Blackstone Group Inc. is a major American alternative investment management firm based in New York City that recently bought the Certified Collectibles Group (CCG). CCG is one of the foremost providers of grading and conservation services in the global collectibles sector. If you like graded coins or banknotes, you probably already have some of their products! Recently, Blackstone agreed to buy a majority stake in CCG, valuing the company above $500 million. However, Mark Salzberg, the founder, and Steven R Eichenbaum (CEO) will continue to hold a considerable minority stake in CCG. What this means is, Blackstone and CCG will be working together to grow its already successful business even further. This partnership may revolutionize the world of graded collectibles in more ways than we can imagine for the better!

[soros]Q1 2021 hedge fund letters, conferences and more

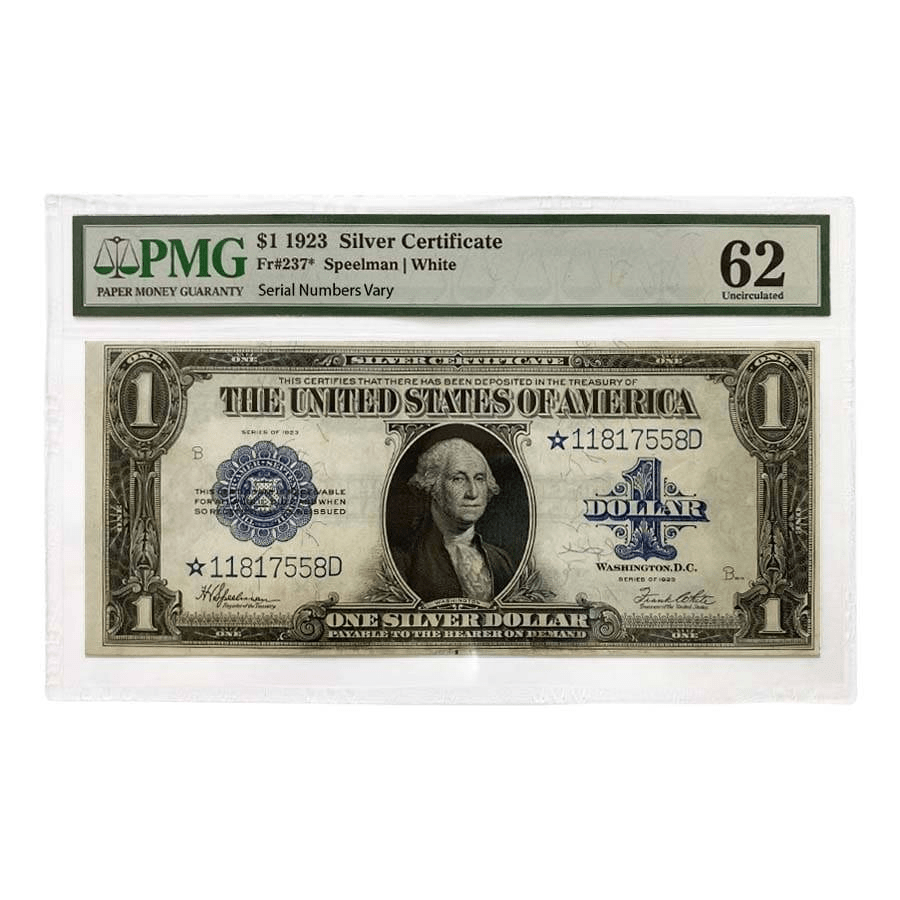

1923 $1 Silver Certificate Currency Note PMG UNC 62

Who is CCG?

CCG is an expert company that provides impartial and technologically advanced grading services. These services add value and liquidity to investments like coins, banknotes, comic books, trading cards, sports cards, stamps, and more. Since 1987, CCG companies have certified over 60 million collectibles, infusing billions in value for secondary market items.

Most importantly, it is made up of:

- Numismatic Guaranty Corporation® (NGC),

- Numismatic Conservation Services™ (NCS®),

- Paper Money Guaranty® (PMG),

- Classic Collectible Services® (CCS®),

- Certified Sports Guaranty™ (CSG™),

- Authenticated Stamp Guaranty® (ASG®), and

- Collectibles Authentication Guaranty® (CAG®).

Bullion Exchanges is proud to provide a wide range of NGC-certified and PMG-certified products. You can see our graded coins and certified banknotes regularly on our website.

2020 1 oz & 1/2 oz Mexican Gold Libertad Coin NGC MS 70 ER

What’s So Important About Blackstone And CCG?

Today, Blackstone takes ownership of CCG to expand the company even further than it has done on its own. To put it into perspective, Blackstone is an internationally recognized investment firm with almost $650 billion under management assets. Also, they have a consistent record of creating value and leaving a positive impact on the companies they invest in. Their goal now is to boost the reach of CCG’s services, add more employees to the company worldwide, and acquire new technologies to improve CCG’s services.

The fact that Blackstone now, as an extension, owns NGC, means that graded coins might look a lot different in the near future. The sky is the limit as NGC could offer better, never-seen-before options with advanced technology to better secure coins. The same idea applies to PMG with paper currencies!

The Principal at Blackstone, C. C. Melvin Ike, said:

“As thematic investors, we look for exceptional entrepreneurial teams succeeding in growing markets, and CCG is a great example. We have been closely following the rise of the global physical and digital collectibles industry for several years and we were drawn to CCG because of their leadership role in the categories that they serve, and Blackstone’s ability to grow the platform through both organic and inorganic initiatives. We look forward to working together to help the company continue and even accelerate its impressive growth trajectory.”

So, CCG’s leadership is not going to change. They will be able to retain their positions, but they now have all of Blackstone’s vast resources at their disposal. By themselves, CCG grew from certifying collectible coins to comic books, banknotes, stamps, trading and sports cards, and much more. Now that Blackstone and CCG are together, one can imagine the endless possibilities of where CCG will be able to go next.

CCG’s Official Statement

The founder of CCG, Mark Salzberg stated that his vision for CCG was to take collectibles and make this hobby into an asset class that collectors, dealers, and investors could trust. When Blackstone and CCG met, he also said that he could see how Blackstone had the same vision and the company was in good hands. Now that Blackstone is absorbing CCG, Salzburg says he is excited for the next phase of growth for the company and the collectibles market.

Steven R. Eichenbaum, the CEO of CCG added:

“We are thrilled to be partnering with Blackstone during this key point in the industry as the collectibles market continues to accelerate and attract new collectors and investors. From the moment we met the Blackstone team, we could tell that we shared the same vision for the future of our company and the global collectibles industry.”

See more about the official NGC statement here. You can also view the CEO’s letter right on NGC’s website.

It will no doubt be an exciting future for CCG, and it may completely update the way coins are graded. Stay tuned to learn more about how Blackstone and CCG can positively impact your collectibles in the future. One thing is for certain: this is a major step forward for the industry of graded collectibles.