a management team lacking in seasoned automotive and logistics experience. Rather than building a company that harnesses technology to smooth out the challenge of operating during challenging times in the used car industry, Carvana built one that amplifies them.

Carvana’s competitive differentiation is gone. According to several Carvana senior executives we interviewed, many of the differentiated, consumer friendly offerings that helped Carvana rapidly gain share are no longer unique.

Combined with no longer being able to jam credit markets with the bill for irresponsible cost management, topline growth going forward will resemble that of any other large dealership. Multiple online competitors provide no-haggle offers, fast payments, and flexible delivery options.

At the same time, Carvana has had to adopt the less consumer friendly practices of traditional dealers it once targeted for disintermediation to generate better profits. Over the past year Carvana has curtailed vehicle selection and reduced convenience by charging a higher delivery fee when a customer wishes to purchase a vehicle that is further away.

We believe Carvana should not be valued as anything other than what it is: a poorly positioned, poorly capitalized auto retailer.

Read the full report here by Kerrisdale Capital Management.