The Broad Market Index was up 2% last week and 63% of stocks out-performed the index.

Q3 2021 hedge fund letters, conferences and more

With most US companies now reporting 3rd quarter financial statements it shapes up to be another astonishing jump in corporate growth. Based on the most recent data, sales growth is up again at 77% of US listed companies with an average sales growth rate of 26.5%.

Currently, 3/4 of total market capital is achieving corporate sales growth improvements. That is a huge number and largely generated by an astonishing rebound in the Energy where the sector average sales growth was -54% during the virus depressed 2nd quarter of last year and now stand at 46%.

Sector Valuation Opportunities

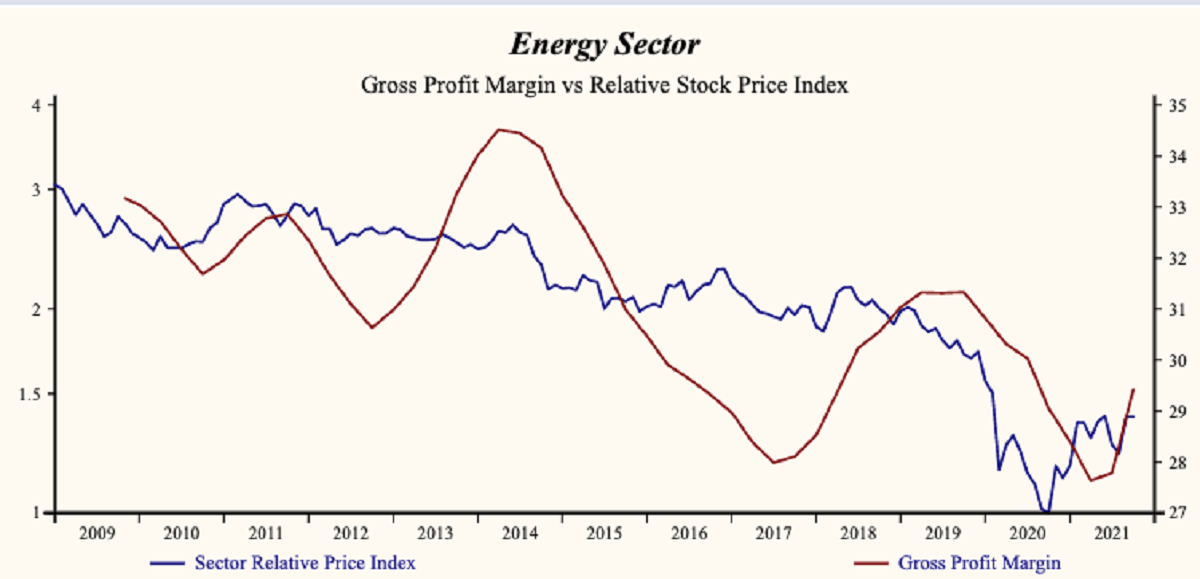

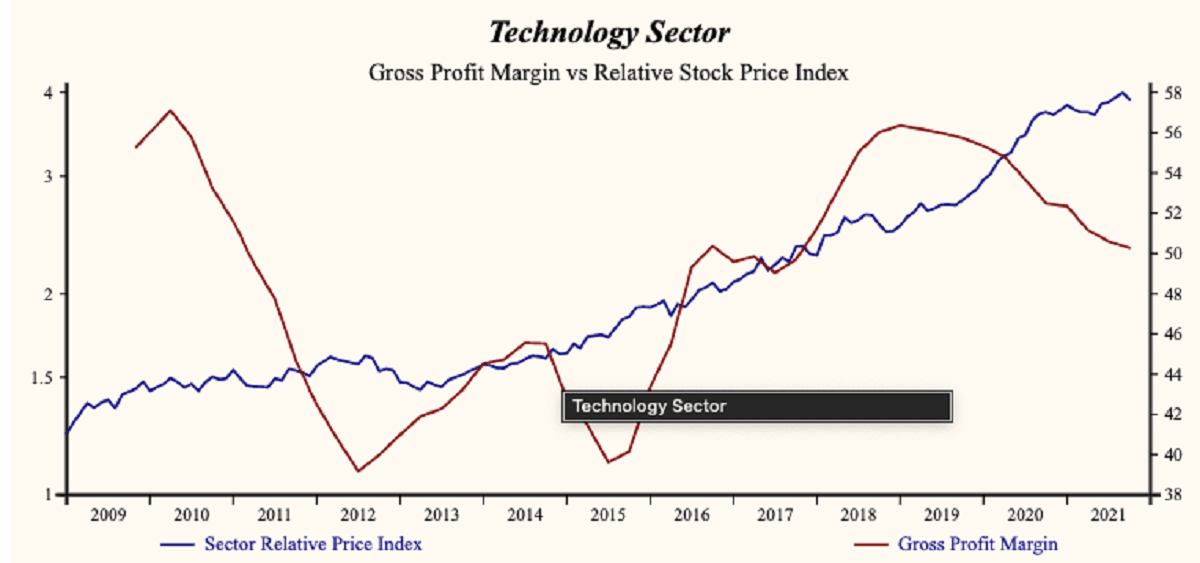

Average sales growth of the energy sector is now higher than the technology sector while price valuations are far apart. The average price-to-sales of technology stocks is 2x; while driven by bigger cash flow, the energy stocks are currently reporting 0.46x prices-to-sales.

Even Higher Oil Prices

That valuation gap was the highest ever this summer and is now closing with technology down and energy up. Energy sector capital expenditure-to-sales reached an unprecedented high last year and is now down for the third consecutive quarter. That is a reliable cycle trough indicator and with oil supply growth constrained and demand still rising.

Overheated Corporate Sector

Pent up desire to spend, rising wealth, low interest rates, easy access to credit and fear of missing out on rising asset prices has produced an overheated corporate sector. Add to that the newly legislated federal infrastructure spending and there are all the conditions for rising commodity prices and inflation.

Inflation Effect On Sectors

As commodity and labor costs rise at a faster rate than product prices, the gross profit margin falls. Noteworthy, the average gross profit margin of US companies has been falling since 2019.

So far with the recent numbers, the average gross profit margin was down in the technology and consumer growth sectors and was up in the consumer cyclicals, basic industry and energy sectors.

Investors do not wait. Get ready for Active Management now!

It is important to be scrupulous around growth attributes of your portfolio companies. With share-price indexes back to all-time highs, it is best to sell stocks of companies with falling growth.

Review your portfolio MoneyTrees and sell stocks of companies with lower sales growth (Red Moneytree Trunk) and falling profit margins (Red MoneyTree Pot)

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.