Apis Deep Value Fund commentary for the fourth quarter ended December 31, 2021.

Q4 2021 hedge fund letters, conferences and more

Dear Partners,

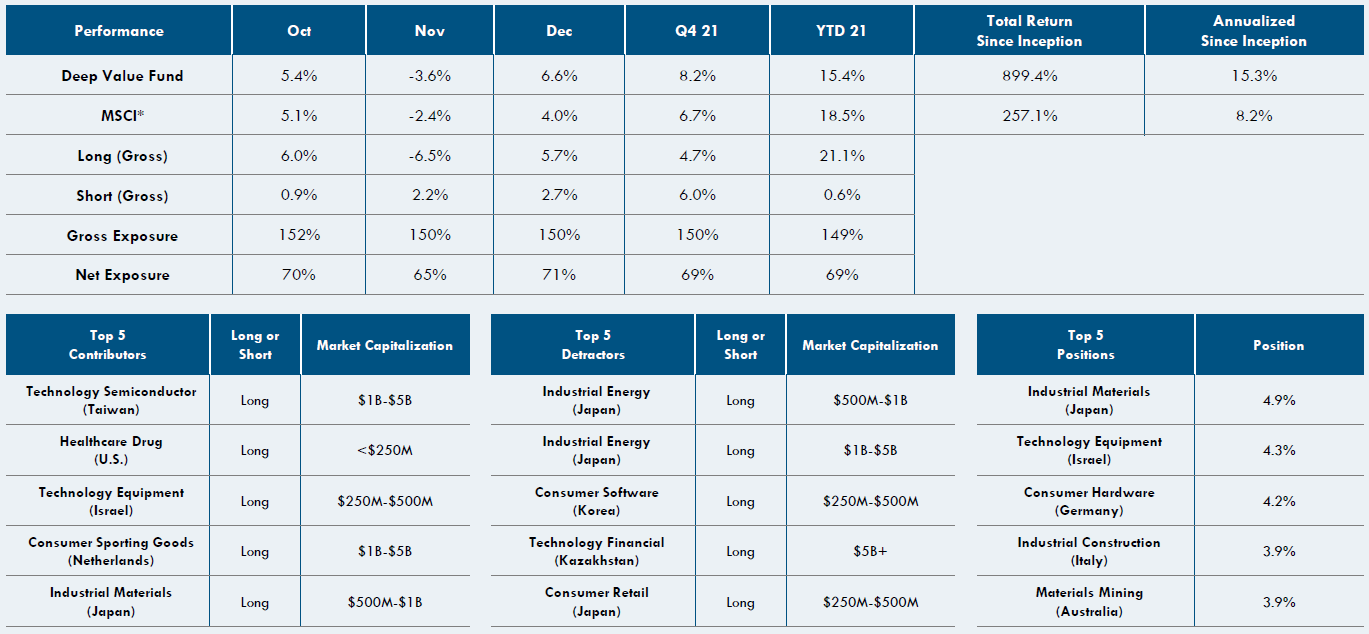

The Apis Deep Value Fund was up 8.2% net in Q4 2021 and ended up 15.4% net for the year. During the past quarter, our longs contributed 4.7% (gross) and our shorts contributed 6.0% (gross). At the end of December, the Fund was approximately 71% net long with the portfolio 110% long and 39% short.

Performance Overview (Gross Returns)

Returns during 2021 were in-line with the average of the Fund’s strong performance over the past 18 years. Despite lower net exposure, we were unable to exceed benchmark returns, which we’ve been able to do in the long-term. We purposely avoid deep analysis of our returns relative to any benchmark. By simply owning great businesses at reasonable prices and shorting underperformers, you should succeed over time. Much has been written about a few mega stocks (such as Tesla Inc (NASDAQ:TSLA) or Apple Inc (NASDAQ:AAPL)) driving index gains that belie the returns across the rest of the market. Additionally, the emergence of “meme” stocks also contributed to various benchmark returns, which likely hurt us relatively and, in some cases, actively as bets against these situations (especially in late January and again in June), which contributed to underperformance in those months. Our focus on smaller companies outside the U.S. worked against us in 2021, but just the same will work in our favor in other years.

