Commenting on stocks boosted by Biden’s economic policies and today’s trading Gorilla Trades strategist Ken Berman said:

Even though volatility remained very high today on Wall Street, the fact that the major indices hit new weekly highs might mean that a durable bottom is in. We had another historic session in stocks with almost unprecedented moves in some of the sectors, but the notable late-day strength and the strong bullish momentum might be foreshadowing a sustained rally.

Q4 2019 hedge fund letters, conferences and more

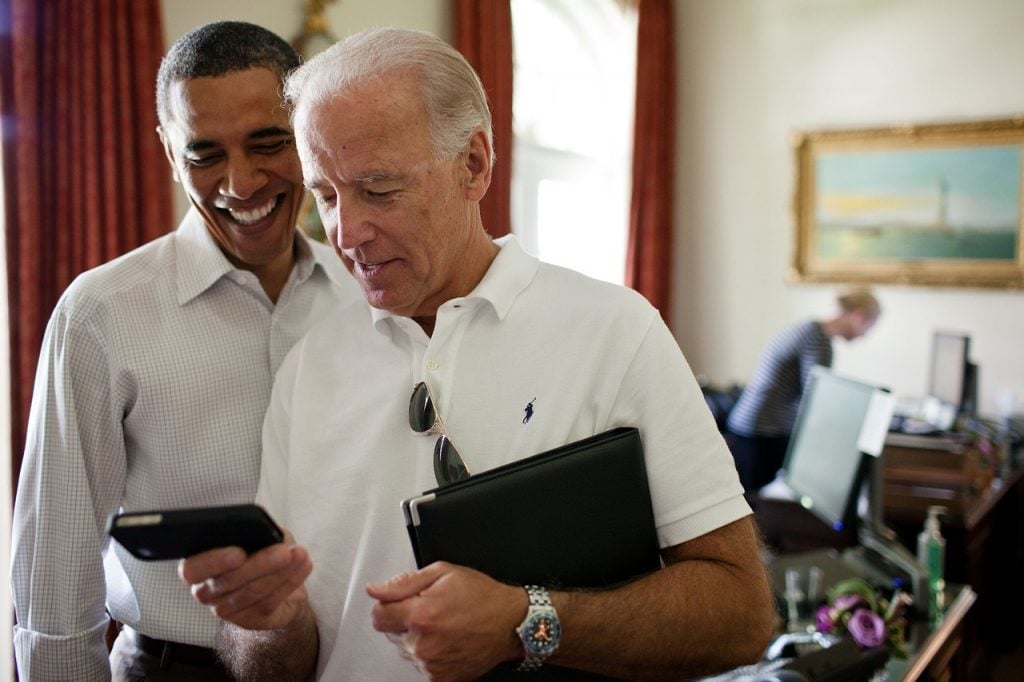

Biden's Economic Policies Help Boost Stocks

The major indices erased yesterday's steep losses thanks to the easing coronavirus-related worries and Joe Biden's strong Super Tuesday showing. The Dow Jones Industrial Average (INDEXDJX:.DJI) was up 1173, or 4.5%, to 27,091, the Nasdaq (INDEXNASDAQ:.IXIC) gained 334, or 3.9%, to 9,018, while the S&P 500 (indexsp:.inx) rose by 127, or 4.2%, to 3,130. Advancing issues outnumbered decliners by an almost 4-to-1 ratio on the NYSE, where volume was well above average again.

The Presidential campaign changed substantially, and now, only two Democratic candidates have realistic chance to challenge President Trump in November. According to the largest prediction markets, Senator Bernie Sanders was the clear frontrunner in the race for the nomination ahead of Super Tuesday, but Joe Biden staged an impressive comeback yesterday. Biden's result boosted stocks across the board today, as his economic policies are considered more market-friendly, with the healthcare sector, in particular, gaining ground.

Healthcare stocks jumped higher by more than 3% on average, with United Health (UNH, +10.7%), Cigna (CI, +10.7%), and Anthem (ANTM, +15.6%) being among the strongest issues on the day. The utilities sector also saw strong gains due to the new all-time lows in long-dated Treasury yields. The fact that the key risk-on sectors lagged behind the traditional safe-havens is a worrying sign for bulls, at least from a short-term perspective. Small-caps also remain relatively weak, meaning that the ‘wall-of-worry’ is still firmly in place due to the economic uncertainty.

While the Fed and U.S. managed to draw the public's attention away from the outbreak, the COVID-19 virus continues to spy across the globe. That said, the exponential growth of confirmed cases slowed down somewhat, and the total number of cases is still below 100,000 and the number of deaths being below 3,500. The International Monetary Fund (IMF) announced a $50 billion package to counter the effects of the likely global pandemic, which helped to sustain the positive investor sentiment today.

We will have another busy day of economic releases, and the labor market will be in focus ahead of Friday’s government jobs report. Besides factory orders, the Challenger job cuts estimate, the revised non-farm productivity, and the weekly number of new jobless claims will all be out tomorrow morning. Job cuts increased substantially last month, while the number of claims also ticked higher unexpectedly last week. In light of this week's emergency rate cut, any weakness in the labor market could cause another steep drop in Treasury yields ahead of this month’s Fed meeting. Stay tuned!