Discusses the insiders that have accumulated stock, the recent equity raise and broker initiation

Clinical stage biopharmaceutical company IN8BIO, Inc. (NASDAQ:INAB) topped the Fintel Significant Insider Buying Activity screen this week with 11 insiders buying over the last 90 days.

Inside Buying At IN8BIO

INAB scored 99.72, based on the 11 insider’s collective 5.4 million share buy. They bought at an average of $1.90 per share. With the stock now trading at $2.41, the average purchase parcel has a gain of 26%.

Q2 2022 hedge fund letters, conferences and more

Insiders bought during the firm's most recent stock offering, launched on Aug. 9, to help finance clinical development s and general operational expenses.

The insiders contributing to the stock offering included the company's largest shareholder and fund manager, Bios Capital Management (Aaron Fletcher). The latter purchased an additional 1.78 million shares and increased the fund's total shareholding to about 8.3 million or 44% ownership in the company.

The company's second largest insider and company Board Director, Emily Fairbairn, acquired an additional 790K of shares, bringing her total to 4.2 million or 22% ownership.

Following this was Board Director Peter Brandt, who acquired 105K shares, doubling his position to 182K shares or 1.5% ownership in the stock.

Other insiders participating in the stock offering included; Chairman Alan Roemer, Co-Founder & CEO William Ho, Co-Founder Lawrence Lamb, Board Director Luba Greenwood, Chief Medical Officer Trishna Goswami, CFO Patrick McCall and COO Kate Rochlin.

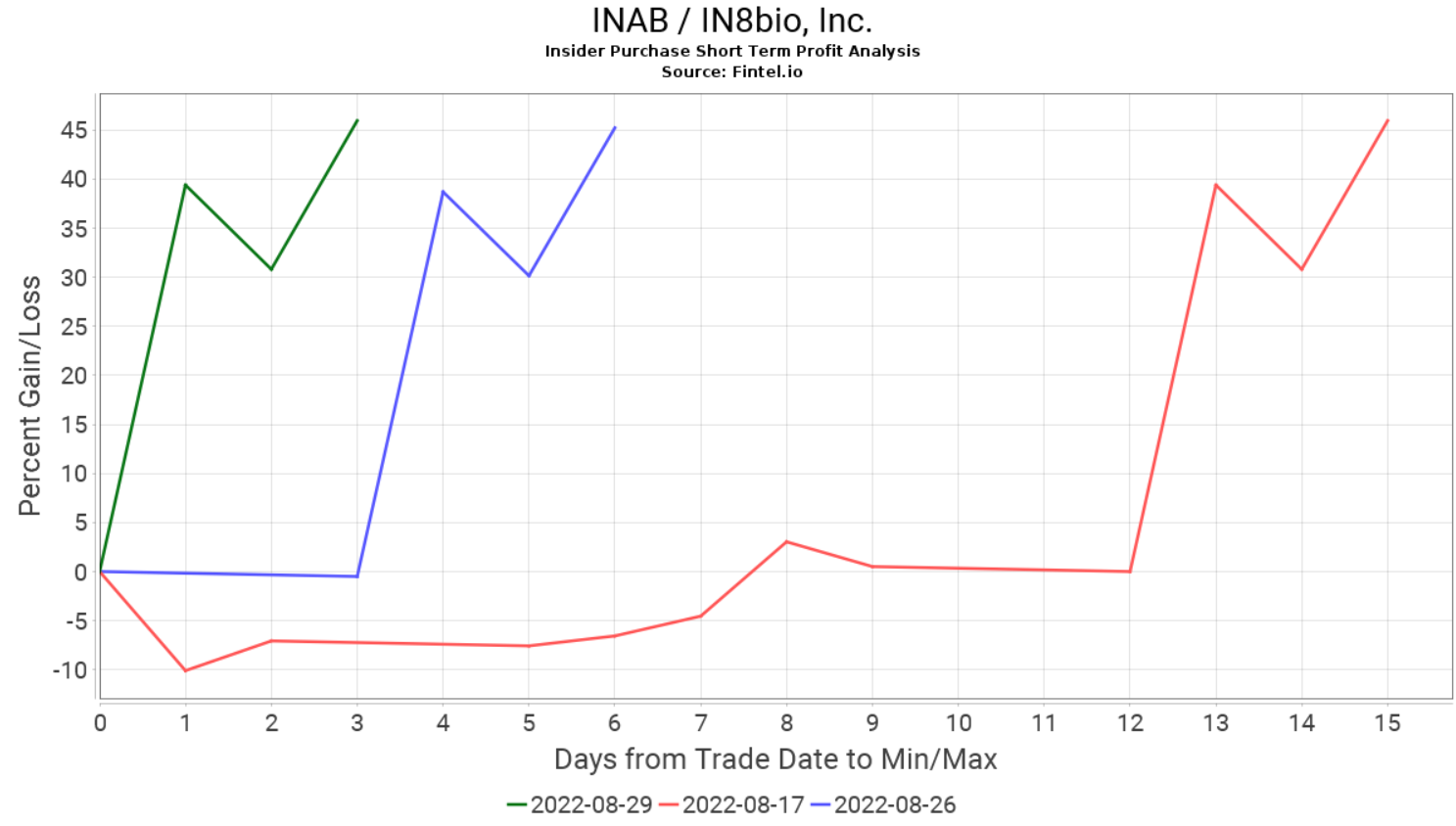

The chart provided to the right illustrates the significant short-term gain made from the purchases made in the stock offering:

Although recent gains have been made in the stock over the past month, INAB continued to trade at a -75% discount to the IPO listing price one year ago. The stock now has a market capitalization of only $60 million.

H.C. Wainwright Rates INAB A Buy

Analyst Swayampakula Ramakanth from H.C. Wainwright & Co initiated coverage on the stock last week with a 'buy' recommendation and a $14 price target.

The whopping target implies a further +540% upside to the current price and is above the all time high price for the stock. The price target is based on forecasts of projected future revenues from the firms INB-200 and INB-100 candidates.

In the note, Ramakanth points out that the Gamma-Delta T cells could be a game changer as the therapy is advantageous over conventional chimeric antigen receptor (CAR)-T cell therapies because of its better safety profile.

The institution believes initial results from the INABs Phase 1 trial to be released in 2022, with top line results of cohorts expected to be seen in 2023. They expect the cell therapy products to enter the market in 2025.

INAB has three 'buy' recommendations across three institutions that give an average consensus target price of $11.70. While the average target price has retreated from IPO highs, the valuation increased incrementally in August.

Article by Fintel