Silver is an interesting proposition right now, with precious metals being key to the global push for net-zero carbon emissions.

Silver’s secret is that it’s great for conducting electricity, so given that the world needs more electric vehicles and solar cells, it also needs more silver.

Plenty of analysts feel the demand outlook for silver is good, though things can always change fast.

In this guide, we will explore everything you need to know about how to invest in silver in 2024.

The easiest way for most people to invest in silver is by purchasing a silver ETF through an online broker.

There are a number of ways to invest in silver beyond ETFs. Which of these suit you is likely to depend on your appetite for risk and your investment experience. Let’s take a look at the options.

Buy a Silver ETF online

Buying a silver exchange-traded fund (ETF) is a straightforward to invest in silver.

An ETF like the iShares Silver Trust (SVR) essentially purchases and stores the physical silver on your behalf, meaning you get the benefits of owning it, without the hassle of dealing with the physical asset.

There are also ETFs that track more diverse investment strategies, like investing in silver futures, silver miners, or other strategies.

ETFs are a common way to invest in hard assets and commodities because they let you trade the product online through an online stock broker or stock trading platform.

This means that they offer high liquidity and you can easily buy or sell silver at the current market price. You can also set limit orders to buy or sell when your target price is hit.

There are two fees to be aware of when buying an ETF – the annual management fee by the ETF issuer, and the trading fee of the trading platform you choose. So it’s wise to compare silver ETF brokers before you make your choice.

A downside to an ETF is that it’s not the actual physical product, which is an important aspect of owning silver for some people.

Buy Silver in Physical Form

Buying physical silver is a tried and true method that is still favoured by many. You can buy silver coins or silver bullion. Various weights are available, commonly ranging from one to around 100 ounce bars.

You’ll also need somewhere to safely keep this silver. Once you’ve got hold of it, you can use buyback services to resell as and when you feel the price is right.

If you do opt to buy silver in this way, always check your purchase is insured throughout delivery; you don’t want your silver getting lost in transit.

It is also worth checking your contents insurance policy. How it might pay out in the event of theft, loss or another unforeseen event might impact on the volume of silver it’s wise to keep at home.

There are also specialist dealers and traders you can approach; these will vary in price, quality and speciality depending on your location.

Some people feel safer with a real-world asset they can see and touch. But this doesn’t make physical silver better or worse than other investment options; it’s simply a choice.

For many, the best way to invest in silver is to purchase shares in a silver company. However, depending on your preferred route to market, options vary.

You could simply invest in a silver mining firm. There are many international extractives companies out there, and plenty specializing in other precious metals.

Then again, you might prefer to put your money into a firm that uses or processes silver into other products.

Such a company might comprise a solar panels firm, or a manufacturing company that feeds its silver-based products into electrically-powered vehicles.

There are some risks here which differ from investing purely in silver itself. If you’re considering how to buy silver stock, remember it won’t just be supply and demand that define your returns.

If your silver mining firm is found guilty of environmental mismanagement, or has an accident harming staff on its site, that will impact on its share price. This could lower your return, even if that very same day, the price of silver as a metal is actually rising on the markets.

In short, investing in silver companies will mean running all the gauntlets of the stock market. But your hunch is likely to be on the fact silver demand against supply is rising, and your investment towards firms leveraging that.

Invest in Funds Containing Multiple Silver Investments

Investing in silver funds is another interesting way to approach the silver investment market. A silver fund consists of a number of companies working in silver, like miners or processors.

By buying into a fund, you try to mitigate risk. As explained, if you invest in a single mining firm, it could be affected by bad press, an accident, or government policy change. Any of these elements might damage your returns, even if silver itself is becoming more valuable.

But, if you invest into a fund, because the fund return is based across a number of sub-investments, one company crisis shouldn’t affect your returns so significantly.

There are likely to be specific funds available. Some might focus more tightly on the mining sector, others on mining and processing.

