If you’re thinking about how to invest in gold, there is a strong chance you like a hedge against uncertainty.

For a long time now, precious metals such as gold and silver have been favored as a source of inherent value, weathering various economic and political events.

There are many ways you can invest in gold, and estimates suggest we can continue mining it until the 2050’s. At that point, prices would likely surge.

In this guide, we will provide a summary of how to invest in gold, in addition to the various methods.

The Different Methods of Gold Investing

Investment in gold can be achieved in all kinds of interesting ways. There is of course the physical option, but you can also put money into companies that mine gold, into funds that invest into gold’s surrounding markets, and more.

Here is a brief summary of the varying methods of investing in gold.

Buy Gold in Various Physical Forms

There are many ways to buy physical gold, including coins, bars, bullion, jewelry, or even gold leaf.

It is worth remembering that the purity of gold, measured in karats, will vary, so be sure to understand how this works.

There is an argument that investing in gold bullion is a wise option, but you need to be aware of concerns surrounding security and storage, plus insurance.

Some people also love the concept of owning raw gold, and hedging their investment against a variable market. For some of us, the safety and value of gold in its physical, arguably most tangible form, is compelling.

But as ever, there are a myriad of ways to play the markets surrounding one of the world’s oldest precious metals.

Invest in Firms in the Gold Industry

There is a vast production pipeline connected to the gold industry. The first stage of this is the companies that extract the material from the earth, which include the exploration and development of mines, and the mining of the material itself.

Other companies then process gold into things that we use; such as jewelry or cameras and games consoles. You might even include artisanal gold miners in places like Peru, but these operations often operate dangerously and illegally.

No matter which you choose, there is an overarching logic: investing in gold is about finding a company whose value should rise as the value of gold itself rises on global markets.

You are seeking a strong correlation here, ideally proven over time. The logic is that by putting money into gold-related businesses, you are hedging your cash on the value of gold itself.

Buy Into Funds Containing a Range of Gold Investments

However, the aforementioned hedge on the value of gold itself comes with some caveats.

The challenge herein is that gold investing isn’t just about the price of gold. The danger to your investment comes from corporate actions far divorced from precious metals.

Let’s imagine that a gold mining firm you’ve invested in takes a tumble on the markets, because its CEO has been accused of money laundering. In this scenario, the value of your investment is going to fall.

Similar scenarios might include hostile takeovers, issues on ESG or CSR, or new market players that threaten your company’s profits.

The key here is that by diversifying across a range of gold investments, you limit the fallout should one single company go bad.

The Best Way to Invest in Gold Online

If you are keen to invest in gold online, you would be well advised to do some initial research. This will include an overall investment strategy.

You will also engage in some risk management, ponder the ways to manage your investment, and get your options up and running.

1. Choose the Right Strategy for You

Identifying and implementing a comprehensive strategy is the most important step regarding where to invest in gold.

You need to decide what your level of risk is, and how much you might comfortably afford to lose. Once this is established, consider what your end goals might be.

These are very personal. Some people invest for the excitement. Others seek to create retirement pots or funds for children or family.

Depending on these criteria, the way you navigate gold markets online, and through which brokerages is going to vary.

2. Choose a Brokerage that Aligns With Your Goals

If you’re buying gold as an investment, you will need a tool to help you make your way through the markets.

In the US, high-quality options include Plus 500 and Robinhood. Here, you can get involved with gold investment at a macro or micro level, across indices, shares, ETFs and more.

Whichever brokerage you choose, never misalign your overall strategy. There are many options, most of which have the potential to offer plenty of advantages.

