Artificial intelligence is on the rise. NVIDIA Corporation (NASDAQ:NVDA) jumped 24% after hours with the release of its earnings. The company is already up more than 140% YTD. A.I. continues to fuel growth in most tech stocks, putting the sector at the forefront of the global industry’s transformation. Nasdaq’s research report predicts that the industry may grow up to $31.2 Billion by 2025 and fuels the growth of sectors like:

- Semiconductors

- Software

- Internet & Computer Services

- Specialized Consumer Services

- Broadline Retailers

- Telecommunications

- Defense

- Automotive

Investors looking to boost their portfolio returns can start looking at these sectors for potential long-term growth.

Key Drivers Of A.I. Investments

When investing for company growth, investors must understand the key drivers fueling the growing interest in the technology. For example:

- Potential to revolutionize company operations, enhance efficiency, reduce operating costs, and drive revenue growth. This includes automation and predictive analytics, personalized marketing, and customer service. A.I. will help enable companies to gain a competitive edge.

- World organizations and government’s recognition of A.I.’s strategic importance. With companies heavily investing in research and development, these investments can spur innovation, help advance economies, optimize certain sectors, and increase growth.

- With A.I.’s Machine Learning and Natural Language Processing comes exponential use of data for analytics and cloud computing. The ability to collect, process, and analyze vast amounts of data fueling A.I. algorithms, enables companies and their clients to efficiently make better and more accurate predictions that will help in their decision-making.

Risks And Challenges In A.I.

While investing in A.I. presents promising opportunities, investors must consider the risks and challenges associated with the technology. For example:

- Like any technology field, developments move rapidly in terms of technological advancement. Current tech and products may become obsolete in a few months or years. Since A.I. is a dynamic and evolving field, any investor exposed to A.I. must be updated on the changes happening in the technology.

- One of the latest topics in A.I. has been ethical considerations and regulations that must be applied to the fair use of the technology. With A.I. being able to process a large quantity of data and making the process more efficient, it also raises questions about its handling of data privacy, algorithmic biases, and the potential for job displacement.

With how fast technology advances, the market is highly competitive and also risks market saturation. Identifying unique and innovative companies becomes vital to achieving significant returns. Choosing companies at the forefront of the A.I. provides investors with a safety cushion.

Let’s look at some of the big players in A.I. right now that are pushing the boundaries of innovation.

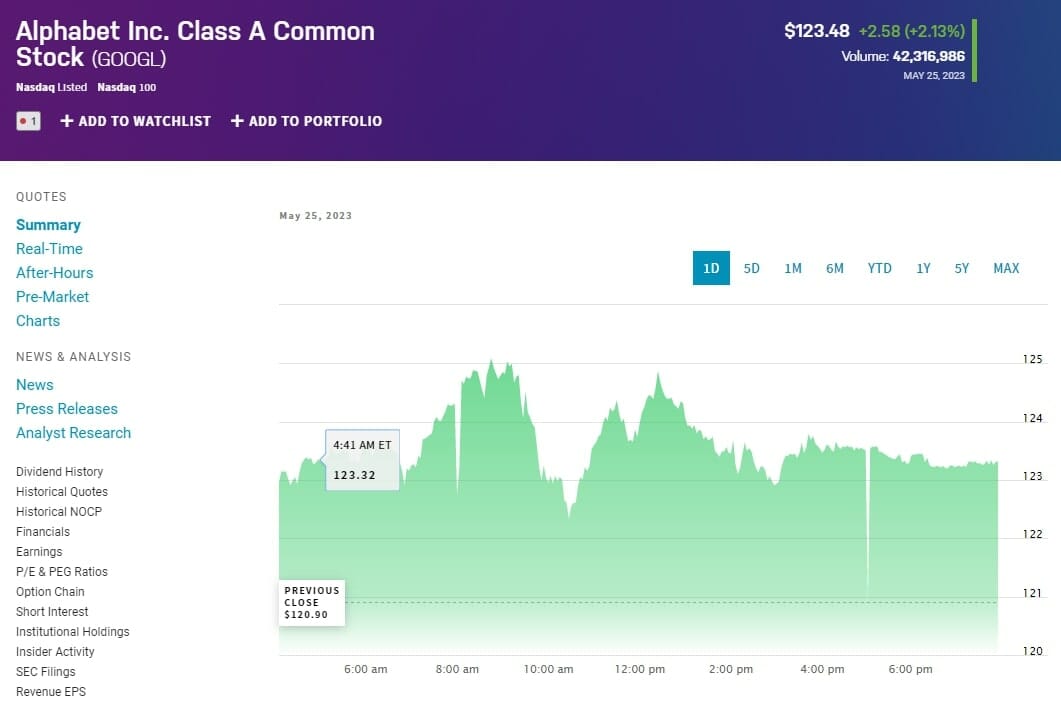

Alphabet Inc (GOOG)

Market Cap: $1,292.00 Billion

Alphabet Inc (NASDAQ:GOOG) is a holding company focused on different key market segments. This includes:

- Google Services – offers products and services such as Android, Ads, Chrome, Search, Google Maps, YouTube, and Google Play.