Some will offer greater or lower levels of risk. Primarily, a fund can be seen as a way to spread your silver eggs across more than one basket.

Nonetheless, funds can still be negatively impacted by economic news, politics, the challenges of emerging markets and so on.

While generally more reliable due to the diversification, it’s important to keep in mind that funds are no more of a guarantee than the silver you might store in your basement.

The Best Way to Invest in Silver Online

If investing in silver is your chosen pathway, as opposed to purchasing the raw material, you are going to need two things.

First, an overall strategy to follow. Second, a brokerage and account to enable you to buy and sell your silver assets through an app or your internet browser.

1. Establish an Investment Strategy

The best silver investments you can make will stem from a bespoke strategy. You should spend serious time deciding this before you move any cash.

First, what are you seeking? To make big sums of cash, or perhaps create a savings pot for family? These and other personal factors will determine your appetite for risk. What can you afford to lose? How willing are you to take a punt on the financial future of silver?

It could be useful to consider whether you seek a certain amount of financial return, set against a certain timescale

Then, you can choose whether you need a faster, potentially riskier strategy, or opt for something less urgent, where you can pick a safer strategy that pays out more slowly, allowing stocks to bounce back should they take a hit.

No matter your strategy, markets will rise and fall. You should always be aware of this.

2. Select a Brokerage that Aligns With Your Strategy

Once you’ve identified your strategy, the next thing you will require is an online account and a broker to give you access to market.

Such brokers can allow you, for example, to follow the investment strategy of other top investors on the platform. If you feel their experience and example will benefit you, just follow their moves and see whether the returns come in.

Alternatively, you could pick from a ready-made portfolio that you feel suits your predefined strategy and your needs.

And of course, there’s the option to run everything yourself, picking a range of silver shares and assets and watching the markets to choose when and where you move.

Whatever your strategy, a little due diligence is always worthwhile. Be sure to research any platform you are considering using, and certainly don’t ever send money to potential spam platforms that email you without invitation.

3. Verify Your Identity and Add Funds to Your Account

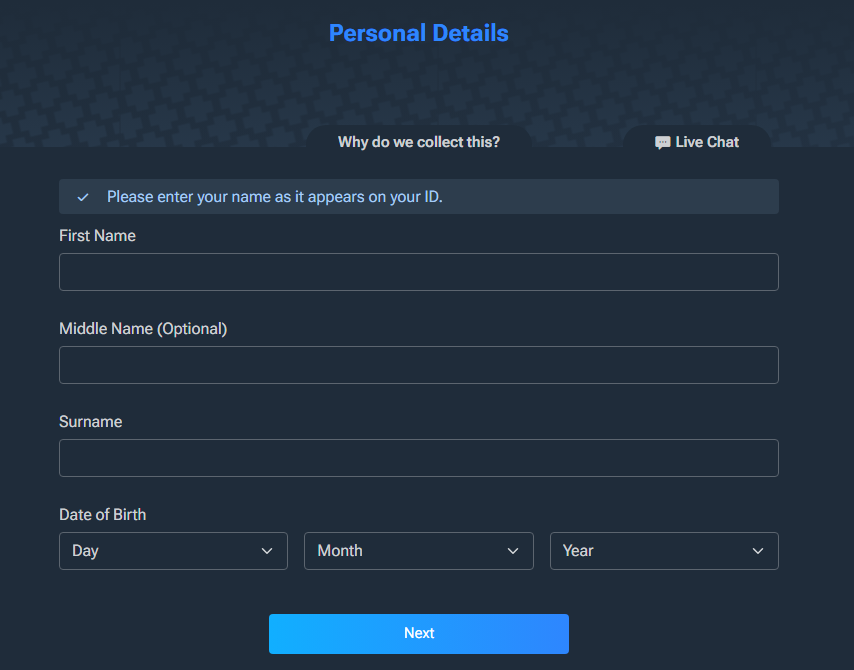

Every reputable and safe platform will ask you to verify your account, to make sure you are who you say you are and determine your money is protected properly. To begin this process, you first need to make an account with your broker of choice, and confirm a series of personal details.