The most memorable feature of 2021 was the extreme individual stock volatility divorced of fundamental rationale. GameStop Corp. (NYSE:GME) was one of several “moonshots” where retail investors challenged and, in some cases, won against their institutional rivals. While not involved in GameStop, we held several positions on the short side that were up at times over 100% in the year. Despite this, for all of 2021 shorts generated positive absolute returns against sharply higher markets, making 2021 one of the best years ever on the short side. Beyond successful stock picking, the key to winning in this environment is managing risk. Most of the 100%+ gainers fall into what we call our “battleground” shorts. Battleground shorts are often fads such as electric vehicles, SPAC’s, crypto, COVID-19 cures, etc., where fantastical “TAMs” touted by “the Street” create a speculative frenzy. The only way to survive 100%+ upward moves is to keep positions very small. It’s not unusual to have 20 or 30 positions in the group that together add up to only 15-20% of the Fund. When the narrative changes (and for these businesses, all they have is narrative), we will add to maintain or in some cases, increase exposures. This approach helped us recover early year short side losses and generate positive results in all but one month over the last two quarters.

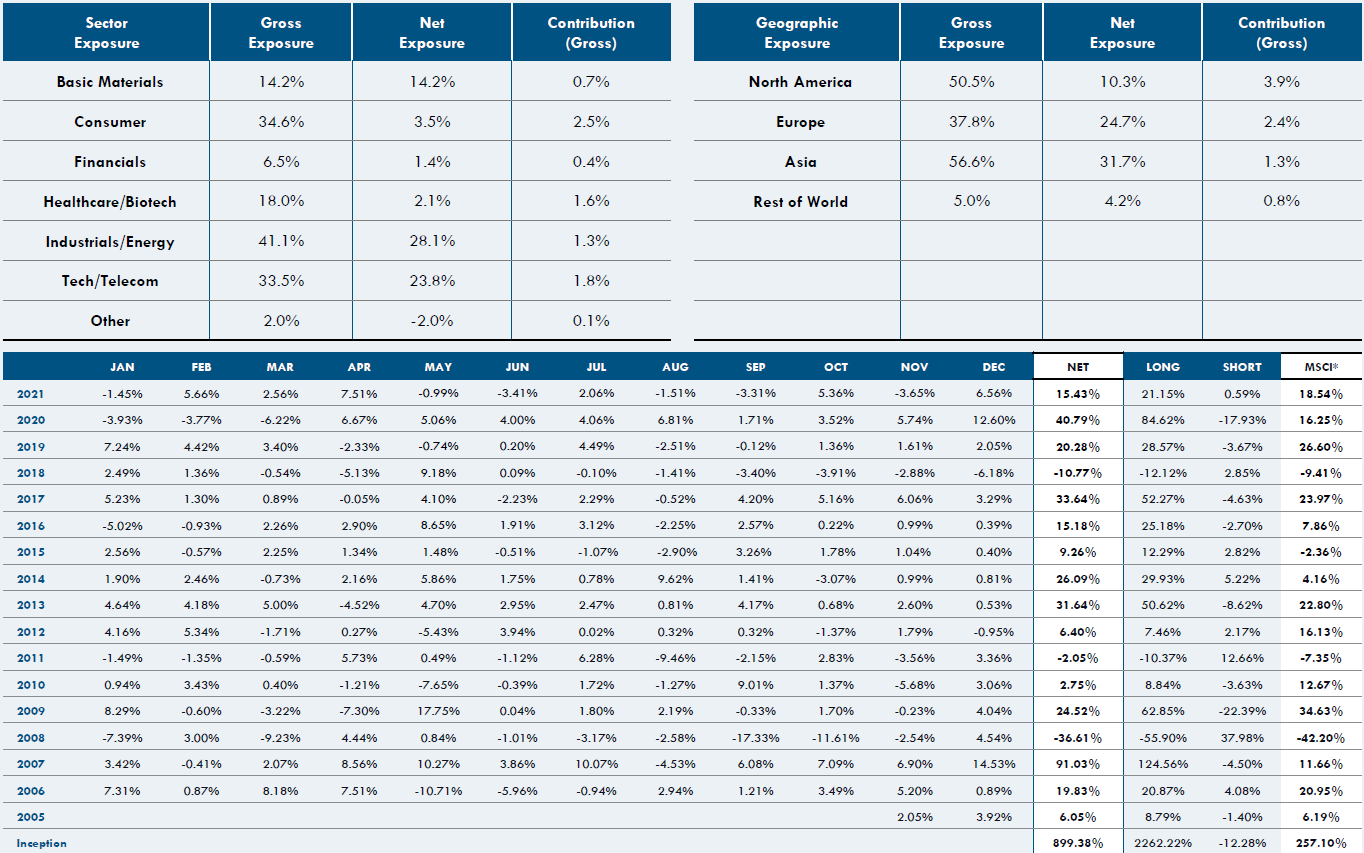

Geographically, returns were reasonably balanced, with North America adding 9.1% (gross), Asia 7.5%, and Europe 4.5%. All sectors were positive, with Industrials/Materials contributing 10.2%, followed by Technology at 6.8%. Notably, Technology’s contribution was boosted by 1.5% from successful shorting. Although volatile, the transition to more GDP-sensitive, commodity-related companies helped while a few of last year’s winners, such as online retail or gaming, turned unfavorable.

