Discusses the latest MoU and the IPCEI funding from the EU

Advent’s Middle Eastern Deal

The renewables sector fuel cell system manufacturer Advent Technologies (NASDAQ:ADN) ended the week more than 20% higher after news of a new Memorandum of Understanding (MoU) that was signed with Saudi based company, Hydrogen Systems Inc. The latest MoU is the third to be signed by the company in the last two months.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

News of the understanding shot the stock up 9.4% at the opening of trading on Thursday before retracing and closing with a gain of 5.1%. Friday saw another push with the stock rallying a further 12.5% over the day.

Under the MoU signed, the Riyadh based company aims to utilize their existing relationships in the region to sell, distribute and install ADN’s line of high-temperature proton exchange membrane fuel cells and hydrogen production products.

In addition to the understanding, both companies intend to explore potential large-scale development opportunities for hydrogen fuel cell power applications across the Middle East.

Advent Technologies share price broke a significant down trend in share price momentum back in mid-July when the company announced that it had been awarded €782 million in funding over 6 years from the Greek Government for the IPCEI (Important Projects of Common European Interest) Green HiPo Project.

At the time, ADN’s stock was trading down towards the $1 level after originally listing via a SPAC merger at $10 in November 2020 and rising above $15 by January of 2021.

A month after the original funding package was announced, the European Union (EU) approved a $5.4 billion aid package of funding for hydrogen IPCEI projects.

This development, and consistent news flow from the company has driven share price gains of over 200% from the low points.

Analyst Laurence Alexander from Jefferies Research expects Advent to secure more partnerships with OEMs which will position the company well to secure additional government support in the future while leveraging existing energy infrastructure.

The firm remains bullish with a ‘buy’ call and $5 target based on the prospects of a significantly growing addressable market and expectations that revenue generation will scale up in the coming years.

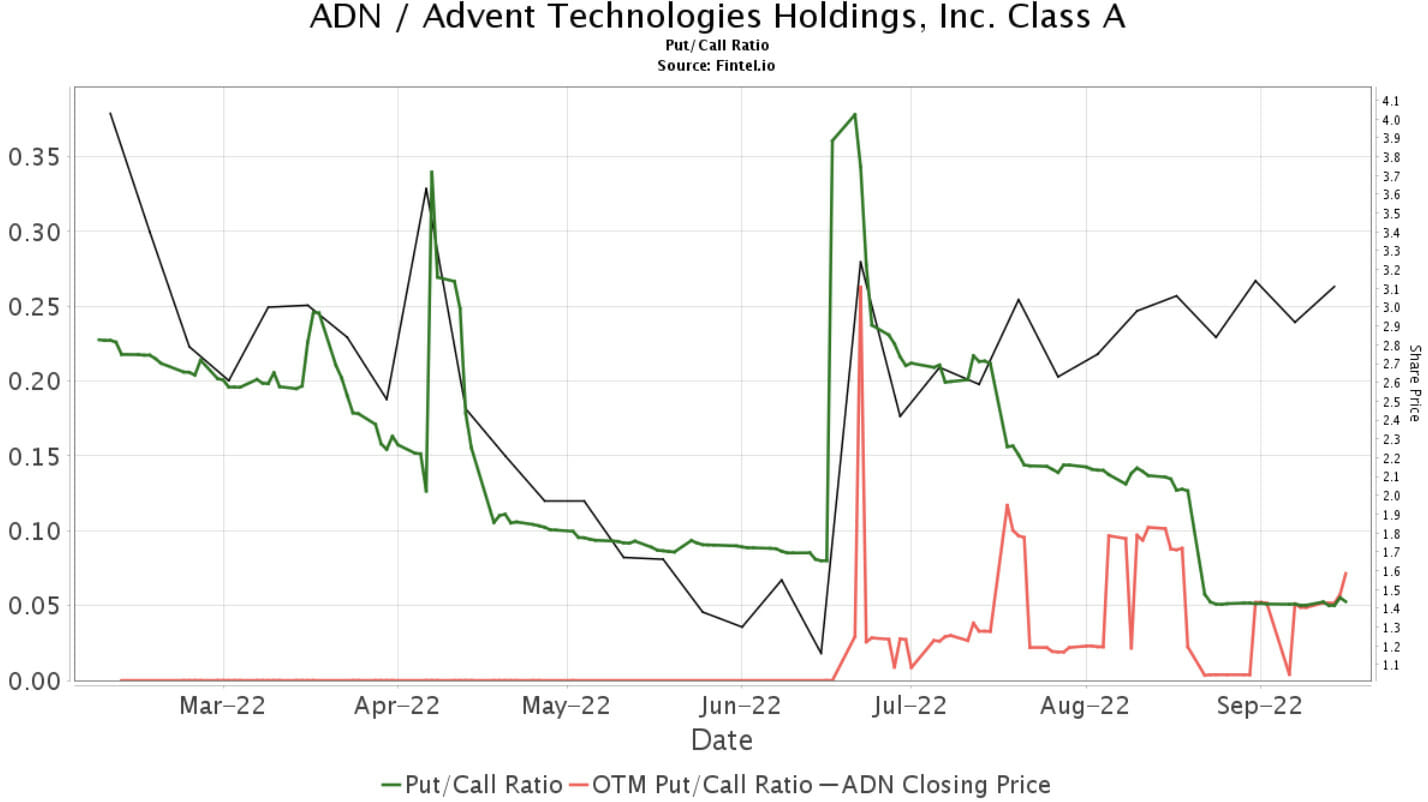

Fintel’s gamma squeeze score of 96.30 is bullish on ADN, as the recent share price rally was in part the result of actions that have occurred in the options market. The company ranks in 8th position out of 359 screened companies in the US market.

ADN’s put/call ratio has fallen by -15.46% over the past week alone, which is explained by the growth in call option volume. Net Call open interest currently represents 3.84% of ADN’s total float size.

The chart provided below illustrates how the put/call ratio has behaved over the last few months against the ADN share price.

Article by Ben Ward, Fintel