“Don’t fidget, don’t fuss, don’t bail out, don’t let your emotions get the better of you, and don’t be concerned with day-to-day market fluctuations.” –– Charles Brandes

Charles Brandes: Background & bio

Charles Brandes is the founder and Chairman of Brandes Investment Partners, L.P., and also a member of the firm’s Investment Oversight Committee.

One of the more closely followed value investors working today, Charles Brandes is a disciple of Benjamin Graham. Like almost all of the well-known value investors, Brandes spent time with Graham in San Diego while he was training to be a stockbroker. And just like many others, Brandes was able to learn first-hand the techniques Graham used to determine undervalued investment securities.

Brandes grew up in Pittsburgh. In 1965, he graduated from Bucknell University with a bachelors degree in economics and started as a broker trainee during 1968. After several years working as a broker and learning from Graham, Brandes set out on his own during 1974 and founded Brandes Investment Partners – with the enthusiastic support of Ben Graham – based on the Graham and Dodd value investing tenets.

A screenshot from Brandes’ new book, Brandes on Value: The Independent Investor.

Brandes first met Graham during the late early 70s. A bear market had wiped 45% to 50% off the market and as a new trainee, Brands was grappling with an initiation of fire. One day, Graham walked into Brandes’ office, looking to buy National Presto Industries, as Brandes was the designated person to greet incoming people, he was able to interact with him.

Charles Brandes: Investing philosophy

Even after watching assets under management fall from an eye watering $111 billion before the financial crisis, to a low of $21 billion over five years, Brandes has stayed put. He believes that as long as human nature doesn’t change, value investing will remain an effective long-term investment strategy.

Brandes was one of the first Western value investors to start investing in emerging markets way back during 1982 and to this very day he sticks to his Graham-Dodd roots. According to Brandes himself:

US Market And Its Potential

“When I started my firm in 1974, I was not just fascinated by the US market but also with the potential investment and knowledge of other markets. But there weren’t a whole lot of public companies in EMs to invest in and hardly any reports or disclosures. The closest EM to San Diego, where my office was located, was Mexico. At that time, Mexico would have been called a frontier market, not an emerging market. In 1982, the Mexican government faced a debt crisis. As value guys, we thought that, perhaps during a crisis like this, we can get an opportunity to invest cheap. Going through the S&P 500 book, I found state-owned Telefonos de Mexico. The only reports I could get was some old balance sheets and income statement for two years.

But just looking at those I said, “Wow, look at the price. It looks like the stock is trading at 10% of the book value.” Of course, you can’t believe the book value and it looked like it was trading at 1X or 2X reported earnings. That was the first EM in which we invested. From then on, over the years we have continued to invest in EMs, depending upon the opportunities that arose.”

*********

Important Learnings Of Market

If you look back at the four decades that you have spent in the markets, what would be the most important learnings?

The market has taught me to continually stay the course even though I do believe that prices of businesses in public markets and, maybe, even in private equity, fluctuate and that volatility is much higher than the actual long term value of a business. The market has umpteen times demonstrated the same over the years. Secondly, the market has taught me that long-term can be quite long. Thirdly, the market has taught me to ignore the market most of the time. Just stick to fundamental investing as there are only a couple of times when you should be concerned about the market.

Charles Brandes: Brandes Investment Partners, L.P

Brandes Investment Partners was founded by Charles during 1974 and currently has over $52.9 billion under management. The company is based in San Diego, California.

From Brandes Investment Partners, L.P’s website:

Brandes Investment Partners, L.P., is a leading investment advisory firm, specializing in managing global equity and fixed-income assets for clients worldwide. Since the firm’s inception in 1974, Brandes has applied the value investing approach, pioneered by Benjamin Graham, to security selection and was among the first investment firms to bring a global perspective to value investing. The independently owned firm manages a variety of active investment strategies and applies its investment philosophy consistently in all market conditions.

The 100-year vision at Brandes grew from a recognized need to ensure we maintained our independence and could manage growth — ingredients critical to our long-term value investing philosophy. Our mission is to be an exceptional firm that provides superior investment advisory services in an atmosphere of accomplishment and enjoyment.

100 Year Vision

At the core of our 100-year vision is a steadfast dedication to our clients. We strive to maintain long-lasting, trust-based client relationships

We manage the firm with the long term in mind. This means that we invest significantly in our business and our people. Our ownership structure provides for broad participation in the success of our firm, with plans for a long-term recycling of equity. We work hard to maintain a progressive culture that rewards teamwork and encourages a work-life balance. We do not respond to the latest investment fads and we stick to our time-tested investment philosophy in all market environments. We have established and acted on conservatively established capacity limits for all our investment products. Our investment process and business model are not dependent on specific individuals to be successful over time. These commitments do not maximize short-term payback, but are designed to pursue rewards for our firm and our clients over the long run.

Our Investment Philosophy

By applying the value-oriented investing principles of Graham and Dodd, Brandes seeks to take advantage of market irrationality and short-term security mispricing by buying securities that we believe are undervalued and offer attractive total-return potential – i.e., dividend income and capital appreciation growth. Our analysts begin with rigorous, independent, bottom-up analysis of individual companies. By choosing stocks that are selling at a discount to our estimates of their intrinsic business value, Brandes seeks to establish a margin of safety and an opportunity for competitive long-term performance.