3. Verify and Fund Your Account

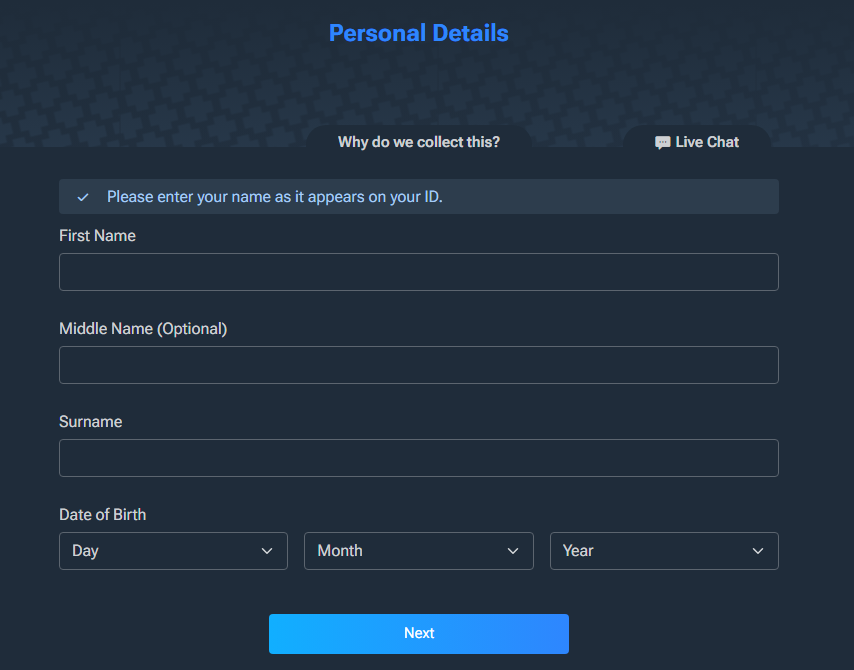

Every reputable and safe platform will ask you to verify your account. To begin this process, you first need to make an account with your broker of choice, and confirm a series of personal details.

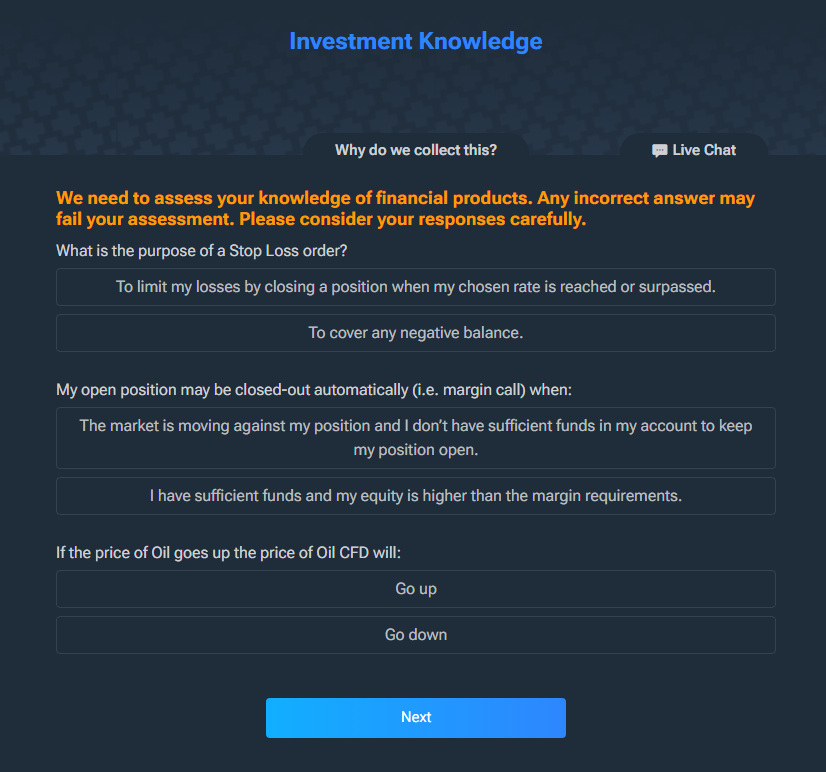

Many brokers will then ask you a series of questions to determine your investment approach and knowledge.

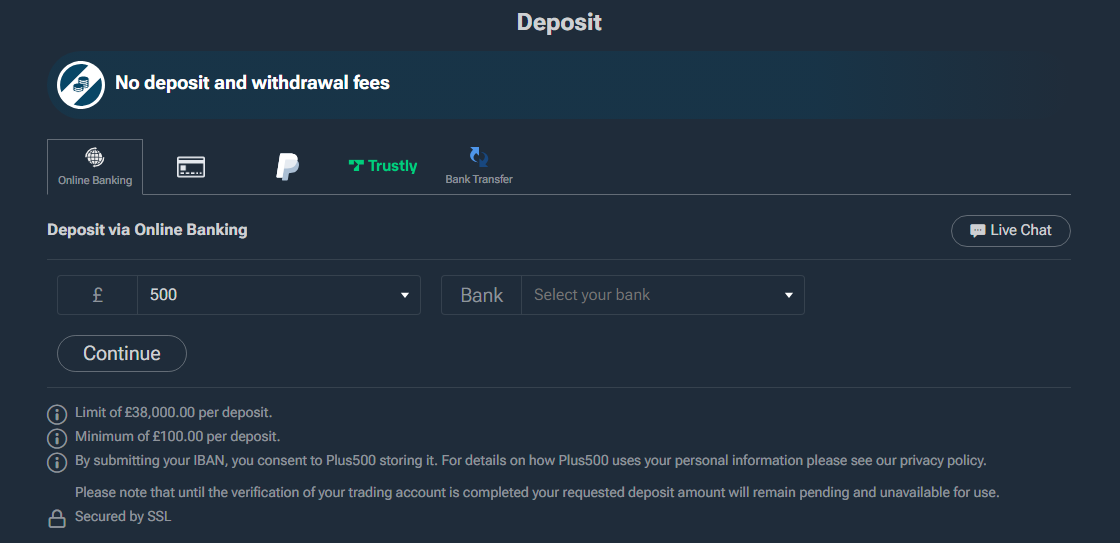

Now that this is done, all that remains is to fund your account.

