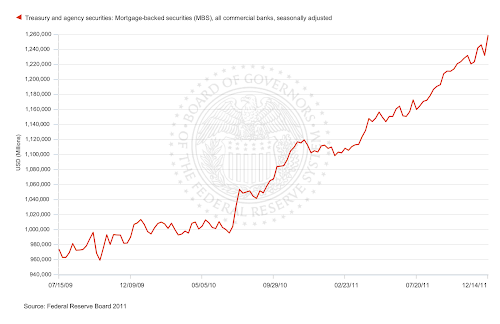

The reasons why are debatable but the numbers don’t lie: banks continue to accumulate agency MBS in mass amounts. I wrote about this very topic in July with a post called “Banks hoard securities…” Though absolute dollar amounts of loans are actually up since April, the growth is anemic and unable to keep up with rising deposits.

Should the Fed engage in a QE3, they would likely buy additional Agency MBS securities – so rates would be pushed down and banks would reap further gains. To put the below chart in perspective, year over year, holdings of Agency MBS are up ~120bil. Total bank credit (All Commercial Banks) increased 190bil, so ~63% is attributed to Agency MBS alone.