What’s New In Activism – Carl Icahn At Crown Holdings

Carl Icahn acquired 8.5% of Crown Holdings, Inc. (NYSE:CCK) and believes the beverage-can maker should divest non-core assets and accelerate buybacks, while suggesting he may target the board in a proxy contest.

Icahn’s investment, worth about $780 million and disclosed on November 3 in a 13D filing, makes him Crown’s second-largest shareholder. In the filing, Icahn said he believed the shares were undervalued and revealed plans to engage with Crown’s leadership on ways to address the issue, including through potential changes to the company’s governance and capital allocation policies.

Q3 2022 hedge fund letters, conferences and more

Icahn said at an investor conference on the same day that his firm was interested in gaining board representation at Crown and hinted at a potential proxy contest.

Icahn believes Crown should consider spinning off or selling non-core divisions like Signode, a specialist in transit packaging the company acquired in 2017 for $3.9 billion, people familiar with the matter told the Wall Street Journal. The activist is also targeting Crown's aerosol and food-packaging operation as well as its minority stake in a European food-can business.

Activism chart of the week

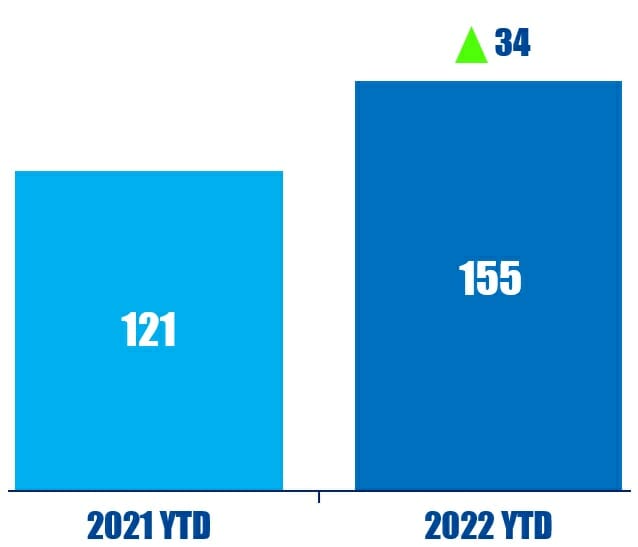

So far this year (as of November 3, 2022), activists have initiated campaigns at 155 Asia-based companies. That is compared to 121 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - COP27

A group of 602 investors issued a call to governments around the world to implement the policy actions needed to address the climate crisis and accelerate the transition to net-zero emissions ahead of COP27.

In a November 2 announcement, the $42 trillion investor coalition urged governments to implement five priority policy actions including establishing medium- and long-term climate strategies, transitioning energy away from fossil fuels, ending deforestation, bolstering climate finance, and strengthening disclosures.

Other requests include for governments to contribute to the reduction in non-carbon dioxide greenhouse gas emissions and support the effective implementation of the Global Methane Pledge to cut levels by 30% from 2020 levels by 2030.

"We are committed to working with governments to ensure policy mechanisms are developed and implemented to transition to a climate-resilient, net-zero emissions economy by 2050 or sooner," the statement read. "The ongoing energy security crisis further highlights the imperative for an orderly transition."

Voting chart of the week

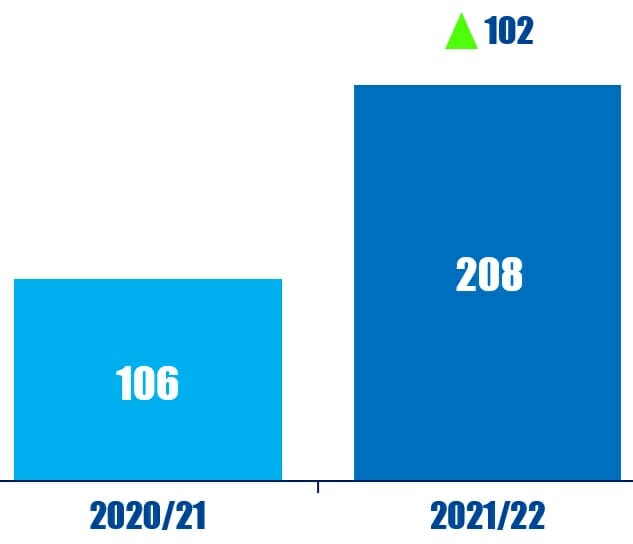

There were 208 social proposals at U.S. companies in the 2021-22 proxy season, almost twice as many as 2020-21 (106). This data point comes from The Proxy Voting Annual Review 2022.

Source: Insightia | Voting

What’s New In Activist Shorts - Murchinson’s Nano Dimension Acquisition Offer

Canadian investment firm Murchinson, Nano Dimension Ltd (NASDAQ:NNDM)'s biggest shareholder, is said to have made a $4-per-share offer to acquire the rest of the 3D printer company. Nano was targeted by a short seller last year.

Murchinson made the offer, which values Nano at about $1 billion, in a September 5 letter to the board, according to Bloomberg. At the time, the bid carried a 52% premium to the unaffected share price.

"We believe that our proposal is the best opportunity for shareholders to achieve maximum and certain value for their shares," wrote Murchinson's CEO Marc Bistricer, according to the newswire. Murchinson reportedly owns 10 million Nano shares, the equivalent of a 15% stake.

Two months ago, Nano reported first-half revenues of $21.5 million, compared to just $1.6 million a year before. In an October 24 statement, it said that it expected third-quarter sales to come in at $10 million, an increase of 646% from the same period last year. The company also had a record backlog of $9 million at the end of September.

Shorts chart of the week

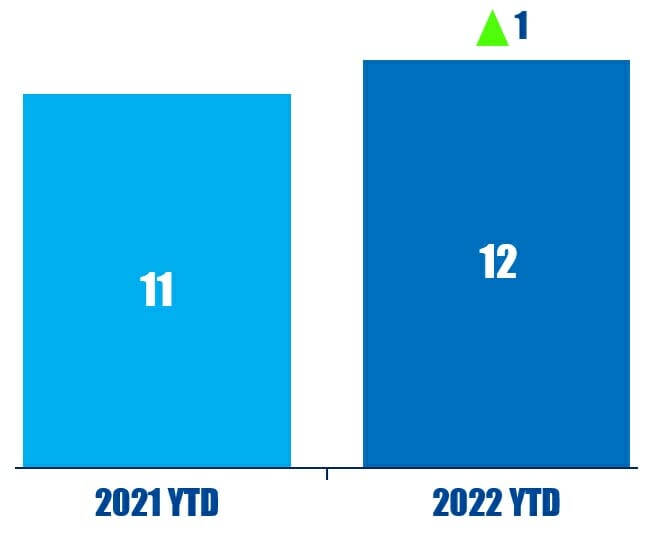

So far this year (as of November 4, 2022), 12 public activist short campaigns have alleged product ineffective against the company. That is up from 11 in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from George Norcross in a November 1 letter highlighting his "utter astonishment" at the departure of Republic First Bancorp Chief's Frank Cavallaro. Read our coverage here.

“We have read with utter astonishment the 8k filing submitted to the Securities and Exchange Commission late last Friday announcing the abrupt departure of Frank A. Cavallaro, Chief Financial Officer Of Republic First Bancorp, Inc.”