The Broad Market Index was down 2.11% last week and 41% of stocks out-performed the index.

Second quarter financial statements have been collected for 90% of the companies in our Otos database. There will be a slow period now while we wait on the last of financial statements for companies with quarters ended July expected by the first week of September.

Growth continues to fall in the technology, basic industry, energy and consumer cyclicals sectors. With inflation rising and long bonds yields up, falling growth makes stocks vulnerable to decline.

We will continue to focus on sell decisions and plan about large cash positions after the update is complete.

With our low-risk short term investment (MINT) yielding over 5%, and growth falling it is too early to buy stocks.

Energizer Holdings (ENR) $34.840 SELL This Rich Company Getting Weaker

Energizer Holdings (NYSE:ENR) has been a profitable company with persistently high cash return on total capital of 10.4% on average over the past 21 years. Over the long term, the shares of Energizer Holdings have declined by 77% relative to the broad market index

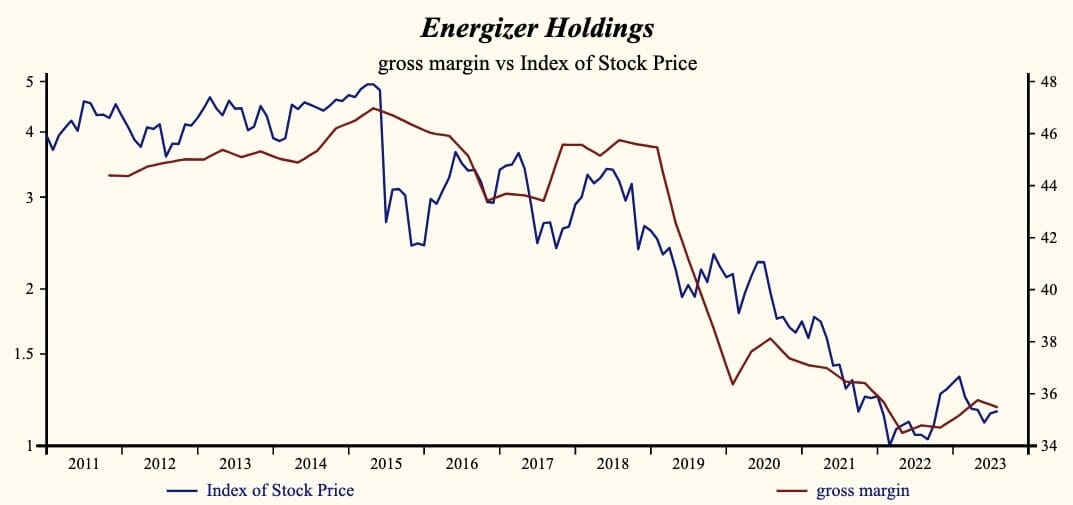

The shares have been correlated with trends in Growth Factors. The dominant factor in the Growth group is the Gros Profit Margin which has been 60% correlated with the share price with only a one-quarter lead.

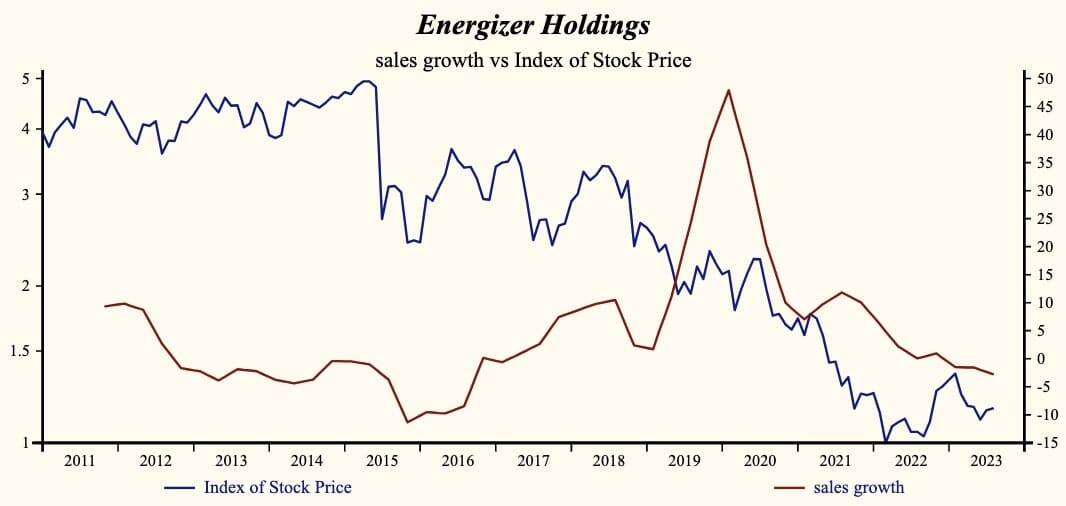

Sales Growth to fall

Currently, sales growth is -2.7% which is low in the record of the company. Sales growth has been steadily declining since its peak in early 2020. Negative sales growth; sales have been shrinking since June 2022. Another telling sign is that receivables continue to increase putting in question the potential of future sales.

