Jeoff Hall, Managing Economist, Refinitiv comments on the latest job data regarding average hourly earnings:

“Bottom Line Up Front: December’s employment situation report was one of the weakest in 2019 but we’re still assigning it a grade of B-. Total nonfarm payroll employment growth of 145k was the smallest since May (+62k) and about 30% below the trailing 3-month average. Growth in private payrolls, which removes the impacts of temporary hiring for the decennial census, was 139k in December, the smallest since July (+122k) and also about 30% below the trailing 30-month average.

More disappointing was the feeble growth in wages last month, as average hourly earnings rose just 0.1% m/m, missing expectations of a 0.3% advance. The year-on-year change in average hourly earnings slowed to 2.9%, the smallest 12-month gain in 17 months, which should mitigate fears of wage-driven inflation pressures.

Q4 2019 hedge fund letters, conferences and more

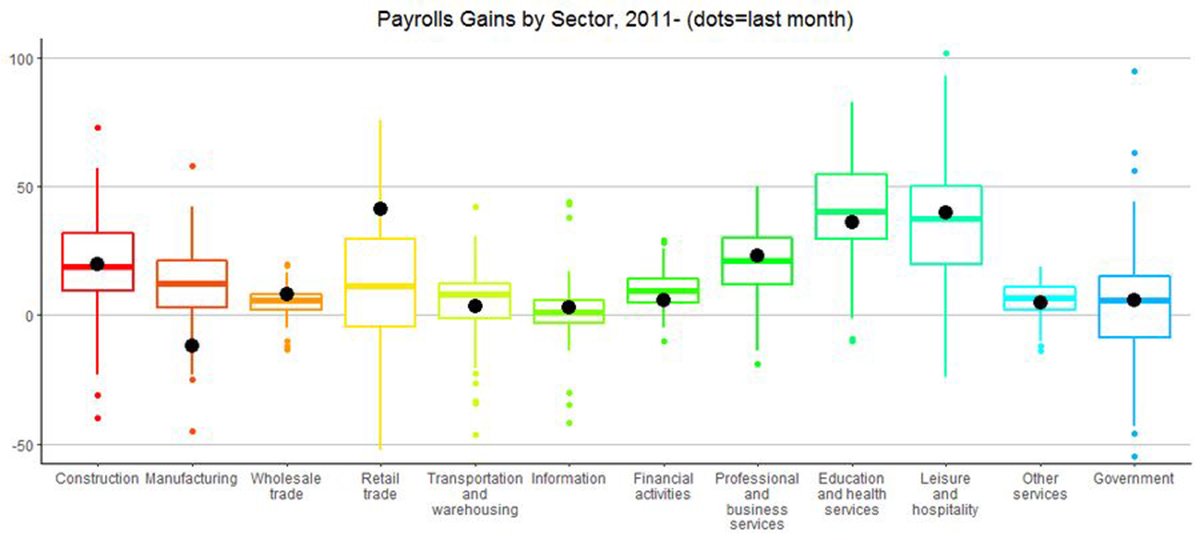

Details: More than half (56%) of December’s 145k rise in nonfarm payrolls came from just two industries: Retail Trade (+41.2k) and Leisure and Hospitality (+40.0k). These industries are at the very bottom of the order in terms of wages. Ironically, average hourly earnings for retail trade workers rose by 1.0% m/m in December, the largest 1-month gain in 25 months; it followed declines of 0.4% and 0.3% in October and November, respectively.

Goods-producing employment fell by 1k in December after rising an average 12k in October and November. The only bright spot among goods-producing industries was Construction, where employment rose 20k in December, the most in eight months and 2.5 times the trailing 6-month average (+8k). We do not expect that kind of growth to stick around.

Beyond average hourly earnings data to more employment details

Now that the effects of the United Auto Workers strike are over, we’re getting a clearer picture of hiring in the manufacturing sector, and it’s not good. On a strike-adjusted basis, factory employment fell an average 2k in October and November and it fell 12k in December.

Nondurable goods manufacturing employment fell for the first time in seven months and by the most in more than four years. Keep in mind, employment in this sector rose an average 9k per month in the two preceding months, about three times more than the long-term average gain.

Employment in mining and logging fell by 9k in December, the most in nearly three-and-a-half years, and that followed an 8k drop in November. The latest two monthly losses left employment in the mining and logging sector at its lowest level since May 2018.

As mentioned, employment growth in service-providing industries was dominated by two low-paying categories: retail trade and leisure and hospitality. Growth in every other category was at or below trend.”