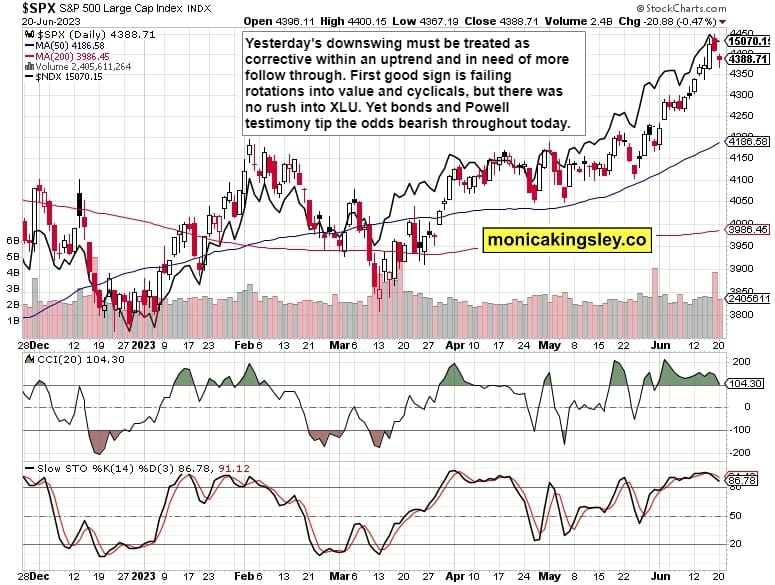

S&P 500 followed through on Friday‘s decline, yet the strength of the intraday reversal higher begs the questions whether the buyers can stage a comeback. Market breadth lower than -1,000 for advance decline line suggests an uphill battle for the buyers, and so do the largely non-existent rotations of yesterday.

I‘m not looking for Powell to deliver any kind of dovish surprise – the market is likely to be disconcerted by hearing not one but two rate hikes still this year, with really no cuts. Real assets are for today erring on the side of caution, even if USD remains flat and unable to hold however modest appreciation attained.

For all the fresh Treasury financing needs, there‘s not liquidity leaving the markets to support a squeeze on bulls yet. Meanwhile, markets are gladly ignoring 70% recession odds by the Fed‘s own models, and more.

Implications for stocks? Covered Sunday:

(…) The market topping process thoroughly described a week ago would come from sheer overvaluation driven by AI FOMO that has taken stocks into extreme greed territory already – from realization thereof. Perhaps characteristically, while the bullish sentiment rises, stock funds are seeing outflows to bond funds.

The current rally is built on the false notion that recession has been and would be avoided, that earnings would start to rise, and that incoming data aren‘t generally bad. Further, markets still expect the Fed to cut rates, and significantly so – disregarding and challenging Powell who said no real cuts over the next 2 years, with Fed funds rate projected at 5.6%. Yet tech still keeps doubting the yields message – and its only saving grace Friday was that volume wasn‘t considerably higher.

To me, this current sky is the limit bear market rally has the hallmarks of post dotcom bubble and even the 2008 suckers‘ rallies when it was either not universally accepted that recession was already here, or it was fiercely debated whether the worst was actually over.

While it‘s notoriously hard to time the top in euphoric upswings of current Nasdaq flavor, the bubble going from developing to having developed would give way to ridiculous overvaluations and rotation the like of which we saw Friday – away from tech and other Top 10 leaders belonging to XLC and XLY in favor of defensives (XLU, then some XLRE with perhaps XLP and select XLV components) and really undevalued resource stocks from oil stocks to precious metals and base metals miners.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren’t enough) – combine with Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 4 of them.

S&P 500 and Nasdaq Outlook

Bulls can forget about ES 4,490 – 4,510 area – there isn‘t enough sectoral breadth or looming catalyst of such a move. Even 4,448 would be a tough nut to crack – it‘s unlikely that the bearish positioning is to such an extent that it would cause a brief short squeeze. The 4,415 area certainly looks more easily attainable, and tech would lead any downswing again.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.