- Google Cloud – enterprise collaboration tools, infrastructure and platform services, and other services.

- Other Bets – focuses on early-stage technologies that are not part of Alphabet’s core business portfolio. This includes health technology and Internet services.

Alphabet also has Google Workspace and Google Cloud Platform, which are enterprise-ready cloud services offered by Alphabet. This provides cybersecurity, artificial intelligence (AI), data analytics, machine learning, and infrastructure. Google Workspace includes several tools like Gmail, Docs, Drive, Meet, Calendar, and others.

Alphabet’s Bets

Alphabet is one of the leaders in A.I. and data analytics and has been one of the giants in this space. The company has aggressively acquired A.I. startups for several years to further invest in its artificial intelligence capabilities. Its recent addition Bard A.I. is the company’s response to Microsoft’s Chat GPT. The company is continuously revolutionizing its technology and adding A.I. to its other services.

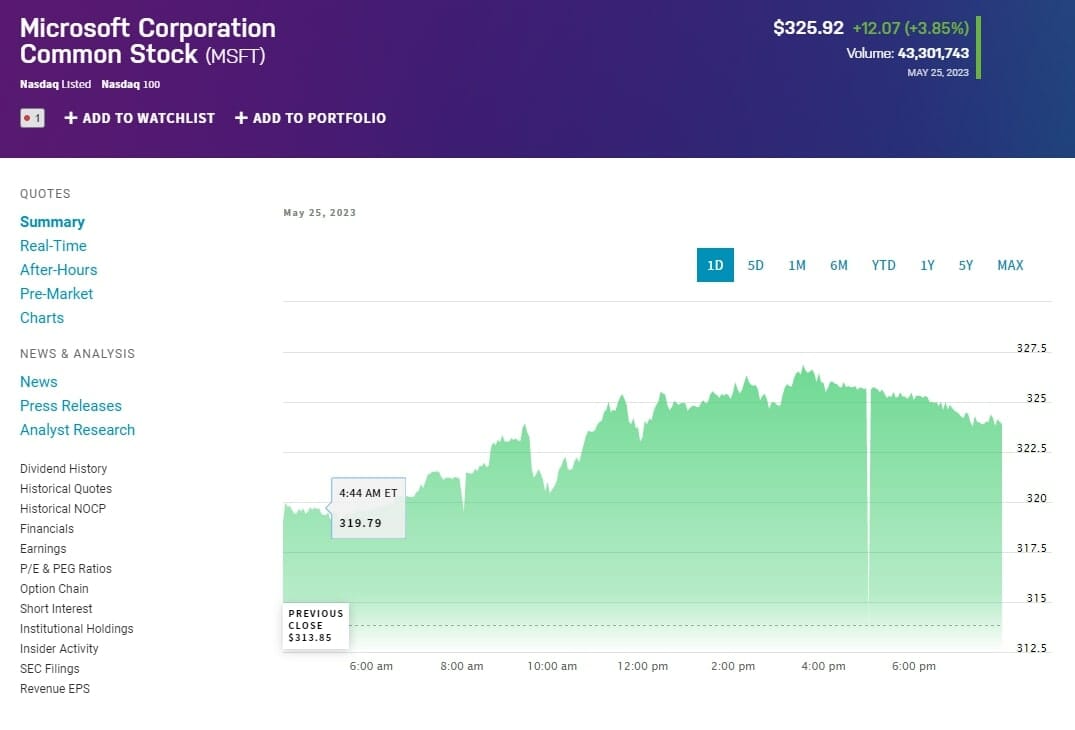

Microsoft Corp (MSFT)

Microsoft Corp (NASDAQ:MSFT) is a company that specializes in technology that everybody knows. They create and provide support for software, devices, services, and solutions and the famous Windows operating system, Microsoft Office applications, and Surface Tablets. The company is divided into three segments:

- Productivity and Business Processes – This includes products and services related to information services, productivity, and communication, available on different devices and platforms. Some examples are LinkedIn, Office Consumer, dynamics business solutions, and Office Commercial.

- Intelligent Cloud – This offers cloud services and server products that can be used by developers and modern businesses and also includes enterprise services.

