The latest US inflation data sent bond yields higher with the core CPI rising 1.8% y-o-y versus consensus at 1.7%. 1 The US 10-year treasury yield neared levels just under 2.6% and analysts at HSBC are forecasting a yield of 2.3% by 2018 year-end.2 With a practically mouth-watering return delivered from US equities in 2017, what risks and/or opportunities, do these spikes in bond yields pose for global equities in 2018?

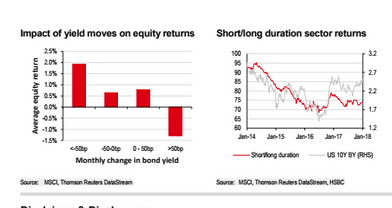

History has shown us that we can expect equities to gain strength from a backdrop of continually rising yields. However, this is only the case when the yields grow steadily rather than sharply. If yields continue sailing upwards at this rate, we might not see such favorable outcomes in all equity markets. Under these circumstances, we might see a divergence in sector performance.

Investors can expect sectors that benefit most from higher yields to perform positively as expected – specifically financials and industrials with their short duration are already showing signs of benefiting, outperforming other sectors by an impressive 1.5% in the last month alone. 2However, investors should not bank on short duration segment in isolation.

Backed by strong economic fundamentals, long duration staples and telecoms are also poised for delivering stable returns in 2018. On the other end of the spectrum we are already seeing the impact on equities of negative sensitivity to bond yields – with utilities underperforming close to 10% over the past 4 weeks of trading. 2

Where do emerging markets fit in?

While global equities marched higher on average over the first two weeks of trading in 2018, developed markets significantly outpaced their emerging market peers in this asset space. Investors should keep in mind that the upwards movements in developed market bond yields have the power to throw emerging markets’ strength off course. We therefore might expect to see some struggling for emerging market equities over the short to medium term.

However, assuming we do not experience any additional sharp geopolitical risks/ shock type events in the market, it looks like there will be spoils enough to go around. Industrial output is forecast to grow across the globe throughout the year – supported by firmed up macro factors across both developed and emerging markets.

New Year – Buoyant Flows

Investors have kicked off 2018 with sizeable inflows into equity markets – with equity funds experiencing inflows of USD 24.5bn in the week ending 12th January 2018, a 6-month peak in weekly inflows. Looking at current indications, investors have not been put off by any short term softening in emerging market equities as inflows to EM funds have outpaced developed market funds so far this year.

Retail investor sentiment has been a major factor in these inflows – with recent asset allocation investor surveys signalling that bullish sentiment is at multi-year high.3

Overall, bullish sentiment on global equities is strong. For all the tactical investors out there, apply some yield risk- optimized allocation to capture that extra bit of alpha.

Source:

1 Trading Economics,

2 HSBC Global Research, 14th January 2018, Global Equity Data Monitor

3 AAII investor surveys