The most common comment on my recent Berkshire Hathaway stock analysis was about Buffett being 90 and dying. I prefer to say that Buffett will retire and that is what I’ll discuss in this Berkshire Hathaway video. Buffett and Munger have created a good vehicle that will keep doing what it has been doing for decades now. Berkshire might not grow as fast because of its size, but will likely do very good with a return between 6% and 8% and it is probably the one that will survive and stay around forever. This is Berkshire and it is actually opposite to Wall Street.

Q3 2020 hedge fund letters, conferences and more

When it comes to investing in BRK, you have to see how this investing mindset Berkshire and Warren Buffett have fits your investment requirements.

Berkshire offers a return between 6% and 10% depending on what happens in the world and there is not much to add to that. They might surprise with a great acquisition but then the economy should be in a bad situation.

Berkshire Hathaway Stock When Buffett Dies, Hm, Retires

Transcript

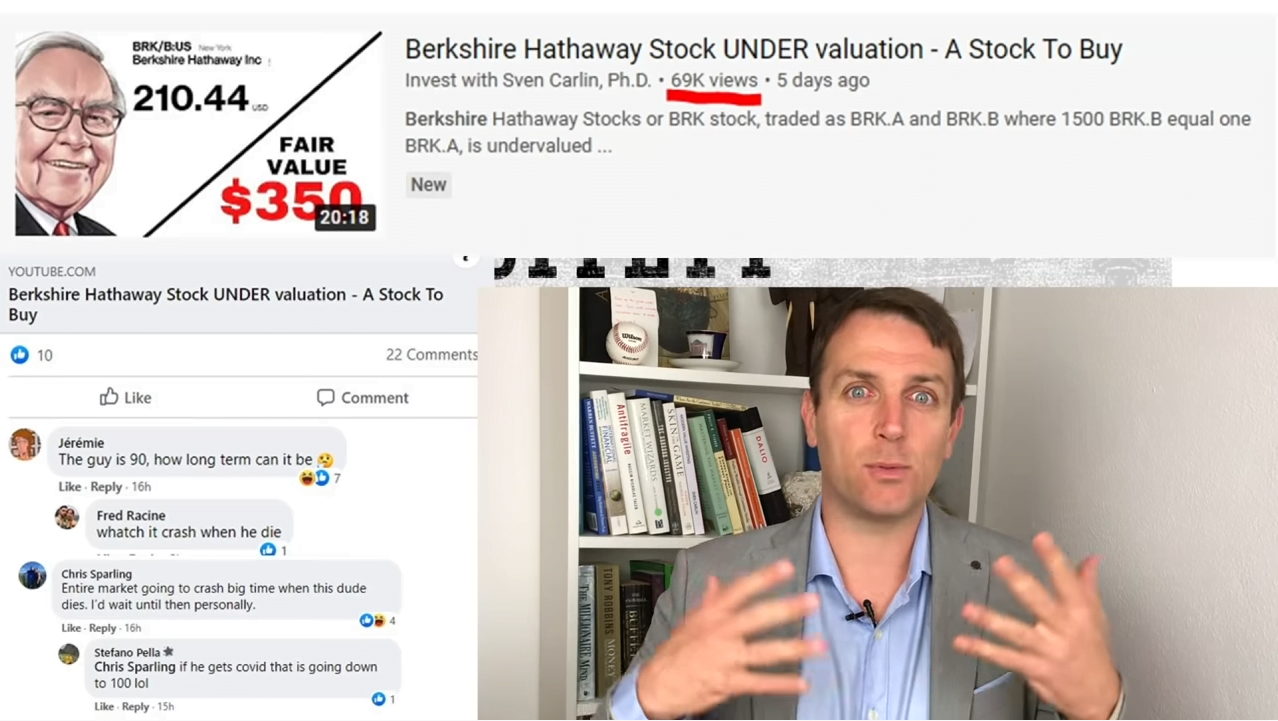

Good day fellow investors. One of the topics related to Berkshire Hathaway that's hard to discuss, but has been really a big topic in the comments in the recent video on Berkshire that I made. I've got more than 70,000 views and a lot of new subscribers. So I thank you all and welcome you for subscribing to this channel. And I thank you also for watching Berkshire Hathaway. So the main topic that was in the comments was what happens when Warren Buffett dies, that were the comments, I will prefer to say retires. What happens when Warren Buffett retires? Buffett recently had his 90th birthday, which means that sooner or later he will have to retire and go do something else with his life. And that's exactly what I want to discuss in this video, we'll go through the stock price Buffett's impact, the Buffet premium. What Berkshire really is? You have to understand Berkshire as a business. What is the expected return? And then you will see, okay, what will be the impact on what Berkshire is, or potentially also the stock price when Buffett decides to retire.

So if I look at the stock price, the current market capitalization is 507 billion. And if I look at the stock price over the last 10 years, well, Buffett was 80 in 2010. He is90 now in 2020, he will be 100 in 2030, but since then stock is up 4x. Is it such a big difference 80 or 90? Is this because of Buffett because of his age, or because of other things. And that's what we're going to also discuss when discussing the expected return, what's investing in Berkshire and how it should be approached. When it comes to investing in something you want to see first. Okay, what's the expected business return and when you have that expected business earnings return, that Buffett always focuses on, you know, what is the biggest impact on the stock price and what will be the long term stock also performance.

