Inflation has become the hot topic as of late. Gas prices are up, grocery trips are more expensive, and home prices are continuing to climb. This focus on inflation is completely justified. November’s Producer Price Index increased 9.6% over the previous year and the CPI rose 6.8% for the same 12-month period. This increase in CPI is the largest 12-month increase since the period ending June 1982. With the PPI and the CPI on the rise, both companies and consumers are feeling the heat. As a follow-up to the article, 5 Signs that Higher Trends in US Backend Rates are Here to Stay, this article will discuss the current inflation predicament and the effects of inflation on the U.S. economy today.

Q4 2021 hedge fund letters, conferences and more

The Fed's Stance On Inflation

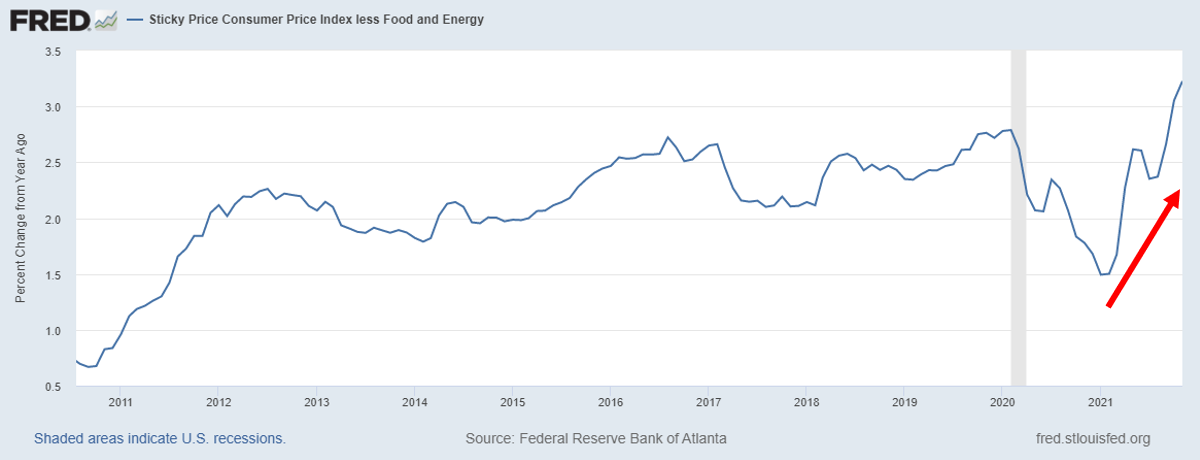

Throughout 2021, the Federal Reserve has remained relatively neutral on the topic of inflation. It was only in August when Jerome Powell stated in his Jackson Hole speech, “The spike in inflation is so far largely the product of a relatively narrow group of goods and services that have been directly affected by the pandemic and the reopening of the economy.” In other words, it’s transitory inflation. The data is now disproving Powell’s previous stance. Using the sticky CPI as a measure of less volatile goods, prices are on the rise and most likely will stay elevated for some time.

The Fed has finally noticed and is planning to act. In November, Powell said to Congress, “At this point, the economy is very strong, and inflationary pressures are high, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at our November meeting, perhaps a few months sooner.” He also stated, “We tend to use [the word transitory] to mean that it won’t leave a permanent mark in the form of higher inflation. I think it’s probably a good time to retire that word and try to explain more clearly what we mean.” The FOMC backed up these statements in the most recent FOMC meeting by committing to doubling the rate of tapering per month and signaling three rate rises in 2022.

Of course, this hawkish policy stance will put the Fed at war with its own dual mandate. Yes, the Fed is responsible for maintaining price stability, but it is also responsible for maximum employment. Rising rates will put pressure on a fragile economy post-COVID shutdown. Jobless claims are low, which is a good sign, but the November employment missed the mark, and the economy is still missing more than 4 million jobs compared to just before the pandemic. Conditions have yet to warrant any type of stagflation call, so how will tighter lending conditions caused by higher rates and high inflation affect the average person?