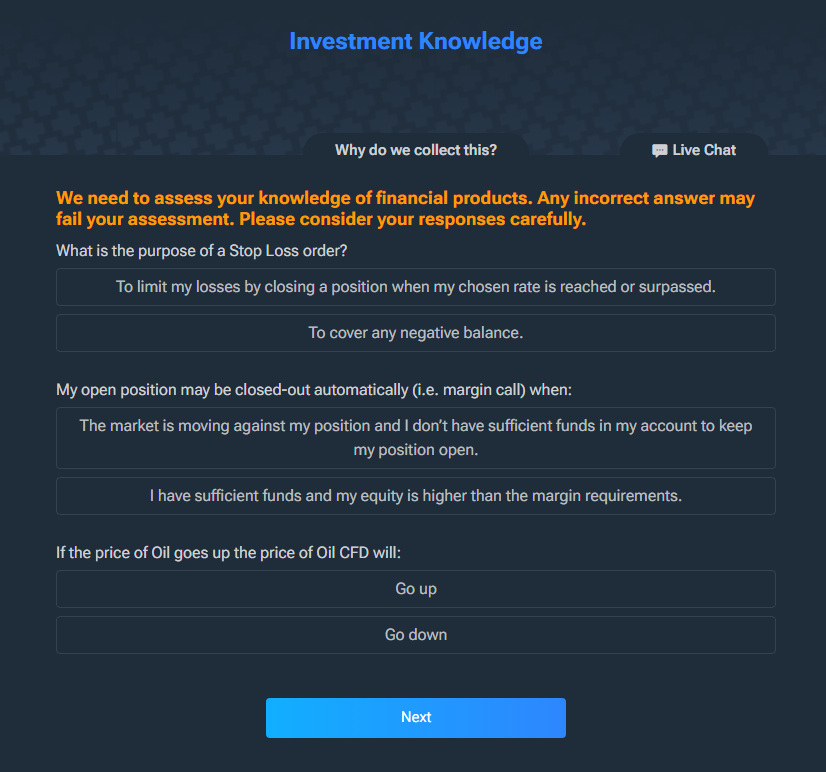

Many brokers will then ask you a series of questions to determine your investment approach and knowledge.

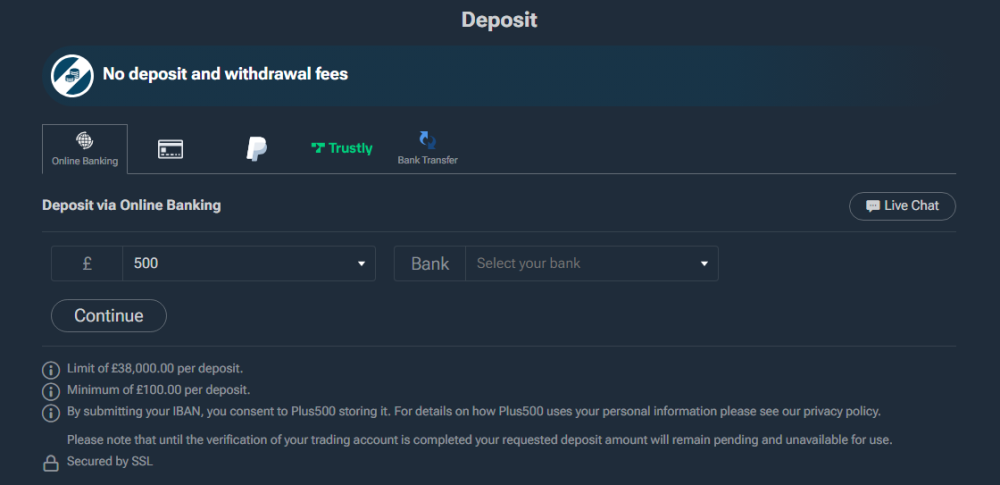

Now that all this is done, all that remains is to fund your account.

