Ares Capital Corporation (NASDAQ:ARCC) said on February 7, 2023 that its board of directors declared a regular quarterly dividend of $0.48 per share ($1.92 annualized). Shareholders of record as of March 14, 2023 will receive the payment on March 31, 2023. Previously, the company paid $0.48 per share.

At the current share price of $19.95 / share, the stock’s dividend yield is 9.62%. Looking back five years and taking a sample every week, the average dividend yield has been 9.51%, the lowest has been 7.90%, and the highest has been 19.80%. The standard deviation of yields is 1.46 (n=196).

Q4 2022 hedge fund letters, conferences and more

The current dividend yield is 0.08 standard deviations above the historical average.

The company's 3-Year dividend growth rate is 0.20%, demonstrating that it has increased its dividend over time.

Analyst Price Forecast Suggests 7.92% Upside

As of February 9, 2023, the average one-year price target for Ares Capital is $21.53. The forecasts range from a low of $20.20 to a high of $25.20. The average price target represents an increase of 7.92% from its latest reported closing price of $19.95.

The projected annual revenue for Ares Capital is $2,410MM, an increase of 14.98%. The projected annual EPS is $2.27, an increase of 88.00%.

What is the Fund Sentiment?

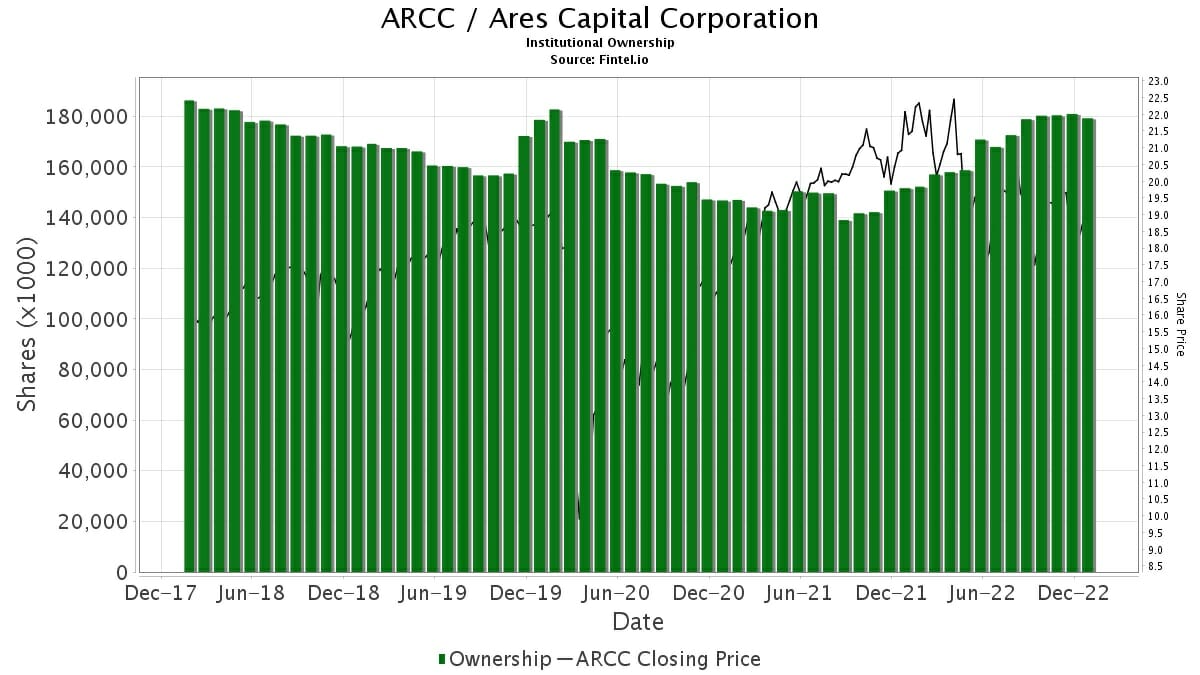

There are 697 funds or institutions reporting positions in Ares Capital. This is a decrease of 2 owner(s) or 0.29% in the last quarter. Average portfolio weight of all funds dedicated to ARCC is 0.43%, an increase of 7.03%. Total shares owned by institutions increased in the last three months by 1.48% to 179,906K shares. The put/call ratio of ARCC is 3.42, indicating a bearish outlook.

Ares Capital Background Information

(This description is provided by the company.)

Founded in 2004, Ares Capital is a leading specialty finance company focused on providing direct loans and other investments in private middle market companies in the United States. Ares Capital's objective is to source and invest in high-quality borrowers that need capital to achieve their business goals, which often leads to economic growth and employment.

Ares Capital believes its loans and other investments in these companies can generate attractive levels of current income and potential capital appreciation for investors. Ares Capital utilizes its extensive, direct origination platform and incumbent borrower relationships to source and underwrite predominantly senior secured loans but also subordinated debt and equity investments.

Ares Capital has elected to be regulated as a business development company ('BDC') and is the largest BDC by market capitalization as of December 31, 2020. Ares Capital is externally managed by a subsidiary of Ares Management Corporation, a publicly traded, leading global alternative investment manager.

Article by Fintel