Individual stock performance was characterized as a year of strong “batting average” and fewer home runs. Seventeen longs each contributed at least 1.0%, while only 3 detracted more than that. The top gainers were Maire Tecnimont (Italy) at 2.3% and Silicon Motion (Taiwan) +2.1%. Last year’s biggest winner, Gravity (South Korea), was this year’s biggest detractor. Gravity is an oddball (listed on Nasdaq with zero broker coverage) online/mobile gaming company with a franchise game called “Ragnorok” which is very popular in Asia. To those few that follow it, growth of 10% top-line and 20% bottom-line might have disappointed, although these growth rates are similar to previous years. At a $450mm market capitalization and $200mm net cash, generating about $70mm FCF/year, Gravity still looks attractive.

Portfolio Outlook And Positioning

Our economic outlook for 2022 is mixed. On one hand, we are witnessing once-in-a-generation blistering economic growth and inflation. Companies that have managed to control their costs and demand pricing power are delivering record profits. On the other hand, the government stimulus driving this growth has also created a series of jaw-dropping bubbles across asset classes, including venture capital, private equity, housing, cryptocurrency, electric vehicles, SPACs, and “meme” stocks.

Even more concerning is that these bubbles are acting in concert, unlike those observed in 2000 or 2007. As governments worldwide look to manage inflation lower and dial back their financial stimulus, we expect to see a lot of volatility coupled with attractive opportunities.

We have exposure to several unique ideas where we think underlying drivers can prevail against whichever way the macroeconomic winds blow. We are involved in a variety of both cyclicals and compounders, as well as growth and value companies on the long side. Some of the ideas we’re most excited about include a small basket of names in the equipment supply chain for manufacturing batteries. These Asian & European companies are still emerging as the battery production buildout is just beginning. Another area of interest is the traditional energy sector, where numerous stocks can be bought for absurdly low valuations. We’ve got one in the U.K. where it could conceivably earn its entire market cap in 6 months at current natural gas prices. The world has become so disinterested in traditional energy companies that it has forgotten basic common-sense valuation with respect to these names. In Japan, we have assembled a unique group of longs that possess both compelling valuations and growth. These names have exposure to some exciting long-term industry dynamics along with dominant positions in their industries. We discuss them below in further detail.

On the short side, after a fruitful 2021 during which many bubble stocks began to unwind, we have continued to reload and rotate into names that have either bounced or somehow managed to defy gravity. The world is awash in SPACs, “meme” stocks, and profitless “growth” companies, and we look forward to common sense continuing to return to this space in 2022. We have positions in companies with little chance at revenue in the foreseeable future, zero profitability, with a dire combination of both a falling stock price, and the need to raise capital. The SPAC & “meme” bubbles finally appear to be coming to an end. The market is also losing patience with profitless growth companies. In the online gambling space, where we have a few shorts, companies have spent 2-4 times the level of their European peers to acquire new customers. The resultant growth was initially rewarded by investors, but not anymore. Profit has always been a light at the end of the tunnel, but that light is fading in online gambling and across many other stocks, which probably should never have been brought public. Shorting should be a rewarding endeavor if 2022 continues to bring sanity to this space.

Investment Highlights

Beenos (Japan – $290mm market cap)

Beenos Inc (TYO:3328) is a holding company with four different business segments, including a venture capital arm. Its most significant business segment, which generated over 100% of profits last fiscal year, is its Global Commerce segment. The main business in this segment is Buyee. It enables consumers outside of Japan to buy goods from Japanese e-commerce sites such as Rakuten, Mercari, and Yahoo! Japan Auctions. Buyee translates the Japanese sites into the user's local language and handles international shipping and logistics. Buyee takes an 18-20% cut of the transaction between shipping, service fees, and a small spread on the foreign currency transaction. Buyee’s gross merchandise value grew 48% in the fiscal year ended September 2021, and it generated 34% operating margins due to its increased scale. We believe this business alone is worth more than Beenos’ current enterprise value. In fact, attributing zero value to the other three segments, we see about 37% upside by putting Buyee on similar multiples as eBay, which has a similar business model. There could be even more upside if the market gave Buyee multiples closer to those of a more recently listed comparable business, Global-E, which trades on 20x Enterprise Value/Revenue and 189x Enterprise Value/EBITDA vs. Buyee at 2.8x and 8x, respectively.

