For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

What is it about the first week of August in the third year of a Biden/Obama first term that causes the bond rating agencies to lose their patience with trillion-dollar annual deficits as far as the eye can see?

And why did the first downgrade (2011) shock the investing world to its heels – with a 20% S&P 500 summer swoon, and a 25% surge in gold – while the 2023 downgrade caused nary a budge in either gold or stocks – even though the debt numbers have doubled, while inflation and interest rates have tripled?

There’s a parallel script in the cause of the downgrades, but a total yawner when it comes to the sequel.

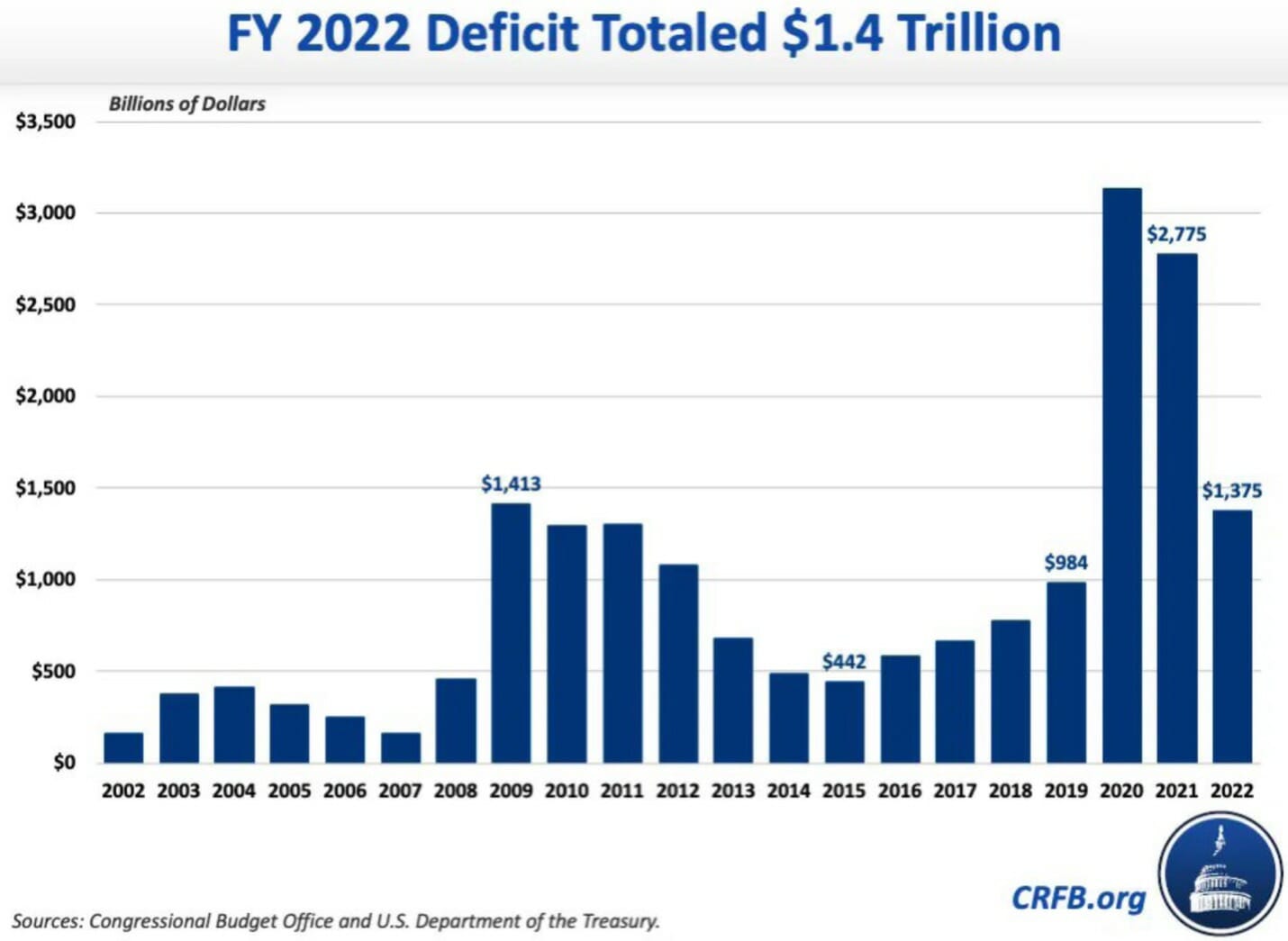

There were eight trillion-dollar deficits in U.S. history: The first four were in President Obama’s first term (2009 to 2012) and the second four were in the COVID years, 2020 to 2023, mostly under Biden. This year, the CBO estimates the deficit will reach $1.7 trillion, and it is already at $1.6 trillion as of July 31.