4. Choose Your Investment and Open a Trading Position

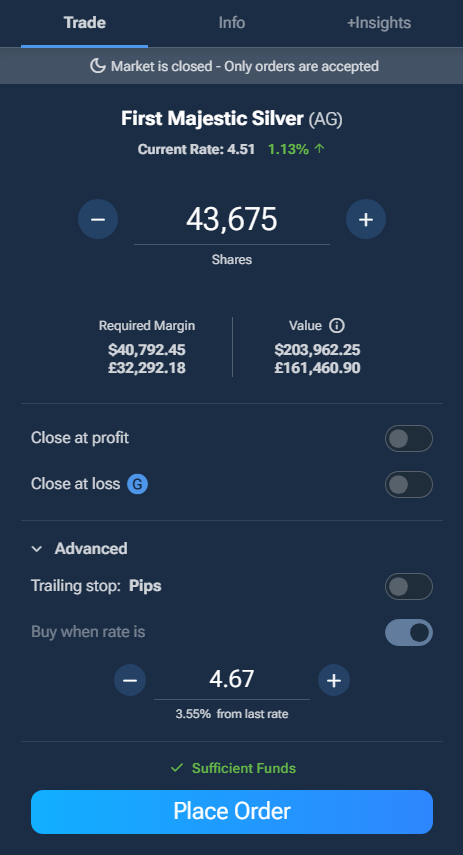

Having completed the various signup and identification requirements, and funded your account, you are now in the position to start investing in silver.

At this stage, remember your overarching strategy, and what your objectives and aims are from this silver investment.

To complete this step, all you need to do is locate your chosen investment using the platform’s search function. This will display the real time price of the silver, the amount you are opening a position on, whether you prefer to use units or cash as the metric, and details on any fees.

That is really all there is to do. Pick how much you want to spend, and you will be on the open market.

Where to Buy Silver in 2024

As we’ve established, if you’re considering how to buy stock in silver, the answer is pretty simple; you need an online broker.

Less clear however is which broker you should choose. As tends to be the case with many online financial scenarios, there are a myriad of options available.

Here is a quick rundown of some popular options.

1. Plus500: The Best Online Brokerage for Most People

Plus 500 is a global organization that covers a vast diversity of options, from CFDs such as forex and indices to Shares on Plus500Invest platform, and futures on the Plus500Futures platform, available only in the US.

This means virtually everything any burgeoning investor might require is there, but equally there is a fair bit of complexity to navigate.

This being the case, a handy amount of resources are available, covering a trading academy, market insights, an economic calendar and even a risk management section.

Some of these instruments are truly valuable, such as a market stop, which effectively places an absolute limit on the amount you could potentially lose.

You set a price at which your position on silver closes, and then you can rest assured that you’ll never lose beyond this set amount.

Similarly, a trading stop feature will help you to lock in a certain amount of profit too. These tools are very useful for new investors, as well as those who want a position they don’t have to necessarily watch with eagle eyes.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. eToro: A safe, Responsible Option for Beginners

The eToro brokerage is among the top online brokerages available. It is secure, reliable, safe and trustworthy, and as crucially, well-established.

Some other advantages stand out. The eToro Academy is an intriguing place, where potential investors can learn about markets.

There are plenty of simple tutorials too, which can run would-be silver traders through the nuance of the markets and the complexities of assets, commodities, positions and futures.

Additionally, a digest and invest section offers further learning potential, to scale up newbie investor knowledge in a logical and sensible way.

All this is welcome for a platform that takes its responsibilities seriously when it comes to protecting investments and helping investors get clued up on the key skills and knowledge they need.

A nifty virtual portfolio is worth a mention. Here you can trial out approaches without having genuine cash in the game.

Warning: Your capital is at risk.