While Buyee alone is worth more than the current market cap, this is before we even consider Beenos’ venture capital arm, which owns stakes in several exciting tech companies, mostly in Southeast Asia. Two of its holdings are planning IPOs in the near future, potentially in the first half of this year, which could generate significant profits for Beenos. The first is Droom, an online marketplace for used cars in India, which filed for an IPO in November 2021. The company was last valued at $1.2bn in a July pre-IPO funding round, which values Beenos’ 8.7% stake at about $104mm. This is over 1/3 of Beenos’ current market cap. The second holding on the precipice of an IPO is GoTo, formed by the merger of ride-hailing app Gojek and e-commerce company Tokopedia. Beenos owns a ~0.5% stake in GoTo, which recently raised a pre-IPO funding round at a $28.5bn valuation – this would be $143mm, or nearly half of Beenos’ current market cap. Besides the two highlighted here, there are at least 14 other companies in Beenos’ VC arm which could provide future monetization opportunities.

Sum-of-the-parts stories are sometimes tricky, but we like this one because there are clear near-term catalysts (the upcoming IPOs of portfolio companies) and an attractive and growing underlying business. We think that Beenos could at least double just by attributing a more appropriate valuation multiple to the Buyee business and taking the current market value of the venture capital portfolio. This attributes zero value to Beenos’ two other segments, which are more or less breakeven. We also think there is significant discovery potential for this stock, given only one local Japanese analyst covers it, and the market cap is still small enough to be under most investors’ radar.

Furuya Metal (Japan – $760mm market cap)

Furuya Metal Co., Ltd. (TYO:7826) specializes in refining rare platinum group metals – mostly iridium and ruthenium – for various industrial uses. Its products are used in the supply chains of semiconductors, smartphones, touch panels, OLED screens, and medical imaging equipment. It also has a burgeoning recycling business, which takes used products (including from other manufacturers) or waste and extracts the rare metals to be used to create new products. The company was founded in 1968 and has strong relationships with the three leading platinum group metal miners. It has built deep moats in the niche and technically complex business of working with these metals.

Furuya serves many different end markets, which are all mostly healthy and growing. For example, it is one of only two companies (with 70% market share) globally that makes a specific ruthenium-based product that increases the storage of hard disk drives, which are expected to grow by an 18.5% CAGR through 2025* due to demand from data centers and cloud service providers. It also has a dominant market share of precious metal compounds used in OLED phosphorescent materials. Its primary customer here has a forecasted revenue CAGR of 23% for the next three years. The company raised earnings guidance twice last fiscal year ended June and reported operating profit and EPS that were over double the initial projection. The stock is currently trading at about 10x the company’s FY 6/22 EPS guidance, which we think is a bargain for a dominant player in a niche specialty field. Our valuation calls for 50%+ upside from the current price.

* source: IDC

Hirano Tecseed (Japan – $430mm market cap)

Hirano Tecseed Co Ltd (TYO:6245) is an undiscovered play on the coming global electric vehicle (EV) battery capacity build-out. The company has been around since 1935 and originally provided machinery to the textile industry. Now, the company provides equipment used to manufacture and coat different types of films, papers, and metals. In making an EV battery, one of the first process steps is coating the cathode and anode foils with electrode materials. The coated foils then have to be put through drying machines that look like long, large ovens. These electrode coating and drying machines compose 50% of Hirano’s business and have been driving strong growth in its order backlog, sales, and profits.

The company recently raised its guidance for their fiscal year ended March 2022, indicating 36% sales growth and 68% profit growth. The order backlog related to EV battery equipment as of September is JPY 21bn, vs. JPY 13bn in EV battery-related sales last fiscal year – so the company has nearly two years of visibility. Hirano is one of only 3-4 companies globally that makes these types of machines. One of its larger competitors, Wuxi Lead Intelligent Equipment in China, trades on 45x next year’s EPS. Hirano only trades on 13x management’s EPS forecast for the year ended this March and has a net cash position of about a third of its market cap. With global EV battery capacity forecasted to rise from approximately 440 GWh in 2020 to more than 2 TWh by 2026* (a CAGR of at least 29%), Hirano should see continued double-digit sales and earnings growth. This forecast alone could continue driving the stock higher, but it also has room for a multiple re-rating once the market discovers this niche EV play.

* source: Morgan Stanley

As always, we encourage your questions and comments, so please do not hesitate to call our team here at Apis or Will Dombrowski at +1.203.409.6301.

Sincerely,

Daniel Barker

Portfolio Manager & Managing Member

Eric Almeraz

Director of Research & Managing Member