The market headline in July was that both US and emerging market stocks made strong gains. The S&P 500 gained 3.72% for the month while emerging markets also gained 2%.

Q2 hedge fund letters, conference, scoops etc

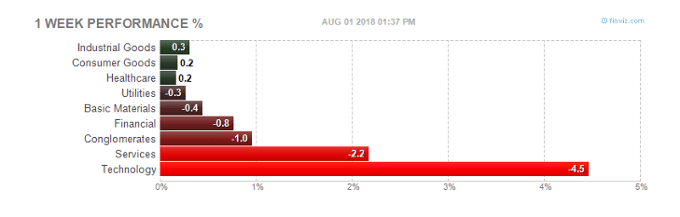

The headline was certainly not the whole story however as the final week in the month saw Facebook lead the technology sector down to finish off nearly 5% for the week.

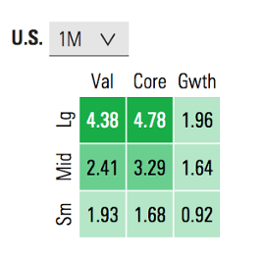

Large cap stocks outperformed small cap for the month although large cap stocks still lag on a year to date basis. Also bucking the prevailing trend, value stocks outperformed growth stocks for the month but again are lagging considerably over the past year (source: Morningstar).

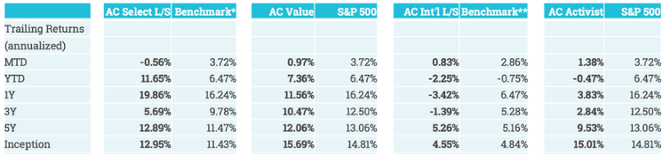

Reflecting the strength in value stocks, we saw our AlphaClone Value Masters (+0.97%) and Activist Masters (+1.38%) strategies return the best performance for the month. Value Masters is also outperforming the S&P 500 on year to date basis (+7.36% vs 6.47%) while Activist Masters continues to lag the market for the year. Our Select Long/Short strategy, which is unconstrained in terms of its manager style selection, continues to perform well, returning nearly double the S&P 500 so far this year (+11.65%). Download July performance.

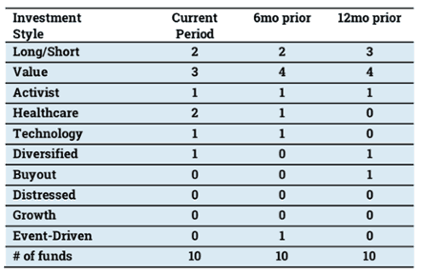

The ten managers that underlie Select Long/Short are exactly the same as those that underlie our AlphaClone Hedge Fund Masters Index (long only), which is available as an ETF. The table below summarizes the investment styles they represent for the current and previous two periods.

In case you missed them, I published a couple of research notes last month:

- The Market Gamble looks at traditional cap weighted benchmarks like the S&P 500 and how they've performed in rising interest rate environments.

- Clone Score - How We Pick Managers takes a deeper dive into our methodology for manager selection.

Please don't hesitate to reach out if you have questions about our strategies or would like to learn more about how our products and solutions can help you better achieve your investment objectives.

Article by Maz Jadallah, AlphaClone