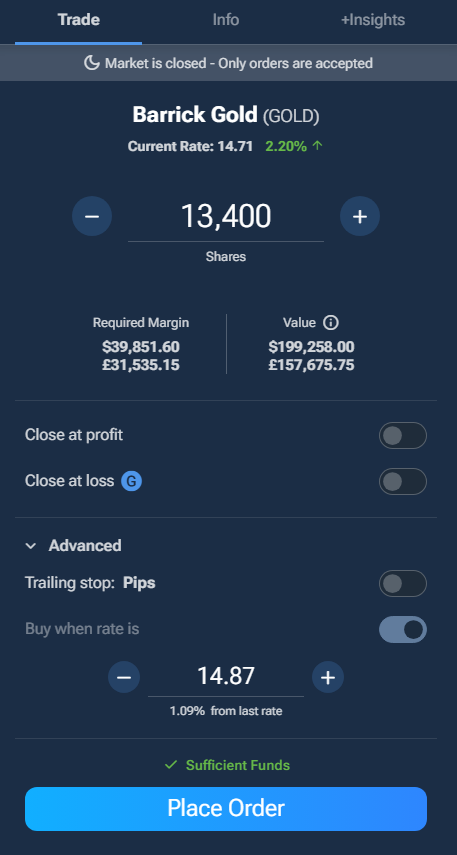

4. Choose a Gold Investment and Purchase

Having completed the various signup and identification requirements, and funded your account, you are now in the position to start investing in silver.

At this stage, remember your overarching strategy, and what your objectives and aims are from this silver investment.

To complete this step, all you need to do is locate your chosen investment using the platform’s search function. This will display the real time price of the silver, the amount you are opening a position on, whether you prefer to use units or cash as the metric, and details on any fees.

Where to Buy Gold in 2024

There are many available providers to help you invest in gold. Specialist sites cover specialist gold markets, but there are also more generalist and indeed more complex, or simpler options to choose from.

1. Plus500 – The Best Gold Brokerage for Most People

Plus500 is the best CFD broker in 2024 providing access to everything from CFDs such as forex and indices to Shares on Plus500Invest platform, and futures on the Plus500Futures platform, available only in the US. It also offers a comprehensive range of options for both new investors and those more experienced.

Pro tip: beginner traders should make use of the demo account and the Trading academy to gain experience prior to trading with real money because trading comes with inherent risks.

Crucially, you can use the platform’s ‘demo’ mode, which will grant you $40,000 in virtual money to practice investing.

The visual design behind the site is clear and appealing, and it’s fast and simple to view changing prices on gold, and indeed other similar valuable commodities.

You can also add instruments to watchlists – essentially a way to track gold across specific companies or funds, which is extremely useful.

A Trader’s Guide is also to hand, which again is a very nifty tool for rookie investors to help them get to grips with the details on gold transactions and markets.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. Robinhood – Commission-Free and ESG-Focused

Robinhood promises to unlock your investment potential, and offers 5% AER on uninvested cash while you seek the right investment option.

This is a 24 hour market, and that is welcome. The theory here is that Robinhood is primarily designed to work as an app.

This may be why the desktop site appears a little limited in terms of design. It isn’t the cleanest and might be a little bright for some people’s taste.

Robinhood also runs its own internal ESG program, which may be of interest to those seeking sustainable investments. This is also welcome because ESG risks are among the biggest threats to a portfolio.

There’s a weekly Plus500 podcast series too, covering themes such as the best fintech apps and contextual approaches to investing. This is a nice touch for those wanting to engage with the subject on a deeper level.

3. WeBull – A Great All-Rounder with Crypto and Forex Options

WeBull is another brokerage that will add 5% interest to your money while you decide where to place it.

You can cover the expected bases on the platform; stocks, options, ETFs, while there is also a strong focus on retirement accounts.

Mobile apps are available in addition to the desktop native platform, and an interesting feature called a smart advisor puts automation at the helm of your investments, assuming you feel this is the right way to go.

You can also ride the crypto and forex markets if you so choose, and the visualizations of market price and trends across both these and commodities are clear and simple to navigate.

You can check out the week’s top winners and losers as well as the most popular ETFs, so getting a good sense of how gold markets work and where you want to place your investments should not take long.

The 4 Best Options to Invest in Gold for Beginners in 2024

Buying gold as an successfully demands a knowledge of past and projected performance, in addition to expansion plans and company strategy.