3. Robinhood: Low Fees But With a More Exclusive Feel

This brokerage invites you into its domain via a waiting list, which perhaps isn’t the friendliest way to win new business.

After all, we all like to feel special, and as though our new business and attention is welcome. Some people might find the initial interface a little garish too, but bear in mind this is actually an app.

However, the platform boasts low deposit and zero trading fees on a wide array of investments, and a community-oriented approach which allows for features such as social trading.

It is available across the UK, EU and US, with 24/7 support. There are some interesting options for investors seeking to develop retirement pots, and there is also the option to take out a debit card.

This links up spending and investment, which is an intriguing proposition. Plenty of basic tutorials across the various options including ETFs, dividends and portfolios are available.

Warning: Your capital is at risk.

4. WeBull: A Winning Platform for More Experienced Traders

WeBull’s opening pages aren’t the simplest, describing Webtrade 4, Investing for Retirement, Smart Advisor and OTC trading.

These are undoubtedly worthy products, but the messaging isn’t the clearest for a new investor who remains uncertain precisely what they are seeking.

Further, clicking on WebTrade pulls users directly into a complex trading visualization, having neither requested a login nor specified a user. Usability could improve.

These visualizations are complex, and there is a lot going on here. Clearly this is a platform designed for those in the know, and less of a newbie option.

But for more astute and experienced traders, WeBull could provide an exceptional outlet. For instance, a range of analytical tools are among the features on offer.

All in all, the platform is evidently powerful, but the question surrounds how accessible this power is.

Warning: Your capital is at risk.

The 4 Best Silver Investments for Beginners in 2024

If you’re wondering where to invest in silver, the following four investments offer a good representation of the market.

Any investment can rise and fall, so always be aware returns are never guaranteed.

Mag Silver Corp (MAG)

MAG’s Juanicipio silver facility processed 346,766 tons of mineralized material in Q4 2024, up from 322,249 in Q3, reflecting ongoing efforts to ramp up production and optimize operations.

That’s a good sign in terms of expansion and projected performance. MAG also holds silver facilities with some 19 years predicted lifespan.

MAG’s ESG performance also appears solid, with the promise the firm recycles 68% of its waste and zero existing or outstanding incidents of poor ethics or corruption.

Jim Mallory, MAG’s Chief Sustainability Officer, stated: “Our second annual Sustainability Report reflects our continued commitment to lasting and sustainable value to our people, stakeholders, communities, and the planet.”

All in all then, MAG looks like a fine investment option, that illustrates silver’s longevity.

The Aberdeen Trust holds allocated physical silver bullion bars stored in secure vaults. It is simple to check the ETF’s status, as the bar list is posted daily on its website.

Aberdeen’s metal is held in London. JP Morgan is the custodian behind its activities, and Aberdeen’s net assets are in the region of $1,060,402,598.

The fund has also performed very strongly in relation to the wider S&P 500 in recent times, boasting a correlation of 0.297 over the past decade. This puts into sharp focus the value of diversifying your investment portfolio with silver.

The point here is simple: Aberdeen’s ETF almost exactly tracked the value of silver itself over the last decade.

Therefore, if you want to invest in silver, but don’t want to buy actual bullion, then this ETF, to date at least, has represented a practically identical return.

Allspring Precious Metals Fund (EKWAX)

The Allspring Fund is a long-term capitalization fund, so it’s one for those interested in the longer game. It places some 80% of the fund’s assets into investments related to precious metals, silver included.

Allspring was launched in 1998 and invests in companies involved in the exploration, development, mining, processing, or dealing of gold, precious metals and minerals.

The logic here is that these tend to have a relatively high correlation to underlying commodity prices and relatively low correlation to the prices of other stocks and bonds.

As explained, Allspring focuses on a longer-term investment horizon, looking for companies that have lower-than-average cost structures, are well managed, and are likely to improve their relative value over time.

On this basis, the fund aims to do a lot of the hard work for you. It seeks to deliver a strong silver-related performance, without actually placing your money into physical silver itself.

