S&P 500 duly reversed as I called for it intraday to do. Not that the message from bonds or the dollar would be more optimistic really – for the bulls I mean. Whatever ground the buyers recovered yesterday, was defensive in nature as yields continue rising even on the long end of the curve.

No top in yields – that‘s not a bullish message for stocks. As I have written an extensive analysis on Monday, and yesterday presented the key idea that may drive an upswing attempt that would be sold into, I‘ll concentrate on live Twitter updates around the FOMC such as this feel of the market pulse (with intraday updates on my site should trading decisions need to be updated, of course).

Q2 2022 hedge fund letters, conferences and more

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

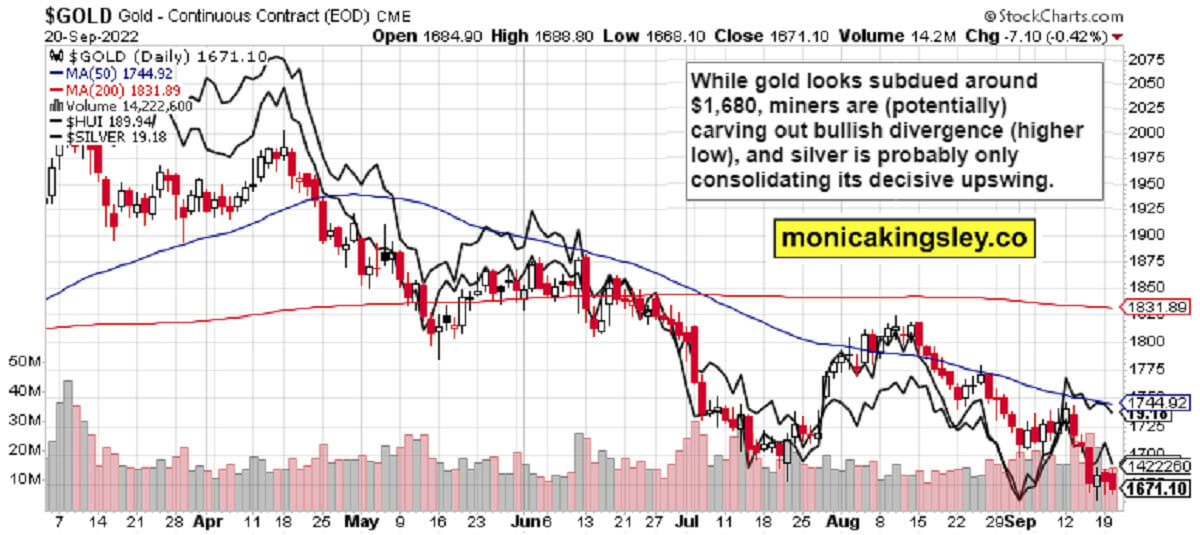

Gold, Silver and Miners

Silver will shake off any FOMC blues easier than gold, and the direction miners take, would determine the next move in the whole sector. Miners rising could be equated to doubts about the Fed vs. soft landing as much as rising yields.

Crude Oil

Crude oil will be least affected today (this could turn into an understatement), and not only because of the news from Eastern Europe. Looking for the upswing to slowly gather pace over the coming weeks.

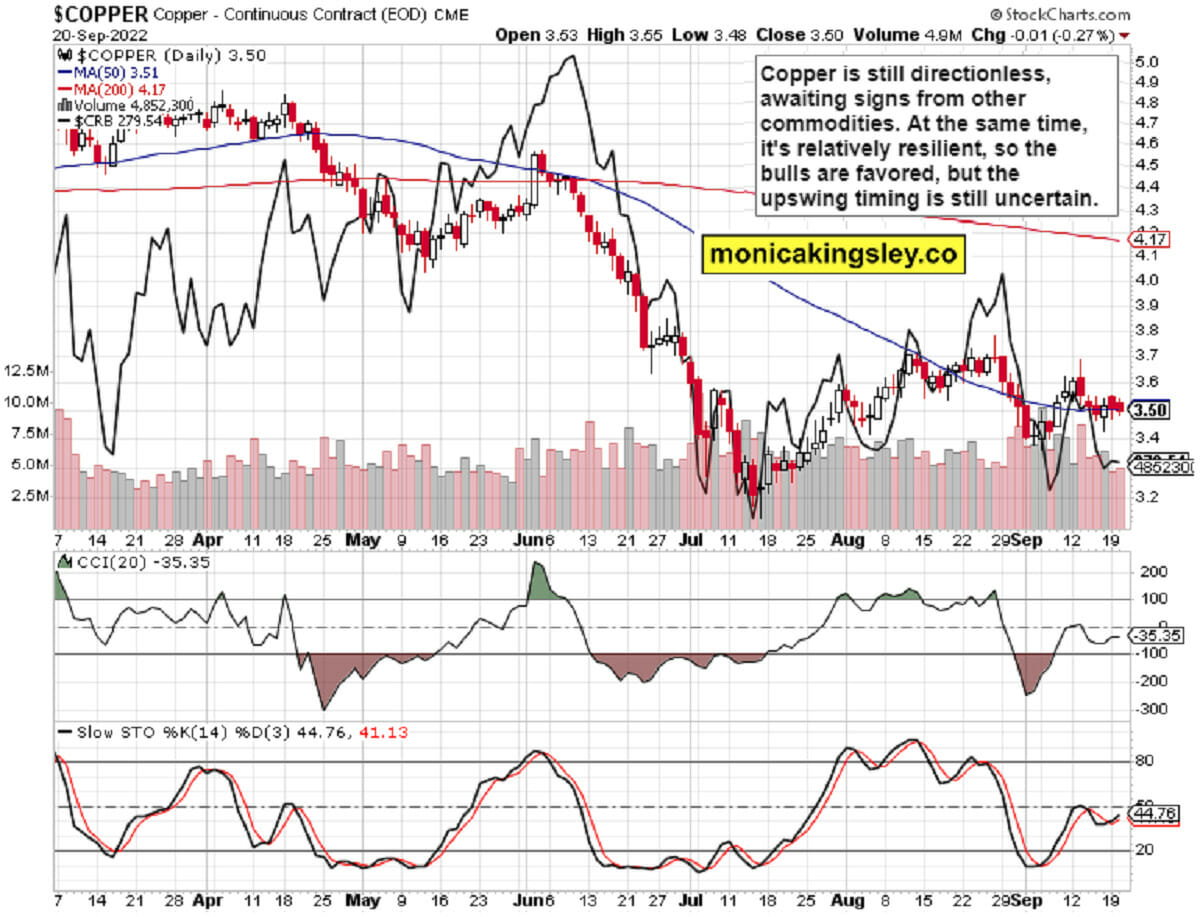

Copper

Copper is still going sideways, and I don‘t see a deep flush as likely this week at all.

Bitcoin and Ethereum

Cryptos will likely join in the temporary jubilation that‘s ahead, but will decline once the true hawkish Fed message gets acknowledged for what it is.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica's Stock Signals presenting stocks and bonds only.

Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves on top of my extra Twitter feed tips. Thanks for subscribing & all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss.

Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.