As a rule of thumb, higher rates should increase saving rates and decrease spending. This theory will be put to the test this time around, the effects of this recent bout of inflation erodes the buying power for a larger percentage of Americans. Two groups to find the price increases especially challenging will be the lower-earning households and the recently retired. Saving for these two groups will be limited due to price pressures on daily goods like food, gas, and rent, which are a more considerable percentage of their monthly budgets. As for higher-income households, rates will limit their borrowing capacity and reduce economic mobility. Markets should watch carefully for changes to economic strength indicators and constantly monitor the effectiveness of monetary policy over the coming months.

GDP Growth

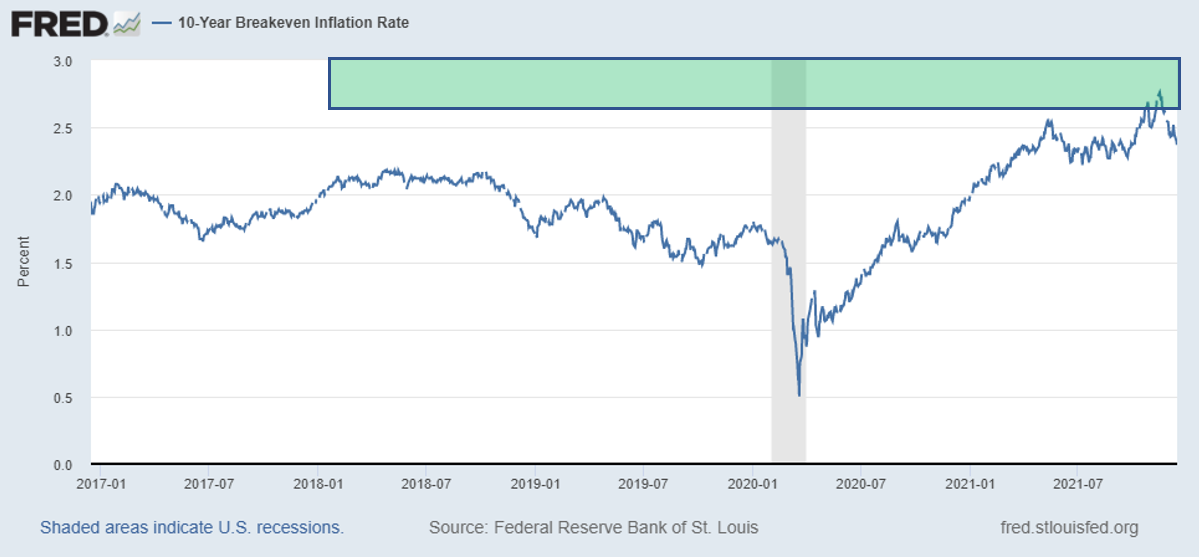

All is not lost. So far GDP, since the COVID drop, has continued to grow around 2%, and by increasing the look back of the inflation calculations the results become more reasonable. As seen in the chart below, 10-Year Breakevens are current just above levels seen in 2018.

Wages are also on the rise which will combat the negative effects of rising prices. Although this bout of inflation has exceeded the window to deem it “transitory” due to some extraordinary events in 2020, with the fed ready to act and the economy remaining resilient in the face of a pandemic, market shocks seem relatively distant at this moment.

As monetary policy shifts around this current inflationary environment, assets and other investments can be affected in a variety of ways. The asset management industry needs the tools and insights to prepare businesses for a transformed investment industry landscape and to be equipped to further help clients weather both short-term changes and “not-so transitory” market trends.

About the Author

Stephanie Colling is a senior consultant and Makinoon Sami is an associate at Capco, a global management and technology consultancy dedicated to the financial services industry.

References:

https://www.foxbusiness.com/markets/stocks-wall-street-inflation-economy-fed-meeting

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.federalreserve.gov/newsevents/speech/powell20210827a.htm