Margins Looking Weak

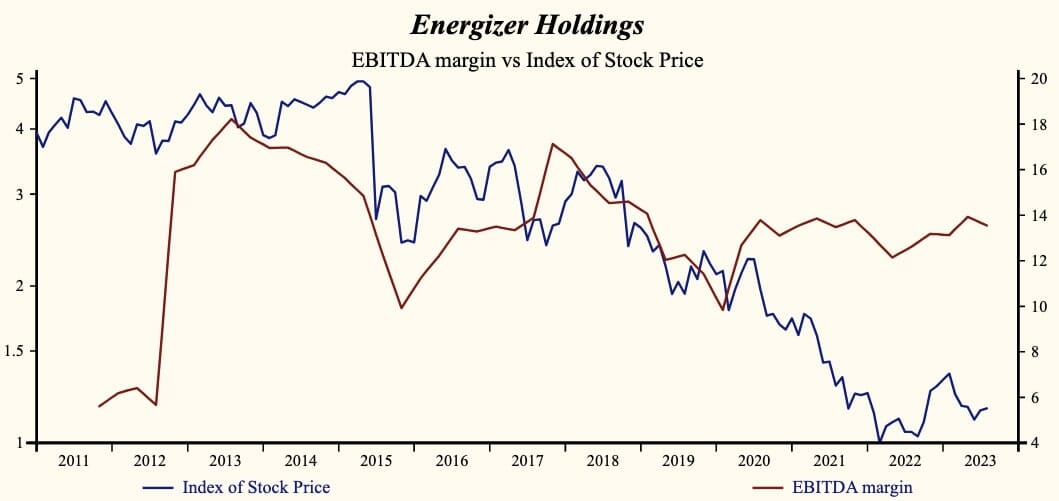

The company is recording a high and falling gross profit margin. Sales, General & Administrative (SG&A) expenses are low in the record of the company and started to rise. The company has room for further cost containment but for now rising costs with a weaker gross margin is slowing the EBITDA growth rate relative to sales and cash flow.

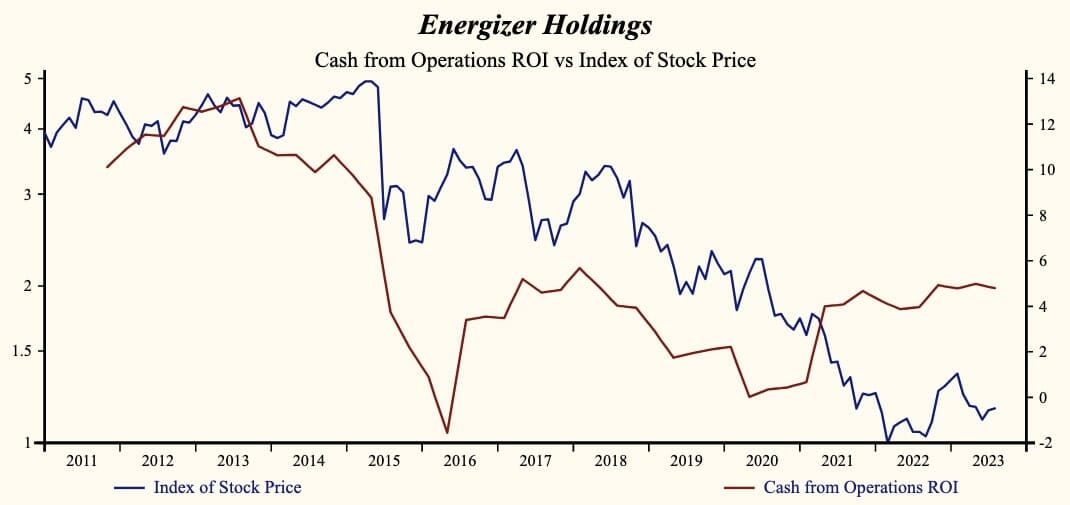

Cashflow Stalling

Free cash flow growth remains around its highest level since 2015 but down-ticked last quarter. As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. The weaker gross margin and higher costs is producing a slowing in the EBITDA profit margin thereby decelerating free cash flow growth as well. Interest costs relative to sales have also been steadily increasing since late 2021.

Dividend Not Enough

More recently, the shares of Energizer Holdings have advanced by 11% since the March, 2022 low. The shares are trading at upper-end of the volatility range in a 17-month rising relative share price trend. The current indicated annual dividend produces an interesting yield of 3.5%.

However, the current extended share price and the broad weakening in fundamentals provides a good opportunity to sell the shares of this evidently decelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.