- Personal Computing – This provides a customer-centric experience with its technology through products and services such as Windows, gaming devices, and search and news advertising.

Leader Of The Pack?

Microsoft has been considered by most as at the forefront of A.I. due to its partnership with OpenAI and its integration of ChatGPT into its products and reshaping how we do online searches for data. Microsoft’s Azure cloud service also offers A.I. services like bot services, machine learning, cognitive services, and other A.I. solutions.

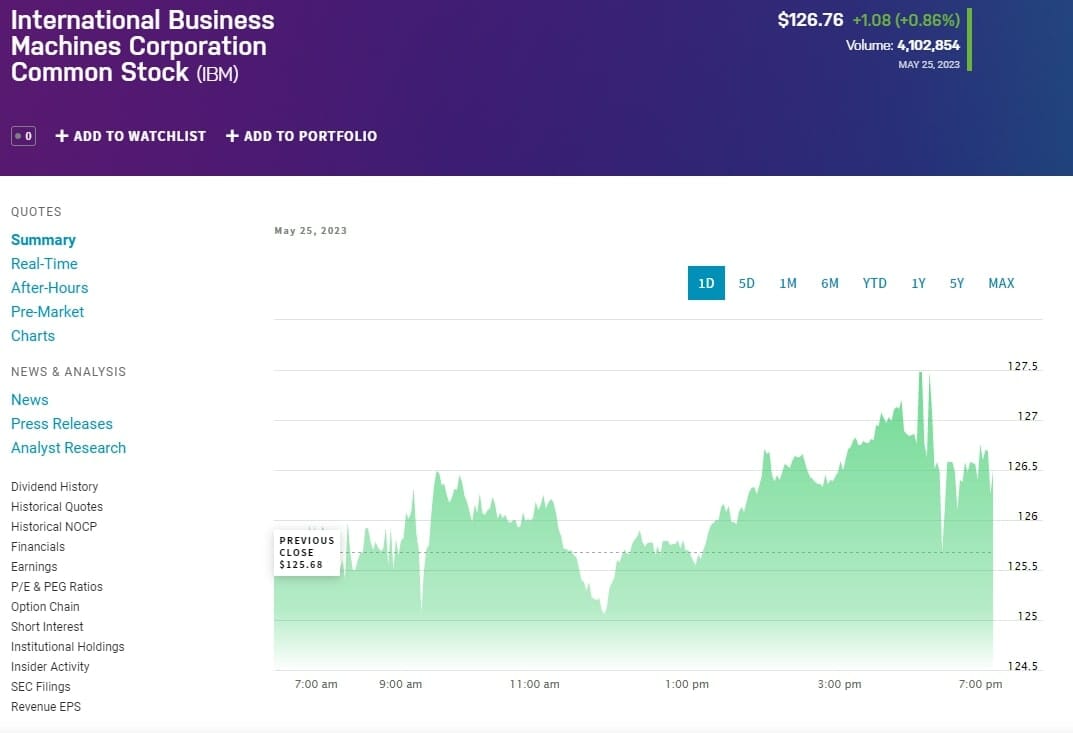

International Business Machines (IBM)

IBM (NYSE:IBM) is a technology company that provides artificial intelligence (AI) and hybrid cloud solutions. Its product offerings include integrated solutions and products that use data and information technology (IT) in business processes and industries. The company operates in segments:

- Software – includes Hybrid Platform & Solutions that includes software to help clients optimize, operate, and manage their IT resources and business processes within the hybrid, multi-cloud environments, and Transaction Processing. Their software also includes products that support clients’ mission-critical, on-premises workloads in various sectors.

- Infrastructure – provides infrastructure support and hybrid infrastructures.

- Financing – engages in client and commercial financing business.

- Consulting – provides consultancy in business transformation, application operations, and technology.

What Does IBM Offer?

Being one of the longest-running technology companies, IBM has been one of the leaders and biggest players in the technology sector. When it comes to A.I., the company’s cloud platform IBM Cloud is considered the best choice by most Fortune 500 companies.

Its efforts are centered around its AI-based cognitive service IBM Watson, the scale-out system designed to deliver cloud-based analytics, A.I. services, and A.I. software. IBM has continued its portfolio of A.I.-centered ventures through its acquisitions of several startups with promising technology.

Final Thoughts

Investing in new technology is both exciting and risky. It provides the enthusiasm of being proven right and hitting the jackpot and the gloom and doom bought about by being wrong. So before jumping on to this trend, investors should always conduct their due diligence and understand the business prospects and the technology behind it.

Just like how the Dot-com Bubble went down in the 90s, there will be companies that will stand toe to toe with industry giants or those that will be left in the dust.