“The federal budget deficit was $1.6 trillion in the first 10 months of fiscal year 2023, the Congressional Budget Office estimates – more than twice the shortfall recorded during the same period last year.” – Congressional Budget Office Monthly Review, August 8, 2023

Both Obama and Biden took a crisis and used it as a Hall Pass to spend on every dream they ever had. It was Obama’s chief of staff, Rahm Emanuel, who said, “You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things that you think you could not do before.” Obama used the 2008 financial crisis and Biden used the Covid crisis, both on the wane, to spend way too much.

Within a month of taking office, Obama and his rubber-stamp Congress passed the American Recovery and Reinvestment Act (ARRA) on February 17, 2009, tagged as “$787 billion in shovel-ready jobs,” but the jobs were nowhere near shovels and the price tag reached $831 billion. Then came his “cash for clunkers,” killing the used car market, and his pet plan, Obamacare, “the Affordable Care Act,” passing March 23, 2010. His first (2009) deficit was $1.4 trillion, almost $1 trillion more than the 2008 deficit.

In retrospect, President Obama, Fed Chair Ben Bernanke, and Treasury Secretary Tim Geithner gave VP Joe Biden a blueprint for how to front-load spending in a first term. “Helicopter Ben” Bernanke promised to throw money from helicopters, if needed, in order to avoid a deflationary depression.

He lived up to those words with three major rounds of quantitative easing, plus five years of 0% interest. Gold soared to new record highs. Gold tends to grade our leaders and the dollar. Gold was $564 when Bernanke took office on February 1, 2006. Gold tripled during Ben’s first five years, to over $1,800 in August 2011.

In November 2010, voters staged a Tea Party rebellion, reversing a 63-seat Democratic majority in the House to create a 63-seat Republican majority – a 126-seat swing, in what Charles Krauthammer called (in our political panel in New Orleans that year) “a restraining order” on Obama’s spending plans. That led to some ferocious debates over the debt ceiling the next summer and the fateful first debt downgrade.

What Happened Before and After the First Debt Downgrade

Here’s a blow-by-blow account of what happened just before and after the 2011 debt downgrade:

- On Tuesday, August 2, 2011, Congress ended its month-long highly contentious debt-ceiling debate when President Obama signed the Budget Control Act of 2011. The Dow fell 265.87 that day. Then, the Dow fell another 512.76 points on Thursday, August 4. The cause of the second decline was fear that Standard & Poor’s would downgrade America’s credit rating, and the market was on the money!

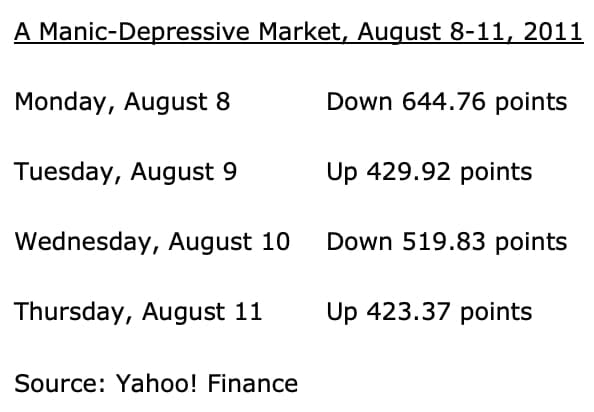

- Sure enough, S&P downgraded U.S. debt after the market closed on Friday, August 5. Even though that move was widely anticipated by then, the market went on a bizarre manic-depressive binge the next week. From August 8 to 11, the Dow rose or fell 423 points or more on four straight days!

- On Meet the Press Sunday, August 7, former chairman Alan Greenspan said, “The United States can pay any debt it has because we can always print money to do that.” Gold and stocks sneered at him. The previous Friday, gold closed at $1,659. On Monday, gold hit $1,710 and the Dow fell 645 points.

- On August 9, when Chairman Bernanke said the Fed would keep rates near zero until at least 2013, gold soared to $1,818 the next day, causing such a gold bidding furor that COMEX had to raise the margin requirements by 22% in order to slow down gold’s rapid surge to new record highs.