First Majestic Silver Corp (AG)

In terms of production, FR achieved a 6% uptick in Q4 2023, reaching 6.6 million AgEq ounces in Q4 2023. Evidently, this spells promise from an investment perspective.

There is also good news from an environmental perspective. First Majestic’s ESG score with Sustainalytics has improved drastically in recent years, putting the company in the top 38% of its industry peers.

This is vitally important, because strong ESG performance helps alleviate risks on ethics or safety performance that might damage the corporation’s share value, even when the value of silver itself might be rising.

FR also has some heritage, boasting 100% ownership of three producing mines: San Dimas, Santa Elena, and La Encantada. San Dimas is particularly valuable, being one of Mexico’s largest producing mines and having been in operation for more than 250 years.

San Dimas is one of the country’s most prominent silver mines and the largest producing underground mine in the state of Durango, with over 250 years of operating history.

When weighing up investment options, it is always welcome to see long operational histories, and companies with diversified activities.

Our Verdict on How to Invest in Silver in 2024

If you’re seeking the best silver stocks, investment vehicles and brokerages available, then you should align any investment with the strategy and objectives you previously defined.

A longer term investment might well benefit from funds similar to the Allspring Fund. But if you’re seeking something quicker and you feel that a spike in silver prices is on the way, then you can look to shorter term options.

You can also research markets that are strongly aligned with silver. Investing in companies that use silver in their products, and whose products are in the ascendancy can also be a clever way to leverage money.

In these scenarios, investing in firms that should benefit from ongoing green transitions to low carbon might be effective, who use silver in electrical products, which as aforementioned then help tomorrow’s solutions like electric vehicles to run properly.

But the overall upshot remains the same; you can invest in silver itself, a mining firm, a fund or an ETC, a wider portfolio, or you can find other ways to play the market.

FAQs

Is Investing in Silver a Good Investment?

No one can definitively say what a good investment is, because the markets change daily, as do global economics, politics, demand and supply.

It is possible to say that silver has performed well in recent years and certainly enjoys something of a safe haven status. In other words, it is considered a decent investment as long as the market conditions are right.

How to Buy Silver for Beginners?

Beginners should first define what their objectives are when it comes to investment, and the levels of risk they are comfortable with.

Then, they should learn about various investment choices (bullion, shares, ETF) and select a platform to help them play the markets.

What is the Safest Way to Invest in Silver?

Sadly, there is no guaranteed safe option when it comes to any investment. There are however various tools available including market stops that can help investors insulate themselves from risk, by guaranteeing prices at which they will leave/close positions.

Will Silver Hit $100 an Ounce?

No one can predict silver prices with absolute certainty. That said, market predictions on silver rely on predicting inflation. This is the most likely driver for $100 an ounce, but this price peak is by no means certain.

References

- https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

- https://www.cbsnews.com/news/is-silver-a-good-investment-heres-what-experts-say/

- https://www.valuewalk.com/the-price-of-freedom-a-look-at-the-evolution-of-gold-and-silver-prices-since-the-first-memorial-day/

- https://economictimes.indiatimes.com/wealth/invest/buying-silver-this-dhanteras-these-factors-will-decide-the-return-on-this-investment/articleshow/105113302.cms?from=mdr

- https://www.royalmint.com/invest/discover/invest-in-gold/an-introduction-to-silver-investment/

- https://www.comparebanks.co.uk/guides/how-to-buy-silver/

- https://www.hattongardenmetals.com/buy-silver-bars

- https://www.businessinsider.com/personal-finance/how-to-buy-silver?r=US&IR=T

- https://www.cnbc.com/2023/01/20/metals-silver-prices-could-hit-a-9-year-high-in-2023-outpacing-gold.html

- https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

- https://markets.businessinsider.com/news/commodities/gold-price-record-us-default-debt-ceiling-crisis-dollar-bonds-2023-5