Elizabeth Lilly from the Ben Graham Conference in Canada from earlier this week on small cap investing – full article for subs

– Small and micro cap

– Laying the groundwork and how to discover investment opportunities

– Rising interest rates environment

– There is a misnomer that small caps underperform in rising interest rates environment

– Because of higher costs

– The case for small and micro caps

– Value Investing – Graham and Greenwald

Fundamental analysis is key: low P/E, low P/B

Actively seeks undervalued stocks for less than their intrinsic value

– Malkiel & Fama

Stock markets are efficient

Market prices reflect the sum of all information

Impossible to outperform market through stock selection and market timing

– Small caps outperform over full market cycle. Over a 15 year period, as illustrated above, a

$10,000 investment in small cap company stocks would have grown to $124,669 compared to

$90,064 for large company stocks

– Small caps during rising interest rates

– Average annual performance of small caps and large caps when treasury rates are rising and

falling

– Since the inception of the Russell 2000 in 1979 through 2012

– Historically, small caps tend to perform better in rising rate environment than during a period of

falling rates, perhaps attributable to improving economic activity, a harbinger of stronger

earnings

– Long-term rates 10 year treasury rate

Falling interest rates: small cap 10.2 vs large cap 12.4

Rising interest rates: small cap 17.6 vs large cap 14.6

– Short term interest rates 3 month treasury rates

Falling interest rates: small cap 9.4 vs large cap 13.0

Rising interest rates: small cap 18.0 vs large cap 14.9

– Why small caps outperform in rising rates because they are more leverage

– Merger and Acquisition activity benefits small/micro caps

i. Activity: M&A transactions targeting small and micro cap companies continue at a

robust pace, with US M&A volume reaching a record $2.3 trillion in 2016, up 35% from

the prior year

ii. Activists: Following a period of non-uniform equity performance, activists investors are

prodding company managements to unlock value, often through a sale of the company

iii. Attractive: in a lower than historical growth environment, large-cap companies seek

inorganic growth through the acquisition of small companies

– We do not invest in companies that will be acquired

– They happen to be beneficiary of M&A environment

– Also, can be a beneficiary of activist

– Example: Supervalue – retail

– Have a lot of hidden real estate value (15 million square feet worth close to $30 a share)

– Do something about that, unlock the value

– Yesterday, they said they will unlock value by 5 million sqft, generating $400 million cash, an

additional $11 per share of value that they will unlock

– The original intent was not because an activist would be involved but rather the analysis

concluded it was mismanaged and that they needed management to understand where they

can unlock the value

– Betted also that an activist would come along to unlock the value

– This is more and more of the case that small and micro caps

– Also a lot of smaller hedge funds who want to make a name for themselves by identifying these

opportunities

– Also a lot of the small caps are bit size and easy for bigger companies to grow bigger and acquire

them with cash

– Rise of hedge funds and high frequency trading, changes investment horizon

– Increased market volatility equals greater opportunity

– The ascendancy of hedge funds and high frequency trading firms have changed the investment

environment, introducing volatility and shorter investment horizons

– Volatility greater inefficiencies better investment opportunities higher potential return

– Average turnover for funds

1986: 30%

2016: 44%

– Greater inefficiencies creates stocks on sale for no reason opportunity for bottom up

fundamental research

– We do not rent stocks, we own businesses for a long time

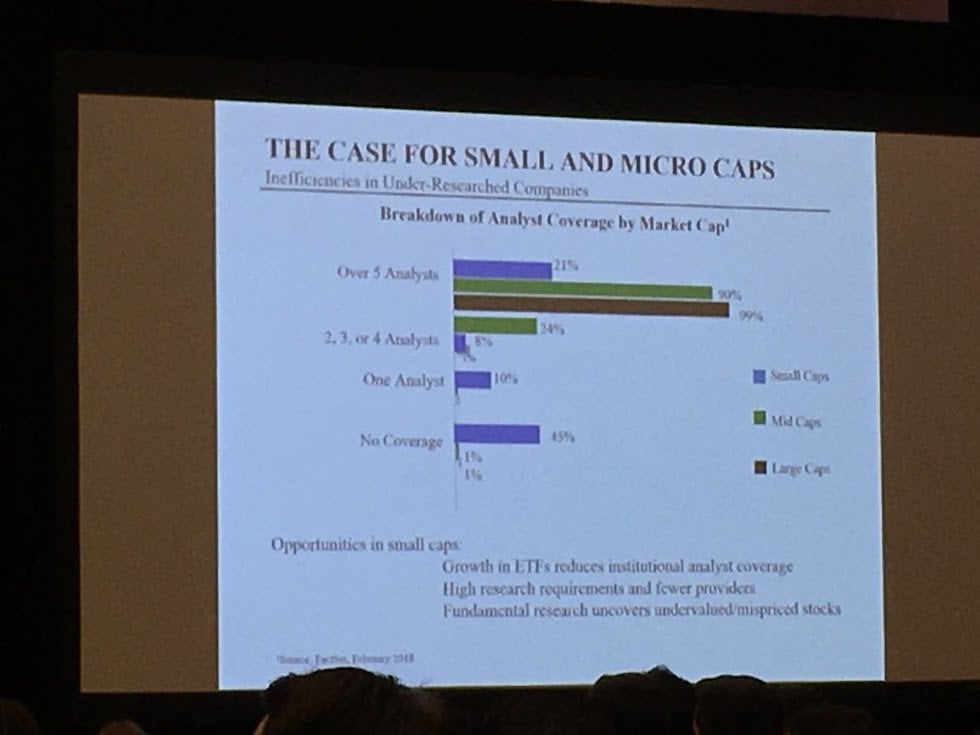

– What is the most compelling piece of information as to why you should invest in small caps?

Breakdown of analyst coverage by market cap

Inefficiencies in under-researched companies

Over 5 analysts coverage: 21% small – mid cap 90% – larger 99%

2, 3, 4 analysts: 8% small cap vs 1% for large/mid (have at lea

No coverage: large.mid 1% ish,small 45%

Dontinues here