For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

High and stubborn inflation can bring down nations, kings, and presidents.

The Ides Of March

Let’s take another look at the Ides of March 2021, and how an unlikely soothsayer in the person Larry Summers, perhaps the leading Democratic Party economist of the last 25 years, warned President Biden and his stunned staff that high inflation would result from the President’s first big spending bill.

Q4 2022 hedge fund letters, conferences and more

Lawrence Summers served as President Bill Clinton’s Secretary of the Treasury and Barack Obama’s Chairman of the Council of Economic Advisors. In between, he was President of Harvard University for six years, so he is super-connected.

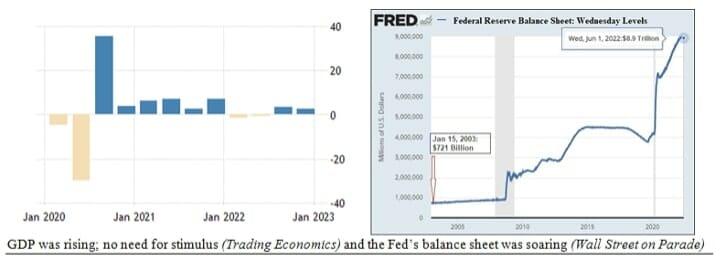

Summers did not care for Biden’s “American Rescue Plan” (ARP), a $1.9 trillion “economic stimulus” bill, designed to “facilitate recovery from the pandemic and resulting economic downturn,” since the recovery from mid-2020 on was already strong, and money was flowing:

While this “American Rescue Plan” was being debated in Congress, Larry Summers penned an editorial for The Washington Post, published on February 4, 2021, in which he warned that “there is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off strong strong inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability.

This will be manageable if monetary and fiscal policy can be rapidly adjusted to address the problem. But given the commitments the Fed has made, administration officials’ dismissal of even the possibility of inflation, and the difficulties in mobilizing Congressional support for tax increases or spending cuts, there is the risk of inflation expectations rising sharply.”

The bill passed on March 11, 2021. Speaking on Bloomberg TV’s “Wall Street Week” on March 19, Summers said, “I think this is the least responsible macroeconomic policy we’ve had in the last 40 years.”

Far from muting his dissent later on, Summers doubled down. After April’s Consumer Price Index came in at a then-staggering 4.2% above the previous April, the largest increase since 2008, with the Fed still pumping $120 billion per month into the economy, Summers told Axios, “The traditional role of the Fed is to remove the punch bowl before the party gets good, right? They have announced that their new policy is to remove the punch bowl only after they have clearly seen a number of people staggering around drunk.”

The Fed and the Biden team were unanimously in denial. This is why I was so upset to see a Barron’s “love fest” interview with the blindly inflationist San Francisco Federal Reserve District President Mary Daly in the April 12, 2021, edition of Barron’s.

Getting Inflation Up To The Target

In Barron’s, Daly said several times (eight by my count) that we “must get inflation up to our 2% target.”

Barron’s asked: “Inflation is top of everyone’s mind. You’re not worried?” Her response? “We have struggled for a whole decade…to get inflation up to our 2% goal,” adding, “We always have the tools to pull inflation down if it gets too high,” because our goal is “lifting inflation up to our 2% inflation target.”

That’s when I went slightly ballistic in my April 13 (Jefferson’s birthday), 2021 Growth Mail column:

“The latest inflation figures show a rapid escalation to a 1% (monthly) rise in the Producer Price Index, which is a 12% annual rate. The major commodity price indexes are soaring at double-digit annual rates.

It’s only a matter of time until producer prices translate into consumer prices. The massive amount of cash in the bank accounts of consumers and corporations are just itching to be spent, and when we finally escape our artificial COVID prisons, after the vaccines push us into ‘herd immunity,’ Katy bar the door.

“The International Monetary Fund (IMF) has just lifted its 2021 growth forecast for the U.S. by a giant leap forward, from 5.1%, to 6.4%, the fastest U.S. GDP growth rate since 1984, ‘Morning in America’ under Reagan. These are the fruits of the multi-trillion-dollar stimulus packages under Trump and Biden.

“Amazingly, official Fed policy is to try to push their favorite inflation metric higher, to 2%. In a Barron’s interview (‘A Central Banker on a Mission,’ April 12, 2021), San Francisco Fed President Mary Daly, a voting member of the FOMC this year, said ‘we have struggled for a whole decade…to get inflation up to our 2% goal’ then said, ‘We always have the tools to pull inflation down if it gets too high.’

“File that promise away for future review – or review Paul Volcker’s experience in 1979-82 to see how he struggled to rein-in double-digit inflation: We suffered double-dip recessions that felt like a Depression.” –Growth Mail, April 13, 2021, by Gary Alexander, “Inflation Will Roar Again – And Probably Soon“

At that point in the Barron’s interview, we learned of Daly’s other passions, including fighting global warming, more inclusion, equity in housing allocation, and other issues not within the Fed’s mandate.

For instance, the San Francisco Fed conducted a conference around climate risk, and another about a John Lennon-style “imagining” of a financial world of total equity, which concluded, In 2019, we would have gotten something close to $2.7 trillion of extra output if those inequities were gone.

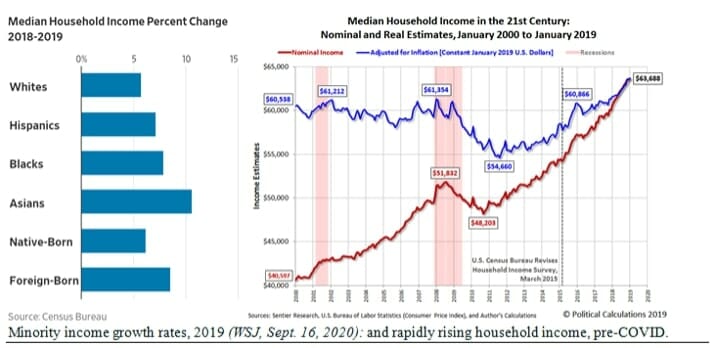

To put that into context, the $1.9 trillion American Rescue Plan would be completely paid for with this elimination of inequities in one year.” Actually, that almost happened in 2019, but San Franciscans couldn’t imagine something so bizarre as rapidly rising wages among minorities during a Donald Trump administration.

This 2021 interview takes on new perspective when we see that the leading bank failures this month came out of San Francisco. Silicon Valley Bank, under Mary Daly’s purview, was clearly not well supervised, and bank supervision is the main charter of the Federal Reserve. Now comes a second San Francisco-based giant, First Republic Bank, each in the $200 billion range in deposits or assets at their recent peak.

Fed Chair Jerome Powell has made it clear that the Fed’s charter and mandate do not include changing the planet’s climate or resolving any social agenda. Perhaps he was sending a message to San Francisco…

There isn’t enough room or time to get into the banking crisis this week, so I’ll save that for next week. But let me allow Larry Summers’ favorite economic guru to give us the final word for this week.