The troubled fitness retailer and services company reported earnings last week

Baillie Gifford & Co has filed a 13G/A form with the SEC disclosing ownership of 2,054,987 shares of Peloton Interactive, Inc. Class A (NASDAQ:PTON). This represents 0.66% of the company.

In their previous filing dated January 27, 2022, they reported 31,817,011 shares and 10.67% of the company, a decrease in shares of 93.54% and a decrease in total ownership of 10.01% (calculated as current – previous percent ownership).

Baillie has filed eight 13D/G filings since November 13, 2019.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Peloton's Expectations

Last week Peloton said it expects $700 million to $725 million in revenue in its holiday quarter, short of the $866 million analysts had forecast. It cited lower disposable consumer income and a shift in spending patterns.

Peloton also said it saw its member count decline to 6.7 million during its first quarter from 6.9 in its fourth, reflecting "the rolloff of a Covid-impacted quarter" and a drop in subscribers for the Peloton app.

What are other large shareholders doing?

Price T Rowe Associates Inc /md/ holds 44,787,453 shares representing 13.17% ownership of the company. In its prior filing, the firm reported owning 40,969,073 shares, representing an increase of 8.53%. The firm decreased its portfolio allocation in PTON by 52.40% over the last quarter.

Vanguard Group Inc holds 26,265,904 shares representing 7.72% ownership of the company. In its prior filing, the firm reported owning 25,768,977 shares, representing an increase of 1.89%. The firm decreased its portfolio allocation in PTON by 57.91% over the last quarter.

Baillie Gifford & Co holds 25,119,141 shares representing 7.39% ownership of the company. In its prior filing, the firm reported owning 27,564,218 shares, representing a decrease of 9.73%. The firm decreased its portfolio allocation in PTON by 30.84% over the last quarter.

Morgan Stanley holds 15,685,003 shares representing 4.61% ownership of the company. In its prior filing, the firm reported owning 15,189,243 shares, representing an increase of 3.16%. The firm decreased its portfolio allocation in PTON by 65.47% over the last quarter.

BlackRock Inc. holds 15,271,909 shares representing 4.49% ownership of the company. In its prior filing, the firm reported owning 15,909,782 shares, representing a decrease of 4.18%. The firm decreased its portfolio allocation in PTON by 60.28% over the last quarter.

What is the overall institutional sentiment?

There are 807 funds or institutions reporting positions in Peloton Interactive, Inc. Class A. This is a decrease of 86 owner(s) or 9.63%.

Average portfolio weight of all funds dedicated to Peloton Interactive, Inc. Class A is 0.1487%, a decrease of 37.3921%. Total shares owned by institutions decreased in the last three months by 2.58% to 304,262,926 shares.

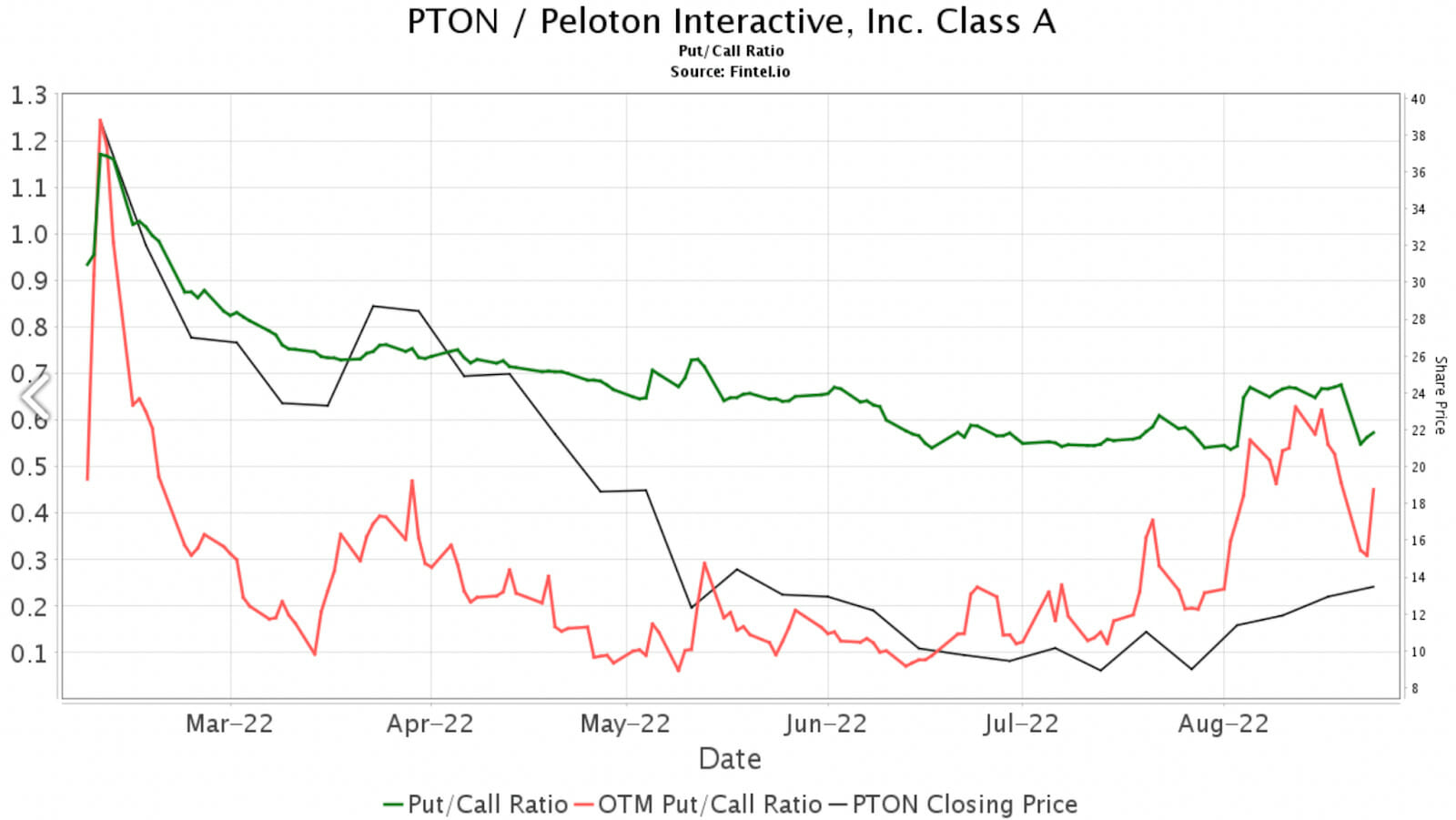

Based on this information, institutional sentiment is bearish.

Article by Fintel