Don’t just pay attention to PR or news; dig deep into corporate histories and seek out firms with both legacy and legitimacy.

Barrick Gold Corporation (GOLD)

Barrick paid out a dividend of $0.10 for every share in the fourth quarter of 2023. The company attributes this to the consistently strong performance of its balance sheet.

Barrick has also been growing its reserves throughout 2024, replacing 109% of gold depletion. This essentially means the company always keeps enough gold in hand to support its positions.

New business across the Dominican Republic, Zambia and Pakistan is also highly positive when it comes to ensuring Barrick’s supply remains good in coming years.

Barrick also claims to be one of the few companies on the market holding almost no net debt, which is plainly encouraging from a shareholder perspective.

Sprott Gold Miners ETF (SGDM)

The Sprott Fund essentially aims to target larger gold companies, seeking to ensure results that accurately track the performance of the underlying gold index.

The Fund’s 2023 Annual Report says Dundee, Torex and Gold Fields were the largest positive contributors to the overall performance of the Fund.

The document explains that for the six months leading to June 2023, the Gold Fund generated a total return of 4.78%.

The ETF report also notes that certain investors are beginning to embrace artificial intelligence (AI) as a route to market.

It remains to be seen how prominently AI can affected gold price and trading, but either way, this certainly hints that Sprott has its eye on the ball when it comes to futurism.

You can inspect the performance of Sprott, and indeed many other funds, across useful media tools like The Financial Times’ market trackers. This is a sensible approach and should help you maintain a balanced view of how ETFs are performing across the global markets.

iShares claims to be a 20 year leader in the ETF marketplace, and is part of asset management giant Blackrock.

IAUM’s online data sheet reveals a 13.72% total return in a year, across the most recent year to date, which is 2023.

IAUM has also argued that gold is tactical allocation to set against risk i, diversify portfolios and top act as a hedge against any potential market shocks in the current climate.

This aligns well with historical perceptions on how and why investors have favored gold down the years.

Various market commentators define IAUM as a good way to hold physical gold by allowing exposure to the day to day price shifts on gold bullion. When ridden effectively, this rollercoaster can pay out decent returns.

Additionally, whilst there is no certainty to any investment, Blackrock is an established name, which may go a long way in terms of winning the confidence of novice investors.

Kinross Gold (KGC)

Kinross is looking like an interesting prospect, largely because of its Great Bear Project in Ontario, which is targeting a potential start this year.

Additionally, Kinross has a number of diversified routes to bring gold to market, so it is also, to a certain extent, insulated against risk.

Kinross claims to have more than doubled its cashflow year over year in 2023. This is a good thing, as cash fluidity enables a more comprehensive strategy and builds in the ability to plan strategically across gold futures.

On ESG, Kinross is also building solar power into its efforts and seeking to reduce its emissions across the world by 30% before 2030.

This is no guarantee that Kinross is an environmental crusader, but any awareness of ESG and the associated risks when it comes to investment is almost a prerequisite nowadays.

Our Verdict on Buying Gold as an Investment in 2024

If you are considering where to invest in gold, then intriguingly, the best answers can come from within.

To recap, those eyeing gold investments must define their objectives and appetite for risk upfront. In simple terms, the two routes are riding the markets yourself through an online broker, or going back to basics and purchasing gold in physical forms.

For any of these approaches, the key is to understand that at its core, gold is seen as a safe and stable investment. If you foresee market risk, or simply don’t want to take the plunge, gold has many innate advantages.

FAQs

How to Invest in Gold for Beginners?

The most important thing is to analyze your appetite for risk. Don’t move any money, or set up any investment without an overarching strategy to guide what you are doing.This will ensure you research markets properly, and ideally lead you to the best returns.

Is Investing in Gold a Good Investment?

This is impossible to definitively say, because any investment, across gold or other commodities, is not without risk.General consensus is that gold is among the safer long term investments. That is different however to arguing its returns are in any way guaranteed.

What is the Best Option to Invest in Gold?

The great thing here is about choice. The myriad range of options and opportunities makes gold investment an intriguing choice for many potential players. Again, the best advice is to spend solid time checking your strategy before making any moves.

Can I Invest $1,000 in Gold?

Of course, you can invest as much or as little as you choose, as long as you have enough cash to hit the minimum purchase cost on whichever route to market you are taking.

References

- https://www.barrick.com/English/news/news-details/2024/q4-2023-results/default.aspx

- https://sprottetfs.com/media/6613/etfs-sar-fs-2023.pdf

- https://markets.ft.com/data/etfs/tearsheet/summary?s=SGDM:PCQ:USD

- https://www.ishares.com/us/products/306979/ishares-gold-trust-micro

- https://www.kinross.com/Acquisition-of-Great-Bear-Resources-Ltd