Let's start with the business of Berkshire. Now, tell me, are you going to turn on the light tomorrow over the next 10 years use electricity? Are you going to pay for your car insurance? Are you going to buy either no cars, grain, eat? Whatever, it's transported to railroad. Are you going to continue to buy iPhones or any other Apple products? Are you going to use American Express? Are you going to drink Coca-Cola? Well, perhaps you should stop with that I haven't had one. for a decade now. I feel great. No sugar, and late nights, I can make videos that give value to you. So if you ask about that stock market investment returns will be perfectly correlated to business returns in the long term. And to know what to expect from Berkshire, we have to look at Berkshires long term returns. This is something that we have to exclude from this calculation. This is just a new accounting gimmick introduced a few years ago, where they have to show the stock market portfolio going up and down. But this is not really impacting real business earnings. This is what Berkshire earns. And if I sum that up, I come to 23 million per year in a good year like 2019, then I have to add the stock market investment returns. And they get 3.7 billion in dividends. But the retained earnings that's their share, Berkshire's share that are not paid out as dividends are another 8.3 billion. These are the hidden earnings not shown in the accounting. Total 31 billion in earnings is what Berkshire makes for year. This year, a little bit less next year a little bit more on average to likely grow. So this is the basis done taking as valuation for Berkshire.

So we have 31.4 billion, 500 billion market capitalization, price to earnings 16, earning yield 6.19 and then we still have to ask ourselves about the future growth. Will Berkshire still be Berkshire when Buffett decides to retire or not, that's about the business fundamentals that he installed into the business. And when it comes to business fundamentals what really matters then we have to go to Munger he says that when it comes to investing in any business over the very long term, it will all depend on the return on invested capital the business manages to achieve and that is Berkshires focus. And I think that focus will be there even when Munger and Buffett will not be there anymore as managers of Berkshire, they will both go beyond 140. And when we look at the annual letter, he says that all the stocks that they own are great businesses that on average, deliver 20% of net tangible equity capital. Those are great businesses, Apple, literally investments over the free cash flows that have great returns on the equity and that compounds over time. And that's why they are investing in them without employing excessive levels of debt. And if I compare it to others, Berkshire Energy 10% expected return on invested capital plus growing as they reinvest. Burlington Northern Santa Fe, 10% return when he bought now it's 15% cash on what he paid just 10 years ago, other businesses are also there, and their long term target is eight to 10%. So this is what Berkshire is set up for.

Also, when you look at the last deals he made, people say hey, it's a bet on oil, it's not a bet, it's a loan where he gets 8% plus all the upside, if there is positivity in oil, which we'll discuss over the next few videos as I prepare something on oil stocks, Royal Dutch Shell, so subscribe and click that notification bell to get notified. Also, similarly, recent investment in ION Media, but what he did is, again, a loan with 600 million at 8% and plus equity options in case stocks go up, he makes a lot of money. So no downside, or very limited downside and all the upside. So those are the deals he's making and those are the deals that will likely be there for Berkshire over the very long term. But then again, on the strategy did he miss out on buying here? Well, Berkshire is such a big company, so much money that he can't buy in a week or in another week and is with this 110 percent decline where he could have bought or not, is not what he really is waiting for. That's not Warren Buffett, when he makes an acquisition, he waits for really pain in the economy, he bought this after the big crash in March of 2009. He bought this towards the end of 2009, and still did great. So there is always a lag between what happens in the stock market and the actual economic activity that can get hit. And that's also what he is waiting for I think.

Buffett will buy what and when others can't, when there are sectors in problems that will need the money. And that's also something to keep in mind, I think he will make big bets when other insurance companies find it difficult or other sector that he loves. And that's where he or others that are there at Berkshire will take the helm and do similarly to what he has been doing because it's actually not that difficult. Or the simplicity makes it actually very difficult. If we look at the latest conference call, first time he was there without Munger. But there was Greg Abel there. Plus he always has so many great words for Ajit that insurance person there. So he is not really that much already into managing Berkshire and therefore Berkshire will simply continue to remain Berkshire, as it was also in the future.

So here it was with Greg Abel at the last Hathaway conference. You can watch my summary of it if you fancy that. But he is the CEO of Berkshire Hathaway Energy, very well managed, all and the Vice Chairman of non insurance operations. And you can see here the balance sheet of Berkshire Hathaway Energy, they are growing equity more than 10%, 10% no debt and investing what's left into new projects that will likely grow in return on capital 10%, typical Berkshire Hathaway.

So will the strategy remain there? I think so because we have already an earnings return of 6 to 8%, very long term with ups and downs due to crisis. He's waiting for really bad times in the economy to buy those insurance, borrowing to people if you want an 8% yield with preferred equity option and he's building and he has built a business and the people there are managing a business to last forever, a financial fortress. And this is also the difference between Berkshire and Wall Street. Wall Street is about growth, about taking as much leverage as one can take, and about thinking about just the next quarter, next quarter, and really taking advantage in the shortest possible amount of time of all the opportunities. Taking money now, if you go bankrupt, you have already made big money, that's Wall Street. Berkshire is the total opposite. And this Charlie Munger has three really key things that are the key in life, but perfectly characterise also Berkshire.

So don't race trains to the track, don't do drugs, don't get into AIDs situations. So Berkshire is going forward by avoiding failure most than other. And that's the simple difference between Berkshire and Wall Street. And that's what made Berkshire one of the best investment vehicles over the last 50-60 years. Just avoiding failure, more important than anything else, also in life, then, about those crazy things that seem so important now just avoid failures and you'll do great. Thank you for watching, another failure to avoid is not being subscribed to this channel. Looking forward to your comments and I'll see you in the next video.