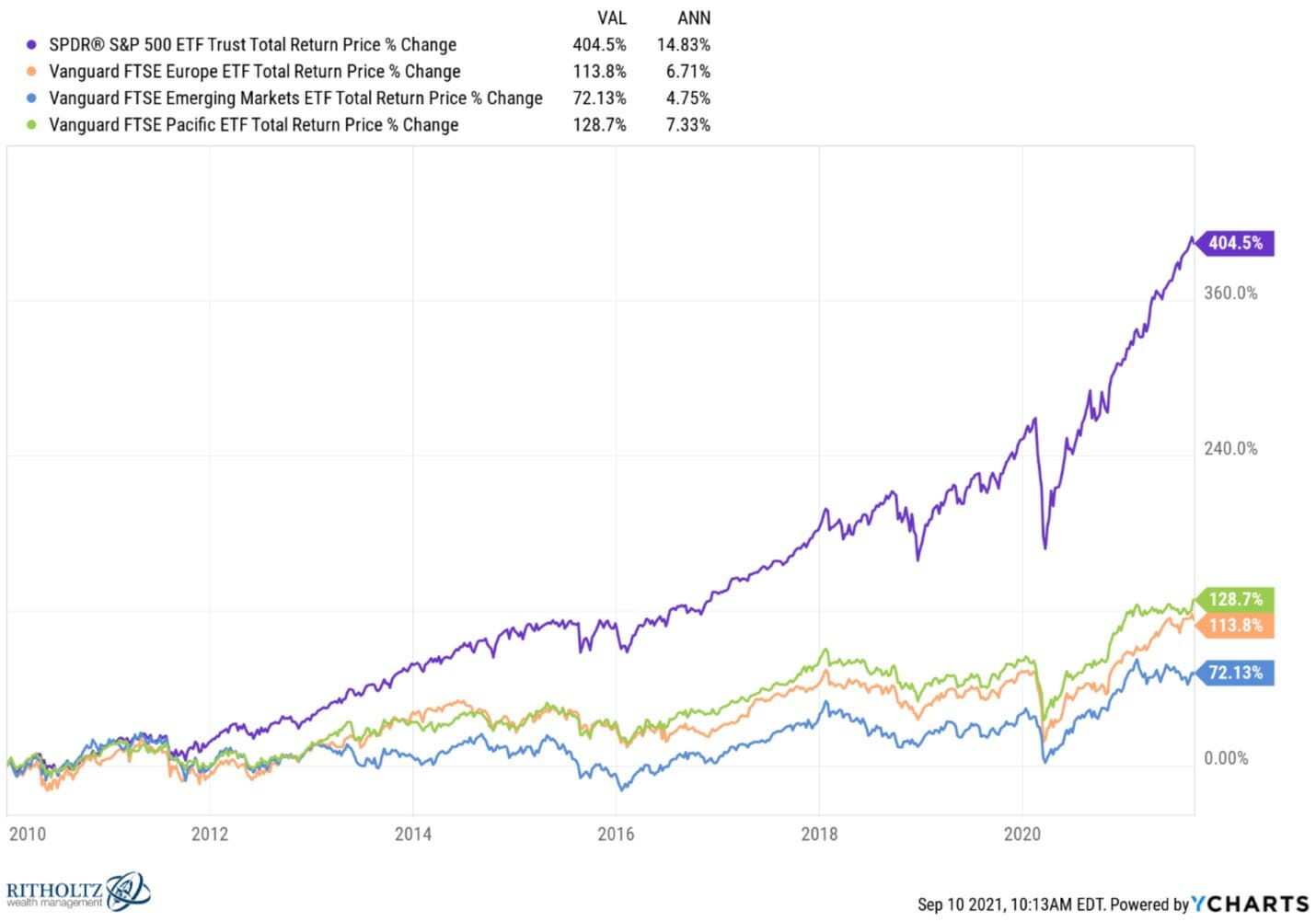

Markets quickly recovered. The dollar did not die. The economy went on a 9-year surge, as did the stock market, after the debt downgrade. On August 1, 2011, the euro traded at a lofty $1.426. A year later, the euro traded at just under $1.23, after touching $1.20, when Mario Draghi, head of the European Central Bank (ECB), said that he would do “whatever it takes” to protect the falling euro. Also, the U.S. stock market basically had a phenomenal 8-year surge until a Wuhan-based China bug infected markets.

America, despite the 2011 downgrade, whipped the rest of the world in stock market returns, 2010-2020.

Is this why the market yawned after Fitch’s debt downgrade in 2023? “Life goes on; the market will rise.”

Why No Big Reaction to the 2023 Fitch Downgrade?

Ten days after Fitch downgraded U.S. debt by the same single notch (AAA to AA+) on August 1, 2023, the S&P is down 2.7%, and gold is also down 3%, reflecting no great fear for the economy or the dollar. The 10-year bond rate rose immediately, but as of last Thursday, August 10, it was unchanged at 3.95%.

All of that qualifies as one big yawn, especially compared to the massive over-reactions of August 2011.

The answer, I think, lies in We the People, the voters. There was no Tea Party Revolution of 2022 against Biden’s massive overspending in 2021-22 – like Obama’s first two years. There was no restraining order to Bidenomics in 2022, no outrage over 9% inflation rates. There was only a 17-seat swing in the House and no switch in the Senate, a faint echo of the outrage that greeted Obama’s overspending in 2009-10.

This points to major problems in 2024. If America can’t see fit to nominate younger and more courageous Presidential candidates than the aging and divisive 2020 pair, and a Congress willing to cut spending instead of inventing new and ever more unrealistic spending promises, a third debt downgrade may ensue.