“Margin of safety” is the difference between a company’s market price and what Brandes believes is the intrinsic value of the company. Intrinsic value is a company’s real worth, taking into consideration all determinants of value. For example, we believe book value and short-term pricing variables don’t always reflect true value. That’s why we undertake a thorough due diligence to estimate each company’s true value and establish a reasonable expectation for how its price may behave going forward.

The theory of value investing holds that the market should eventually realize the true worth of a company and its price should climb toward its intrinsic value over the long term. This combination of rational fundamental analysis and the discipline to try and take advantage of market price irrationality enables the firm to target competitive long-term results.

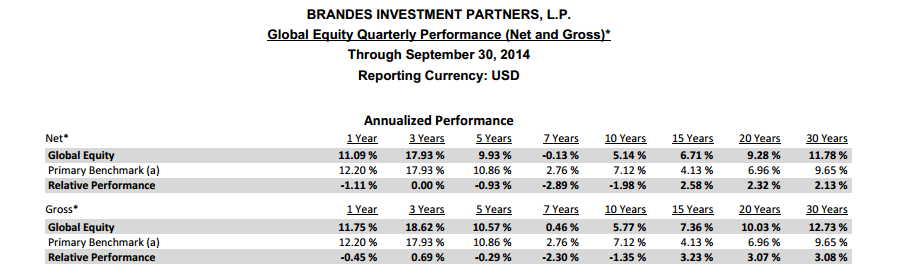

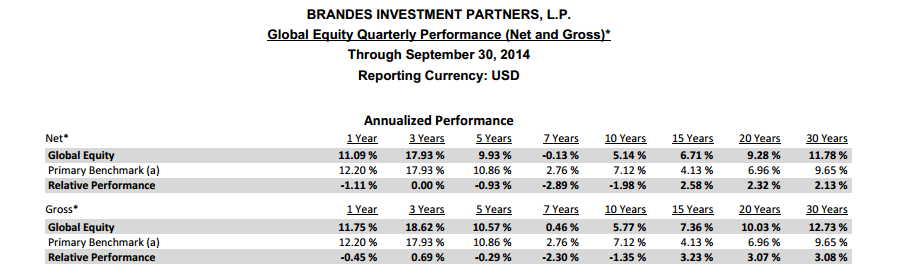

Brandes Investment Partners Global Equity Fund long-term performance:

Charles Brandes: Quotes

“The stock market is inherently misleading. Doing what everybody else is doing can often be wrong.”

“They find themselves switching in and out of stocks, feeding the brokers instead of themselves.”

“Run from corporate managers more concerned with perquisites [special rights or privileges], golden parachutes, bonuses, and excessively high salaries in relation to the return to shareholders.”

“By choosing stocks with a substantial difference between price and value, a wide margin of safety is created. The lower the purchase price relative to value, the lower the risk. Contrary to popular belief, by decreasing risk, this method increases potential reward.”

“I am greatly indebted to my mentor, ‘The Dean of Investing,’ Mr. Benjamin Graham. His basic principles formed the solid foundations for my worldwide investment success.”

“Value investing – I will admit to being a convert to this approach and, as with many converts, I am deeply committed to it. I have seen the results; I know it works; and I know it will build wealth for those who apply its principles.”

“Most people get involved in thinking and getting confused about the difference between investment and speculation.”

“It is so important to understand whether you are really an investor or whether you are a closet speculator.”

- Sep 30, 2014 Brandes Quarterly Commentary

- May 29 2014 Charles Brandes’ First Quarter 2014 Commentary

- Sep 30, 2014 Fixed Income Quarterly Commentary

- Sep 30, 2014 Emerging Markets Quarterly Fund Commentary

- Brandes Quarterly Commentary 2Q12

Videos From Brandes Investment Partners, L.P

- Full Video Archive

- When Charles Met Benjamin Graham

- Why Has Value Underperformed Recently

- Value vs Growth – Where We Stand Today

- Value vs. Glamour: International Small Cap

- Compelling Opportunities in Europe

- Thinking Fast and Slow

- Todays Opportunity for Value Investing

- Searching for Value in Emerging Markets

- Investing in Small Companies with Big Potential

- Broad is the New Narrow: How Passive Investing Creates Concentrated Portfolios?

Charles Brandes: Articles

- Charles Brandes – Forbes

- Invest like a legend: Charles Brandes – The Globe and Mail

- Charles Brandes’ Top Year End Stocks

- Billionaire investor sees the value in sticking to his hunch

- The Alchemist’s Way – Charles Brandes High-Impact Sells

- Charles Brandes Discusses Principles of Graham-Dodd

- Six Sells in Review – The Charles Brandes Third Quarter

- County’s richest couple battle over a fortune

- Charles Brandes slams indexing

- Charles Brandes on Investing Lessons from Benjamin Graham

- Value Investor Charles Brandes Thinks Large Russian Companies Are Unbelievably Cheap

- Charles Brandes: Active Investment Strategies

Books

Newspaper Cuttings

- Searching For Value In A Bear Market

- Investing In Other Lands

- Long-term Treasury Securities Can .Offer .Sanctuary

- A Diamond Is Forever, But Its Stock Can Wane

- Finance .If Diamonds Are Forever, Consider De Beers

- Bush Plan May Provide Only Mild Stimulus

- Market Beat .